Yijing Optoelectronics (600537) Investment Value Analysis Report: In-Depth Financial Analysis of Insolvency and Delisting Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the comprehensive data I have collected, here is an in-depth financial analysis report on Yijing Optoelectronics:

Known as the “First A-Share Photovoltaic Component Stock”, Yijing Optoelectronics is currently facing severe operational difficulties. On January 8, 2026, the company released a performance pre-loss announcement, expecting the net profit attributable to shareholders of the listed company in 2025 to be negative, and the loss amount is expected to exceed the audited net assets of the previous year. The company’s year-end net assets in 2025 may be negative [1][2][3].

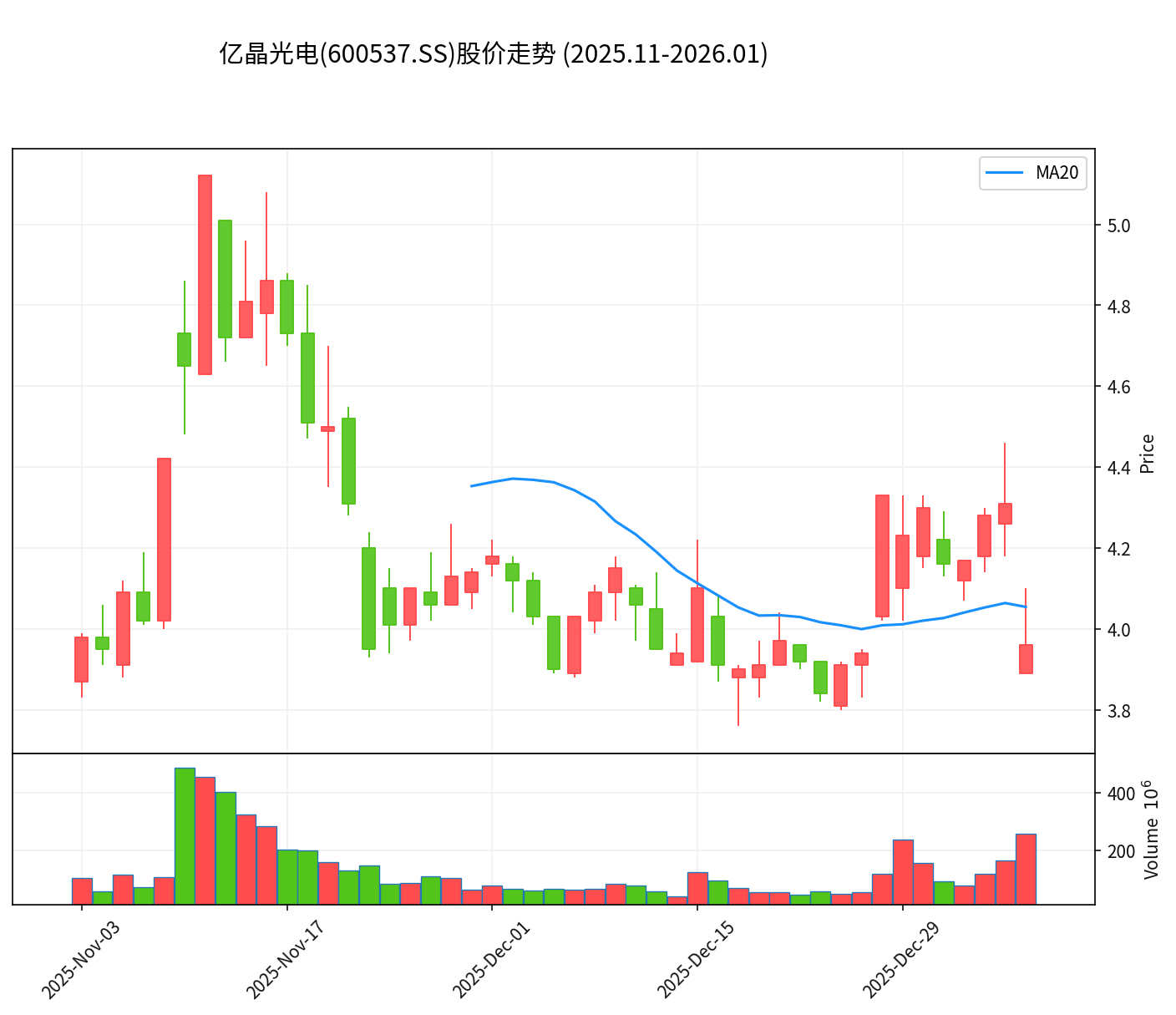

Affected by the above negative news, the company’s stock price plummeted 8.12% on January 8, 2026, closing at RMB3.96 per share, with a total market capitalization of approximately RMB4.7 billion [0][1]. From a technical analysis perspective, the current stock price is in a range-bound consolidation pattern, with support around $3.86 and resistance around $4.06 [0].

