In-Depth Analysis of Investment Value for Progressive Corporation (PGR)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above in-depth research, I now present to you a comprehensive investment analysis report on Progressive (PGR).

Progressive Corporation is one of the largest property and casualty insurers in the U.S., ranking alongside State Farm and Geico as the top three auto insurance providers in the country [0]. As of January 7, 2026, the company has a market capitalization of $122.6 billion, a current share price of $209.10, and a consensus analyst target price of $242, representing approximately 15.7% upside potential [0].

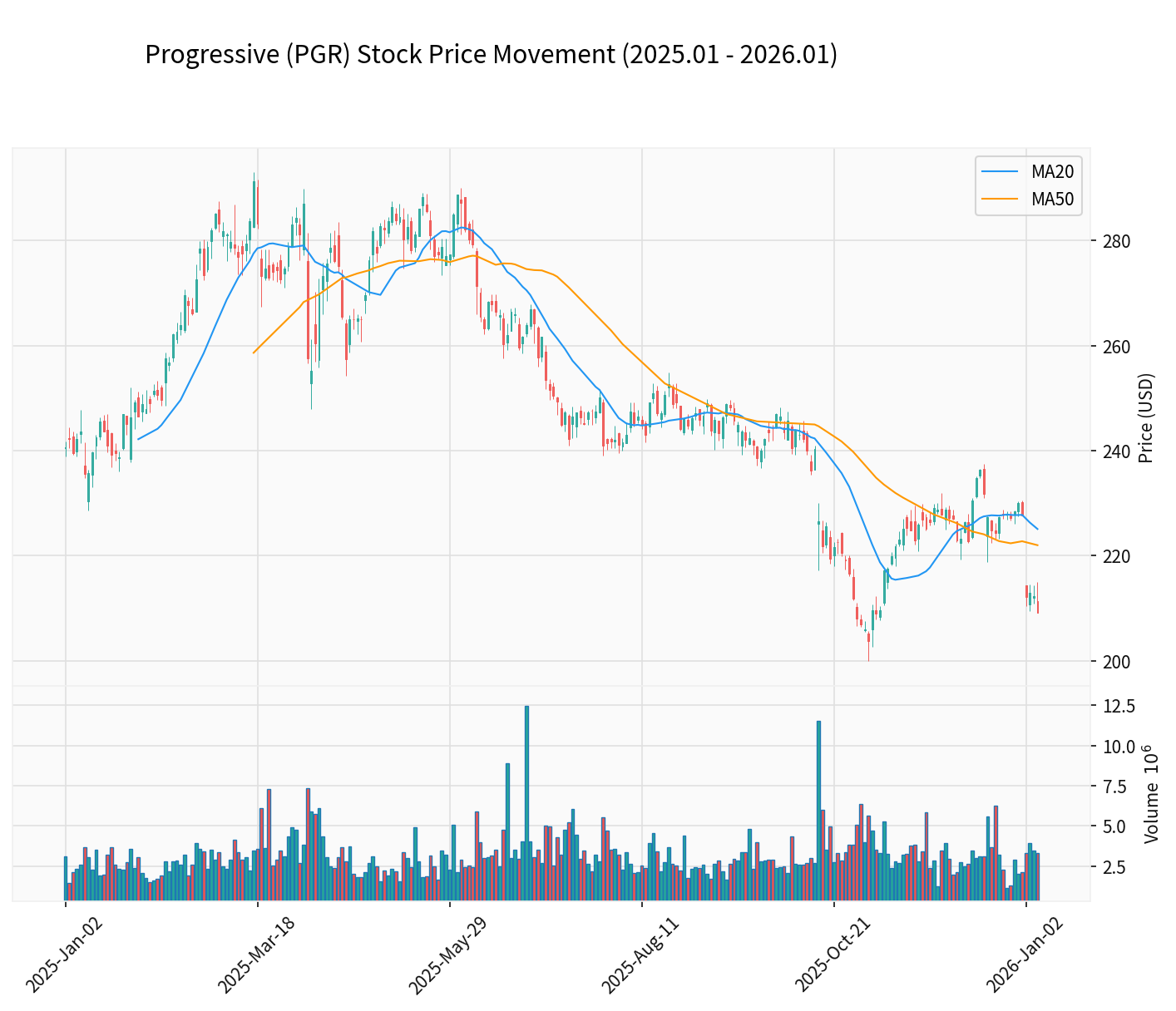

In terms of stock performance, PGR has underperformed over the past year, with its share price falling 14.16% and a YTD return of -13.11%. However, its long-term performance remains solid: a 58.40% gain over three years and a 121.27% gain over five years [0]. The stock is currently in a range-bound trading pattern, with a trading range of $206.64 to $225.09. Technical indicators show it is in an oversold zone, with both RSI and KDJ signaling oversold opportunities [0].

The chart above shows PGR’s stock price trend from January 2025 to January 2026, including the 20-day and 50-day moving averages. It can be seen that the stock price has continued to pull back from its high at the start of the year and is currently in a key support zone.

Based on the latest financial data [0][3]:

| Metric | Value | Industry Comparison |

|---|---|---|

| P/E Ratio | 11.48x | Below industry average |

| ROE | 34.96% | Significantly higher than industry |

| Net Profit Margin | 12.58% | Excellent level |

| Operating Margin | 15.86% | Stable |

| 2024 Net Profit | $8.46 billion | 117% YoY growth |

| 2024 Total Revenue | $75.37 billion | 21.4% YoY growth |

The company delivered exceptionally strong performance in 2024, with net profit surging from $3.9 billion in 2023 to $8.46 billion, mainly driven by improved underwriting profits and increased investment income [3].

- Sufficient premium growth momentum: Unearned premiums increased from $20.134 billion to $23.858 billion [3]

- Investment portfolio size reached $80.25 billion, with investment income of $2.832 billion in 2024 [3]

