Analysis of the Impact of Surging Brazilian Agricultural Exports on the Investment Value of the Agricultural Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Brazil’s agricultural exports achieved a historic breakthrough in 2025. Despite pressure from U.S. tariff policies, Brazil’s annual export value still reached USD 348.7 billion, hitting a record high[1]. The value of agricultural exports increased by 7.1% year-on-year, led by green coffee and soybeans[2]. This achievement fully demonstrates the resilience and competitiveness of Brazilian agriculture in the global supply chain.

- 2025 trade surplus reached USD 68.3 billion[1]

- Exports to China grew 6% to USD 100.021 billion, and China has been Brazil’s largest trading partner for consecutive years[1]

- Exports to the U.S. decreased by 6.6%, falling from USD 40.368 billion to USD 37.716 billion[1]

- The value of agricultural exports increased by 7.1% year-on-year[2]

The tariff policy implemented by the U.S. against Brazil (imposing a 50% tariff on multiple commodities including beef, with a total tax rate as high as 76.4%)[3] instead accelerated the diversification of Brazil’s agricultural export markets. Brazil successfully converted the losses from exports to the U.S. into breakthrough growth in other markets:

- The total soybean export volume in 2025 is expected to reach 102.2 million tons, a record high[3]

- China accounts for 79.9% of Brazil’s total soybean exports, a significant increase from 74% in 2021-2024[3]

- China imported 6.5 million tons of soybeans from Brazil, accounting for 93% of Brazil’s total soybean export volume[3]

- U.S. soybean exports to China have fallen to zero[3]

- In September 2025, Brazil’s beef exports to China increased by 38.3% year-on-year to 187,340 tons, a monthly record high[3]

- In September, Brazil’s total beef export revenue reached USD 1.92 billion, up 49% year-on-year, with sales volume reaching 373,867 tons, up 17% year-on-year[3]

- The EU has become Brazil’s second-largest beef market, with procurement value reaching USD 131.7 million, up 106% year-on-year[3]

- 130 countries around the world have increased their procurement of Brazilian beef[3]

Brazil’s agriculture is at the bottom of the cycle and is gradually emerging from difficulties and entering a recovery phase[4]. The current industry exhibits the following characteristics:

- Brazil’s traditional agriculture faced difficulties in 2025, with a large number of farms going bankrupt due to low commodity prices[4]

- A report from Banco do Brasil shows that the agricultural loan default rate reached a record high of 5.34%, with overdue loans amounting to BRL 19.3 billion[4]

- Brazil’s interest rate remains at 15%, far higher than the 2-3% level in developed countries, pushing up the capital cost of agriculture[4]

- Brazil produces 40% of the world’s soybeans and is the world’s leading producer of products such as green coffee and beef[5]

- It has natural conditions suitable for year-round production, with abundant land, soil and labor resources[4]

- Strong R&D capabilities in agricultural technology; the Brazilian Agricultural Research Corporation (Embrapa) showcased net-zero emission crop varieties at COP30[4]

- It has a large domestic market and is the world’s largest exporter of agricultural and food products[4]

Marfrig delivered a strong performance in the second quarter of 2025[6]:

| Indicator | Q2 2025 | Year-on-Year Change |

|---|---|---|

| Net Profit | BRL 85 million | +13% |

| Consolidated Net Revenue | BRL 37.7 billion | +8.6% |

| EBITDA | BRL 3 billion | - |

| Operating Cash Flow | BRL 3 billion | +17% |

| Financial Leverage Ratio | 2.7x | 3.38x → 2.7x |

In terms of regional business, net revenue in South America reached BRL 4.03 billion, up nearly 10% year-on-year, with an adjusted EBITDA margin of 10.9%; net revenue in North America reached USD 3.26 billion, up 5.3% year-on-year[6].

As Brazil’s largest poultry processing enterprise, BRF achieved net revenue of BRL 15.4 billion in the second quarter of 2025, with adjusted EBITDA reaching BRL 2.5 billion and a profit margin of 16.4%, demonstrating strong profitability[6].

As the world’s largest beef producer, JBS surpassed the U.S. to become the world’s top beef producer in 2025[7]. Brazil’s beef production increased by 4% in 2025, while analysts had previously predicted a decline of 2.7%; the actual increment was approximately 800,000 tons, equivalent to Argentina’s annual export volume[7].

