Investment Analysis of D-Wave Quantum: Cantor Fitzgerald's Overweight Rating and Commercialization Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now, based on the collected information, I will provide you with a comprehensive analysis report.

According to the latest data, Cantor Fitzgerald reiterated its

The current consensus target price is

D-Wave demonstrated an impressive revenue growth trajectory in the first three quarters of 2025:

- Q1 FY2025: Revenue of $15.0 million (an unusually high figure, possibly including a one-time large contract)

- Q2 FY2025: Revenue of $3.1 million, down quarter-over-quarter but still up year-over-year

- Q3 FY2025: Revenue of $3.74 million, representing100% year-over-year growthand exceeding market expectations by 23.29% [4][5]

This triple-digit year-over-year growth rate is extremely rare in the quantum computing industry, indicating that the company’s commercialization process is accelerating.

As of the end of Q3 2025, the company’s cash and cash equivalents reached

The company has made substantial progress in client expansion:

- Has over 100 revenue-generating clients

- Including 24 Forbes Global 2000 companies[4]

- Signed a €10 million Italian quantum computing system contractfor 5 years, covering 50% of the system’s capacity [4]

The endorsement of these enterprise clients not only validates the commercial value of D-Wave’s technology but also provides predictability for subsequent revenue growth.

D-Wave’s Advantage 2 system has been put into operation at Davidson Technologies in Alabama, U.S., supporting the U.S. Department of Defense and aerospace clients [4]. The company is seeking certification for classified government applications, and a breakthrough in this field will bring significant revenue increments.

D-Wave Quantum adopts the

- Closer to Commercialization: Annealing technology is specifically targeted at optimization problems, with clear commercial application scenarios in combinatorial optimization, machine learning, drug discovery, and other fields

- Faster Practicalization Timeline: Unlike gate model quantum computing that requires a large number of error-correcting qubits, annealing technology can generate practical value more quickly

- High Technical Maturity: D-Wave has over 25 years of R&D accumulation and is the world’s first commercial quantum computer supplier [6]

The company is also advancing

| Milestone | Details |

|---|---|

| Launch of Advantage 2 System | 5th-generation annealing machine with over 5,000 qubits, featuring significantly improved performance |

| €10 Million Italian Contract | Important breakthrough in European market expansion |

| Deepened Government Cooperation | Applications in U.S. Department of Defense and aerospace sectors |

| Participation in CES 2026 | Showcasing commercialization results as a CES Foundry sponsor [7] |

On January 7, 2026, D-Wave announced the acquisition of Quantum Circuits Inc. for

- Integrating annealing systems with error-correcting superconducting gate model technology

- Accelerating the dual-platform technology roadmap

- Planning to launch the first dual-track system in 2026

- The team of Yale University physicist Rob Schoelkopf joins, enhancing R&D capabilities [8]

| Forecast Source | 2025 Market Size | 2030/2035 Market Size | Compound Annual Growth Rate (CAGR) |

|---|---|---|---|

| MarketsandMarkets | $3.52 billion | $202.0 billion (2030) | 41.8% [9] |

| Precedence Research | $1.62 billion | $11.12 billion (2035) | 21.24% [10] |

| Quantum-AI Integration Market | - | $150.0 billion (contribution value) | - [11] |

- Drug Discovery and Materials Science: Exponential advantages of quantum computing in molecular simulation

- Financial Modeling and Optimization: Portfolio optimization, risk analysis, fraud detection

- Supply Chain and Logistics: Complex route optimization, inventory management

- Cybersecurity: Surging demand for post-quantum cryptography (2025 PQC market size of $1.9 billion, expected to reach $12.4 billion by 2035) [11]

| Indicator | Value | Interpretation |

|---|---|---|

| Market Capitalization | $10.46 billion | Ranks among the top in the quantum computing space |

| P/E (TTM) | -25.89x | In a loss-making state, consistent with high growth expectations |

| P/S (TTM) | 433.26x | High valuation reflects future growth expectations |

| P/B | 15.40x | Relatively high, mainly supported by cash assets |

| Beta | 1.56 | High volatility, with a fluctuation range approximately 1.56 times that of the broader market |

The cumulative revenue in the first three quarters of 2025 was approximately $22.0 million, representing over 200% growth compared to the same period in 2024 [12]. Following the current trend, full-year revenue is expected to exceed $40.0 million. If this growth trajectory continues, the revenue scale may reach hundreds of millions of dollars in the next 2-3 years.

The $836 million cash reserve (approximately $8 per share) forms a valuation safety cushion. Even under the most pessimistic assumptions, the company has sufficient resources to support operations and R&D for the next 5-7 years, which greatly reduces the time risk of investment.

As the world’s first commercial quantum computer supplier, D-Wave has established a significant first-mover advantage in technical accumulation, customer relationships, and brand recognition. The company has over 100 enterprise clients, including 24 Forbes 2000 companies, and this customer stickiness is difficult to replicate quickly.

Technical routes in the quantum computing field have not yet fully converged. Although annealing technology is more suitable for current commercialization, gate model quantum computing has broader application prospects in general-purpose computing. If competitors make breakthroughs in gate model technology, D-Wave’s competitive advantage may be weakened.

The company is still in a loss-making state (net profit margin of -1651.81%), and the possibility of achieving profitability in the short term is low [3]. The high valuation relies on the market’s expectations of the company’s future profitability; once growth slows down or the technical route is hindered, it may face valuation correction pressure.

Tech giants such as IBM, Google, Microsoft, and Amazon have all invested heavily in the quantum computing field. These companies have stronger R&D resources, cloud platform advantages, and ecosystem integration capabilities, which may pose competitive pressure on D-Wave.