- Continuous market share expansion

- Q3 EPS was $4.05, missing analysts’ expectation of $4.99, with an unexpected decline of 18.84% [0]

- Analysts forecast a -3.03% earnings growth rate for 2026, which may lag behind the industry average [4]

- Recent price target downgrade: BMO Capital lowered its target price from $256 to $253 [5]

According to research from S&P Global Market Intelligence and industry analysts [6][7], the U.S. property & casualty insurance industry faces the following landscape in 2026:

- State Farm: Leading in market share, but with a combined ratio as high as 112.5%, suffering severe underwriting losses [1]

- Geico: Its price advantage is facing challenges; it was forced to raise prices due to rising claims costs, losing some of its price leadership [1][2]

- Allstate: With a combined ratio of 103.9%, it is also facing profitability pressure [1]

Insurance companies primarily invest collected premiums in high-quality fixed-income securities, including government bonds and corporate bonds [9]. The interest rate environment impacts insurance company valuation in the following ways:

- U.S. investment yields are expected to rise from 3.9% in 2024 to 4.0% in 2025 and 4.2% in 2026 [10]

- “Roll-over” effect of insurance company investment portfolios: New funds are reinvested at higher interest rates, boosting overall returns

- Progressive’s 2024 investment income reached $2.832 billion, a significant increase from $1.892 billion in 2023 [3]

- The Federal Reserve has started an interest rate cut cycle, with the first 25 basis point cut in September 2025 [10]

- If rate cuts continue, yields on new funds will decline, narrowing the gap with yields on existing investment portfolios

- Unrealized losses on fixed-income securities: Progressive’s unrealized losses on held-to-maturity securities amount to $1.408 billion [3]

Progressive’s Investment Portfolio Composition [3]:

- Available-for-sale securities: $75.947 billion

- Held-to-maturity securities: $75.332 billion (cost: $77.126 billion)

- Equity securities: $4.303 billion

- Total investments: $80.25 billion

- For every 100 basis point increase in interest rates, insurance company investment income increases accordingly