COP30, held in Belém, Brazil in 2025, has created a global brand effect for Brazilian agriculture, becoming an important catalyst for attracting foreign investment[4]:

- The “COP Regenerative Landscape Action Agenda” launched a joint investment platform, which will invest USD 5 billion in Brazil’s land restoration projects[4]

- The Bill & Melinda Gates Foundation invested USD 1.4 billion to support farmers affected by extreme weather[4]

- ByteDance announced plans to invest over USD 37 billion in Brazilian data centers to support the development of agricultural artificial intelligence[4]

Brazil’s agriculture is accelerating its digital transformation:

- Significant opportunities exist in areas such as agricultural artificial intelligence, supply chain digitalization, and farm data commercialization[4]

- The Yield Lab Latam is collaborating with various parties to establish an agricultural artificial intelligence research center[4]

- It is expected to establish an Ignition Fund with a scale of USD 20 million similar to Mexico’s, to lay out early-stage agricultural technology startups[4]

-

Market Diversification Dividend: The pressure of U.S. tariffs has instead accelerated the restructuring of Brazil’s agricultural export market. The growth in exports to China not only made up for the losses in exports to the U.S., but also opened up new markets such as the EU and the Middle East[3]

-

Accelerated Industry Integration: The merger of Marfrig and BRF will create a more competitive global agri-food giant, enhancing industry concentration and bargaining power[6]

-

Continuous Inflow of Foreign Capital: After COP30, international capital’s interest in Brazil’s sustainable agriculture sector has increased significantly, with regenerative agriculture and agricultural technology becoming investment hotspots[4]

-

Sustained Production Growth: Brazil’s soybean production reached a record high of over 170 million tons, and its beef production surpassed the U.S. to rank first in the world. The continuous expansion of supply has laid a foundation for export growth[3][7]

-

Exchange Rate Advantage: The value of the Brazilian real relative to the U.S. dollar provides a cost advantage for Brazilian exporters, enhancing the competitiveness of their products in the international market

-

High Interest Rate Environment: Brazil’s benchmark interest rate of 15% significantly increases the financing cost of the agricultural sector, restricting industry expansion[4]

-

China Policy Risk: In late December 2025, China imposed quotas on imported beef to protect domestic farmers, which poses a potential threat to the Chinese market, where nearly half of Brazil’s beef exports are destined[1]

-

Price Volatility Risk: Persistently low commodity prices have squeezed farm profits, and the farm bankruptcy rate in 2025 has tripled compared to 24 months ago[4][8]

-

Geopolitical Uncertainty: Uncertainties in U.S.-Brazil trade relations and the evolution of Sino-U.S. trade patterns may affect the export path of Brazilian agricultural products[3]

-

Seasonal Volatility: Agricultural exports exhibit obvious seasonal characteristics, usually peaking in the middle of the year and declining at the end of the year[9]

Based on the above analysis, we propose the following investment strategies for Brazil’s agricultural sector:

| Strategy Type | Recommended Target | Investment Logic |

|---|---|---|

Core Allocation |

MBRF (Post-Merger Entity) | Industry integration leader, multi-protein strategy, global layout |

Growth Allocation |

Agricultural Technology Startups | COP30 effect + AI wave, large valuation upside potential |

Defensive Allocation |

BRF (BRFS3) | High proportion of high-value-added products, strong profit stability |

Cyclical Allocation |

JBS (JBSS3) | World’s largest beef producer, benefits from supply gaps |

Currently, Brazil’s agriculture is at the bottom of the cycle and is gradually emerging from difficulties[4]. Gartlan, Managing Partner of The Yield Lab Latam, said: “For any investor, we recommend entering now. Don’t wait until things start to heat up, because that’s usually too late”[4].

- Industry M&A activities have started to pick up slightly[4]

- Foreign enterprises’ interest in entering the Brazilian market is growing[4]

