In-Depth Analysis of China's Transformer Industry: Opportunities and Strategies Amid Global Capacity Shortages

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data and market information I have collected, below I will provide a systematic and comprehensive in-depth analysis report on China’s transformer industry.

According to the latest statistical data, China’s transformer industry is experiencing an unprecedented export boom. In the first 11 months of 2025, China’s transformer exports reached RMB 43.995 billion, a substantial year-on-year increase of 47% [1]. Among them, the export value of power transformers exceeded RMB 39 billion, with a growth rate of over 50% [2]. Looking at monthly data, transformer exports reached RMB 29.711 billion in the first 8 months of 2025, and are expected to exceed the RMB 48 billion mark for the full year [3].

In terms of regional market performance, China’s transformer exports from January to October 2025 showed a multi-point growth trend: exports to Asia increased by 65.39%, Africa by 28.03%, and the European market soared by more than 138% [3]. This growth trend reflects the continuous improvement of the competitiveness of China’s transformer products in the global market.

As the absolute leader in the domestic transformer industry, TBEA (600089.SH) has performed particularly prominently in this round of global transformer shortage. From January to September 2025, the company’s domestic power transmission and transformation contracts reached RMB 41.5 billion, a year-on-year increase of approximately 10%; while the international product contract amount reached US$1.24 billion, a substantial year-on-year increase of more than 80% [1].

The company recently won a bid from Saudi Electric Company with a total value of approximately US$2.4 billion and an execution period of 7 years, mainly for ultra-high voltage and high-voltage power transformers and reactors [1]. In terms of delivery cycles, due to full order books, the delivery cycle for some of TBEA’s products has been extended to about 12 months, which is consistent with the overall industry situation.

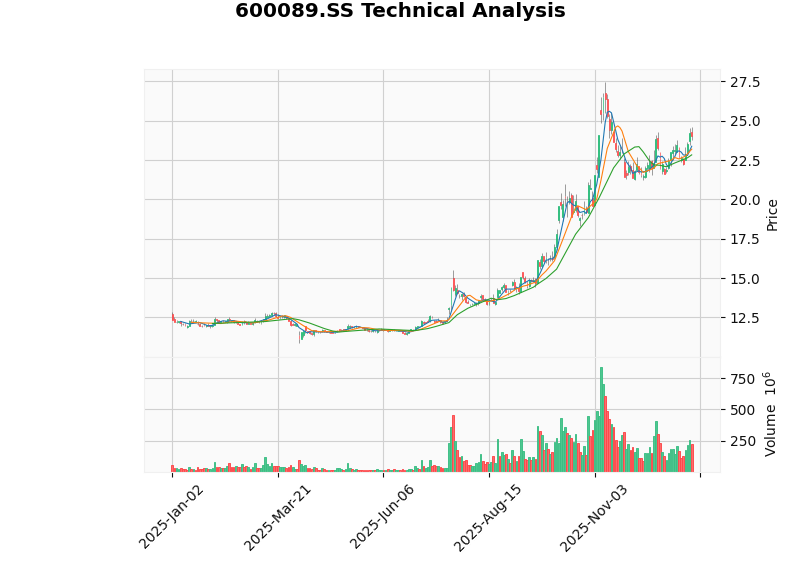

In terms of stock price performance, TBEA’s stock nearly doubled in 2025, technically in an uptrend, closing at US$24.05 per share on January 8, 2026 [4].

From the perspective of financial data, major transformer enterprises have achieved rapid growth in 2025:

| Enterprise | Highlights of Q1-Q3 2025 Performance |

|---|---|

| TBEA | Net profit attributable to shareholders: RMB 5.484 billion, up 27.55% YoY |

| Siyuan Electric | Net profit attributable to shareholders: RMB 2.191 billion, up 46.94% YoY |

| TGOOD | Net profit attributable to shareholders: RMB 0.686 billion, up 53.55% YoY |

| Jinpan Technology | Net profit attributable to shareholders: RMB 0.486 billion, up 20.27% YoY |

| XD Electric | Net profit attributable to shareholders: RMB 0.939 billion, up 19.29% YoY |

In terms of overseas business proportion, in the first half of 2025, Xuji Electric’s international business revenue increased by 72.68%, while domestic business revenue decreased by 7.41%, with the proportion of international business increasing from 2.16% to 3.95% [2]; TBEA’s international market product contract amount increased by 65.91% year-on-year, far higher than the 14.08% growth in the domestic market [2].

