US Jobs Report Analysis: January 2026 - Market Expectations and Equity Rotation Amid Policy Uncertainty

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

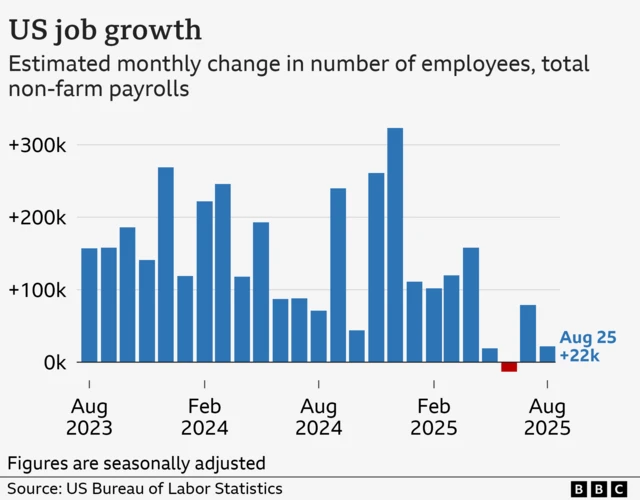

Bloomberg Television’s Carol Massar and Tim Stenovic hosted Stuart Paul and Alli McCartney of UBS Alignment Partners for a comprehensive discussion on expectations for the January 2026 non-farm payrolls (NFP) report, scheduled for release on Friday, January 9, 2026 at 8:30 AM EDT [1]. The segment occurred against a backdrop of significant equity market rotation, with traders and investors positioning themselves for potential volatility surrounding the data release. This jobs report carries particular significance as it represents the first “clean” employment data release since the resolution of the government shutdown impasse, providing the Federal Reserve with unobstructed visibility into labor market conditions after a period of data disruption [2].

The Bloomberg segment highlighted the critical importance of this particular employment report for several reasons. First, it serves as a key input for Federal Reserve monetary policy decisions, particularly as officials assess whether the current restrictive stance of monetary policy remains appropriate given evolving labor market conditions. Second, the report arrives at a pivotal moment in the economic cycle, with 2026 projections complicated by potential tariff-related inflation pressures and ongoing structural shifts in labor market dynamics [5]. Third, recent data quality concerns raised by Fed Chair Powell regarding potential overstatement of employment figures add an extra layer of complexity to market interpretation of the upcoming release [5].

Economists surveyed by Dow Jones anticipate the BLS jobs report will show approximately 73,000 non-farm payroll additions, representing an improvement from November’s revised reading of 64,000 jobs [2]. This consensus figure sits within a broader range of expectations spanning 55,000 to 73,000 new positions, reflecting uncertainty regarding the true trajectory of employment growth amid mixed high-frequency indicators [2][3]. The unemployment rate is expected to remain steady within the 4.5% to 4.6% range, while hourly earnings growth is projected at a modest 0.1% to 0.3% month-over-month—indicating continued moderation in wage pressure that could provide the Federal Reserve with additional flexibility in its policy deliberations [2].

The consensus forecast of 73,000 new jobs suggests economists believe the labor market remains resilient despite evidence of softening conditions. However, this expectation should be contextualized against the December ADP private payrolls report, which showed only 41,000 jobs added in the private sector—significantly below the 48,000 to 50,000 consensus estimate and representing a reversal from November’s surprising 29,000 job loss [2][3]. The divergence between ADP and BLS methodology continues to create interpretive challenges for market participants, though both measures collectively indicate a labor market that has lost the robust momentum observed in earlier stages of the economic expansion.

The ADP employment report released January 7, 2026 revealed significant sectoral divergence in labor market conditions, providing granular insight into the composition of employment gains and losses across the economy [2]. The education and healthcare sector emerged as the strongest generator of job growth, adding 39,000 positions and reflecting continued demand for healthcare services and educational personnel [2]. Leisure and hospitality contributed an additional 24,000 jobs, indicating persistent strength in consumer-facing service industries even as broader economic uncertainty persists [2]. Trade and transportation added 11,000 positions, while financial services contributed 6,000 jobs, suggesting continued expansion in distribution and banking activities [2].

However, significant employment contractions in other sectors temper optimism about overall labor market health. Professional and business services experienced a substantial decline of 29,000 positions, potentially reflecting corporate delayering and efficiency initiatives as companies adapt to an environment of elevated interest rates and uncertain demand [2]. The information services sector shed 12,000 jobs, continuing a pattern of workforce reduction in technology-adjacent industries that has persisted throughout 2025 [2]. This sectoral pattern—strength in healthcare, hospitality, and logistics alongside weakness in professional services and information technology—characterizes what analysts have described as a “low-hire, low-fire” dynamic representing a precarious equilibrium as 2026 begins [4].

