Cellnex Telecom: Growth Constraints and Valuation Outlook Post-Goldman Downgrade

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my comprehensive research, I can now provide you with a detailed analysis of the factors limiting Cellnex’s growth catalysts and their valuation implications following Goldman Sachs’ downgrade.

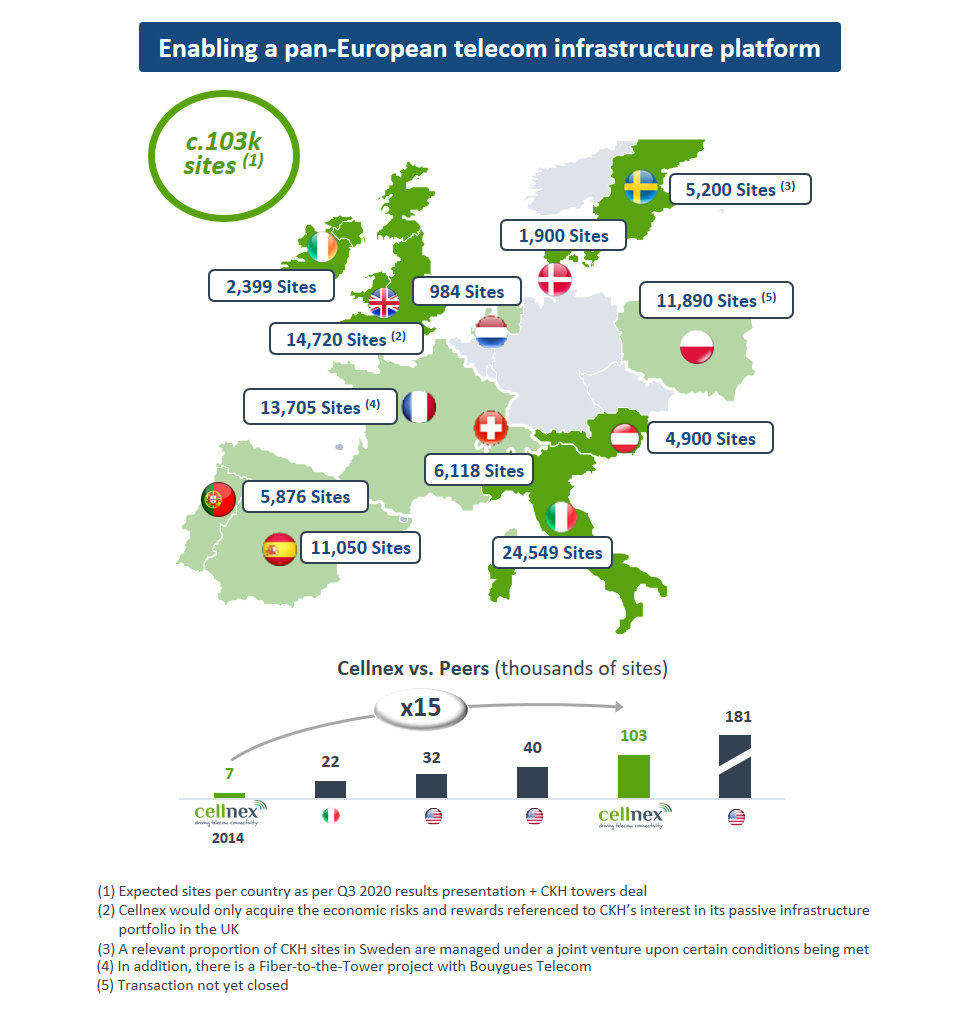

Cellnex Telecom S.A. (BME:CLNX) is Europe’s largest telecommunications tower infrastructure operator, managing approximately 53,000 sites across 12 European markets including Spain, France, Italy, the UK, Ireland, and others. The company operates as a pure-play tower infrastructure provider, leasing space to mobile network operators (MNOs) for antenna installations and providing broadcast infrastructure services[1][4].

Cellnex’s aggressive acquisition-driven growth strategy has resulted in a substantial debt burden that continues to constrain strategic flexibility. The company’s net debt-to-EBITDA ratio remains elevated at approximately 6x, approaching the tolerance threshold established by credit rating agencies[3]. S&P Global Ratings has relaxed its leverage tolerance threshold from 6.5x to 7.0x, reflecting recognition of Cellnex’s critical infrastructure role, but this accommodation simultaneously signals the magnitude of the deleveraging challenge ahead[3].

The company has embarked on a deleveraging pathway, committing to reduce leverage through asset sales, improved free cash flow generation, and disciplined capital allocation. However, the debt burden remains a primary constraint on growth catalyst development, as it limits:

- Capacity for accretive M&A opportunities

- Flexibility in capital deployment

- Ability to invest in new growth vectors such as small cells and edge infrastructure

The structural consolidation of European telecom operators represents a fundamental constraint on Cellnex’s growth model. The company’s revenue visibility depends heavily on maintaining and expanding tenancy ratios across its tower portfolio. When operators merge, the resulting entity rationalizes network infrastructure, reducing the aggregate tenancy opportunity[2][5].

Recent examples include:

- MasOrange in Spain: The merger of Orange and MasMovil has created Spain’s largest mobile operator, with Cellnex managing the transition through a new long-term contract (through 2048) that provides revenue stability but temporarily reduces near-term PoP (Points of Presence) growth[5].

