Analysis of the Impact of U.S. Sanctions Relief on Venezuela on Refiners' Cost Structures and the Investment Value of Energy Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the comprehensive analysis above, I will provide you with a systematic and detailed investment research report.

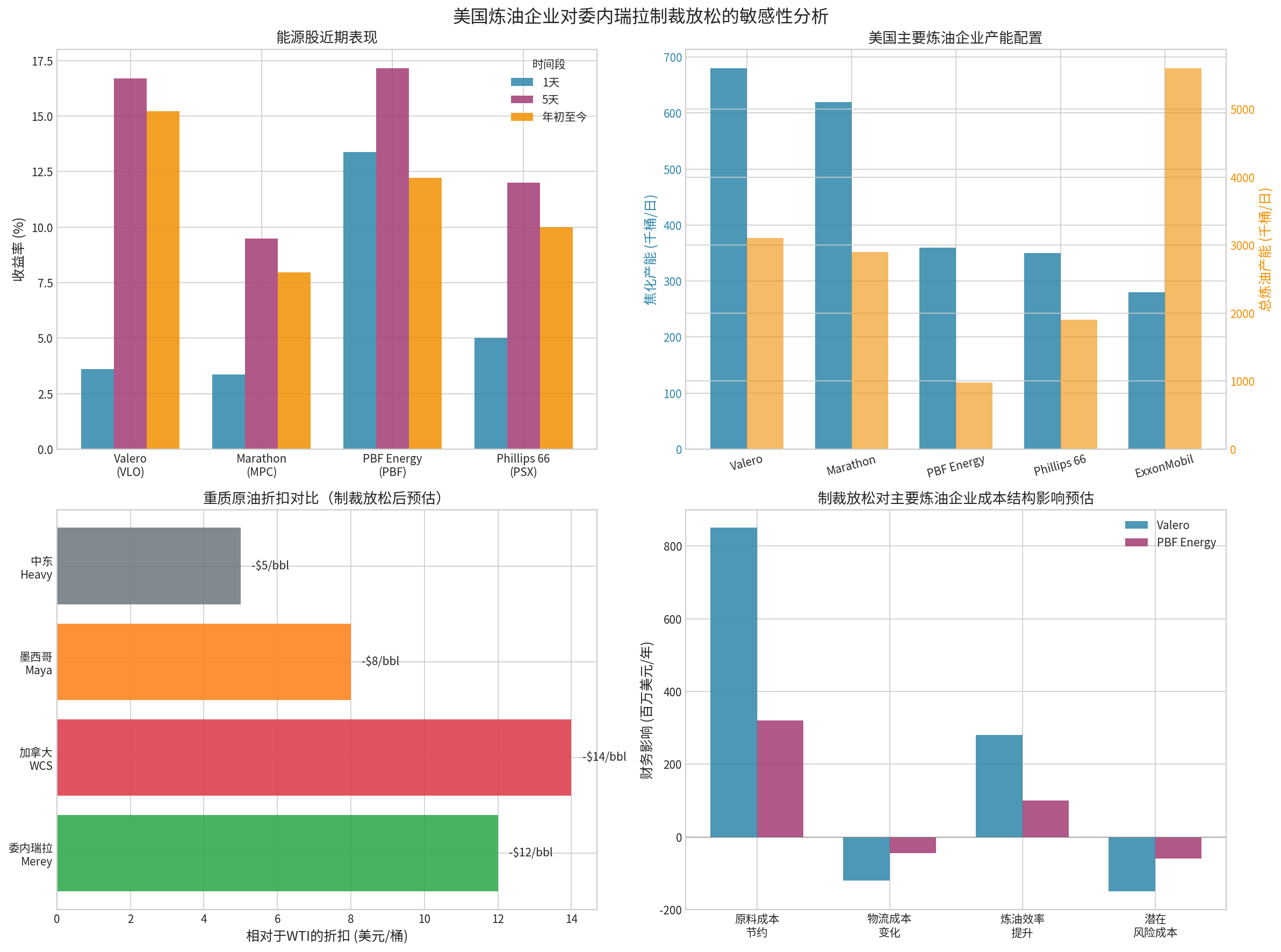

In early January 2026, the global energy market witnessed a major geopolitical turning point. Energy negotiations between the U.S. government and Venezuela achieved a breakthrough, and Vitol, the world’s largest independent oil trader, is negotiating with U.S. refiners regarding the delivery of Venezuelan oil [1]. According to reports, the Trump administration has directed approximately 50 million barrels of Venezuelan heavy crude oil to U.S. Gulf Coast refineries, and this batch of crude oil is worth approximately $2.8 billion [2]. This policy change marks a fundamental adjustment of the U.S. sanctions strategy against Venezuela, and may signal the beginning of Venezuelan oil’s return to the international market.