The global shortage of transformer supply has become an indisputable fact. According to the forecast of United Markets, an international energy industry analysis institution, the global transformer market size will increase from US$58.6 billion in 2021 to US$103 billion in 2031, achieving nearly double growth [3]. However, the speed of capacity expansion lags far behind demand growth.

In terms of short-term shortages, Wood Mackenzie, an energy consulting firm, predicts that the U.S. power transformer supply gap will reach 30% and the distribution transformer gap will be 10% in 2025 [5]. Rystad Energy estimates that the global transformer supply shortage will persist until at least the end of 2026 [6].

Looking at the U.S. market, about 80% of its power transformer supply and about 50% of its distribution transformer supply rely on imports [5]. 31% of U.S. transmission equipment and 46% of distribution facilities are already past their service life, creating an urgent need for equipment renewal [3]. The situation in Europe is equally severe; a September 2025 Goldman Sachs report pointed out that most grid facilities in Europe have been in operation for 40-50 years [3].

The current surge in transformer demand stems from the superposition of multiple factors:

Grid facilities in developed countries such as Europe and the United States are generally aging and require large-scale renewal. The Edison Electric Institute (EEI) predicts that the U.S. power industry plans to invest more than US$1.1 trillion in grid upgrading and expansion over the next five years, with expenditures in 2025 expected to reach US$207.9 billion, an increase of nearly 50% compared to 2020 [3]. The EU plans to spend 1.2 trillion euros on grid upgrades over ten years, with the European grid expansion plan alone involving 584 billion euros in investment [3].

The rapid rise of the artificial intelligence industry is reshaping the demand pattern for power equipment. The power consumption of three days of training for the ChatGPT large model is enough to power 3,000 Tesla vehicles to travel a cumulative 320,000 kilometers; while a new medium-sized data center built by Meta requires hundreds of step-down transformers [3]. According to ABI Research, more than 8,400 data centers will be put into operation globally by 2030 [2].

The global push for green and low-carbon transformation has led to the rapid construction of green energy power stations such as photovoltaic, wind, and hydropower. Data shows that the transformer demand of a photovoltaic power station is 1.8 times that of a thermal power station of the same scale [3]. According to data from the International Energy Agency (IEA), global grid investment is expected to double to US$600 billion by 2030 [1].

Transformer capacity expansion faces multiple constraints:

Transformers are a typical labor-intensive industry with a long talent training cycle. It takes 3 years to train a qualified winder, and more than 7-8 years to train a senior technician [2]. A Wood Mackenzie report pointed out that labor shortages have become a key reason why manufacturers cannot expand production to meet growing demand [2]. Andreas Schlumberger, CEO of Hitachi Energy, the world’s largest transformer manufacturer, has publicly stated that the company has been overwhelmed by demand, and it is difficult for transformer manufacturers to rapidly increase production [5].

Transformer production involves multiple core components such as oriented silicon steel, insulating materials, and copper wire, with a long cycle from raw material procurement to finished product delivery. It usually takes 2-3 years from the construction of new capacity to production, which results in limited short-term capacity flexibility.

Transformer models and certification standards vary across different countries and regions, and entering new markets requires obtaining various qualification certificates, which increases the market development costs and time for export enterprises.

After decades of development, China’s transformer industry has formed the capability to cover the entire industrial chain from raw materials to finished products. Taking oriented silicon steel, a core material, as an example, China’s oriented silicon steel output reached 3.0325 million tons in 2024, which is 5 times that of Japan and 8 times that of the United States, leading the world by a wide margin [3]. Even more impressively, Baowu Group has built the world’s only dedicated production line for 0.18mm and 0.20mm thick silicon steel sheets, which can control the material angle error within 4.5 degrees, achieving top-tier performance [3].

This complete industrial chain advantage gives Chinese transformer products significant cost and efficiency advantages. According to industry insiders, a transformer with equivalent performance is priced at about RMB 10,000 for domestic products, while similar equipment in Europe may cost RMB 30,000 to 50,000 [2].

China’s transformer industry has formed a competitive pattern of “national team + strong private enterprises”. Established in 2021, China Electric Equipment Group has integrated veteran players such as XD Electric, Baobian Electric, and Shandong Electric to build the “strongest national team” [3]. Among them:

- XD Electric (601179.SH):A leader in ultra-high voltage, participating in all national strategic ultra-high voltage projects

- Baobian Electric:Has advantages in high-voltage and large-capacity equipment, with products exported to more than 40 countries and regions

- TBEA (600089.SH):Long-time top of China’s Electrical Industry Top 100 list, with an annual output of 420 million kVA of transformers and reactors, ranking among the top globally

- Jiangsu Huapeng Electric:The only Chinese enterprise selected as one of the top 10 transformer brands in North America, ranking first globally in new energy power transformer exports

- Eaglerise Electric:Maintains a global leading position in step-up transformers for photovoltaic and energy storage fields

This industrial echelon has enabled China to control more than 60% of the global transformer production capacity [3].

