Former Fed Vice Chair Analyzes Potential Fiscal Impact of Supreme Court Ruling on Trump Tariffs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

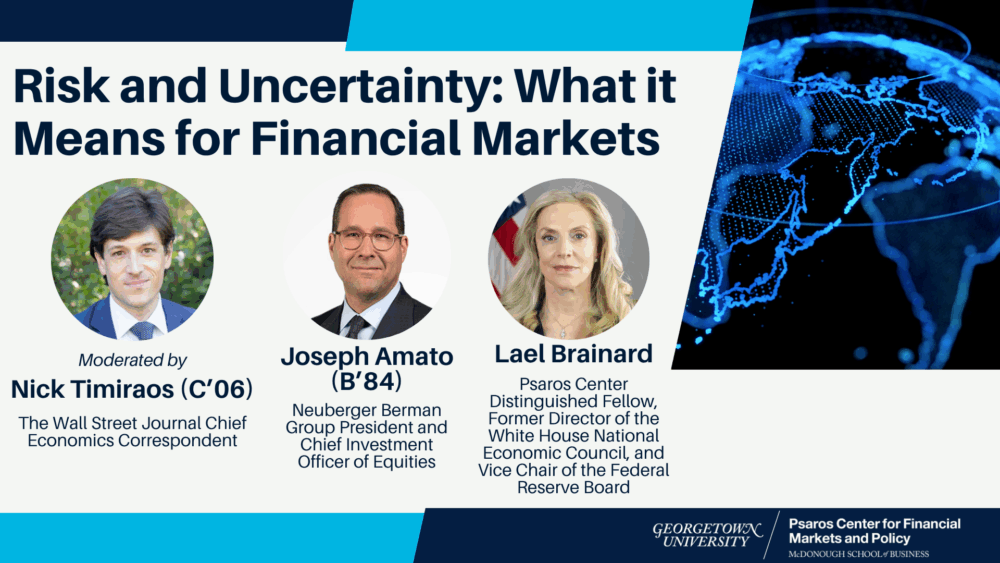

This analysis is based on the Georgetown University Psaros Center presentation [YouTube] published on January 8, 2026, featuring Lael Brainard, former Vice Chair of the Federal Reserve and current advisor at Georgetown’s Psaros Center for Financial Analysis. Brainard provides critical analysis of the potential fiscal consequences should the U.S. Supreme Court strike down the Trump administration’s “Liberation Day” tariffs implemented under the International Emergency Economic Powers Act (IEEPA). Her central thesis emphasizes that the fiscal impact depends substantially on how the refunding process is managed if tariffs are invalidated, rather than the ruling itself. Market indicators suggest elevated uncertainty, with prediction markets assigning only a 28-30% probability that the Supreme Court will uphold the tariffs [1][2]. The administration has acknowledged multiple backup options under the Trade Act of 1962, while defense sector equities have exhibited notable volatility in anticipation of the ruling [2][4].

The Supreme Court is expected to issue its ruling on January 8-9, 2026, determining the legality of the Trump administration’s emergency tariff powers. According to current market intelligence, prediction markets are pricing in only approximately 28-30% probability that the court will uphold the tariffs under the IEEPA framework [1][2]. This relatively low probability reflects significant legal uncertainty regarding the scope of presidential emergency economic powers in trade policy. The court’s decision carries profound implications for fiscal policy, as the tariffs have become a substantial revenue source for the federal government, generating approximately $195 billion in fiscal year 2025 and an additional $62 billion in fiscal year 2026 according to Treasury Department data [1].

The market response to impending ruling has been characterized by sector-specific volatility rather than broad-based selling. On January 8, 2026, the S&P 500 closed marginally higher by 0.07%, while the NASDAQ declined 0.29%, the Dow Jones gained 0.85%, and the Russell 2000 advanced 1.11% [0]. This mixed performance suggests that market participants are processing the potential outcomes in a differentiated manner, with smaller-cap stocks potentially benefiting from specific domestic policy considerations while technology sector exposure to trade policy remains a concern.