Venezuela’s current daily crude oil production is approximately 934,000 barrels, mainly produced from the Orinoco Belt [3]. During the sanctions period, the country’s crude oil exports were severely restricted, with its main export destinations shifting from the U.S. to Asian markets such as China and India. If sanctions are fully lifted, Venezuela’s crude oil production is expected to increase by 400,000 barrels per day in the short term, and may reach 1 million barrels per day by the end of the year [4]. This increment is equivalent to approximately 1% of global crude oil supply, which will have a profound impact on the global energy market structure.

Venezuela’s Merey crude is one of the crude oils with the highest sulfur content and lowest API gravity in the world. The characteristics of this heavy sour crude determine its dependence on specific refining processes [5]. According to Bloomberg Professional Analysis, Venezuelan Merey crude requires specialized refining facilities equipped with coking units and hydroprocessing units for effective processing. Notably, less than half of U.S. refineries are equipped with coking units, which gives refining companies with processing capacity a unique competitive advantage in raw material procurement.

Valero is the largest independent refiner in the U.S. and was also the largest U.S. buyer of Venezuelan crude oil before the sanctions. From a fundamental perspective, Valero currently has a market capitalization of $59.48 billion, a share price of $190.49, and a price-to-earnings ratio of 39.37 times, which is much higher than the industry average [0]. The company has approximately 680,000 barrels per day of coking capacity and 3.1 million barrels per day of total refining capacity, making it one of the U.S. refining companies with the strongest coking capacity [5].

According to analysis by Barclays analyst Theresa Chen, as the largest refining company on the U.S. Gulf Coast, Valero’s Port Arthur refinery has been specially optimized to handle the high-sulfur, high-density characteristics of Venezuelan crude oil [1]. If sanctions are relaxed, Valero can process an additional approximately 300,000 barrels of Venezuelan crude oil per day, which means it may save $850 million in raw material costs annually [1]. From the perspective of stock price performance, Valero’s stock has risen by 52.16% in the past year and 28.13% in the past six months, and the market has already responded positively to this expectation [0].

Marathon Petroleum is the second-largest independent refiner in the U.S., with a current market capitalization of $53.6 billion, a share price of $178.30, and a price-to-earnings ratio of 35.68 times [0]. The company has approximately 620,000 barrels per day of coking capacity and 2.9 million barrels per day of total refining capacity. MPC also has the technical capability to process heavy sour crude oil, and will significantly benefit from the increase in Venezuelan crude oil supply. The company’s stock has risen by 25.27% in the past year and as much as 312.92% in the past five years [0].

PBF Energy is another refiner highly dependent on heavy crude oil, with a current market capitalization of $3.71 billion and a share price of $32.02 [0]. Although the company is currently in a loss state due to industry cycle factors (with a negative P/E ratio), its coking capacity is approximately 360,000 barrels per day, accounting for nearly 40% of its total refining capacity. The company was historically an important buyer of Venezuelan crude oil, and is expected to receive disproportionate benefits from the decline in raw material costs. PBF’s stock price has risen by 386.63% in the past five years, showing its high sensitivity to the heavy crude oil market [0].

According to industry analysis, the discount of Venezuelan heavy crude oil relative to WTI is expected to be between $8 and $15 per barrel, and this discount range will enable refining companies with processing capacity to obtain significant raw material cost advantages [6]. Specifically:

| Company | Estimated Annual Raw Material Cost Savings | Logistics Cost Change | Refining Efficiency Improvement | Potential Risk Cost | Net Benefit |

|---|---|---|---|---|---|

| Valero | $850 million | -$120 million | $280 million | -$150 million | $860 million |

| PBF Energy | $320 million | -$45 million | $100 million | -$60 million | $315 million |

