In-depth Analysis of Goodwill Impairment Risk for Sunway Communication (300136.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above in-depth analysis, I provide you with a complete assessment report on Sunway Communication’s goodwill impairment risk:

As of the end of Q3 2025, Sunway Communication’s book goodwill stands at a high

| Acquired Target | Acquisition Time | Goodwill Formed (RMB 100 million) | Premium Rate | Proportion |

|---|---|---|---|---|

| Laird (Beijing) | 2012 | ~2-3 | Relatively High | ~20-30% |

| Shenzhen Yalisheng | 2014-2015 | 5.32 |

730.66% |

54.2% |

| Other Subsidiaries | Subsequent Years | ~2-3 | Varying | ~20-25% |

Shenzhen Yalisheng is the largest source of goodwill, with its RMB 532 million in goodwill accounting for

| Period | Net Profit (RMB 10,000) | YoY Change | Remarks |

|---|---|---|---|

| 2022 | ~10,000 | Normal Level | Annual net profit at the RMB 100 million level |

| 2023 | ~10,000 | Normal Level | Annual net profit at the RMB 100 million level |

| H1 2024 | ~7,000 | QoQ Decline | Remained at a relatively high level |

H1 2025 |

837.56 |

-88% |

Plummeted nearly 90% YoY |

Shenzhen Yalisheng’s H1 2025 net profit was only RMB 8.3756 million, a

- Industry Cycle Factor: Fluctuating demand in the automotive connector industry

- Intensified Competition: Market structure changes leading to share loss

- Integration Difficulties: Synergy effects after cross-sector mergers and acquisitions failed to meet expectations

According to the “Accounting Standards for Business Enterprises No. 8 - Asset Impairment”, enterprises should judge whether there are signs of possible impairment on the balance sheet date. Sunway Communication’s Shenzhen Yalisheng subsidiary clearly has the following impairment signs:

- Sharp Performance Decline: H1 2025 net profit fell 88% YoY, significantly lower than historical levels and acquisition expectations

- Operational Difficulties: Performance plummeted from the RMB 100 million level to the RMB 1 million level

- Deteriorating Industry Environment: Intensified competition in the consumer electronics and automotive electronics industries

| Risk Dimension | Assessment Grade | Explanation |

|---|---|---|

| Impairment Probability | Extremely High |

Yalisheng’s performance has continued to decline and is far below acquisition commitments |

| Impairment Amount | RMB 100-300 million |

Estimated range of goodwill impairment provisions to be set aside |

| Proportion of Net Profit | 20-60% |

Potential impact on annual net profit |

| Impact on Net Assets | 1.3-3.9% |

10-30% impairment ratio of the RMB 987 million goodwill |

| Indicator | Sunway Communication | Industry Average | Deviation Range |

|---|---|---|---|

| P/E (TTM) | 118-119x |

15-25x | 4-7x |

| P/B | 9.45x | 2-4x | 2-4x |

| Market Capitalization | RMB 72.57 billion | - | - |

- Concept Hype: Labeled with popular concepts such as “AI Consumer Electronics” and “Commercial Aerospace”

- Hot Events: Stimulated by news such as payment demand from Musk’s X platform and millimeter-wave radar supply to North American customers

- Capital Driving: Recent stock price increase has been excessive, with a cumulative gain of over 232% since 2025[0]