Based on the latest financial data, Yijing Optoelectronics’ financial condition is showing a comprehensive deterioration:

| Financial Indicator | Value | Industry Interpretation |

|---|---|---|

P/E Ratio |

-2.71x | Sustained losses make the price-earnings ratio meaningless |

P/B Ratio |

20.85x | Excessively high price-to-book ratio reflects poor asset quality |

ROE (Return on Equity) |

-520.26% | Severe erosion of shareholder equity |

Net Profit Margin |

-74.51% | A loss of RMB0.75 for every RMB1 of revenue |

Operating Profit Margin |

-85.69% | Continuous blood loss from core business |

Current Ratio |

0.88 | Insufficient short-term solvency |

Quick Ratio |

0.75 | Tight liquidity |

The company’s financial performance has been under sustained pressure in recent years:

| Fiscal Year | Operating Revenue | Net Profit Attributable to Parent Company | YoY Revenue Growth |

|---|---|---|---|

| 2024 | RMB3.478 billion | -RMB2.090 billion | -57.07% |

| First Three Quarters of 2025 | RMB1.556 billion | -RMB0.214 billion | -42.58% |

The net loss of up to RMB2.09 billion in 2024 has severely eroded the company’s net assets, laying the groundwork for the current insolvency crisis [2].

Yijing Optoelectronics’ original production capacity layout and current status are as follows:

| Base | Capacity Type | Planned Capacity | Current Status |

|---|---|---|---|

| Changzhou Base | PERC Cells | 5GW | Suspended |

| Chuzhou Phase I | TOPCon Cells | 7.5GW (Total 10GW) | Suspended |

| Chuzhou Phase II/III | Slicing + Modules | 10GW Slicing + 10GW Modules | Not Built |

The company began to suspend production at the Chuzhou Base in October 2024, and both the 5GW PERC cell capacity at the Changzhou Base and the 7.5GW TOPCon cell capacity at the Chuzhou Base have been suspended [1][3]. This means the company’s core production links are basically in a state of stagnation.

Production suspension directly exposes fixed assets and construction in progress to massive impairment provision pressure. The company’s RMB10.3 billion photovoltaic industry base project (planned 10GW cells + 10GW slicing + 10GW modules) invested and constructed in Chuzhou in 2022 has only completed the phase I 7.5GW capacity implementation so far, and a large amount of early investment may become sunk costs [2].

Production suspension directly causes the company to lose its source of sales revenue. Operating revenue in the first three quarters of 2025 has dropped 42.58% year-over-year. If production remains suspended, 2026 operating revenue may further shrink, approaching the RMB100 million delisting trigger threshold [2].

Financial analysis shows that the company’s latest free cash flow is -RMB0.138 billion, with a negative FCF Margin [0]. Under the production suspension status, fixed cost expenditures and plummeting revenue form a vicious cycle, accelerating cash consumption.

The company’s debt risk rating is “High Risk” [0]. A current ratio of 0.88 means current assets are insufficient to cover current liabilities, and coupled with revenue decline caused by production suspension, debt repayment pressure has risen sharply.

Using the Discounted Cash Flow (DCF) model to conduct a valuation analysis of the company, the results show that the current stock price is significantly overvalued:

| Valuation Scenario | Intrinsic Value | Comparison with Current Price |

|---|---|---|

Conservative Scenario |

$2.30 | -41.9% |

Base Case Scenario |

$0.97 | -75.5% |

Optimistic Scenario |

$2.12 | -46.5% |

Probability-Weighted Valuation |

$1.80 | -54.6% |

DCF analysis shows that the company’s reasonable valuation range is only $0.97-$2.30, while the current stock price of $3.96 has a downside potential of approximately 54.6% compared to the probability-weighted valuation [0]. Under all three scenarios, the company’s stock price is clearly overvalued.

| Parameter | Conservative Scenario | Base Case Scenario | Optimistic Scenario |

|---|---|---|---|

| Revenue Growth | 0% | -4% | 0% |

| EBITDA Margin | -10.7% | -11.3% | -11.9% |

| Terminal Growth Rate | 2.0% | 2.5% | 3.0% |

| Cost of Equity | 9.0% | 7.5% | 6.0% |

| Cost of Debt | 28.3% | 27.3% | 26.3% |

| WACC | 9.0% | 9.0% | 9.0% |

It is worth noting that all three scenarios assume a negative EBITDA margin for the company, reflecting the objective reality that the company is difficult to achieve profitability in the current industry environment [0].

