CATL Market Share Analysis Report: A Study on the Sustainability of the Rise of Second-Tier Manufacturers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest market data, Contemporary Amperex Technology Co., Limited (CATL) is facing challenges of sustained pressure on its market share. In Q3 2025, CATL’s installed capacity market share in China’s power battery market dropped to

Meanwhile, CATL’s global competitiveness remains solid. According to data from South Korea’s SNE Research, CATL’s global power battery installed capacity reached 339.3GWh in 2024, with a year-on-year growth of 31.7%, and its market share rose to

The core reason for CATL’s market share loss lies in the

- Tesla: Procures lithium iron phosphate (LFP) batteries from CATL, nickel-cobalt-manganese (NCM) batteries from LG Energy Solution and Panasonic, while advancing the development of its in-house 4680 battery

- Volkswagen: In addition to procuring from CATL, it has invested in Gotion High-Tech and built its own battery factories in Europe

- Li Auto, XPeng, NIO: While cooperating with CATL, they have actively introduced second-tier players such as Sunwoda, CALB, and EVE Energy

This supply chain diversification trend has led to a decline in CATL’s customer concentration and reduced its reliance on single major customers.

As the world’s second-largest power battery manufacturer, BYD’s installed capacity reached 153.7GWh in 2024, with a year-on-year growth of 37.5%, and its market share rose to

The rapid rise in the market share of lithium iron phosphate (LFP) batteries has also impacted CATL. In H1 2025, LFP batteries accounted for

As a relatively mature technology route, LFP batteries have lower technical barriers, providing entry opportunities for second-tier players and driving the evolution of the competition pattern from head monopoly to decentralization.

Six Chinese companies made it to the top 10 global power battery list in 2024, with a combined market share of

| Player | 2024 Global Installed Capacity | Market Share | Year-on-Year Growth/Change |

|---|---|---|---|

| CALB | 39.4GWh | 4.4% | Risen 2 ranks |

| Gotion High-Tech | - | ~5.2% | 73.8% growth |

| EVE Energy | - | ~3% | 26.9% growth |

| Sunwoda | - | ~2% | 74.1% growth |

CALB is the only company in the top 10 list that saw a ranking rise, moving from 6th place in 2023 to 4th place in 2024[3]. Players such as Gotion High-Tech and Sunwoda have achieved installed capacity growth rates of over 70%, significantly higher than the industry average.

- Narrowing Technology Gap: LFP battery technology is becoming standardized, and second-tier players have already gained competitiveness in basic products

- Cost Advantage: Second-tier players have established cost advantages in LFP batteries through economies of scale and process optimization

- Deeper Automaker Binding: With the deepening of cooperation, automakers and second-tier players have formed stable supply relationships

- Capacity Expansion Support: Gotion High-Tech plans to invest in building a total of 40GWh capacity bases in Nanjing and Wuhu[4]

- Shallow Technology Moat: In cutting-edge fields such as high-end NCM batteries and solid-state batteries, head players still hold significant advantages

- Profitability Pressure: Sunwoda’s power battery gross profit margin is only 9.77%, far lower than CATL’s over 22%[4]

- Capital Strength Gap: Head players far outperform second-tier players in R&D investment and global layout capabilities

- Overseas Market Expansion: International players such as LG Energy Solution and Panasonic have deeper roots in the European and American markets

It launched its battery swapping brand EVOGO in 2022, which was upgraded to

- Shifting from one-time sales to recurring service revenue

- Directly engaging with end-users and gaining access to operational data

- Inversely influencing automakers’ product design

CATL has deeply bonded with global head automakers:

- Joint venture with Stellantis for capacity expansion

- Cooperating with global head automakers such as BMW and Volkswagen

- Its global market share rose to 37.9% in 2024, further consolidating its leading edge[2]