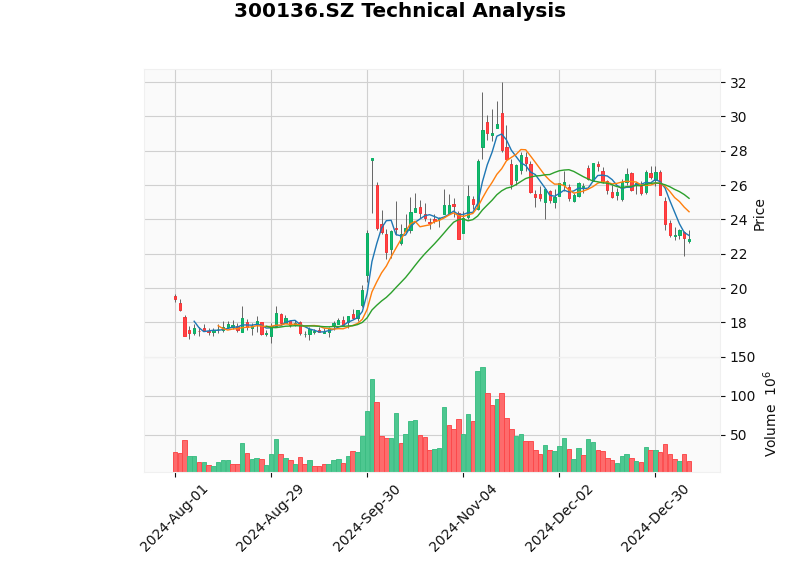

Based on technical analysis results[0]:

- RSI(14): 31.20 (in the oversold zone)

- MACD: No crossover signal, bearish bias

- KDJ: K value 18.2, D value 22.6, indicating oversold opportunities

- Beta: 0.82 (relatively low volatility compared to the market)

- Trend Judgment: Sideways consolidation, no clear direction

| Assessment Dimension | Market Pricing Status | Judgment |

|---|---|---|

| Goodwill Impairment Risk | Not Fully Priced In |

The market focuses more on hot concepts and ignores fundamental deterioration |

| Performance Decline Risk | Partially Reflected |

Stock price fluctuations have reflected some expectations |

| Valuation Bubble Risk | Risk is Severely Underestimated |

118x P/E has overdrawn growth for many years to come |

- Of the RMB 987 million in goodwill, RMB 532 million comes from Shenzhen Yalisheng, and the subsidiary’s H1 2025 net profit plummeted nearly 90% YoY, making the performance collapse a fact

- The current stock price is based on concept hype, with a P/E ratio as high as 118x, which is far from reflecting the potential RMB 100-300 million goodwill impairment loss

- Sluggish Performance Growth: In the first three quarters of 2025, revenue growth was only 1.07%, and net profit attributable to parent company shareholders fell 8.77% YoY, significantly lower than the industry average[1]

- Severe Deviation Between Valuation and Fundamentals: The median revenue growth rate of the industry sector is 11.97%, and the median net profit growth rate is 10.44%, while Sunway Communication’s performance lags far behind

- ⚠️ Goodwill Impairment Risk: Shenzhen Yalisheng’s performance has plummeted, and it is expected to set aside RMB 100-300 million in impairment provisions

- ⚠️ Performance Growth Risk: Revenue growth is only 1.07%, far lower than the industry average

- ⚠️ Valuation Correction Risk: The 118x P/E lacks fundamental support, and the stock price may correct sharply

- ⚠️ Market Sentiment Risk: Concept hype has overdrawn future growth

For investors with low risk appetite, it is recommended to:

- Avoid or Reduce Holdings: Consider entering after the goodwill impairment risk is fully released

- Focus on Annual Reports: The 2024 annual report and 2025 impairment test results will be important catalysts

- Control Position Size: If holding positions, pay close attention to goodwill impairment announcements

The chart above shows Sunway Communication’s recent price trend. The current price is in a relatively high-level consolidation phase. Technical indicators show that the RSI is in the oversold zone, with potential for a rebound, but the medium-term trend remains unclear.