- Progressive’s long-term bond portfolio will benefit from rising interest rates

- However, falling interest rates will compress future investment income growth space

| Metric | PGR | Industry Average |

|---|---|---|

| P/E | 11.48x | ~15-18x |

| P/B | 3.47x | ~1.5-2x |

| P/S | 1.44x | - |

| ROE | 34.96% | ~10-15% |

| Beta | 0.34 | ~1.0 |

PGR’s P/E is significantly below the industry average, but its P/B is relatively high, reflecting the market’s recognition of its high ROE and profitability. The low Beta of 0.34 means the stock price volatility is lower than the broader market, making it suitable for defensive allocation.

- Intensified pricing competition in auto insurance may erode profit margins

- Q3 performance missed expectations (EPS unexpectedly declined by 18.84%) [0]

- Falling interest rates may impact investment income

- Catastrophic losses caused by natural disasters (global insurance losses exceeded $107 billion in 2025) [7]

- Data analysis capabilities continue to bring pricing advantages

- Further expansion of market share

- Strong capital return capability (generous share repurchases and dividends in 2024) [0]

- Valuation reversion opportunity (P/E is below historical average)

| Dimension | Assessment | Support Level |

|---|---|---|

| Growth Drivers | Medium-High | Growth is supported by data advantages and market share expansion, but short-term growth has slowed |

| Competitive Landscape | Neutral-Weak | Industry pricing competition is intensifying, but Progressive’s relative advantages are obvious |

| Interest Rate Environment | Neutral | Current high interest rate environment is favorable, but the rate cut cycle may weaken it |

| Valuation Attractiveness | Medium-High | P/E is below historical and peer levels, with excellent ROE |

Progressive maintains a leading position in industry competition through its excellent data analysis capabilities and underwriting discipline. The company’s 34.96% ROE and stable combined ratio support long-term value creation. However, short-term growth slowdown, intensified competition, and changes in the interest rate environment pose risks. Considering the current attractive valuation (11.48x P/E) and the approximately 15% upside potential per analyst consensus, it is reasonable to allocate during market pullbacks.

[0] Jinling API Market Data - Progressive (PGR) Company Profile and Financial Metrics

[1] KoalaGains - Progressive (PGR) Stock Analysis & Key Metrics (https://koalagains.com/stocks/NYSE/PGR)

[2] Focused Compounding - Progressive (PGR) Analysis (https://focusedcompounding.com/wp-content/uploads/2017/05/Progressive-1.pdf)

[3] SEC EDGAR - Progressive Corporation 10-K Filing (https://www.sec.gov/Archives/edgar/data/80661/000008066125000007/pgr-20241231.htm)

[4] Wall Street Zen - PGR Progressive Corp Stock Forecast (https://www.wallstreetzen.com/stocks/us/nyse/pgr/stock-forecast)

[5] CNN Business - PGR Stock Quote and Forecast (https://www.cnn.com/markets/stocks/PGR)

[6] Seeking Alpha - U.S. P&C 2026 Outlook: Competition Revs Up, Pricing Slows (https://seekingalpha.com/article/4857641-us-p-and-c-2026-outlook-competition-revs-up-pricing-slows-on-road-ahead)

[7] Insurance Business Magazine - US Property Market Outlook 2026 (https://www.insurancebusinessmag.com/us/news/breaking-news/us-property-market-outlook-2026-competitive-rates-and-emerging-opportunities-561190.aspx)

[8] Monexa - The Progressive Corporation (PGR) Earnings Sustainability (https://www.monexa.ai/blog/the-progressive-corporation-pgr-earnings-sustainab-PGR-2025-08-08)

[9] Yahoo Finance - 3 Insurers to Buy Heading Into 2026 (https://finance.yahoo.com/news/3-insurers-buy-heading-2026-165000740.html)

[10] Deloitte - 2026 Global Insurance Outlook (https://www.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/insurance-industry-outlook.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.