Cha Baidao H1 2025 Operational Analysis and Overseas Expansion Outlook

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to Cha Baidao’s 2025 Interim Report, as of June 30, 2025, the company’s total number of stores nationwide reached 8,444, an increase of only 59 compared to 8,385 in the same period of 2024,

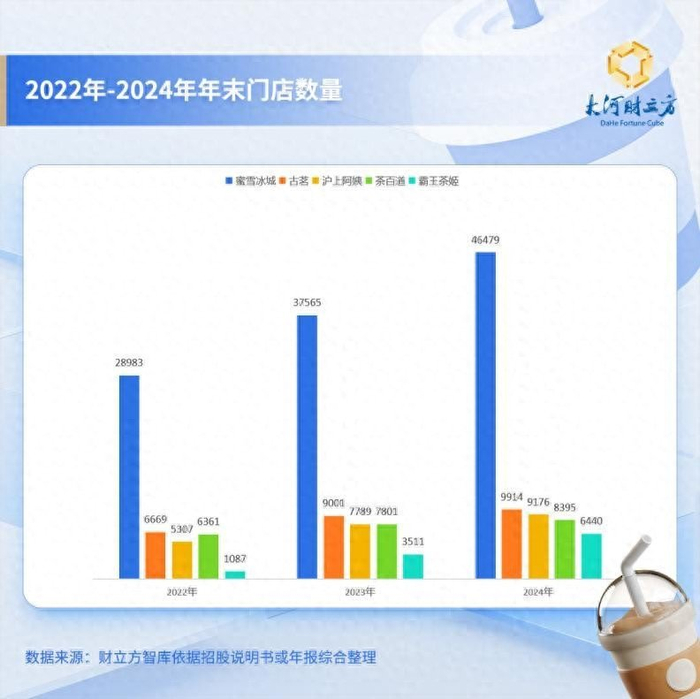

Even more noteworthy is the significant rise in store closure rate. Cha Baidao’s store closure rate reached 10.62% in 2024, with 890 stores closed throughout the year, compared to only 2.82% in 2023[1]. In the current market environment, the entire new tea beverage industry has shifted from incremental expansion to stock competition — as of July 2025, the total number of milk tea shops nationwide is approximately 426,300, with a net growth of -39,200 in the past year, meaning store closures outnumber new openings[2].

Another major challenge facing Cha Baidao is

Data from H1 2025 shows that the situation has improved but still faces pressure: 505 franchisees terminated their cooperation during the period, of which 265 stopped cooperating by transferring their stores to other franchisees, 228 terminated due to their own reasons, and 12 were terminated by the company[0]. A total of 596 new franchisees were added during the period, resulting in a net increase of 91 franchisees, with the total number of franchisees rising from 5,742 to 5,833[0].

Despite the slowdown in expansion, Cha Baidao’s

The company has implemented multiple measures to improve store operation models:

- Optimize investment threshold: Launched installment payment policies to reduce initial investment pressure on franchisees

- Digital upgrade: Systems such as intelligent site selection, automatic replenishment, and AI inspection improve operational efficiency

- Accelerate product innovation: 55 new products were launched in H1 2025, far exceeding the 21 launched in the same period of 2024[4]

These adjustments have shortened the payback period of single stores by approximately 1-2 months compared to 2024[4], significantly improving the single-store model.

Cha Baidao has made

| Supply Chain Indicators | Current Status |

|---|---|

| National Warehousing & Distribution Centers | 26 |

| Next-Day Delivery Rate to Stores | 93.8% |

| Unified Fruit Distribution Rate | 80% |

| Distribution Model | “Trunk + City + Express” three-tier distribution |

| Self-Produced Raw Materials | Expanded from packaging materials to tea leaves |

The company has made a breakthrough in the efficient supply of perishable fruits (such as mulberries and lychees) from origin to stores, solving the cold chain problem that has previously plagued new tea beverage brands[3]. In addition, Cha Baidao has piloted coffee business in some stores in Sichuan and Guangdong provinces, with cup volume increasing by approximately 10% in pilot stores, providing a new direction for future product line expansion[4].

Cha Baidao’s

The company adopts a

- Store location and product development are close to local culture and consumption habits

- Adopts a “cross-border + local” mixed supply model, cooperating with local suppliers for fresh milk and fruits, while tea bases and packaging materials are transported via cross-border logistics

- Obtained franchise qualification in the South Korean market, with the ability to scale chain operations[3]

However, overseas expansion still faces multiple challenges:

- High long-distance transportation costs for supply chains: Domestic supply chain advantages cannot be directly replicated overseas

- Insufficient localized operation experience: Consumer preferences and regulatory requirements vary significantly across different markets

- Intensified competition: Brands such as Heytea, CHAGEE, and Mixue Ice Cream & Tea are all accelerating their overseas layout

Cha Baidao is currently in a

Regarding the question of “whether the supply chain can support overseas expansion”, the answer is

Looking forward, for Cha Baidao to maintain its advantages in the fierce market competition, it needs to continue to focus on the following aspects:

- Further stabilize the franchisee system and improve single-store profitability

- Accelerate the localization of overseas supply chains

- Strengthen product innovation capabilities to respond to changes in consumer demand

- Cautiously evaluate the pace of overseas expansion and avoid “great leap forward” style layout

[0] Sichuan Baicha Baidao Industrial Co., Ltd. 2025 Interim Report (https://stockn.xueqiu.com/02555/20250925284202.pdf)

[1] Dahe Cube - A Batch of Milk Tea Franchisees Exit, Cha Baidao and Guming Have High Churn Rates (https://app.dahecube.com/nweb/news/20250815/244394n408432dd1b6.htm)

[2] Sina Finance - Cha Baidao’s Franchisee Churn Rate Reaches 16.6%, Aunt Shanghai Has the Highest Store Closure Rate (https://cj.sina.cn/articles/view/2516866423/9604557700101736y)

[3] Securities Times - Mid-Year Report Review of the New Tea Beverage Industry: Intensified Competition Leads to Obvious Performance Differentiation (https://www.stcn.com/article/detail/3316847.html)

[4] Eastmoney - Cha Baidao (2555.HK) Initiation Coverage Report (https://pdf.dfcfw.com/pdf/H3_AP202511241787234893_1.pdf)

[5] UhooGlobal - Cha Baidao Accelerates Overseas Expansion, Global Stores Exceed 20 (https://www.uhootea.com/archives/3443)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.