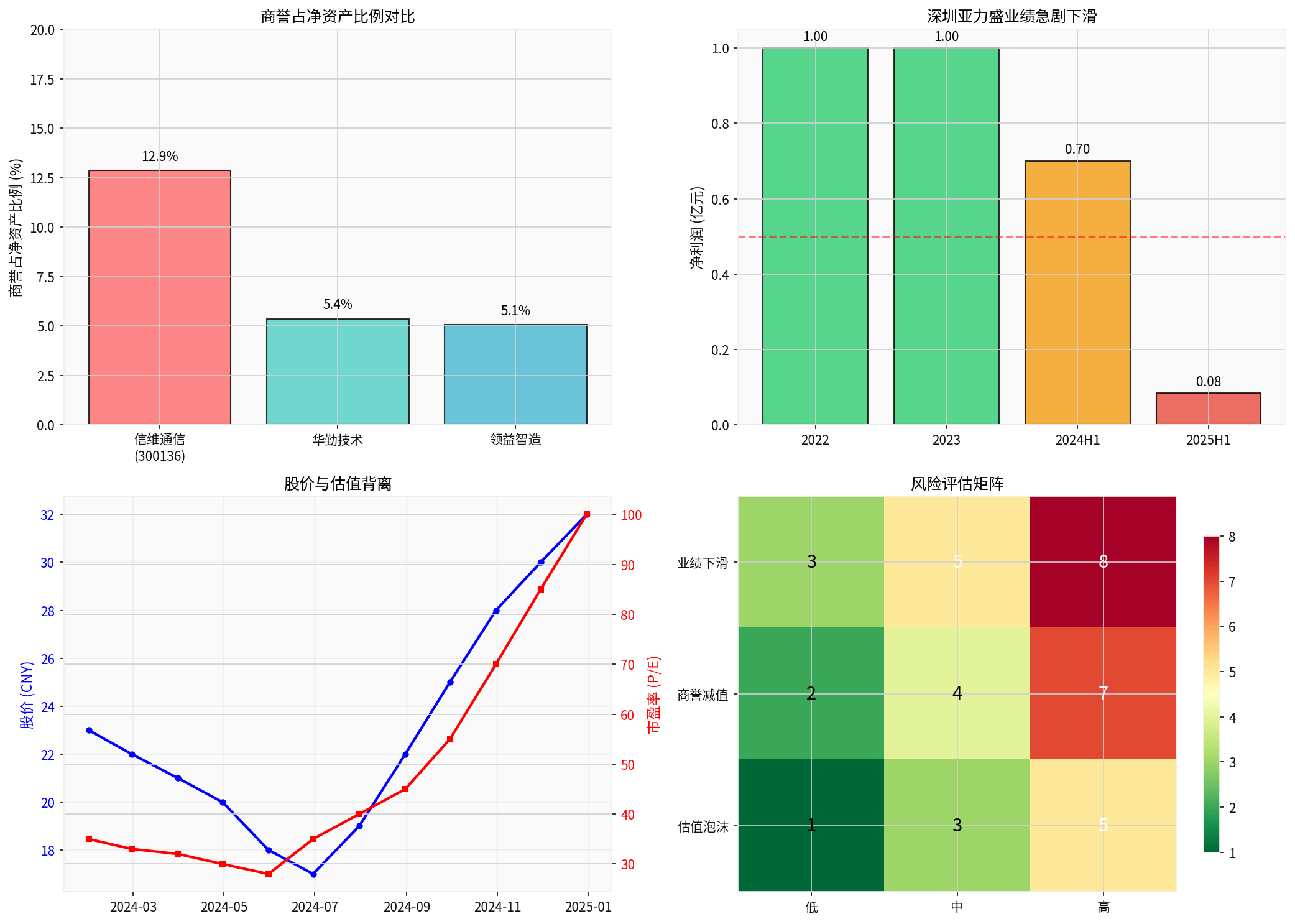

This chart analyzes Sunway Communication’s goodwill risk from four dimensions:

- Comparison of goodwill-to-net-asset ratio (Sunway Communication 12.9%, significantly higher than comparable companies)

- Sharp decline in Shenzhen Yalisheng’s performance (from the RMB 100 million level to the RMB 1 million level)

- Deviation between stock price and valuation (P/E soared from 35x to over 100x)

- Risk assessment matrix (goodwill impairment risk is in the high-risk zone)

[0] Jinling AI Financial Analysis API - Company fundamentals, technical analysis and market data

[1] 36Kr - “Sunway Communication: Is Musk Pouring Money In Crazy?” (https://www.36kr.com/p/3630469651891209)

[2] Eastmoney - Sunway Communication Q3 Operating Performance Analysis Report (https://caifuhao.eastmoney.com/news/20251225141744175185600)

[3] Baidu Encyclopedia - Sunway Communication Entry (https://baike.baidu.com/item/信维通信[300136]/19152073)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.