Lael Brainard’s analysis centers on the refunding mechanism as the critical variable determining fiscal consequences. Should the Supreme Court rule against the administration and mandate that collected tariffs be refunded to importers, the government faces significant fiscal strain. Brainard emphasizes that the manner in which this refunding process is structured—whether through immediate lump-sum repayments, phased approaches, or alternative mechanisms—will substantially influence the economic impact [1].

The potential liquidity implications are considerable. As noted by Eddie Ghabour, CEO of KEY Advisors Wealth Management, “We’ve never seen a ruling that has such an economic impact” [2]. A full refund would effectively remove tariff revenue from government accounts, potentially equivalent to “sucking liquidity from the system” according to market analysts [2]. This contraction effect could have cascading implications for government spending programs and the broader financial system.

The defense sector has emerged as particularly exposed to tariff-related uncertainty. Major defense contractors exhibited significant stock price declines in anticipation of the Supreme Court ruling: Lockheed Martin (LMT) declined 4.82%, Northrop Grumman (NOC) fell 5.50%, and RTX Corporation (RTX) dropped 2.45% [2]. These declines reflect investor concerns about potential disruptions to military spending trajectories linked to tariff revenue.

The fiscal connection between tariff revenue and military spending is substantial. Fortune reporting indicates that if tariffs are struck down and the revenue stream eliminated, it could threaten approximately one-third of the proposed military budget expansion from $1 trillion to $1.5 trillion [3]. This budget constraint could force difficult trade-offs in national security policy and defense procurement programs, potentially affecting contract awards, research and development spending, and force structure decisions over the coming fiscal years.

Treasury Secretary Scott Bessent has publicly acknowledged that the administration has identified at least three alternative options under the Trade Act of 1962 that could preserve much of the tariff structure even if the IEEPA-based tariffs are invalidated [1]. According to JPMorgan analysis, annualized tariff revenue could potentially be maintained at approximately $250 billion under these alternative legal pathways, compared to the approximately $350 billion under current tariff authority [2].

This backup authority represents a significant policy cushion, though the rates under alternative frameworks might be lower than current tariff levels. The administration appears to be positioning itself to maintain tariff revenue streams while potentially adjusting the legal basis for implementation. Market participants should note that the transition to alternative tariff authority could itself create additional uncertainty during implementation.

Brainard’s analysis also highlights the administration’s focus on “resource politics,” particularly amid developments in Venezuela [1]. This dimension adds geopolitical complexity to the tariff discussion, as resource-rich regions and their political stability have implications for commodity pricing, supply chain security, and broader economic policy considerations. The intersection of trade policy, national security, and resource access represents a multi-dimensional policy challenge that extends beyond purely fiscal calculations.

The most significant insight from Brainard’s analysis is that the fiscal consequences of a Supreme Court ruling against tariffs depend less on the ruling itself and more on the administrative response through the refunding process. This finding redirects attention from the legal question to the implementation question, suggesting that market participants and fiscal planners should focus on the mechanics of potential refunding rather than simply the binary outcome of the ruling. The distinction between legal invalidation and fiscal impact creates a nuanced landscape where policy response can substantially mitigate or exacerbate economic consequences.

The substantial gap between current tariff revenue generation and prediction market probabilities of tariff survival indicates that market participants have already priced in significant uncertainty. The relatively muted market response on January 8, 2026—with most major indices showing limited movement—suggests that the expected range of outcomes is being processed in a differentiated manner rather than triggering panic selling [0]. This orderly price action may reflect either market confidence in alternative pathways or simply delayed reaction until the ruling is published.