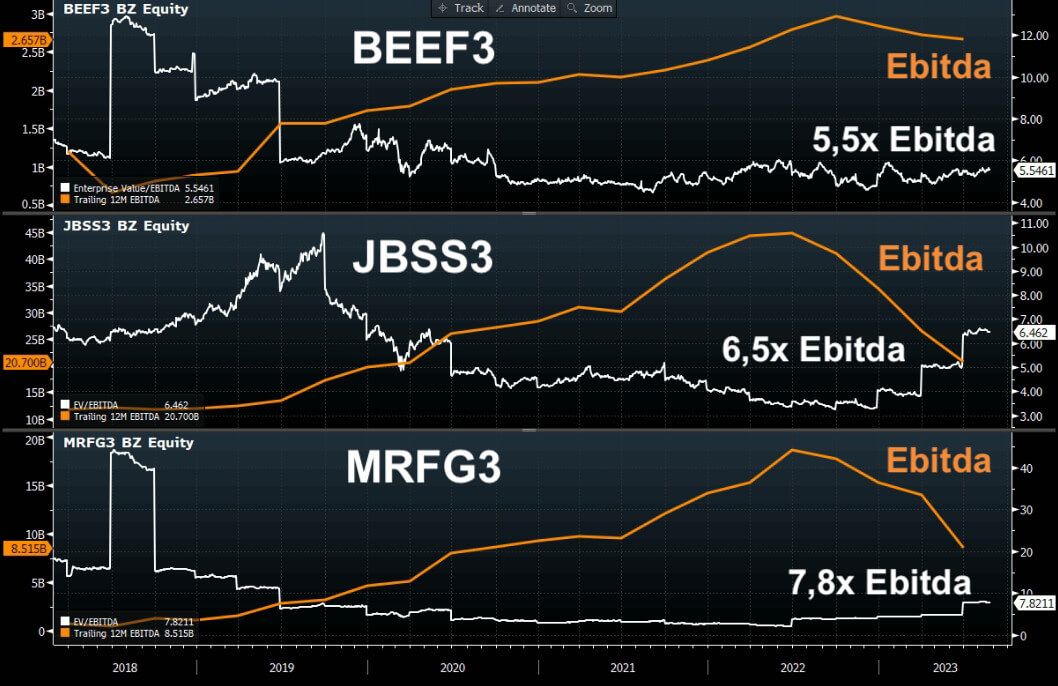

- Current valuation levels have not yet fully reflected the positive impact of surging exports

Investors should focus on the following indicators:

- Evolution of China’s import policies for Brazilian agricultural products

- Changes in Brazil’s interest rate trends and financing environment

- Progress of the Marfrig-BRF merger and the release of synergies

- Sustainability of Brazil’s agricultural export data

- Investment progress in the field of agricultural technology

The surging of Brazilian agricultural exports has had a profound positive impact on the investment value of the agricultural sector. Despite facing pressure from U.S. tariff policies, Brazilian agriculture has demonstrated strong resilience and market adaptability. The surging exports are not only a short-term phenomenon, but also reflect the strategic restructuring of the global agricultural product trade pattern:

-

Structural Opportunities: The rise of the Chinese market and the diversification of export markets have provided a more stable and broader demand foundation for Brazilian agriculture[3]

-

Industry Upgrading: The merger and reorganization of large agricultural enterprises will enhance industry concentration and competitiveness; the birth of MBRF will create a world-leading agri-food giant[6]

-

Innovation-Driven Growth: The brand effect brought by COP30 and the wave of investment in agricultural technology have injected new growth impetus into Brazilian agriculture[4]

-

Cycle Position: Currently at the bottom of the cycle, with the recovery of the price cycle and the increase in M&A activities, the investment window is opening[4]

After a comprehensive assessment, Brazil’s agricultural sector has

[1] Xinhua Silk Road - Brazil’s 2025 Trade Surplus Reaches USD 68.3 Billion (https://www.imsilkroad.com/news/p/803145.html)

[2] Trading Economics - Brazil Posts Record December Trade Surplus (https://zh.tradingeconomics.com/brazil/balance-of-trade/news/514900)

[3] Guancha.cn - “Thank You, America” — Brazil’s Beef Exports to China Hit a New High (https://www.guancha.cn/internation/2025_10_09_792595.shtml)

[4] AgTech Navigator - Investing in Brazil: How COP30, AI are boosting ag sector (https://www.agtechnavigator.com/Article/2025/12/16/investing-in-brazil-how-cop30-ai-are-boosting-ag-sector/)

[5] Nemo Money - Brazil’s Economic Pivot: Global Giants for 2025 Investment (https://explore.nemo.money/en/insights/understanding-brazils-economic-outlook-for-2025-via-global-equities)

[6] Marfrig - MARFRIG GROWS 8.6% IN REVENUE AND 13% IN PROFIT IN SECOND QUARTER 2025 (http://marfrig.com.br/en/news/marfrig-second-quarter-results-2025)

[7] U.S. News - Brazil Surpassing US as Top Beef Producer (https://money.usnews.com/investing/news/articles/2026-01-07/brazil-surpassing-us-as-top-beef-producer-easing-global-supply-squeeze)

[8] Farm Progress - Fresh money masks Brazil’s farm financial crisis (https://www.farmprogress.com/commentary/fresh-money-masks-brazil-s-farm-financial-crisis)

[9] Cultivar - Analysis of Brazilian Agricultural Export Data (https://assets.revistacultivar.com.br/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.