According to Article 9.3.2 of the Shanghai Stock Exchange Stock Listing Rules, if the company’s audited year-end net assets in 2025 are negative, it will trigger the financial mandatory delisting indicator of “audited year-end net assets being negative in the most recent fiscal year”, and the company’s stock will be issued a delisting risk warning (ST) [1][2].

According to exchange rules, 2026 is the only self-rescue window period for Yijing Optoelectronics. The company must meet all of the following conditions simultaneously in its 2026 annual report to maintain its listing status:

- Net Assets Turn Positive— Need to repair the balance sheet through turning losses into profits, asset injection, or other means

- Avoid the “Double 50” Delisting Condition— Net profit cannot be negative, and operating revenue must not be less than RMB100 million

- Obtain a Standard Unqualified Audit Report— The auditing firm must issue an unqualified opinion on the company’s financial statements

If the 2026 annual report still fails to meet the standards, the company will directly face delisting [1][2].

The company also faces debt collection pressure from local state-owned assets. On December 28, 2025, the Management Committee of Quanjiao County Economic Development Zone issued a hearing notice, intending to terminate the investment agreement, recover the RMB0.14 billion capital contribution, and hold the company liable for breach of contract such as repayment of construction-on-behalf fees, rent, and capital occupation costs [1][2][3]. This matter may further exacerbate the company’s financial pressure.

As of December 27, 2025, the company and its consolidated subsidiaries have accumulated a total of 23 litigation and arbitration cases:

| Case Type | Quantity | Involved Amount |

|---|---|---|

| Closed | 7 | - |

| In Trial | 10 | - |

| Filed | 3 | - |

| Not Filed | 3 | - |

As Plaintiff |

10 | RMB26.34 million |

As Defendant |

13 | RMB44.82 million |

The total amount involved in litigation and arbitration is approximately RMB71.16 million, further increasing the company’s operational uncertainty [2].

Yijing Optoelectronics’ predicament is not an isolated case, but a microcosm of structural overcapacity in the entire photovoltaic industry. The company clearly stated in the announcement that due to periodic structural capacity mismatch and weak market conditions in the photovoltaic industry in recent years, the industry-wide capacity utilization rate has continued to decline, resulting in the company’s Chuzhou project being unable to proceed as scheduled [1][3].

The photovoltaic industry as a whole is facing:

- Sustained Low Module Prices— Overcapacity has intensified price wars

- Widely Declining Capacity Utilization Rate— The industry average capacity utilization rate is at a low level

- Full Industry Chain Losses— From silicon materials to modules, all segments are under huge profit pressure

Against this background, as a small-scale photovoltaic enterprise, Yijing Optoelectronics has relatively weaker risk resistance and has fallen into operational difficulties first.

Based on the above analysis, Yijing Optoelectronics is currently facing multiple adverse factors including

From a valuation perspective, the DCF model shows that the company’s reasonable value is only approximately 45% of the current stock price, indicating significant overvaluation. From a fundamental perspective, the company’s core production assets have been suspended, revenue sources have shrunk, cash flow is continuously bleeding, and net assets are facing a turn to negative.

- Delisting Risk: If net assets at the end of 2025 are confirmed to be negative, the company will be issued an ST warning; if it fails to simultaneously meet the conditions of net assets turning positive, revenue exceeding RMB100 million, and unqualified audit opinion in 2026, it will be delisted

- Liquidity Risk: Current ratio is below 1, facing short-term debt repayment pressure

- Asset Impairment Risk: Suspended production capacity may lead to large-scale asset impairment

- Litigation Risk: Cumulative amount involved in lawsuits exceeds RMB70 million

- Industry Risk: The overcapacity pattern in the photovoltaic industry is difficult to reverse in the short term

[1] Securities Times - “First Photovoltaic Component Stock” Plunges in Intraday Trading (https://www.stcn.com/article/detail/3578129.html)

[2] Eastmoney - Yijing Optoelectronics Expects 2025 Performance Loss and is Trapped in Multiple Risks (https://finance.eastmoney.com/a/202601083613121992.html)

[3] Sina Finance - “First Photovoltaic Component Stock” Yijing Optoelectronics Warns of Possible Insolvency in 2025 (https://finance.sina.cn/2026-01-08/detail-inhfqcav4026616.d.html)

[0] Gilin API Market Data and Financial Analysis

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.