In-Depth Analysis of Transsion Holdings' Competitive Landscape in the African Smartphone Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above in-depth research, I now present a comprehensive analysis report for you:

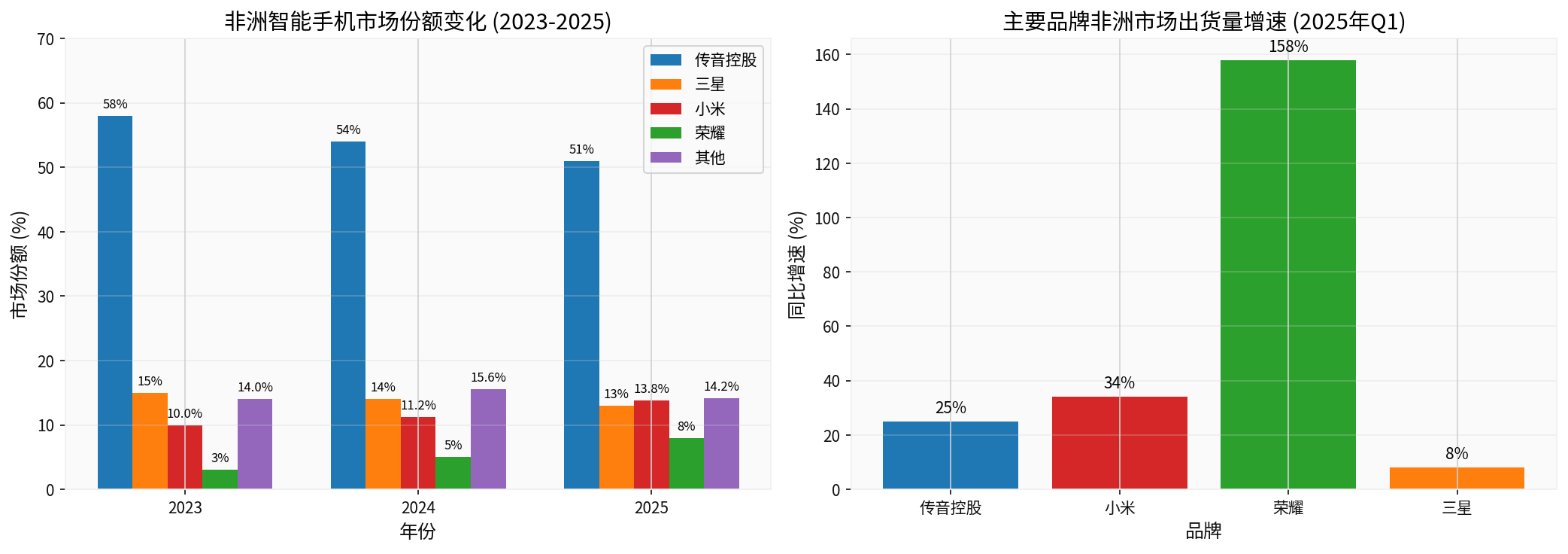

According to the latest market data, Transsion Holdings’ leading position in the African smartphone market is facing severe challenges [1][2]. In Q3 2025, Transsion’s market share in the African smartphone market has dropped from its peak of approximately 61% to 51%. Although it still ranks first in the market, its leading edge has narrowed significantly [1]. This downward trend has continued to accelerate between 2024 and 2025, and Transsion’s “King of Africa” throne is undergoing an unprecedented impact.

From a global perspective, in 2024, Transsion Holdings had a 14.0% share of the global mobile phone market, ranking third; its smartphone share in the global market was 8.7%, ranking fourth [3]. However, this global position is being strongly challenged by competitors such as Xiaomi and Honor.

Brands such as

| Competitive Price Segment | Competitors’ Strategies | Impact on Transsion |

|---|---|---|

| Low-end Market (Under USD 100) | Xiaomi and Realme launch entry-level phones | Transsion’s traditional advantageous market is eroded |

| Mid-to-High-end Market (USD 150-200) | Samsung, OPPO, and Honor launch targeted attacks | Transsion’s high-end transformation is hindered |

