Analysis Report on the Impact of CME's Consecutive Margin Hikes for Precious Metals Futures

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the above data analysis, I now provide you with a complete comprehensive analysis report:

CME Group issued a notice on January 8, 2026, announcing that it would comprehensively increase performance margins for gold, silver, platinum, and palladium futures contracts after the close of trading on January 9, local time [1]. This marks the

| Date | Adjustment Details | Effective Date |

|---|---|---|

| December 30, 2025 | First margin hike for precious metals | After close on December 31 |

| January 6, 2026 | Second margin hike | After close on January 6 |

| January 9, 2026 | Third comprehensive margin hike | After close on January 9 |

CME Group explicitly stated that the margin adjustment was based on a

Taking silver futures as an example, consecutive margin hikes have led to a sharp decline in leverage ratios:

- Before December 30: Margin requirement of approximately $22,000 per contract → Leverage ratio of approximately20x

- After January 6: Margin requirement of approximately $32,500 per contract → Leverage ratio of approximately13.5x

- Increase: Approximately 47.7% [0]

This means traders need to commit more capital to maintain equivalent positions, and

In terms of actual market performance, significant “stampede-style” selling occurred following the margin hikes:

- Silver recorded an intraday drop of approximately 6%[1]

- Gold closed higher on the day but saw significantly increased volatility

- Gold fell by approximately 3.8%on the day [0]

- Silver fell by approximately 9.3%on the day [0]

- COMEX silver futures once dropped by more than 10% [1]

According to technical analysis data, the volatility of the precious metals market is currently at an all-time high [0]:

| Indicator | Gold | Silver |

|---|---|---|

| Annualized Volatility | 32.06% | 61.01% |

| Silver/Gold Volatility Ratio | 1.90x |

- |

| 30-Day Gain | 30.15% | 32.73% |

| Maximum Drawdown | -3.94% | -9.42% |

Silver’s volatility is nearly

-

Exchange’s risk warning mechanism: As the world’s largest futures exchange, CME’s margin adjustments are based on strict reviews of market volatility and collateral coverage [1]

-

Historical reference: When the precious metals market was at an all-time high in 2011, CME raised marginsfive times, after which the market entered a long-term bear market [1]

-

Overheated market signal: Analysts pointed out that silver and platinum have been compared to “meme stocks”, with surging trading volumes but no significant change in open interest, indicating mostly speculative short-term trading [2]

| Risk Factor | Specific Impact |

|---|---|

Margin hike pressure |

Leveraged traders are forced to liquidate positions, forcibly draining liquidity [1] |

Index rebalancing |

Bloomberg Commodity Index annual weight rebalancing (January 8-14) will lead passive funds to sell precious metals [3] |

Crowded positions |

Investors have accumulated substantial unrealized profits, and market positions are relatively crowded [3] |

Weak liquidity |

Low liquidity in Asia during holiday periods amplifies volatility [1] |

“The exchange’s margin hike is intended to cool down the overheated market, reduce futures leverage, and curb sharp fluctuations. Silver price volatility is expected to intensify in the short term, with increased correction risks.” [3]

“Rallies driven by safe-haven sentiment tend to experience ‘rollercoaster’ fluctuations as market sentiment fades.” [3]

Most institutions believe that

| Institution | View |

|---|---|

UBS Wealth Management |

Raised 2026 gold target price to $5,000/oz, with potential to surge to $5,400/oz if uncertainty rises [3] |

Minmetals Futures |

Expectations of expanding U.S. fiscal deficits will drive gold prices higher [3] |

China Merchants Bank |

Expects the Fed’s rate cut cycle is not yet over, and loose trading still has room to unfold [3] |

- ⚠️ Reduce leverage ratiosto avoid excessive speculation

- ⚠️ Set stop-loss ordersto guard against forced liquidation risks

- ⚠️ Monitor margin changesand adjust positions promptly

- 📊 Intensified short-term volatility is normal; no need for panic selling

- 📊 Consider dollar-cost averagingto seize entry opportunities after corrections

- 📊 Focus on physical supply and demand fundamentals, especially as silver inventories have fallen to a 10-year low [2]

- Support levels: $4,350, $4,300, $4,274 [1]

- Resistance levels: $4,400, $4,430, $4,500

- Support levels: $70, $69.2 [1]

- Resistance levels: $80, $84

- CME may continue to raise margins: Historical experience shows that the hike cycle may continue until the market cools significantly [1]

- Higher volatility risk for silver: Volatility is nearly twice that of gold, and correction magnitude may be larger [0]

- Liquidity risk: Trading liquidity is weak during holiday periods, making extreme price movements more likely

- Impact of index rebalancing: Bloomberg Commodity Index weight adjustments may bring additional selling pressure [3]

