In-Depth Analysis of Breo's High Sales Expense Ratio and Sustained Losses

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and information, I will provide you with a detailed analysis of why Breo’s sales expense ratio exceeds 50% yet fails to reverse its losses.

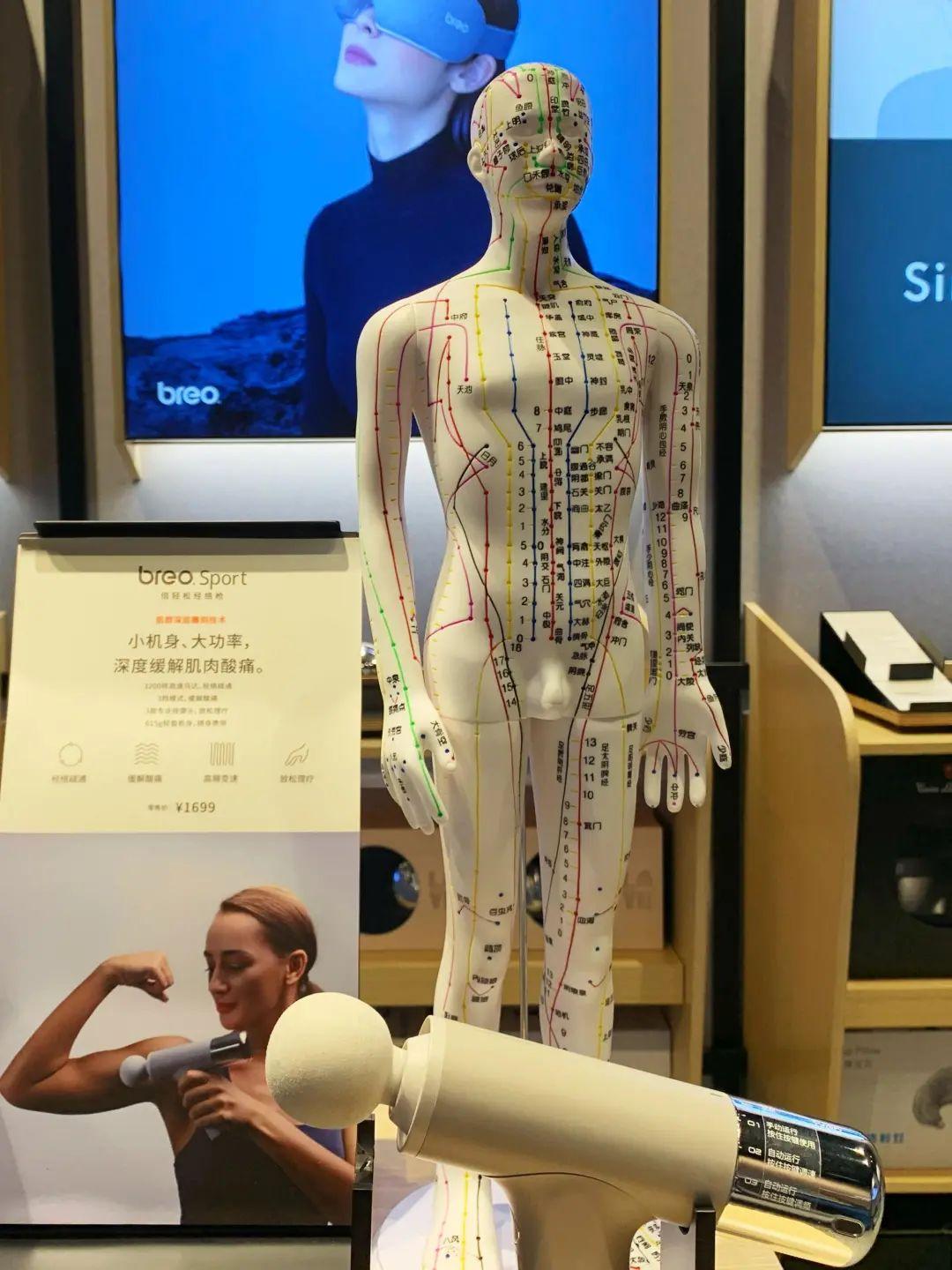

Breo (Stock Codes: 300793.SZ/688793), known as the “first share of portable massagers”, is a consumer electronics enterprise focusing on intelligent portable massage devices, with products covering multiple health categories such as head, eye, neck, scalp, and moxibustion [0]. The company relies on three self-built production bases in Shenzhen to achieve independent production and strict quality control. Its products have passed multiple international certifications and cover approximately 120 countries and regions worldwide [1].

