Investment Value Analysis of BGRIMM Technology (600980.SS)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and market information, I provide you with a complete analysis report of BGRIMM Technology (600980.SS):

| Item | Data |

|---|---|

| Stock Ticker | 600980.SS |

| Company Name | BGRIMM Technology Co., Ltd. (BGRIMM Technology) |

| Industry | Basic Materials/Industrial Materials |

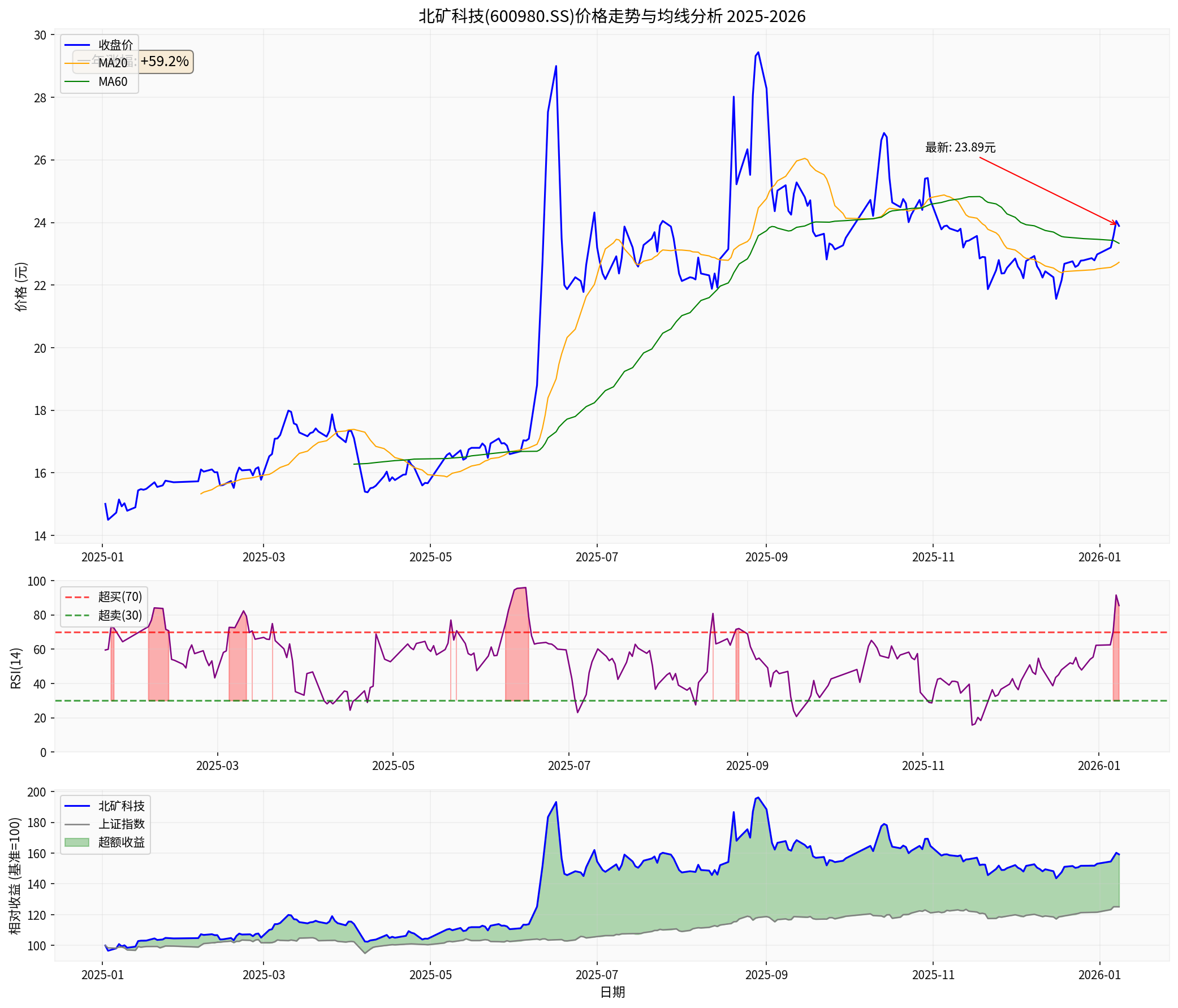

| Current Stock Price | CNY 23.89 |

| 52-Week High | CNY 30.47 |

| 52-Week Low | CNY 14.05 |

| Market Capitalization | Approximately CNY 37.3 Billion |

| Price-to-Earnings Ratio (P/E) | 40.74x |

| Price-to-Book Ratio (P/B) | 3.12x |

BGRIMM Technology has delivered impressive performance over the past year, with a cumulative increase of

According to recent market research reports, several renowned international investment banks have expressed optimistic views on China’s A-share market as well as tracks such as rare earth new materials and robotics[1]:

| Institution | Overview of Views |

|---|---|

Goldman Sachs |

Included BGRIMM Technology in its 15th Five-Year Plan investment portfolio recommendation list, and is optimistic about the materials sector |

Morgan Stanley |

Recommends an “overweight” position in the technology and new materials sectors, believing that tracks such as AI, intelligent driving, and batteries are leading globally |

UBS |

Is optimistic about the rare earth new materials and robotics automation tracks, predicting that the Hang Seng Tech Index’s EPS growth rate will hit 37% in 2026 |

J.P. Morgan |

Focuses on the structural upward trend in profit margins brought by the “anti-involution” policy |

- Rare Earth Permanent Magnet Materials: Core components for new energy vehicles, wind power, and industrial robots

- Rare Earth Luminescent Materials: Applications in LEDs, displays, and lighting

- Rare Earth Catalytic Materials: Automotive exhaust purification and industrial environmental protection

- Industrial Robots: Intelligent upgrading of mining equipment

- Automation Control Systems: Integrated solutions for smart mines

- Intelligent Sensing Technology: Equipment condition monitoring and predictive maintenance