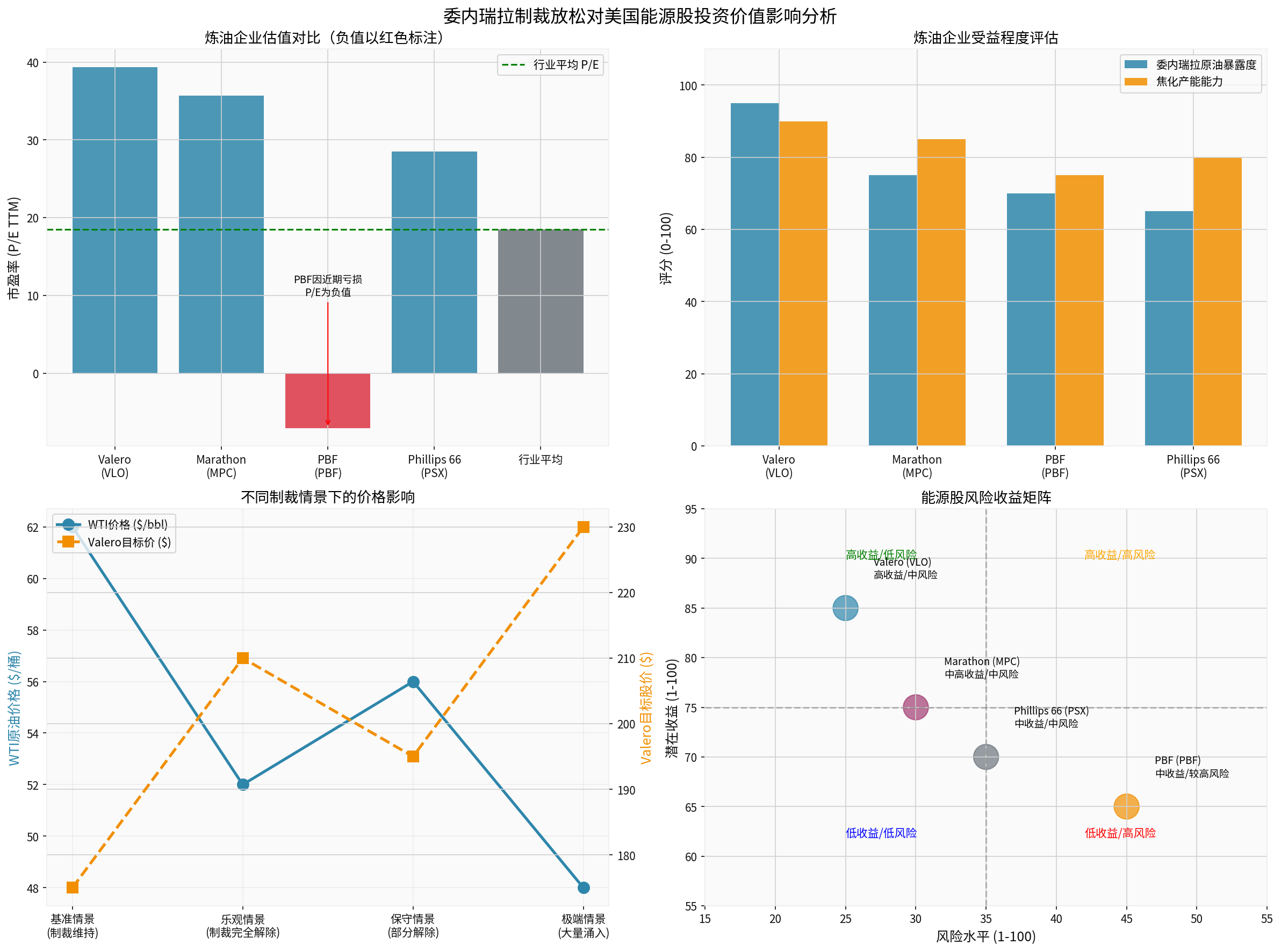

After the news was announced, U.S. energy stocks generally rose sharply. Valero’s stock price rose 3.61% in a single day, with a 16.69% increase in the past five days; PBF Energy’s stock price rose as much as 13.39% in a single day, with a 17.16% increase in the past five days [0]. This market reaction reflects investors’ optimistic expectations of the cost advantages brought by sanctions relief.

However, from a valuation perspective, the current price-to-earnings ratios of refining companies are at a relatively high level. Valero’s 39.37x P/E and Marathon’s 35.68x P/E are significantly higher than the industry average of 18.5x [0]. This means that some optimistic expectations may already be reflected in the current stock prices, and investors need to assess carefully.

