U.S. Federal Government Layoffs Reach 10-Year Low: In-Depth Analysis of Investment Impacts

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest collected data and market information, I will provide you with a

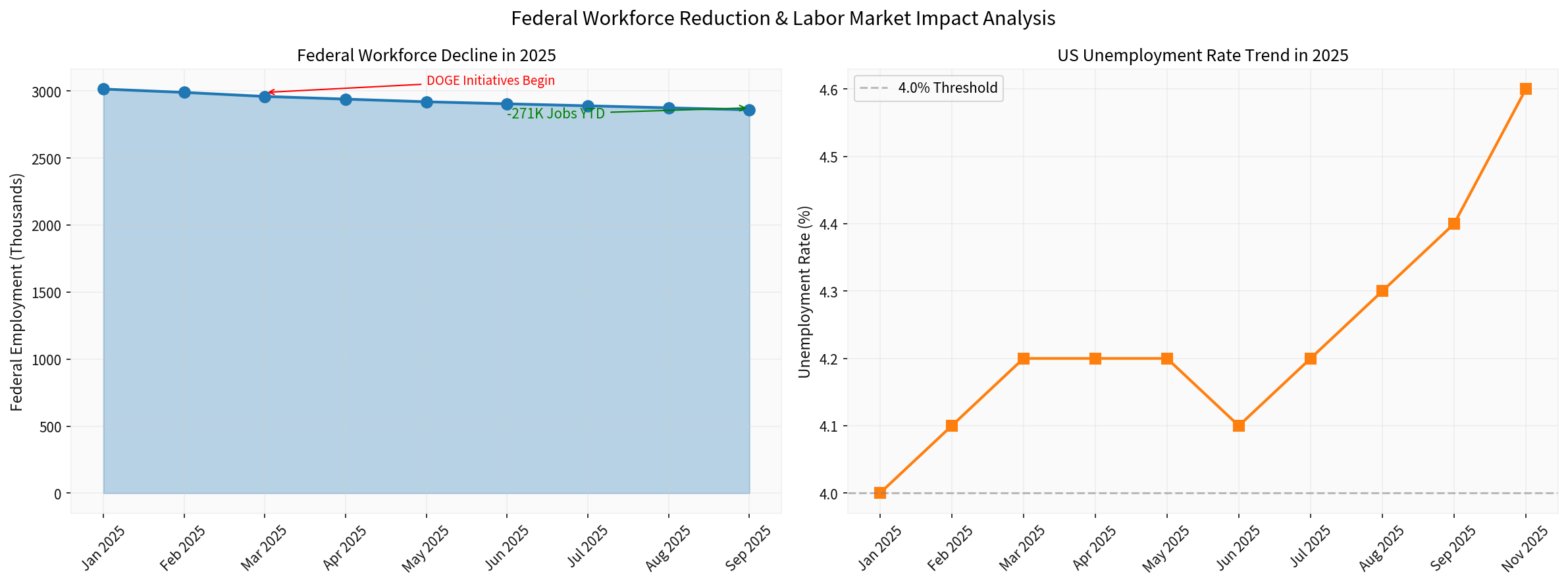

According to the latest data from the U.S. Bureau of Labor Statistics (BLS), the federal government experienced a significant wave of layoffs in 2025[1]:

| Time Period | Number of Federal Employees (Excluding Active Military) | Change from Peak |

|---|---|---|

| January 2025 | 3.015 million | Peak |

| November 2025 | 2.744 million | -271,000 (-9%) |

| November 2025 (Excluding Postal Service) | 2.51 million | -168,000 |

According to estimates from the Federal Reserve Bank of Atlanta, if indirectly employed personnel through contracts and grants are included, federal government-related jobs could decrease by as many as

U.S. unemployment rate shows an upward trend:

- January 2025: 4.0%

- September 2025: 4.4%

- November 2025: 4.6%[3]

Nonfarm payrolls increased by only 64,000 in November 2025, and October saw a net decrease of 105,000, driven primarily by federal layoffs[3].

| Ticker Symbol | Company Name | Latest Stock Price | Period Price Change | Daily Volatility | Sector Classification |

|---|---|---|---|---|---|

| RTX | RTX (Raytheon) | $187.17 | +57.70% |

1.59% | Defense |

| LHX | L3Harris Technologies | $325.74 | +40.85% |

1.42% | Defense |

| HII | Huntington Ingalls | $378.47 | +37.22% |

2.61% | Defense |

| GD | General Dynamics | $351.44 | +20.17% |

1.36% | Defense |

| LDOS | Leidos | $195.22 | +25.95% |

1.84% | Government Services |

| NOC | Northrop Grumman | $590.79 | +15.76% |

1.62% | Defense |

| LMT | Lockheed Martin | $518.44 | -6.77% |

1.62% | Defense |

| SAIC | SAIC | $111.98 | -13.84% |

2.28% | Government Services |

| BAH | Booz Allen Hamilton | $94.22 | -39.46% |

2.33% | Government Services |

- RTX (Raytheon): Stock price rose 57.70%, the strongest performer. As a major manufacturer of F-35 fighter jets and advanced missiles, the company benefited from expectations of increased defense budgets[4].

- L3Harris Technologies: Rose 40.85%, driven by steady demand for communication and electronic systems.