While maintaining a leading position in the traditional transformer field, Chinese enterprises are making inroads in next-generation technologies. Solid State Transformers (SST), also known as Power Electronic Transformers (PET), are becoming the core of next-generation data center power supply solutions [1]. Currently, several Chinese enterprises have laid out their presence in this track:

- Jinpan Technology (688676.SH):Completed the design and production of a 10kV/2.4MW solid-state transformer prototype in August 2025, suitable for HVDC 800V power supply architectures [1]

- TGOOD (300001.SZ):Focuses on the layout of integrated “high-voltage + solid-state transformer” solutions, and is expected to complete the commercial implementation of the first set of 110kV overall solutions for data centers in 2026 [1]

- Eaglerise Electric:Actively expands the market for data center Panama power supply (a type of HVDC solution) [1]

Faced with the global demand boom, Chinese transformer enterprises are accelerating overseas capacity layout to break through trade barriers and get closer to target markets.

- Thailand Plant:After full production, it will have the capacity to produce 700 new energy transformers per month, with supporting capacity for some distribution transformers

- Mexico Plant:Expected to reach full production in mid-2027, with a monthly production capacity of 500 new energy transformers after full commissioning

- U.S. Plant:Mainly produces distribution transformers, with a planned annual capacity of 21,000 units, and its main competitors are local U.S. manufacturers [1]

The U.S. transformer market has high barriers but huge market space. To break into this market, Chinese enterprises have adopted various strategies:

- TBEA (600089.SH):Obtained certification for large-scale U.S. power transformers and successfully entered the U.S. market [1]

- Siyuan Electric (002028.SZ):Entered the U.S. market through the Siyuan Toshiba Transformer joint venture factory [1]

- Eaglerise Electric:Its smart manufacturing plant in Fort Worth, Texas, U.S. has achieved small-batch production [2]

Based on existing production capacity, leading enterprises are improving supply capacity through production expansion and talent cultivation:

As transformers are a labor-intensive industry with a long training cycle, talent reserves have become the key to capacity expansion. Some enterprises are accelerating talent cultivation through cooperation with vocational colleges and the establishment of internal training systems.

The response strategies of different enterprises show differentiated characteristics:

Solid State Transformers (SST) are becoming a new arena for enterprises in the industry to compete for. Compared with traditional transformers, SST has advantages such as small size, high efficiency, and fast response, making it particularly suitable for scenarios with high power supply quality requirements such as data centers.

- TGOOD (300001.SZ):Has formed a full-link capability covering design, equipment, integration, operation and maintenance, and energy management. It is expected to complete the commercial implementation of the first set of 110kV overall solutions for data centers in 2026, and the commercial implementation of fully self-developed solutions in 2027 [1]

- Jinpan Technology (688676.SH):Its SST prototype is expected to complete certification in the fourth quarter of 2025, and high-voltage HVDC is expected to complete certification in the second quarter of 2026 [7]

- XD Electric (601179.SH):2.4MW solid-state transformers have been mass-produced, with an efficiency of over 97.5%, saving 63% of space, and serving the “East Data West Computing” project [7]

Dramatically, the U.S. previously imposed a 104% tariff on Chinese transformers, but against the backdrop of severe global supply shortages, the U.S. has begun to quietly relax restrictions on Chinese transformers [3]. This reflects the reverse effect of market forces on trade policies—when supply falls short of demand to a certain extent, tariff barriers can hardly block the competitiveness of Chinese products.

Due to insufficient production capacity of local enterprises, strong demand for grid upgrading and new energy in Europe has brought significant growth opportunities for Chinese enterprises [1]. Europe plans to invest 584 billion euros in grid expansion, but progress has been slow due to transformer shortages, which provides a huge market space for Chinese transformer enterprises.

In addition to the traditional European and American markets, Chinese enterprises are also actively developing markets in countries along the “Belt and Road”. Jiangsu Huachen’s products are mainly exported to Southeast Asian markets such as Vietnam and Thailand, with revenue of RMB 1.44 billion in the first three quarters of 2025, close to the full-year level of last year [2]. Some transformer enterprises in Chongren, Jiangxi have expanded channels by participating in China-Cambodia Cooperation Fair, Kazakhstan Power and Energy Exhibition, etc., and are negotiating cooperative factory construction with customers from Ukraine and Myanmar [2].

