Monte Rosa Therapeutics $300 Million Public Offering Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my comprehensive analysis, here is a detailed assessment of Monte Rosa Therapeutics’ $300 million public offering and its potential impact on the company’s drug development pipeline and shareholder value.

Monte Rosa Therapeutics announced the pricing of its $300 million underwritten public offering on January 9, 2026, with the following key terms[0][1]:

| Parameter | Details |

|---|---|

Total Securities |

11,125,000 shares of common stock + 1,375,000 pre-funded warrants |

Offering Price |

$24.00 per share (common stock) |

Underwriters’ Option |

Up to 1,875,000 additional shares (30-day option) |

Expected Closing |

January 12, 2026 |

Bookrunners |

BTIG, LLC (sole book-running manager) |

The $300 million capital infusion will significantly accelerate Monte Rosa’s clinical development programs across its molecular glue degrader (MGD) pipeline[2]:

- The company recently announced positive interim Phase 1 data showing deep NEK7 degradation and reduction in inflammation markers

- Stock surged 45%following this announcement on January 8, 2026[3]

- This first-in-class MGD targets the NLRP3/IL-1/IL-6 pathway for treating ASCVD and other cardiometabolic diseases

- The capital will fund continued Phase 1 development and prepare for Phase 2 initiation in 2026

- Licensed to Novartis with exclusive worldwide rights for development and commercialization

- Partner Novartis is expected to initiate multiple mid-stage studies in immune-related diseases in 2026[2]

- Monte Rosa is eligible for up to $2.1 billionin milestones, including 30% U.S. P&L sharing and ex-U.S. tiered royalties

- The offering proceeds will support Monte Rosa’s co-funding obligations for Phase 3 development

- Targeted for castration-resistant prostate cancer (CRPC)

- Phase 2 study (MODeFIRe-1) initiation anticipated in 2026

- Monte Rosa plans to present updated data at the ASCO Genitourinary Cancers Symposium in February 2026

- IND applications planned for 2026 for:

- Next-generation NEK7-directed MGD

- CDK2 and/or cyclin E1-directed MGD

Monte Rosa has established significant strategic collaborations that enhance its financial position:

| Partner | Deal Date | Key Terms |

|---|---|---|

Novartis |

Sept 2025 | $120M upfront + up to $5.7B total deal value for immune-mediated diseases |