The divergence between defense sector declines and broader market stability reveals important sector rotation dynamics. Defense contractors’ direct exposure to potential military budget constraints has created asymmetric downside risk for these equities, while the broader market appears to be weighing multiple factors beyond tariff uncertainty. This sector-specific vulnerability suggests that equity selection within tariff-sensitive industries may be more critical than market-timing strategies in the current environment.

The administration’s acknowledged backup options under the Trade Act of 1962 demonstrate a level of policy preparation that may reduce downside risk from an adverse Supreme Court ruling. While alternative authorities may not fully replicate current tariff rates, the ability to maintain substantial tariff revenue through different legal mechanisms provides a policy bridge during potential transition periods. Market participants should monitor implementation timelines and rate comparisons for these alternative authorities as the situation develops.

The analysis reveals several elevated risk factors that warrant attention. First, the unprecedented nature of the ruling creates implementation uncertainty—market participants and fiscal planners lack historical precedents for a Supreme Court decision with comparable economic magnitude [2]. Second, liquidity contraction from potential full refunds could affect government account balances and potentially transmit through financial markets, though the precise transmission mechanism remains uncertain. Third, defense sector exposure represents concentrated risk for portfolios with sector-specific allocations to industrials and aerospace and defense [2].

The timeframe for the ruling is immediate, with market participants expecting resolution within hours of the January 8 announcement [1][4]. This compressed timeline limits opportunities for defensive repositioning once the ruling is published, suggesting that any risk mitigation strategies should be implemented proactively.

Despite elevated risks, the current environment also presents opportunities for positioned market participants. The sector rotation dynamics observed in defense stocks may create entry points for investors with longer time horizons who believe military spending priorities will be maintained through alternative funding mechanisms. Additionally, the acknowledged backup tariff authorities under the Trade Act of 1962 may provide policy continuity that supports certain domestic industries over import-competing sectors.

The Venezuelan developments and broader resource politics context may also create opportunities in energy and commodity-related equities, as policy attention to resource security tends to benefit domestic production and supply chain resilience. However, these opportunities carry their own risks related to commodity price volatility and potential geopolitical escalation.

The technical indicators and analytical data suggest elevated but manageable uncertainty levels [0]. The key distinction is between short-term volatility from ruling announcement and fundamental concerns about fiscal policy trajectory. Market participants should distinguish between these categories when evaluating risk tolerance and position sizing. The presence of acknowledged backup authorities provides a structural mitigant against worst-case outcomes, though implementation uncertainty remains significant.

The information synthesized from this analysis provides the following key data points for decision-making support:

| Category | Key Data |

|---|---|

Tariff Revenue (FY2025) |

~$195 billion [1] |

Tariff Revenue (FY2026 YTD) |

~$62 billion [1] |

Supreme Court Uphold Probability |

28-30% [1][2] |

Alternative Tariff Revenue (JPMorgan estimate) |

~$250 billion annually [2] |

Military Budget at Risk |

Approximately one-third of proposed expansion [3] |

Defense Stock Declines (Jan 8) |

LMT -4.82%, NOC -5.50%, RTX -2.45% [2] |

The fiscal impact of a Supreme Court ruling against Trump tariffs depends substantially on the refunding process management, according to Lael Brainard’s analysis [1]. The administration has acknowledged multiple alternative tariff authorities under the Trade Act of 1962 that could preserve substantial tariff revenue even if the IEEPA-based tariffs are invalidated [1][2]. Market indices showed mixed performance on January 8, 2026, with sector-specific volatility concentrated in defense contractors [0][2]. Prediction markets assign relatively low probability to tariff survival, though alternative legal pathways provide policy continuity options [1][2].

[“supreme_court”, “tariffs”, “fiscal_policy”, “federal_reserve”, “lael_brainard”, “trade_policy”, “defense_stocks”, “military_budget”, “ieepa”, “trade_act_1962”, “market_volatility”, “economic_analysis”]

[“LMT”, “NOC”, “RTX”, “SPX”, “IXIC”, “DJI”, “RUT”]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.