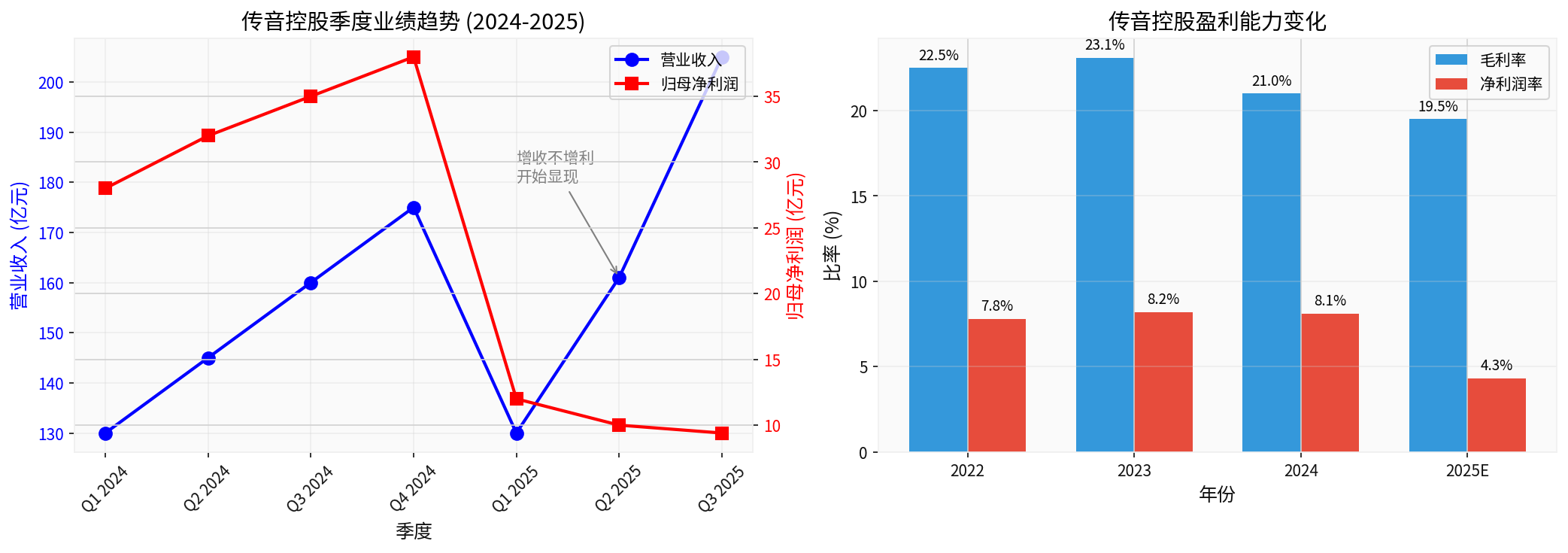

Transsion Holdings’ Q3 2025 report reveals severe profit pressure [1][2]:

| Financial Indicator | First Three Quarters of 2025 | Year-on-Year Change |

|---|---|---|

| Operating Revenue | RMB 49.543 Billion | -3.33% |

| Net Profit Attributable to Shareholders | RMB 2.148 Billion | -44.97% |

| Net Profit Attributable to Shareholders Excluding Non-Recurring Items | RMB 1.731 Billion | -46.71% |

| Operating Cash Flow | RMB 3.285 Billion | +164.66% |

The company attributes this to “the combined impact of market competition and supply chain costs, which led to a decrease in operating revenue and gross profit” [1]. This dilemma of “growing revenue without growing profits” reflects the profit pressure Transsion is facing amid fierce competition.

From a long-term trend perspective, Transsion’s profitability faces structural challenges [3]:

- Gross Profit Margin: Dropped from 22.5% in 2022 to an estimated 19.5% in 2025

- Net Profit Margin: Dropped from 7.8% in 2022 to an estimated 4.3% in 2025

The main reasons for this continuous decline in profitability include: 1. Intensified competition in the low-end market leading to price wars 2. Rising prices of memory chips (DDR4 memory module prices doubled) compressing profit margins 3. Smartphones have a high ASP but low gross profit margin (smartphone gross profit margin is 18.1%, feature phone gross profit margin is 23.7%), and the trend of intelligentization in Africa has instead brought “growing pains in profitability” [3]

Despite profit pressure, Transsion is still increasing its R&D investment [1][3]:

- Total R&D investment in the first three quarters of 2025 reached RMB 2.139 billion, representing a 17.26% year-on-year increase

- R&D investment as a percentage of operating revenue increased to 4.32%

- As of June 2025, the company has 4,343 R&D personnel, accounting for 20.3% of the total workforce

- Has accumulated over 2,800 patents, including over 1,200 invention patents

This indicates that Transsion is attempting to build a new moat through technological innovation.