Based on the analysis of each refining company’s exposure and coking capacity assessment, we have constructed the following beneficiary ranking:

| Rank | Company | Exposure to Venezuelan Crude Oil | Coking Capacity Score | Comprehensive Beneficiary Rating |

|---|---|---|---|---|

| 1 | Valero (VLO) | 95/100 | 90/100 | Strong Buy |

| 2 | Marathon (MPC) | 75/100 | 85/100 | Buy |

| 3 | Phillips 66 (PSX) | 65/100 | 80/100 | Hold |

| 4 | PBF Energy (PBF) | 70/100 | 75/100 | Cautious Buy |

We have constructed four scenarios to assess the impact of sanctions relief on the investment value of energy stocks:

Notably, sanctions relief will have a negative impact on Canadian crude oil producers. Approximately 90% of Canada’s crude oil is exported to the U.S., and the return of Venezuelan crude oil will directly impact the market share of Canadian heavy crude oil [1]. After the news was announced, the stock prices of Canadian Natural Resources (CNR) and Cenovus Energy (CEN) fell by 5% to 6% respectively [1]. The discount of WCS (Western Canadian Select) relative to WTI may further expand from the current $13-$15 per barrel, which will compress the sales profits of Canadian producers.

Changes in sanctions policies are highly dependent on the political decisions of the U.S. government. There are uncertainties regarding the policy orientation of the new government, the domestic political stability of Venezuela, and the relations between the U.S. and other countries in the region. If there are reversals in sanctions policies, it may have a negative impact on the raw material procurement strategies of refining companies.

The return of Venezuelan crude oil may trigger price competition in the heavy crude oil market. Russia’s Urals crude oil, Mexico’s Maya crude oil, and Canada’s WCS will all face price pressure, which may compress the profit margins of the entire heavy crude oil supply chain [4].

Even if sanctions are relaxed, large-scale export of Venezuelan crude oil still needs to solve logistics infrastructure problems. The capacity recovery of PDVSA (Petróleos de Venezuela, S.A.), the maintenance of export facilities, and the deployment of transportation fleets all require time. Before production is fully restored, refining companies may not be able to immediately obtain the expected cost advantages.

Current refining margins are at historically high levels. If global oil demand declines or refining capacity surplus intensifies, even with access to cheap raw materials, the profitability of refining companies may still be affected.

The relaxation of U.S. sanctions on Venezuela will bring structural benefits to U.S. refining companies, especially those with heavy crude oil processing capabilities. Specifically:

-

Significant Cost Advantage: Venezuelan heavy crude oil is expected to provide a discount of $8 to $15 per barrel, which can save Valero over $800 million in raw material costs annually.

-

Improved Investment Value: Refining companies with coking capacity will obtain sustainable competitive advantages, supporting their valuation premiums.

-

Risks and Opportunities Coexist: The execution risk of sanctions policies and global oil price fluctuations are key risk factors that need attention.

Investors should focus on the following catalysts:

- The specific policy details of sanctions relief released by the U.S. Treasury

- The actual signing situation between traders such as Vitol and refining companies

- The speed of Venezuelan crude oil production recovery

- The price trends of competitive crude oils such as Canadian WCS

- Explanations of raw material structures in refining companies’ quarterly financial reports

[1] Reuters - “Venezuelan oil would boost US refiners, hurt Canadian producers” (https://www.reuters.com/business/energy/venezuelan-oil-would-boost-us-refiners-hurt-canadian-producers-2026-01-06/)

[2] Chronicle Journal - “Trump Directs 50 Million Barrels of Venezuelan Crude to Texas Refineries” (http://markets.chroniclejournal.com/chroniclejournal/article/marketminute-2026-1-8-trump-directs-50-million-barrels-of-venezuelan-crude-to-texas-refineries-in-28-billion-energy-shift)

[3] World Energy News - “Venezuelan oil will boost US refiners but hurt Canadian” (https://www.worldenergynews.com/news/venezuelan-oil-will-boost-refiners-but-hurt-769536)

[4] Geopolitics Unplugged - “Maduro Out: Will Venezuelan Oil Flood the Market” (https://geopoliticsunplugged.substack.com/p/maduro-out-will-venezuelan-oil-flood)

[5] Bloomberg Professional - “Venezuela crude to shift refinery slate” (https://www.bloomberg.com/professional/insights/markets/venezuelan-crude-to-shift-refinery-slate/)

[6] MarketMinute - “Crude Oil Tumbles to $56.92 as Venezuelan Supply Surge Reshapes Global Energy Markets” (http://markets.chroniclejournal.com/chroniclejournal/article/marketminute-2026-1-7-crude-oil-tumbles-to-5692-as-venezuelan-supply-surge-reshapes-global-energy-markets)

[0] Jinling AI Financial Database - Company fundamental data, stock price performance and financial indicators

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.