| Metric | Value |

|---|---|

| Net Profit Margin (TTM) | 8.49% |

| Operating Profit Margin (TTM) | 9.59% |

| Return on Equity (ROE) | 7.82% |

- Average gross margin of the rare earth new materials industry: Approximately 15-25%

- Gross margin of high-end rare earth permanent magnet materials: Can exceed 30%

- Rare Earth Price Support: Rare earth prices are at a relatively high level, supporting the gross margin of upstream materials

- Intelligent Upgrading: The robotics business drives an increase in product added value

- Policy Dividends: The “anti-involution” policy optimizes the industry competition pattern, which is conducive to profit margin recovery

- Demand Growth: Demand continues to grow in areas such as new energy vehicles, wind power, and robotics

- Raw Material Volatility: Risk of price fluctuations in rare earth raw materials

- Competitive Pressure: Intensified industry competition may lead to pricing pressure

- Increased Investment: Continuous increases in technology iteration and R&D investment

- Relatively High Valuation: The current P/E ratio of 40.74x is at a historically high level

- High Volatility: Annualized volatility of 48.34% and a Beta coefficient of 1.26, indicating higher risk than the market average

- RSI Overbought: Technical indicators show short-term adjustment needs

- Market Style Shift: Pressure may arise if the market style shifts from growth stocks to value stocks

| Dimension | Evaluation |

|---|---|

Fundamentals |

⭐⭐⭐⭐ Good, benefiting from the dual tracks of rare earths and robotics |

Technical Aspects |

⭐⭐⭐ Short-term overbought, medium-term trend upward |

Valuation |

⭐⭐⭐ Relatively high, needs to wait for valuation digestion |

Institutional Recognition |

⭐⭐⭐⭐ Favored by multiple international investment banks |

[0] Jinling AI Financial Database - Real-time Market and Financial Data of BGRIMM Technology (600980.SS)

[1] Securities Times - “Foreign Investors’ View on A-Shares in 2026: Global Investors Return to the Chinese Market” (https://www.stcn.com/article/detail/3542403.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.