The stock price has increased by 394.59% over the past year, but the Beta value is as high as 1.56, with a daily volatility standard deviation of 7.68% [3][13]. Such high volatility means that investors need to bear significant short-term price fluctuation risks.

Comprehensive analysis shows that Cantor Fitzgerald’s reiterated overweight rating on D-Wave Quantum has

- ✅ Continuous revenue growth exceeding expectations, with 100% year-over-year growth in Q3 2025

- ✅ $836 million cash reserve provides long-term development security

- ✅ Number of enterprise clients exceeds 100, with high client quality

- ✅ Industry market size is expected to expand at a CAGR of over 40%

- ✅ Strategic acquisition of Quantum Circuits accelerates gate model technology layout

- ✅ Multiple Wall Street institutions are uniformly bullish, with strong analyst consensus

- ⚠️ Current valuation is high, with P/S exceeding 400x

- ⚠️ Profitability has not yet been achieved

- ⚠️ Uncertainty exists in technical routes

- ⚠️ Stock price volatility is extremely high

For investors considering investing in D-Wave Quantum, it is recommended to pay attention to the following points:

- Risk Tolerance: Only suitable for investors with high risk appetite, as the stock price may experience sharp fluctuations

- Investment Horizon: It is recommended to adopt a long-term investment perspective of 3-5 years or more, avoiding short-term speculation

- Position Control: It is recommended that the allocation ratio does not exceed 5-10% of the portfolio

- Key Metrics to Monitor: Continuously track revenue growth rate, changes in the number of clients, cash burn rate, and progress in gate model technology

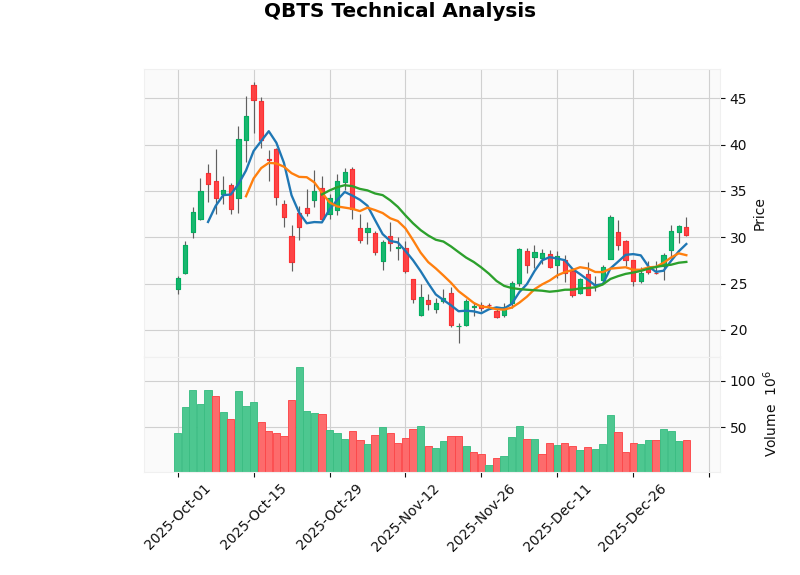

According to technical analysis [13]:

- Trend Judgment: Sideways consolidation/no clear trend (sideways)

- Key Price Range: Support level at $27.34, resistance level at $31.50

- Technical Signals: No MACD crossover (bullish bias), KDJ indicator is bullish, RSI is in the normal range

- Trading Reference: The current price is oscillating within the key range; it is recommended to wait for a breakthrough confirmation

[1] Fintel - Summary of Analyst Ratings for D-Wave Quantum (https://fintel.io/sfo/us/qbts)

[2] Quiver Quantitative - Analyst Ratings for D-Wave Quantum (https://www.quiverquant.com/news/D-Wave+Quantum+Inc.+Stock+(QBTS)+Opinions+on+Recent+Analyst+Coverage)

[3] Gilin API - D-Wave Quantum Company Profile Data [0]

[4] Perplexity Finance - D-Wave Quantum Q3 2025 Earnings Analysis (https://www.perplexity.ai/finance/QBTS/earnings)

[5] Investing.com - D-Wave Quantum Q3 2025 Earnings Call Transcript (https://www.investing.com/news/transcripts/earnings-call-transcript-dwave-quantum-q3-2025-earnings-beat-expectations-93CH-4338398)

[6] LongYield - In-Depth Analysis of D-Wave Quantum (https://longyield.substack.com/p/d-wave-quantum-the-first-real-quantum)

[7] D-Wave Quantum Official News - Announcement of Participation in CES 2026 (https://www.dwavequantum.com/company/newsroom/press-release/d-wave-to-bring-commercial-quantum-computing-to-ces-2026/)

[8] The Quantum Insider - D-Wave Announces Agreement to Acquire Quantum Circuits Inc. (https://thequantuminsider.com/2026/01/07/d-wave-announces-agreement-to-acquire-quantum-circuits-inc/)

[9] MarketsandMarkets - Quantum Computing Market Size Forecast (https://www.marketsandmarkets.com/PressReleases/quantum-computing.asp)

[10] Precedence Research - Quantum Technology Market Size Forecast (https://www.precedenceresearch.com/quantum-technology-market)

[11] StartUs Insights - Future Outlook for Quantum Computing (https://www.startus-insights.com/innovators-guide/future-of-quantum-computing/)

[12] Yahoo Finance - D-Wave Quantum Stock Analysis (https://finance.yahoo.com/news/d-wave-quantum-skyrocketed-today-213108836.html)

[13] Gilin API - D-Wave Quantum Technical Analysis Data [0]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.