| Indicator | 2021 | 2022 | 2023 | 2024 | First Three Quarters of 2025 |

|---|---|---|---|---|---|

| Sales Expenses (CNY 100 million) | 4.85 | 4.82 | 6.80 | 5.44 | 3.16 |

| Sales Expense Ratio | - | - | - | ~50% | 57% |

| R&D Expenses (CNY 10,000) | 4,720 | 5,733 | 5,851 | 5,835 | 4,369 |

| R&D Expense Ratio | - | - | - | 5.38% | - |

Data shows that the gap between Breo’s sales expenses and R&D expenses is

| Financial Indicator | 2021 | 2022 | 2023 | 2024 | First Three Quarters of 2025 |

|---|---|---|---|---|---|

| Operating Revenue (CNY 100 million) | 11.90 | 8.96 | 12.75 | 10.85 | 5.52 |

| Revenue Growth Rate | 43.93% | -24.69% | 42.30% | -14.88% | -34.07% |

| Net Profit (CNY 100 million) | 0.92 | -1.24 | -0.51 | 0.10 | -0.66 |

In the first three quarters of 2025, the company’s operating revenue decreased by 34.07% year-on-year to CNY 552 million, with a net loss of CNY 65.628 million, turning from profit to loss year-on-year, a decline of as high as 600.98% [0][1].

Taking the Douyin platform in 2023 as an example, the company’s total promotion and marketing expenses on the platform reached

The company previously focused on the offline direct sales model. Starting from 2022, impacted by changes in the consumption environment and reduced travel traffic, offline stores have continued to shrink:

- End of 2022: 163 stores

- 2023: 143 stores

- First Half of 2025: 125 stores

After shrinking offline, the company was forced to shift to online channels, but the online track competition is becoming increasingly fierce, traffic dividends are gradually drying up, and products and marketing models among competitors are highly homogeneous, leading to high traffic costs [1].

Although the company’s main business gross profit margin has continued to rise:

- 2021: 56.69%

- 2022: 49.76%

- 2023: 59.27%

- 2024: 60.51%

- First Three Quarters of 2025: 62.10%

the high gross profit is completely swallowed up by the high sales expenses, forming the paradox of “the more expensive the product is sold, the more losses are incurred” [1].

Compared with the huge investment in sales expenses, Breo’s R&D expenditure is weak. From 2021 to the first three quarters of 2025, the R&D expenses were CNY 47.2 million, CNY 57.33 million, CNY 58.51 million, CNY 58.35 million, and CNY 43.69 million respectively, making it difficult to form differentiated product competitiveness [1].

- Related Party Fund Occupation: In 2024, the company transferred a total of CNY 54 million to Shenzhen Xingjiashun Trading Co., Ltd., resulting in a large amount of related party fund occupation [1]

- Controlling Shareholder’s Borrowing: From 2023 to 2024, the controlling shareholder Ma Xuejun borrowed a total of CNY 12.6098 million from the company through employees [1]

- Received annual report inquiry letters for three consecutive years

- In July 2025, the Shanghai Stock Exchange issued another regulatory work letter, marking the thirdregulatory letter received within six months [1]

- The company was placed under investigation in December 2025 [1]

Shortly before the investigation announcement, the controlling shareholder Ma Xuejun reduced his holdings of 2.5526 million shares via inquiry transfer, accounting for 2.97% of the company’s total share capital, cashing out approximately CNY 64.71 million, citing “the transferor’s own capital needs” [1].

According to Frost & Sullivan data, the market size of China’s smart wearable health devices has increased from CNY 30.9 billion in 2019 to

Competition in the health and personal care electrical appliance track is increasingly fierce. Breo faces intense competition from brands such as SKG, Philips, and Omron. Products and marketing models are highly homogeneous, making it difficult to form a moat.

The root causes of Breo’s sales expense ratio exceeding 50% yet failing to reverse losses are as follows:

- Low Marketing Efficiency: Severe imbalance between input and output of online channels, with high traffic costs

- Passive Channel Transformation: Forced to enter the highly competitive online market after offline contraction, lacking differentiated competitiveness

- Weak R&D Innovation: Imbalance between sales expenses and R&D investment, making it difficult for products to form technical barriers

- Prominent Governance Risks: Issues such as fund occupation and regulatory inquiries expose internal control defects, weakening market confidence

The core challenge facing the company currently is how to balance marketing investment and R&D innovation, improve channel efficiency, and enhance corporate governance. If these issues cannot be effectively resolved, even with a high gross profit margin business model, it will be difficult to achieve sustainable profitability.

[0] Jinling AI Brokerage API Data

[1] Caifuhao - “Breo Under Dual Pressure of Investigation and Poor Performance: How to Transform?” (https://caifuhao.eastmoney.com/news/20251231101759404529950)

[2] 10jqka - “Dilemma of Breo, the ‘First Share of Portable Massagers’: Governance Behind the Investigation…” (http://m.10jqka.com.cn/20260105/c673735921.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.