The December ADP data represents a meaningful improvement from November’s shock 29,000-job loss, which initially raised concerns about a potentially sharper labor market deceleration [3]. However, the fact that even this improved reading fell below consensus expectations suggests the labor market’s fundamental momentum remains muted compared to historical norms. Market participants should note that the relationship between ADP and BLS data has historically been imperfect, with the two series diverging significantly in certain periods due to methodological differences in survey construction and sample selection [3].

The upcoming jobs report carries substantial implications for Federal Reserve monetary policy expectations, with market participants closely watching for signals regarding the timing and magnitude of interest rate cuts in 2026 [5]. Federal Reserve officials, as reflected in the December Summary of Economic Projections (SEP), anticipate at least one rate cut during 2026, though the specific timing remains subject to incoming economic data [5]. The CME FedWatch Tool, which reflects market pricing of future Federal Reserve policy, currently embeds expectations for two rate cuts in 2026—with April and September identified as the most likely meeting dates for policy easing [5].

Fed Governor Stephen Miran articulated a more aggressive dovish stance on January 8, 2026, calling for 150 basis points of interest rate cuts during 2026 to provide meaningful support to the labor market [6]. Governor Miran characterized current monetary policy as restrictive, noting that underlying inflation appears to be running around 2.3%—a level that, in his assessment, does not justify maintaining the current degree of policy restraint [6]. This view from a Federal Reserve official, while not representing the consensus position of the Federal Open Market Committee, signals potential dissension within the Fed regarding the appropriate policy path forward.

The current federal funds rate range of 3.5% to 3.75% represents what many Fed officials have characterized as a “slightly restrictive” stance on economic activity [4]. Philadelphia Fed President Paulson has echoed this assessment, suggesting that monetary policy, while no longer highly restrictive as it was during the aggressive hiking cycle, continues to exert meaningful downward pressure on aggregate demand [4]. Fed Chair Powell’s December remarks emphasized the Fed’s patient approach, stating that officials are “well-positioned to wait and see how the economy evolves” before proceeding with additional cuts [5]. This data-dependent posture elevates the importance of each incoming economic release, with Friday’s jobs report representing a particularly significant input for near-term policy expectations.

Contemporary market action reveals a pronounced rotation away from growth-oriented sectors toward rate-sensitive and cyclical industries, a dynamic that has intensified as investors position for potential Federal Reserve easing and assess the implications of evolving labor market conditions [0]. The January 8, 2026 trading session exemplified this rotation pattern, with the Russell 2000 small-cap index advancing 1.11% while the technology-heavy NASDAQ Composite declined 0.29%—a performance differential that underscores the breadth and significance of the ongoing sector rotation [0].

Sector-level performance data reveals consistent patterns of cyclical outperformance and defensive growth underperformance. The energy sector led all major industry groups with a gain of 2.85%, benefiting from both rotation dynamics and prevailing commodity price expectations [0]. Consumer defensive stocks advanced 1.70%, reflecting investor preference for stability amid economic uncertainty [0]. Basic materials added 1.61% and real estate gained 1.31%, both benefiting from their cyclical and rate-sensitive characteristics [0]. Conversely, the technology sector declined 0.95%, healthcare retreated 1.17%, and utilities—a traditional defensive haven—experienced the sharpest decline at 2.19% [0].

This rotation pattern carries important implications for portfolio positioning and risk management. The outperformance of rate-sensitive sectors such as real estate, utilities, and small-caps typically anticipates Federal Reserve easing, as lower rates reduce discount rates applied to longer-duration cash flows and improve financing conditions for interest-sensitive industries. The simultaneous underperformance of high-multiple growth stocks suggests that investors are reducing exposure to companies whose valuations depend heavily on distant cash flows in favor of more immediately profitable, cyclical businesses. Market participants should recognize that this rotation could accelerate or reverse depending on the jobs report’s implications for Fed policy expectations.

The convergence of multiple analytical perspectives reveals several critical insights for understanding the current market and economic environment. First, the labor market’s transition from robust expansion to a more measured pace of job creation appears orderly rather than distressful, with the “low-hire, low-fire” dynamic suggesting neither rapid deterioration nor strong acceleration in employment conditions [4]. This equilibrium state supports the Federal Reserve’s patient approach to policy while providing neither clear justification for aggressive easing nor concern about overheating.