- UK Market: Similar consolidation dynamics are reshaping the competitive landscape, with Cellnex working to manage the implications of reduced customer concentration.

Operator consolidation reduces Cellnex’s bargaining power and compresses the addressable market for new tenancy additions, directly limiting organic growth catalysts.

While Cellnex continues to deliver solid operational performance, the pace of organic growth has moderated from the high-growth phase observed during its initial expansion years. Key metrics indicate[5]:

- Revenue Growth: Approximately 5.7% year-over-year in recent quarters

- EBITDA Growth: Adjusted EBITDA growth around 6.9%

- RLFCF (Recurring Leveraged Free Cash Flow): Growth of 9.4%, with RLFCF per share up 13.2%

These growth rates, while respectable for an infrastructure asset, fall short of the premium valuation multiples the market has historically afforded the company. The moderation reflects:

- Maturation of the tower portfolio

- Slower BTS (Build-to-Suit) delivery timelines

- Colocation growth that has reached more normalized levels

Cellnex trades at a

- Superior growth trajectory

- Geographic diversification benefits

- Scale advantages in European tower infrastructure

- 5G deployment catalyst potential

However, as growth moderates and leverage remains elevated, the valuation premium becomes increasingly difficult to justify, creating pressure on the share price and limiting upside potential.

The higher interest rate environment has increased financing costs and created refinancing challenges for Cellnex. The company’s debt stack, while emphasizing fixed rates and long maturities, remains sensitive to rate movements[3][4]. This macroeconomic factor:

- Increases weighted average cost of capital

- Reduces returns on capital-intensive investments

- Complicates the deleveraging trajectory

Goldman Sachs’ downgrade from Buy to Neutral reflects the investment bank’s assessment that

- Valuation Fairness: At current levels, the risk-reward profile no longer justifies a Buy recommendation given the moderation in growth and persistent leverage

- Catalyst Timeline: The expected acceleration in 5G deployments, tenancy growth, and M&A opportunities has not materialized with sufficient urgency

- Execution Uncertainty: Questions regarding the pace of deleveraging and successful navigation of MNO consolidation impacts

- Competitive Dynamics: Fragmentation in certain markets (particularly France) and the potential for irrational pricing behavior from smaller competitors

The downgrade contributed to a period of share price weakness, with Cellnex experiencing:

- A 30-day return of approximately -8.6%

- Year-to-date decline of approximately -16.4%

- One-year total shareholder return of -17.6%[4]

Analysts’ fair value estimates suggest Cellnex is currently trading at a

- Persistent headwinds from leverage

- Structural growth constraints from MNO consolidation

- Uncertainty regarding the timing and magnitude of 5G monetization

For Cellnex to warrant a more constructive rating and valuation multiple expansion, the following catalysts would be necessary:

| Catalyst | Impact | Timeline |

|---|---|---|

Accelerated tenancy growth |

Improves organic growth trajectory and revenue visibility | Medium-term |

Successful deleveraging to 5.5-6x net debt/EBITDA |

Reduces balance sheet risk and improves financial flexibility | Near-term |

Accretive M&A opportunities |

Validates acquisition strategy and provides scale benefits | Medium-term |

5G deployment acceleration |

Drives colocation demand and small cell opportunities | Medium-long term |

Continued shareholder returns |

€1 billion return program through 2026 provides yield support | Near-term |

Key risks to the valuation outlook include:

- Further MNO consolidation: Additional operator mergers could compress the addressable market and reduce tenancy growth potential

- Regulatory constraints: Antitrust limitations in certain markets (particularly France) limit M&A optionality

- Interest rate volatility: Higher rates could derail deleveraging plans and increase financing costs

- Execution risk: Failure to achieve stated guidance or deleveraging targets

Goldman Sachs’ downgrade to Neutral reflects a recognition that Cellnex’s growth catalysts have become more muted and the valuation premium increasingly difficult to justify. The company’s fundamental challenges—elevated leverage, MNO consolidation pressures, and moderated organic growth—create a more constrained outlook than in previous periods of rapid expansion.

However, Cellnex retains meaningful strengths: its position as Europe’s largest tower infrastructure operator, long-term contracts with inflation escalators, and a clear deleveraging commitment. For investors, the current valuation presents a potential opportunity if the company can successfully navigate the transition from acquisition-driven growth to cash flow generation, but the near-term catalyst set remains limited.

The investment thesis now hinges on

[1] Simply Wall St - “Cellnex Telecom, S.A. (BME:CLNX) Stock Report” (https://simplywall.st/stocks/es/telecom/bme-clnx/cellnex-telecom-shares)

[2] Porter’s Five Force Analysis - “Growth Strategy and Future Prospects of Cellnex Telecom” (https://portersfiveforce.com/blogs/growth-strategy/cellnextelecom)

[3] S&P Global Ratings - “Cellnex Telecom S.A. Outlook Review” (https://www.spglobal.com/ratings/en/regulatory/article/-/view/sourceId/12558726)

[4] Simply Wall St - “Cellnex Telecom: Exploring Valuation After Rising Losses” (https://simplywall.st/stocks/es/telecom/bme-clnx/cellnex-telecom-shares/news/cellnex-telecom-bmeclnx-exploring-valuation-after-rising-los)

[5] Cellnex Telecom Q3 2025 Results Presentation (https://www.cellnex.com/app/uploads/2025/11/20251106-PR-Cellnex-Results-9M2025_EN.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.