Looking ahead to 2026, the high growth trend of power equipment exports is expected to continue. China has built a world-class comprehensive competitiveness in terms of technology, production capacity, quality, and cost control in the field of power electronic equipment, which forms a solid foundation for continued strong exports [6].

In terms of product structure, equipment that better meets the specific needs of overseas markets will have more prominent growth momentum:

- Grid-Forming Energy Storage Equipment: Used to support the stable operation of aging power grids

- Transformers: Core equipment for ensuring power transmission and conversion

- HVDC Equipment: Adapts to the power supply needs of data centers

In contrast, the main market for super-large equipment with Chinese power grid characteristics such as ultra-high voltage will still be concentrated in the domestic market [6].

Combined with industry trends and enterprise competitiveness, it is recommended to focus on three main lines:

- TBEA (600089.SH):The only enterprise deeply involved in all ultra-high voltage projects, with overseas orders in 2025 growing by more than 80% year-on-year, directly benefiting from the global “transformer shortage” [7]

- Siyuan Electric (002028.SZ):A leader in power equipment exports, with multiple products entering the North American AIDC market and continuous capacity expansion [7]

- XD Electric (601179.SH):Absolute advantage in ultra-high voltage AC, leading in magnetic integration technology for high-frequency transformers [7]

- TGOOD (300001.SZ):Leader in the box-type substation field, focusing on the layout of integrated solid-state transformer (SST) solutions [7]

- Jinpan Technology (688676.SH):Leader in the dry-type transformer field, currently promoting SST prototype certification [7]

New technology fields such as solid-state transformers and intelligent power distribution equipment will become the focus of competition in the next stage, and enterprises that lay out in advance are expected to gain first-mover advantages.

- Trade Policy Risk: Although there is currently some relaxation, trade policies still have uncertainties

- Raw Material Price Fluctuation Risk: Fluctuations in the prices of raw materials such as copper and silicon steel may affect gross profit margins

- Overcapacity Risk: If global capacity expands too quickly, it may lead to changes in the industry’s supply and demand pattern

- Technological Iteration Risk: New technologies such as solid-state transformers may replace traditional products

China’s transformer industry is standing at a historic opportunity window. The global capacity shortage of more than 2 years provides a rare expansion opportunity for Chinese enterprises with technological, production capacity, and industrial chain advantages. From export data, transformer exports in 2025 increased by 47% year-on-year to nearly RMB 44 billion, and the overseas order growth rate of leading enterprises generally exceeded 60%, fully confirming the high prosperity of this industry.

Faced with this opportunity, the response strategies of Chinese enterprises show diversified characteristics: laying out overseas capacity to break through trade barriers, deepening regional markets to obtain stable orders, expanding production and improving efficiency to meet strong demand, and laying out next-generation technologies to seize future high ground. The practices of enterprises such as Eaglerise, TBEA, and Siyuan Electric show that the transformation from simple product export to in-depth localized operation has become an industry consensus.

In the long term, with the acceleration of global energy transformation, grid infrastructure upgrading, and the explosion of AI computing demand, the high prosperity cycle of the transformer industry is expected to continue. Relying on its complete industrial chain advantages, technological innovation capabilities, and cost efficiency advantages, Chinese manufacturing is expected to continue to benefit from this round of the global power equipment super cycle.

[1] Sina Finance - “Are Transformers Selling Crazy Overseas? Listed Companies: Demand is Strong but Not "in Short Supply"” (https://finance.sina.com.cn/tech/roll/2026-01-07/doc-inhfnzrp1960119.shtml)

[2] Jiemian News - “Transformers in Short Supply, Chinese Factories "Patch" Global Power Grids” (https://m.jiemian.com/article/13736274.html)

[3] Chinese Business Strategy/Sina Finance - “Global Rush for Chinese Transformers” (https://finance.sina.com.cn/tech/roll/2026-01-06/doc-inhfives6037305.shtml)

[4] Jinling API Data - TBEA Company Profile and Technical Analysis

[5] Caifuhao/Eastmoney - “Grasp the Three Main Lines of Transformers: "Leaders Going Overseas + New Energy Supporting + Technological Leadership"” (https://caifuhao.eastmoney.com/news/20260107181321559855170)

[6] Eastmoney - “The Power Super Cycle Continues, These Fields Benefit” (https://finance.eastmoney.com/a/202601013607432552.html)

[7] Caifuhao/Eastmoney - Transformer Industry Investment Analysis

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.