Reddit Discussion: Analysis of Historical Point of Control (POC) Trading Strategy Effectiveness

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on a Reddit discussion [0] published on November 12, 2025, at 04:36:32 UTC, which examined the effectiveness of historical Point of Control (POC) levels in futures trading, specifically observing a November 5th rally that found support at an October 10th POC on a 30-minute chart.

The November 5th market environment showed moderate bullish momentum across major indices, with the S&P 500 closing at 6,796.29 (+0.39%), NASDAQ at 23,499.80 (+0.61%), Dow Jones at 47,311.00 (+0.45%), and Russell 2000 at 2,464.78 (+1.47%) [0]. This broad-based participation aligns with the rally behavior described in the Reddit post.

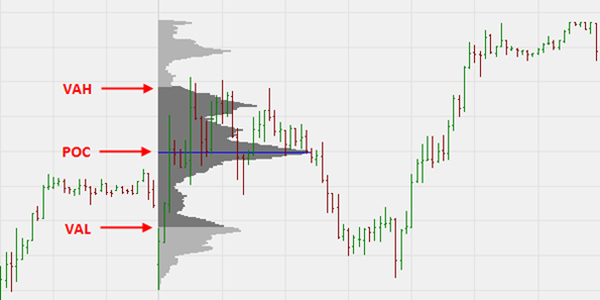

The Point of Control represents the price level where the highest trading volume occurred within a specific timeframe, functioning as a “gravitational center” for market prices and representing areas of institutional activity and consensus value [1]. Professional traders emphasize that POC levels work as strong support or resistance because “institutions placed majority of their orders there” and become active again when price revisits these levels [2].

- Volume Profile Shapes: D-shaped profiles with POC near center suggest balanced markets, while P-shaped/B-shaped profiles with POC near extremes indicate trending markets where POCs are more reliable [1]

- Multi-timeframe Confluence: Weekly/Monthly POCs influence markets for weeks/months, while daily POCs serve as primary references for day traders, and intraday POCs optimize entry timing [1]

- First Test Advantage: Professional traders emphasize that the “first test” of a POC has higher probability of success, with effectiveness diminishing on subsequent tests [2]

- Trending vs. Ranging Markets: POC strategies work best in trending markets where they function as support/resistance, but act more like magnets in ranging conditions [2]

- Volume Confirmation: POC reactions must be verified with corresponding volume spikes to validate institutional participation [1][2]

- Liquidity Conditions: POC analysis is less reliable in thin or illiquid markets and during high volatility events that can cause breaches without rejection [1][2]

The Reddit post’s observation of a November 5th rally respecting an October 10th POC demonstrates several important market dynamics:

-

Institutional Memory: The approximately 26-day gap between POC formation and retest suggests institutional positioning patterns can persist for multiple weeks, supporting the theory that “institutions will likely become active again” when revisiting their established levels [2]

-

Market Regime Validation: The strong Russell 2000 performance (+1.47%) on November 5th indicates broad market participation, which typically enhances POC reliability compared to narrow, index-driven moves [0]

-

Volume Profile Evolution: The fact that the October 10th POC remained “untouched” until November 5th suggests it represented a significant volume node that hadn’t been absorbed, increasing its gravitational pull on subsequent price action

- Position Sizing: POC-based strategies require conservative position sizing due to the possibility of failed tests and multiple test degradation [2]

- Stop-Loss Placement: Professional traders recommend using the “beginning of the heavy volume zone” rather than the exact POC line to avoid missed opportunities and provide buffer against false breakouts [2]

- Time Factor: Historical POC effectiveness may diminish over time, requiring traders to prioritize more recent high-volume nodes while still monitoring older significant levels

- Institutional Flow Analysis: COT reports and other institutional positioning indicators should be monitored alongside POC levels to confirm institutional participation [2]

- Correlation Analysis: Traders should verify whether related instruments show similar POC respect behavior to validate the broader market significance of individual POC reactions

- POC Failure Rate: Historical analysis shows POCs don’t always hold, requiring traders to have reversal strategies prepared for failed tests [2]

- Multiple Test Degradation: Each subsequent test of the same POC typically reduces its effectiveness, making the first test the highest probability setup [2]

- Market Regime Changes: POC reliability varies significantly between trending and ranging markets, requiring traders to identify current market conditions before application [2]

- Volatility Spikes: High volatility events can cause POCs to be breached without rejection, leading to false signals [2]

- Liquidity Conditions: POC analysis is less reliable in thin or illiquid markets where institutional participation may be limited [1]

- First Test Setups: Untouched POCs experiencing their first retest offer the highest probability success rates, particularly when confirmed by volume spikes [2]

- Multi-timeframe Confluence: POC levels that align across daily, weekly, and monthly timeframes create stronger gravitational centers for price action [1]

- Trending Market Context: POC strategies show enhanced effectiveness in confirmed trending markets where they function as reliable support/resistance levels [2]

- Institutional Alignment: POC-based trading aligns with institutional positioning patterns, potentially providing traders with insights into large-scale market participants’ activity [2]

- Objective Framework: Volume profile analysis provides a quantitative, objective framework for identifying key price levels, reducing subjective bias in trading decisions [1]

The Reddit discussion raises valid questions about the reliability of historical POCs, and professional trading literature provides a nuanced perspective. Historical POCs can indeed be powerful support/resistance levels, particularly on first tests and when confirmed by volume and market structure [1][2]. However, their effectiveness is highly context-dependent and requires sophisticated understanding of market dynamics.

- The November 5th rally respecting an October 10th POC could represent genuine institutional memory and positioning patterns, but should be verified across multiple instances and instruments

- POC trading strategies require comprehensive risk management, including position sizing, stop-loss placement, and market regime identification

- Multi-timeframe analysis and volume confirmation are essential components for validating POC-based trading opportunities

- The effectiveness of historical POCs diminishes with multiple tests and changing market conditions, requiring traders to prioritize fresh, high-volume nodes

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.