Roche |

Oct 2023 | $50M upfront + >$2B in milestones for neurological diseases |

The company has received

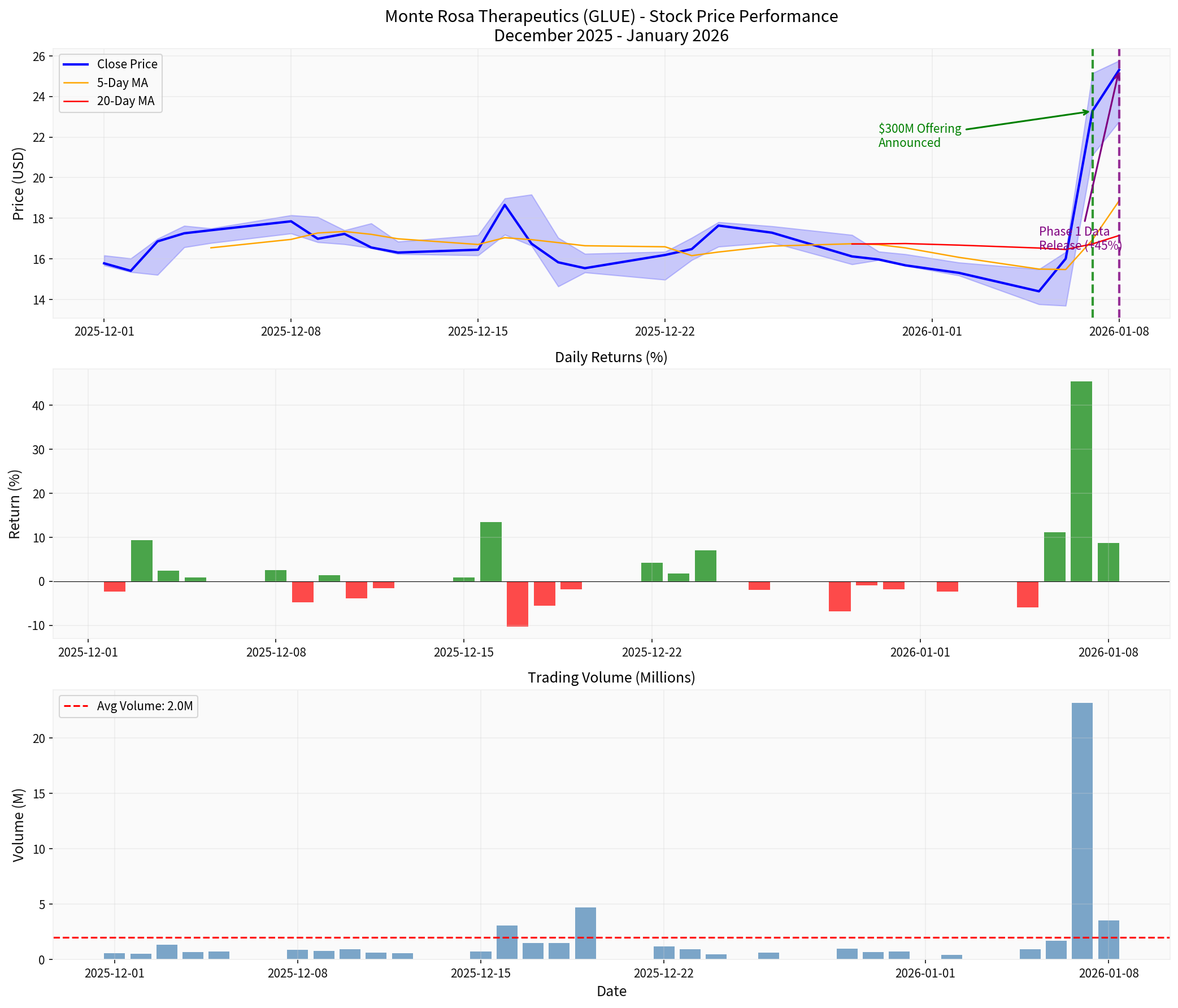

The offering has been announced amid exceptional stock performance:

| Metric | Value |

|---|---|

Current Price (Jan 9, 2026) |

$25.31 |

5-Day Return |

+61.01% |

1-Month Return |

+41.79% |

3-Month Return |

+228.27% |

YTD Return |

+65.32% |

1-Year Return |

+322.54% |

Market Cap |

$1.65 billion |

Stock price chart showing significant rally following Phase 1 data announcement and offering

- Consensus Rating: BUY(77.8% of analysts recommend Buy)

- Average Price Target: $31.00(+22.5% upside from current levels)

- Price Target Range: $22.00 - $37.00

- Wells Fargoupgraded to Overweight on December 16, 2025

- Clinical Catalyst Visibility: Multiple Phase 2 initiations expected in 2026 across all three clinical programs

- Platform Validation: Positive MRT-8102 data provides additional validation for the QuEEN discovery engine

- Strong Balance Sheet: Current ratio of 6.54 and debt-to-equity ratio of 0.16 indicate robust financial health

- Partnership Economics: Tiered royalty arrangements and profit-sharing provide long-term revenue potential

- Cash Position: The offering, combined with collaboration revenue, extends runway through 2028

| Risk Factor | Mitigation |

|---|---|

Clinical Trial Risk |

Multiple programs reduce single-program dependency |

Execution Risk |

Novartis partnership provides development expertise |

Market Volatility |

High short-term volatility (annualized 166.85%) reflects binary outcomes typical of biotech |

Dilution Impact |

Offering at $24.00 represents premium to historical prices, minimizing dilution impact |

Monte Rosa Therapeutics’ $300 million public offering represents a transformative financing event that positions the company to execute on multiple clinical milestones in 2026. The capital infusion will:

- Accelerate Pipeline Development: Fund Phase 2 initiations for MRT-8102 and support MRT-2359 advancement

- Strengthen Partner Obligations: Enable co-funding of Phase 3 development for MRT-6160 with Novartis

- Extend Cash Runway: Provides financial flexibility through 2028, reducing future dilution risk

- Enhance Shareholder Confidence: Strong institutional backing and analyst support validate the company’s value proposition

The timing of the offering—coinciding with positive clinical data and multiple upcoming catalysts—optimizes shareholder value by raising capital at premium levels while preserving upside from clinical execution. The combination of strategic partnerships, a validated discovery platform, and a strengthened balance sheet positions Monte Rosa as a leading company in the molecular glue degrader space.

[0] GlobeNewswire - Monte Rosa Therapeutics Announces Pricing of $300 Million Underwritten Public Offering (https://www.globenewswire.com/en/news-release/2026/01/09/3215883/0/en/Monte-Rosa-Therapeutics-Announces-Pricing-of-300-Million-Underwritten-Public-Offering.html)

[1] SEC.gov - Monte Rosa Therapeutics Form 424B5 Prospectus (https://www.sec.gov/Archives/edgar/data/1826457/000119312526006297/0001193125-26-006297-index.htm)

[2] Yahoo Finance - GLUE Stock Up 45% on Positive Interim Data (https://finance.yahoo.com/news/glue-stock-45-positive-interim-160900258.html)

[3] Seeking Alpha - Monte Rosa Therapeutics: Competitive MRT-8102 Results Offer Additional Platform Validation (https://seekingalpha.com/article/4857965-monte-rosa-therapeutics-competitive-mrt-8102-results-offer-additional-platform-validation)

[4] Monte Rosa Therapeutics Corporate Presentation - January 2026 (https://ir.monterosatx.com/static-files/801df45e-9a6e-4214-8a69-c71caf09cc16)

[5] Company Overview Data - GLUE Market Information (from financial data API)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.