Second, the equity rotation dynamics observed in early January 2026 reflect sophisticated market positioning around anticipated Fed policy shifts and evolving risk-reward assessments across sectors. The magnitude of sector performance dispersion—spanning approximately 5 percentage points from the best-performing energy sector to the worst-performing utilities sector—suggests meaningful conviction among institutional investors regarding the sustainability of this rotation [0]. Third, wage growth dynamics remain bifurcated, with job stayers experiencing 4.4% median pay increases while job changers command 6.6% increases—a discrepancy that could complicate the Federal Reserve’s inflation assessment and potentially limit the willingness to cut rates aggressively despite moderating headline inflation [4].

Fourth, data quality concerns raised by Fed Chair Powell regarding potential overstatement of employment figures by approximately 60,000 jobs per month introduce interpretive uncertainty into the upcoming BLS release [5]. Market participants should exercise appropriate caution in drawing firm conclusions from any single data point, particularly given the known methodological challenges in seasonal adjustment during periods of economic transition. Fifth, the resolution of the government shutdown ensures that Friday’s report will provide uncluttered labor market visibility, but also introduces some uncertainty regarding seasonal adjustment factors that were disrupted during the impasse period.

Data quality concerns represent the most significant risk factor for interpretation of the upcoming employment report. The potential 60,000-job monthly overstatement identified by Fed Chair Powell introduces meaningful uncertainty into any single month’s figures [5]. Investors should recognize that statistical noise in the BLS data could produce misleading signals about the true trajectory of labor market conditions, potentially triggering inappropriate portfolio adjustments based on transient data anomalies.

Sticky wage growth among job stayers poses a risk to the Federal Reserve’s inflation outlook and could constrain the extent of policy easing even if employment conditions soften moderately. The 4.4% median pay increase for workers remaining in their positions represents a level of wage pressure that, if sustained, could prevent inflation from declining to the Fed’s 2% target on a sustained basis [4]. This dynamic could create a scenario where the Fed faces conflicting signals—moderating employment but persistent wage-driven inflation—complicating policy decisions.

Government shutdown distortion effects, while reduced following the resolution of the impasse, may still influence seasonal adjustment factors and complicate comparisons with historical patterns [2]. Additionally, potential tariff-related inflation pressures complicate the economic outlook for 2026, introducing uncertainty into both growth and inflation projections that could affect Federal Reserve policy and market valuations [5].

A jobs report that meaningfully misses expectations (below 55,000 jobs) could accelerate Federal Reserve cut expectations, benefiting rate-sensitive asset classes including small-caps, utilities, and real estate investment trusts. Historically, periods of monetary policy easing have proven favorable for smaller-capitalization stocks and interest-sensitive sectors, suggesting potential tactical positioning opportunities if labor market weakness materializes.

Continued equity rotation from growth to value sectors could present opportunities for investors willing to align portfolios with prevailing market trends. The breadth of sector performance dispersion suggests meaningful alpha potential for active managers who can successfully identify the leadership within the cyclical/value complex and avoid extended positions in underperforming defensive growth names.

The current data-dependent Fed posture creates opportunities for volatility-based strategies, as each significant economic data release could meaningfully shift market expectations regarding the timing and magnitude of policy changes. Investors with appropriate risk tolerance and trading infrastructure could potentially capitalize on short-term market movements surrounding the jobs report release and subsequent Fed communications.

The January 2026 jobs report represents a significant data point for Federal Reserve policy decisions and market positioning, with consensus expectations centered around 73,000 new non-farm payroll positions and unemployment holding near 4.6%. The prior ADP report’s 41,000 private job addition—below expectations of 48,000 to 50,000—suggests labor market momentum remains muted, though the data exhibits sectoral divergence with healthcare and hospitality strength offset by professional services weakness.

Federal Reserve policy expectations have consolidated around 1-2 rate cuts in 2026, with April and September identified as most likely meeting dates, though dissenting views from Governor Miran calling for 150 basis points of cuts introduce policy uncertainty. The current federal funds rate at 3.5% to 3.75% is characterized as “slightly restrictive” by many Fed officials, suggesting limited additional policy tightening is expected regardless of incoming data.

Equity rotation dynamics favor cyclical and rate-sensitive sectors, with energy, consumer defensive, and basic materials outperforming technology, healthcare, and utilities. The Russell 2000’s relative strength versus the NASDAQ exemplifies this rotation, suggesting institutional investors are positioning for a regime shift favoring smaller-cap and value-oriented exposures.

Data quality concerns, sticky wage growth, government shutdown residual effects, and tariff-related inflation pressures represent key risk factors requiring careful monitoring. Market participants should exercise appropriate caution in interpreting single data points and maintain diversified positioning that accounts for multiple potential policy and economic scenarios.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.