- Huntington Ingalls: Rose 37.22%, benefiting from the U.S. Navy expansion program as the largest U.S. shipbuilder.

- Lockheed Martin: Fell 6.77%. Despite being the largest defense contractor, the stock continues to be plagued by F-35 project delays and cost overruns[5].

- Booz Allen Hamilton: Fell 39.46%, directly impacted by government cuts to consulting contracts[6]

- SAIC: Fell 13.84%

- Leidos: Bucked the trend with a 25.95% rise due to business diversification and winning some defense contracts

- DOGE canceled several large government IT contracts, which affected Leidos[7]

- Delays in government funding have led companies to cut employment outlooks

The Trump administration proposed a record

“After long and difficult negotiations… our Military Budget for the year 2027 should not be $1 Trillion Dollars, but rather $1.5 Trillion Dollars.”

— President Donald Trump, Truth Social[8]

| Metric | Change | Investment Implication |

|---|---|---|

| Defense Budget | +50% ($500B/year) | Long-term positive for defense contractors |

| Debt Impact | $5.8 trillion increase over 10 years | Fiscal sustainability in question |

| Funding Source | Tariff revenue | Policy uncertainty |

According to analysis from the Center for American Progress (CAP), the labor market exhibits the following characteristics[3]:

- Federal employment continues to decline: 162,000 jobs lost in October, 6,000 lost in November

- Overall employment growth stagnant: Minimal net change since April 2025

- Unemployment rate rising: Increased from 4.1% in June to 4.6% in November

| Industry | Employment Change | Reason |

|---|---|---|

| Healthcare | +46,000 per month | Demand from aging population |

| Construction | +28,000 per month | Stimulated by falling interest rates |

| Federal Government | -271,000 per year | Policy reforms |

| Postal Service | Relatively stable | Business characteristics |

- Long-term unemployment (average unemployment duration for workers over 65 exceeds 30 weeks)[3]

- Employment-Population Ratio (EPOP) stagnated in 2025

- Unemployment rates for marginalized groups (young people, people of color) are rising faster

| Sector | Rating | Core Logic |

|---|---|---|

Prime Defense Contractors |

Overweight |

High certainty of 50% budget increase, clear order growth |

Government Service Contractors |

Underweight |

Lingering impact of DOGE contract cuts, high revenue uncertainty |

Defense Subsystem Suppliers |

Overweight |

Diversified customers reduce single-source dependency risk |

- RTX (Raytheon)— Strong missile business, record backlog of $221 billion[9]

- General Dynamics— Robust ground systems, shipbuilding business benefits from Navy expansion

- L3Harris— Leader in communications electronics, high technical barriers

- Booz Allen Hamilton— Overly reliant on government consulting services (>90% of revenue)

- Lockheed Martin— Persistent project delay issues

- 2027 defense budget is successfully passed by Congress

- Escalating geopolitical tensions

- Actual layoff scale is lower than expected

- Defense budget cuts (subject to congressional approval)

- Changes in tariff policy impact funding sources

- Risk of government shutdown (a 43-day shutdown occurred in 2025)

-

Significant divergence between defense and traditional government service contractors: Prime defense contractors benefit from budget increase expectations, while firms focused on government consulting face structural pressure.

-

Federal layoffs total approximately 270,000 jobs, with far-reaching impacts but not yet causing an overall labor market collapse.

-

If the

$1.5 trillion 2027 defense budget proposalis passed, it will provide strong support for the defense sector. -

In terms of investment strategy, it is recommended to overweight prime defense contractors, avoid pure government service contractors, and focus on companies with diversified businesses.

[1] BLS - The Employment Situation November 2025 (https://www.bls.gov/news.release/empsit.nr0.htm)

[2] Staffing Industry Analysts - Federal job losses may top 1.2 million under Trump’s staffing reductions (https://www.staffingindustry.com/news/global-daily-news/federal-job-losses-may-top-12-million-under-trumps-staffing-reductions)

[3] American Progress - November’s Jobs Report Hints at Labor Market Weakness (https://www.americanprogress.org/article/novembers-jobs-report-hints-at-labor-market-weakness-ahead/)

[4] Yahoo Finance - Lockheed Martin, other defense stocks jump as Trump floats $1.5T defense budget (https://finance.yahoo.com/news/lockheed-martin-other-defense-stocks-221600796.html)

[5] Yahoo Finance - Lockheed Martin (LMT) Dips More Than Broader Market (https://finance.yahoo.com/news/lockheed-martin-lmt-dips-more-225005693.html)

[6] Finviz - BAH Stock Price and Overview (https://finviz.com/quote.ashx?t=BAH)

[7] GovExec - DOGE was government contracting’s biggest story of 2025 (https://www.govexec.com/management/2025/12/doge-was-government-contractings-biggest-story-2025-and-its-not-close/410427/)

[8] Fox Business - Trump’s call for $1.5 trillion defense budget would add trillions to debt (https://www.foxbusiness.com/politics/trumps-call-1-5-trillion-defense-budget-would-add-trillions-debt-crfb)

[9] MarketBeat - RTX reported a record $221 billion backlog for Q3 2024 (https://www.marketbeat.com/logos/articles/med_20250105151110_chartc-rtx.jpg)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.