Transsion Holdings’ localized innovation strategy (Glocal: Global+Local) was once the key to its success in the African market [3][4]:

- Established a 200-person R&D team and collected nearly 100,000 selfies from local people

- Independently developed core technologies such as dark-skinned face detection and recognition, dark-skinned portrait segmentation, and multi-skin tone intelligent beauty enhancement

- Developed low-light shooting technology for dark-skinned faces, significantly improving the effect of preserving skin texture and tone

- Addressing unstable power supply: Developed high-voltage fast charging and ultra-long standby technology (some models can stand by for up to 30 days)

- Addressing large temperature differences between day and night: Optimized battery management systems

- Addressing excessive hand sweat: Developed sweat-resistant USB ports

- Addressing multi-operator environments: Launched “four SIM, four standby” phones

- Built a “capillary network” extending from urban business districts to rural corners

- Cooperated with local channels such as family-owned stores and wholesalers to build a three-level distributor system

- Has affiliated companies in 32 overseas countries and regions, with over 4,000 after-sales service outlets worldwide

- Foreign employees account for 40.0% of the total workforce

- Xiaomi has started tilting towards small retailer networks in Africa to increase the density of sales outlets

- OPPO is promoting local assembly projects in Egypt, Turkey, and other regions to reduce supply chain costs

- Competitors have also started launching photo-taking features targeted at dark-skinned populations

In the short term, Transsion’s localized innovation strategy

However, in the medium to long term,

Amid profit pressure, Transsion is improving cash flow by strengthening working capital management [1]:

- Net operating cash flow in the first three quarters of 2025 reached RMB 3.285 billion, surging 164.66% year-on-year

- Retained more funds within the company by extending payment cycles to upstream suppliers

- Accounts payable increased from RMB 13.286 billion at the end of 2024 to RMB 16.108 billion at the end of September 2025

Transsion is attempting to break through the limitations of the low-end market:

- The TECNO foldable model PHANTOM V Fold2 5G is priced as high as RMB 7,500, targeting the high-end market

- Its three major brands TECNO, Infinix, and itel cover the entire low, mid, and high price range

- Launched AI smartphone product lines: TECNO AI and Infinix AI

- The music app Boomplay has over 80 million monthly active users

- The content distribution platform Phoenix has over 10 million monthly active users

While consolidating its African base, Transsion is accelerating penetration into other emerging markets [3]:

- Pakistan, Bangladesh: Smartphone market share exceeds 40% in both, firmly ranking first

- Southeast Asian Market: Ranked third with a 46% growth rate in Q3 2025, with market share approaching Samsung

- In 2024, Asia and other regions contributed RMB 44.737 billion in revenue, representing a 13.96% year-on-year increase, far exceeding the 2.97% growth rate of the African market

Transsion’s localized innovation strategy was once its core weapon for success in the African market, but with competitors’ rapid learning and imitation, the relative advantage of this strategy is weakening. However, Transsion’s years of accumulated brand awareness, channel network, and user base still constitute significant competitive barriers.

- Market share may continue to come under pressure, especially facing the strong offensives of Xiaomi and Honor

- Rising memory chip prices and cost pressure will persist

- Omdia predicts that the African smartphone market will decline by 6% in 2026

- There is still significant room for growth in the intelligentization rate of the African market

- Expansion into emerging markets (South Asia, Southeast Asia, Latin America) has initially shown results

- Mobile Internet and energy storage businesses are expected to become the second growth curve

[1] Nanfang Plus - “Mobile Phone Manufacturers Battle in Africa: Transsion’s Net Profit Declines in First Three Quarters, Xiaomi and Others Accelerate Market Seizure” (https://www.nfnews.com/content/EynG14JD3Z.html)

[2] Nanfang Plus - “Mobile Phone Manufacturers Battle in Africa: Transsion’s Net Profit Declines in First Three Quarters, Xiaomi and Others Accelerate Market Seizure” (https://m.mp.oeeee.com/a/BAAFRD0000202511021376029.html)

[3] OFweek Weikehao - “The Third Pole of the Global Mobile Phone Market: Shenzhen Giant with Annual Revenue of RMB 68.7 Billion Spurts Towards HKEX” (https://mp.ofweek.com/ee/a156714419557)

[4] National Business Daily - “Elevating in 2025 | Integrate In: The Power of Brand Globalization to Shape ‘Change’” (https://www.nbd.com.cn/articles/2025-05-15/3876548.html)

[5] Investing.com - “Transsion Holdings: Africa’s Mobile Phone King on the Decline” (https://cn.investing.com/analysis/article-200496496)

Chart Description: The chart above shows changes in the African smartphone market share and a comparison of growth rates of major brands from 2023 to 2025. Although Transsion Holdings still maintains a 51% market share, its year-on-year growth rate has slowed to 25%, while Xiaomi and Honor’s growth rates reach 34% and 158% respectively, and the competitive landscape is becoming increasingly fierce.

Chart Description: The chart above shows the quarterly performance trend and changes in profitability of Transsion Holdings from 2024 to 2025. The company faces an obvious dilemma of “growing revenue without growing profits”, with net profit continuing to decline from its 2024 high, and both gross profit margin and net profit margin showing a downward trend.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.