Analysis of Day Trading Viability with $4,000 Under Pattern Day Trader Rules

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on a Reddit post published on November 12, 2025, at 03:36:42 UTC, seeking realistic annual profit expectations for day trading with $4,000 while subject to Pattern Day Trader (PDT) regulations [0].

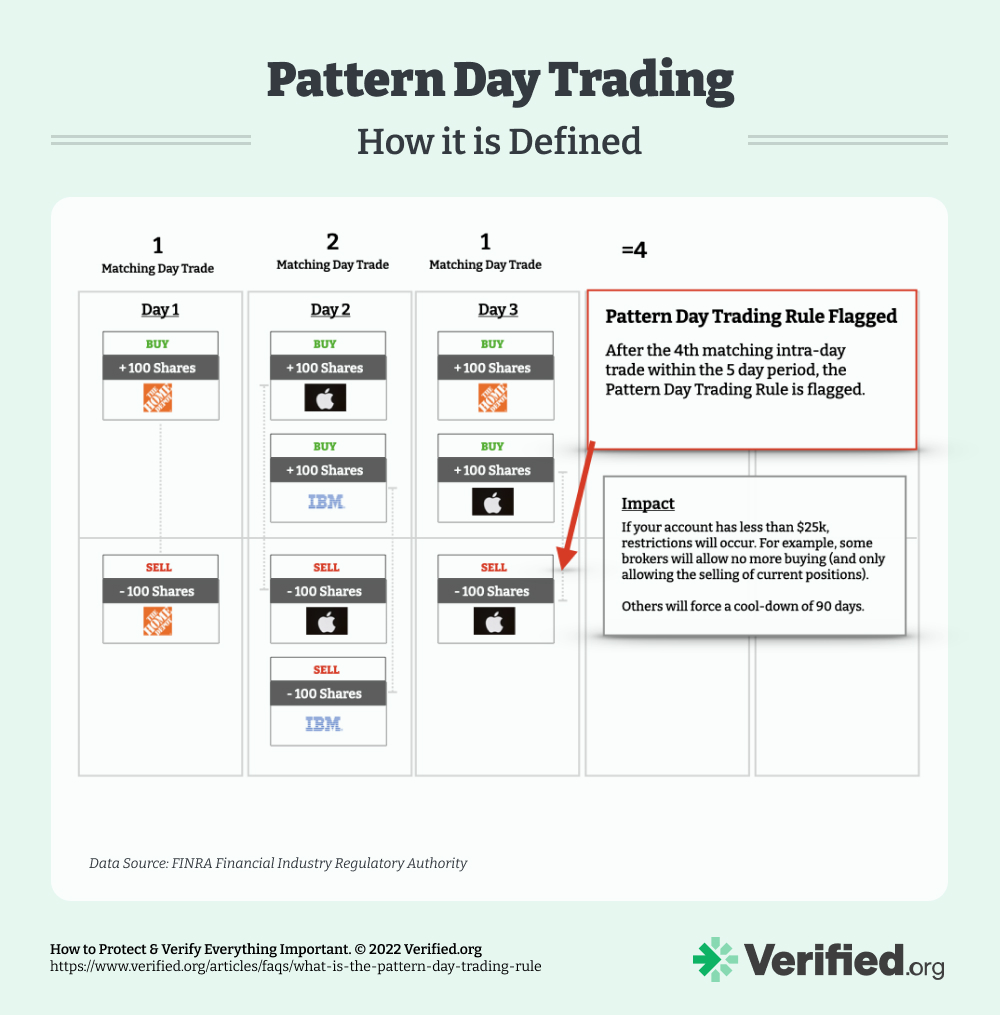

The Pattern Day Trader rule presents the most significant barrier to small account trading. Current regulations require a minimum of $25,000 in equity for margin accounts to make unlimited day trades [0]. With only $4,000, traders are restricted to a maximum of 3 day trades within any 5-business-day period in margin accounts, severely limiting trading frequency and profit potential [0].

A pattern day trader is defined as someone who executes four or more day trades within five business days, representing more than 6% of total trades in that period [0]. This regulatory framework effectively prevents meaningful day trading strategies for accounts under $25,000.

The statistical reality of day trading success presents sobering challenges. Research indicates that only 13% of day traders maintain consistent profitability over six months, with this figure dropping dramatically to just 1% for those profitable over five or more years [1]. This suggests that even with optimal strategy and discipline, the probability of long-term success with a $4,000 account is extremely low.

For successful traders, typical earnings range between 1-4% per month, corresponding to daily earnings of 0.033-0.13% [1]. Applied to a $4,000 account, this translates to approximately $40-160 monthly or $480-1,920 annually for traders who fall into the successful minority.

Current market conditions show mixed performance across major indices, with modest daily movements typically under 1% [0]. This environment creates challenges for small account traders seeking meaningful percentage gains without excessive risk-taking.

Small accounts face disproportionate transaction costs and limited position sizing. With $4,000, even a 2% daily gain ($80) may be insufficient to overcome commission fees and bid-ask spreads, making profitable trading difficult [1]. Professional traders typically aim for 1-2% daily returns, but this requires sufficient capital to make meaningful trades while managing risk effectively [1].

Several approaches exist to navigate PDT restrictions:

- Cash Account Trading: The PDT rule doesn’t apply to cash accounts, eliminating the 3-trade limit but also removing leverage capabilities [2]

- Multiple Small Accounts: Some traders divide capital across multiple margin accounts to bypass PDT restrictions [2]

- Futures Trading: Futures markets are not subject to PDT rules, offering alternative trading opportunities [2]

Regulatory changes may be forthcoming, as FINRA’s Board of Governors approved amendments in September 2025 to replace the $25,000 minimum with an intraday margin framework [3]. However, these changes require SEC approval and are not yet effective, potentially taking until late 2025 or early 2026 to implement [0].

The analysis reveals a fundamental mismatch between small account capital and the requirements for successful day trading. The combination of regulatory limitations, low success rates, and capital efficiency challenges creates a high-risk environment for $4,000 day trading attempts.

The most critical insight is that the PDT rule effectively functions as a risk management barrier, preventing inexperienced traders from depleting small accounts through frequent trading. While this regulation may seem restrictive, it aligns with the statistical reality that most day traders lose money over time.

- Account Depletion Risk: Based on success statistics, there’s an 87% probability of losing money within the first 6 months [1]

- Regulatory Violation Risk: Exceeding PDT limits can result in account restrictions and trading suspensions [0]

- Capital Inefficiency: Transaction costs represent a higher percentage of small account trades, reducing profitability [1]

- Alternative Markets: Futures and options markets offer PDT-exempt trading opportunities [2]

- Regulatory Changes: Pending FINRA amendments may create more flexible trading frameworks for small accounts [3]

- Educational Focus: Small capital may be better utilized for learning through paper trading or minimal position sizing

For a trader with $4,000 seeking to day trade, the analysis indicates:

- Realistic Annual Profit Range: $480-1,920 for successful traders (1-4% monthly returns) [1]

- Success Probability: Only 13% maintain profitability over 6 months, 1% over 5 years [1]

- Trading Limitation: Maximum 3 day trades per 5 business days under current PDT rules [0]

- Alternative Approaches: Cash accounts, multiple small accounts, or futures trading may provide workarounds [2]

The statistical evidence suggests that day trading with $4,000 faces significant structural barriers to success, with regulatory constraints and low success rates creating a challenging environment for consistent profitability.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.