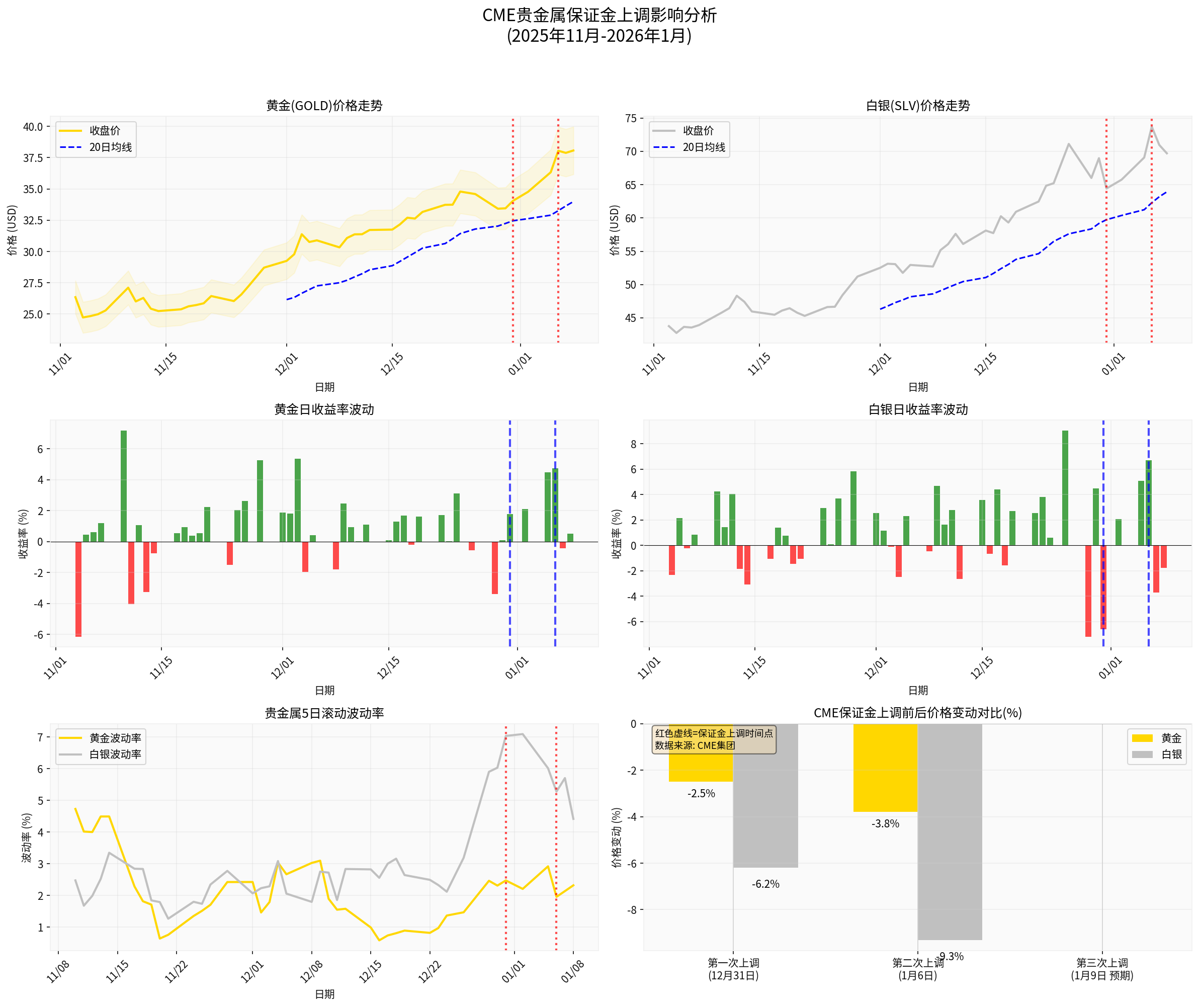

The chart above shows:

- Price trends and moving average analysis for gold and silver

- Daily return volatility distribution

- Comparative changes in volatility

- Price changes before and after margin hikes

CME’s three consecutive margin hikes for precious metals

- Short term: Beware of intensified volatility and correction risks; reduce leverage and set stop-loss orders

- Medium term: The uptrend logic remains unchanged, and corrections may present good allocation opportunities

- Long term: Factors such as global central bank gold purchases, the Fed’s rate cut cycle, and geopolitical tensions continue to support precious metals’ performance

Investors should closely monitor CME’s subsequent policy moves, changes in physical market supply and demand, and macroeconomic policy trends, and seize investment opportunities under the premise of controllable risks.

[1] Eastmoney - “Will CME Raise Precious Metals Margins Again? What Key Levels Should Gold Investors Focus On?” (https://caifuhao.eastmoney.com/news/20260102174317681488300)

[2] CNfol - “Breaking $50 is Just the Start: Physical Shortages Will Drive Silver to $100” (http://mp.cnfol.com/52486/article/1767325462-142195276)

[3] Shanghai Securities News/Securities Times - “Gold and Silver Kick Off the Year with Strong Gains; Divergences Remain on Future Trends” (https://www.stcn.com/article/detail/3572431.html)

[4] CME Group - “Resilience of Precious Metals and Copper Markets Amid High Volatility and Margin Hike Pressure” (https://www.cmegroup.com/cn-s/education/files/metals-weekly-report-2026-01-05.pdf)

[5] IG Group - “Market navigator: week of 5 January 2026” (https://www.ig.com/en/news-and-trade-ideas/weekly-market-navigator--5-jan-2026-260105)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.