- Layouts in key mineral resources such as lithium and nickel

- Advancing innovation in cutting-edge materials such as sodium-ion batteries

- Establishing four global recycling bases with a lithium recovery rate of 91%

- Promoting the construction of zero-carbon factories and renewable energy systems

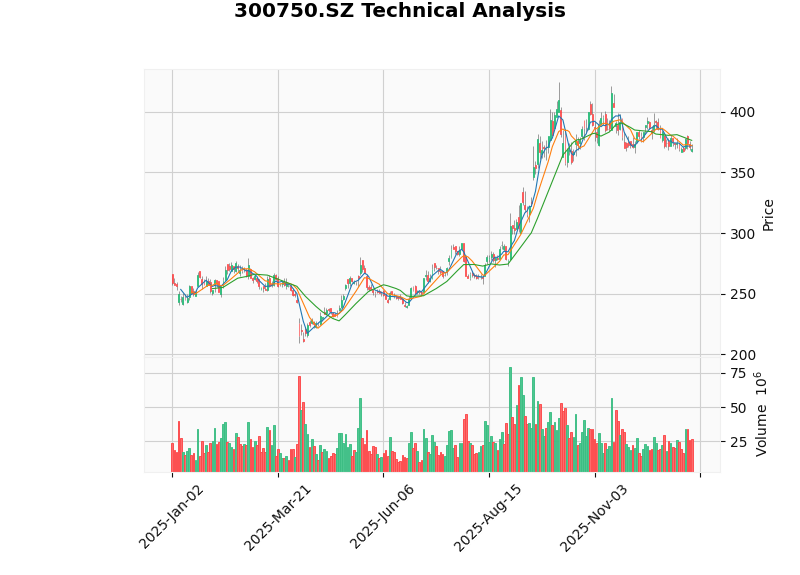

From the perspective of secondary market performance, CATL’s stock price rose by approximately

- MACD Indicator: No crossover signal, overall bearish

- KDJ Indicator: K value 31.9, D value 32.8, in the oversold zone

- Price Range: Support level $364.73, resistance level $376.35

- Trend Judgment: Sideways consolidation, no clear direction[5]

-

Short-Term Sustainability (1-2 Years):Against the backdrop of the dominant LFP technology route, second-tier players will continue to expand their market share by virtue of cost advantages and automakers’ demand for supply chain diversification. In particular, the high growth momentum of players such as Gotion High-Tech and Sunwoda is expected to continue.

-

Medium-Term Pressure (3-5 Years):As new technologies such as solid-state batteries enter mass production, technical barriers will be raised again, and the competitive advantages of head players will re-emerge. CATL’s technical reserves in fields such as sodium-ion batteries and solid-state batteries will serve as a moat.

-

Long-Term Differentiation:The industry will form a competition pattern of “Globalized Head Players + Regionalized Second-Tier Players”. CATL will consolidate its global leading position by virtue of its global layout and technological leadership; while second-tier players may focus on specific regional markets or niche segments.

Despite the decline in its China market share, CATL relies on the following to maintain its strength:

- A global market share of 37.9% (the second-place player has only around 17%)

- Strong technical reserves and industrial chain integration capabilities

- Innovative layout in battery swapping business

- Continuous advancement of its overseas expansion strategy

Its

[1] Pedaily - “CATL Earns RMB 200 Million Daily” (https://news.pedaily.cn/202510/556125.shtml)

[2] Securities Times - “CATL’s Power Battery Market Share Rises to 37.9%” (https://www.stcn.com/article/detail/1524538.html)

[3] National Business Daily - “Chinese Companies Hold 6 Spots! 2024 Top 10 Global Power Battery Installed Capacity List Released” (https://www.nbd.com.cn/articles/2025-02-17/3754167.html)

[4] Securities Times/21st Century Business Herald - “How Did Power Battery Sales Achieve 50% Growth Amid a Narrative Shift” (https://www.stcn.com/article/detail/3332340.html)

[5] Gilin AI Financial Database - CATL (300750.SZ) Technical Analysis Report

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.