Analysis of Kinwong Electronics' Automotive PCB Business and Customer Concentration Risk

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me conduct a comprehensive analysis of customer concentration risk for you.

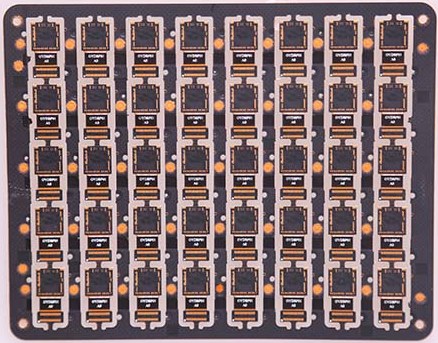

Kinwong Electronics (Stock Code: 603228.SS) is a leading printed circuit board (PCB) manufacturer in China, with a diverse product portfolio including multi-layer boards, HDI boards, flexible circuit boards, metal-based circuit boards, etc. The company’s products are widely used in multiple sectors such as automotive, next-generation communication technologies, AI servers, data centers, AIoT, consumer electronics, industrial control, and healthcare[0].

As of January 2026, the company has a market capitalization of approximately USD 7.06 billion, with a current share price of USD 77.01, representing a 180.24% increase over the past year, significantly outperforming the market[0].

According to Prismark statistics,

The automotive electronics sector has extremely high qualification requirements for suppliers, with long product certification cycles and high supply barriers, which also means strong customer stickiness and relatively stable cooperative relationships.

| Indicator | Value | Industry Comparison |

|---|---|---|

Sales Share of Top 5 Customers (2024) |

23.11% | Lowest among A-share PCB manufacturers with over RMB 10 billion in revenue |

Sales Share of Top 1 Customer |

<10% | No over-reliance on a single major customer |

Concentration Ratio of Top 5 Accounts Receivable |

15.13% | At a relatively low level |

According to public data, the sales share of Kinwong Electronics’ top 5 customers shows a trend of steady decline:

| Year | Sales Share of Top 5 Customers |

|---|---|

| 2017 | 23.68% |

| 2022 | ~20% |

| 2023 | 18.98% |

| 2024 | 23.11% |

This trend indicates that the company

Among the 5 A-share PCB manufacturers with revenue exceeding RMB 10 billion, Kinwong Electronics has the

| Company | Sales Share of Top 5 Customers | Key Customer Characteristics |

|---|---|---|

Kinwong Electronics |

Lowest (~20%) |

Dispersed customers, low reliance on single major customer |

| Unimicron Technology (China) | Relatively high | High sales share from Apple |

| WUS Printed Circuit | Relatively high | 66% revenue from communications sector, high customer concentration |

| Shennan Circuits | Moderate | Focus on aerospace and communications |

Based on a comprehensive judgment of the following factors, Kinwong Electronics’ customer concentration risk is within a

| Factor | Analysis |

|---|---|

High Customer Dispersion |

The top 5 customers account for only 23.11% of total sales, with a single customer accounting for <10% of sales; there is no heavy reliance on a single major customer |

Diverse Downstream Industries |

Although the automotive business accounts for 45.9% of revenue, customers cover multiple types including Tier1 manufacturers, automakers, and intelligent driving solution providers, diversifying single-customer risks |

High Customer Qualification Barriers |

Customers in sectors such as automotive and servers have long certification cycles and high requirements, leading to stable customer relationships and low customer churn |

Continuous Expansion of New Customers |

The company continuously taps into the demand of existing customers while expanding new customers and introducing new designated projects |

Dispersed Accounts Receivable |

The concentration ratio of the top 5 accounts receivable counterparties is only 15.13%, so the risk of payment collection is controllable |

| Factor | Potential Impact |

|---|---|

Cyclical Fluctuations in the Automotive Industry |

The high proportion of automotive PCB business may affect the company’s performance if downstream auto sales decline or price competition intensifies |

Downstream Customers Concentrated in Leading Tier1s |

Although the share of a single major customer is low, adjustments to supply chain strategies by leading Tier1 manufacturers may still have an impact |

Reliance on Export Business |

Exports account for 41.09% of revenue; attention should be paid to the impact of US tariff policies on the company’s export business[1] |

Raw Material Cost Pressure |

Direct materials account for a high proportion of costs; price increases of raw materials such as gold salts may compress profit margins |

- World’s largest automotive PCB supplier(Prismark 2024 data)

- Ranked 10th globally in the printed circuit board industry and 3rd among domestic PCB manufacturers in China’s top 100 list in 2024

- Awarded official Intel AIBC® certification, currently the only PCB manufacturer in mainland China to receive this certification

- Added 30 invention patents in 2024, with the total number of patents ranking among the top in the industry[1]

The company has 5 major production bases in Shenzhen (Guangdong), Longchuan (Guangdong), Jishui (Jiangxi), Jinwan (Zhuhai), and Fushan (Zhuhai), with a total of 11 factories,

The company’s customers cover

| Dimension | Rating | Explanation |

|---|---|---|

| Customer Concentration Risk | Low |

Top 5 customers account for 23.11% of sales, far below the industry average |

| Business Structure Risk | Moderate | Automotive business accounts for 45.9% of revenue; attention should be paid to the automotive industry cycle |

| Customer Quality | Excellent | Global leading Tier1 manufacturers with high customer qualification barriers |

| Growth Potential | Good | Demand growth driven by AI servers and automotive intelligence |

- Downstream Demand Fluctuation Risk: Changes in downstream demand such as auto sales and server capital expenditures may affect the company’s performance

- Intensified Industry Competition: The increasingly fierce competition in the PCB industry may put pressure on gross margins

- Raw Material Price Fluctuation Risk: Price fluctuations of raw materials such as copper and gold salts affect the cost side

- Geopolitical and Tariff Risks: Exports account for 41.09% of revenue; attention should be paid to changes in international trade policies

With Kinwong Electronics’ automotive PCB business accounting for 45.9% of revenue,

The company’s core competitiveness lies in:

- Market position as the world’s largest automotive PCB supplier

- High-quality customer resources covering global leading Tier1 manufacturers

- Strong customer stickiness brought by high customer certification barriers

- Continuous technological innovation and patent accumulation

It is recommended that investors focus on the growth potential of the company’s AI server business and the commissioning progress of the Thailand production base. At the same time, continuous attention should be paid to the prosperity of the automotive industry, changes in orders from major downstream customers, and the impact of international trade policies.

[0] Jinling API - Kinwong Electronics Company Overview and Financial Data (603228.SS)

[1] China Securities Pengyuan - 2025 Follow-Up Rating Report for Shenzhen Kinwong Electronics Co., Ltd. (https://stockmc.xueqiu.com/202506/603228_20250627_R0RP.pdf)

[2] Huajin Securities - In-Depth Analysis Report on Kinwong Electronics: Diversified Product Layout, Gradual Implementation of Globalization Strategy (https://aigc.idigital.com.cn/djyanbao/【华金证券】产品布局多元化,全球化战略逐步落地-2024-08-10.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.