In-Depth Analysis of the Drivers Behind Bilibili (BILI)'s Pre-Market Rally Against the Trend

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the data and analysis I have collected, here is an in-depth analysis report on the drivers behind Bilibili’s countertrend rally:

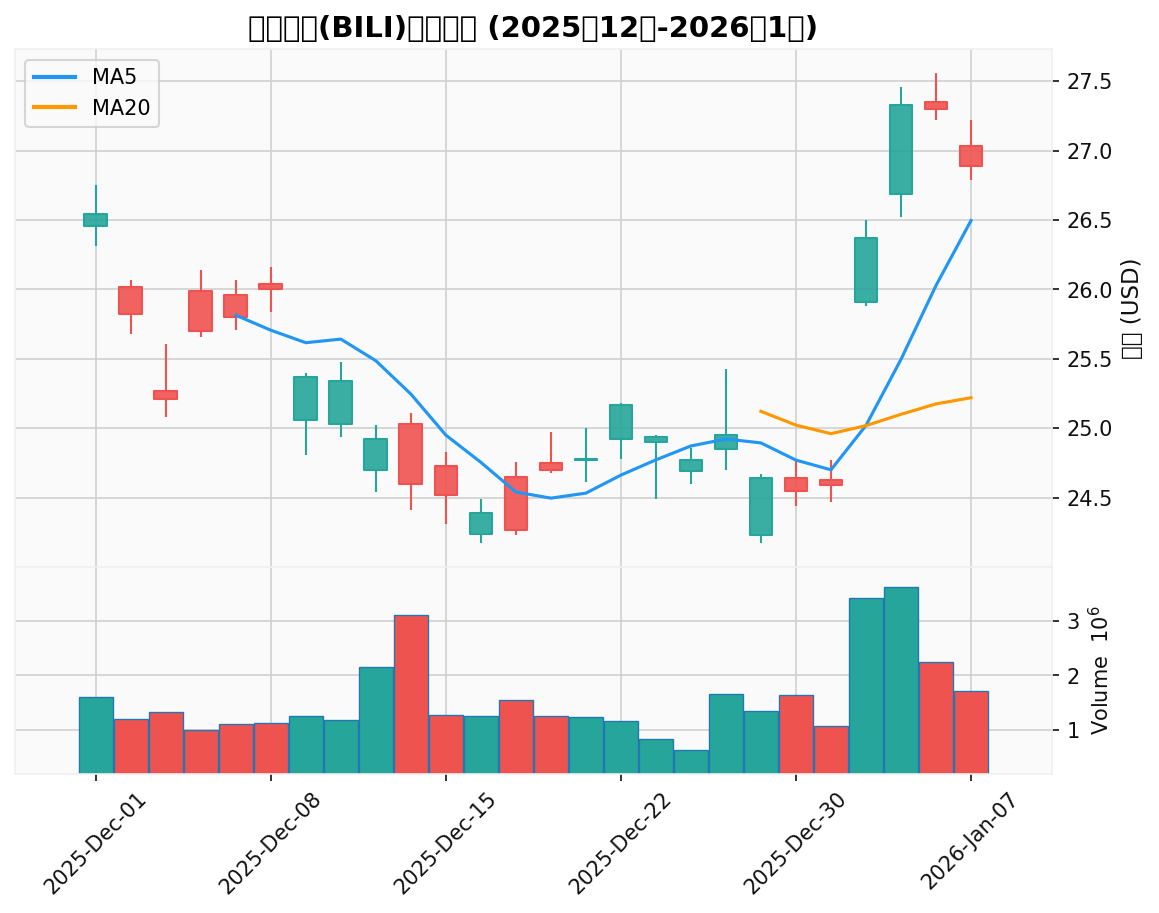

Against the backdrop of pre-market declines for most Chinese concept stocks, Bilibili delivered a standout performance, rallying nearly 3% in pre-market trading to $27.72[1]. Technical charts show that the stock price has trended upward with fluctuations over the past month and a half, with the 50-day moving average providing effective support for the share price[0].

| Indicator | Value |

|---|---|

| Current Price | $26.89 |

| 5-Day Gain | +3.78% |

| 1-Month Gain | +3.42% |

| 1-Year Gain | +60.25% |

| 52-Week Range | $14.47 - $32.50 |

| Analyst Target Price | $33.00(+22.7%) |

According to the latest research report from Morgan Stanley, Bilibili’s advertising business has seen robust growth, which has become the core factor supporting its stock price[1][2]:

- E-commerce ad revenue grew 30% year-over-year during the Double 11 period: This figure significantly exceeded market expectations, demonstrating Bilibili’s continuously improving competitiveness in the e-commerce marketing space

- AI-related ads emerge as a new growth driver: AI-powered targeted advertising is creating new revenue streams

- Ad load rate remained around 7% for the full year: This relatively moderate level ensures user experience while reserving room for revenue growth

In the first nine months of 2025, Bilibili recorded strong performance in both user growth and usage duration, driven mainly by the following factors[2]:

- Continuous promotion of high-quality medium and long-form video content

- Increased stickiness among young user groups

- Healthy development of the community ecosystem

Management expects this trend to continue through Q4 2025 and 2026, providing a solid foundation for revenue growth.

Bilibili announced plans to invest in AI infrastructure in 2026 to improve algorithm accuracy[1]. This strategic initiative has the following implications:

- Improve content recommendation efficiency and enhance user experience

- Increase advertising targeting accuracy and capture a larger share of advertisers’ budgets

- Reduce operating costs and achieve economies of scale

The company is expected to continue its partnership with CCTV[1][2], which will further:

- Enhance brand credibility and market recognition

- Expand its mainstream consumer base

- Provide a broader development platform for content creators

Bilibili’s financial condition is undergoing a positive transformation:

- Positive EBIT Achieved: The company recorded an operating profit of $107 million in 2024, marking a structural turnaround from losses to profitability[4]

- Improved Operating Margin: The operating margin of approximately 8% reflects reduced content costs and improved advertising efficiency[4]

- Consistent Beat of Expectations: Revenue and earnings per share (EPS) have exceeded analyst expectations for the past four quarters

| Quarter | EPS | Expected EPS | Beat Margin | Revenue | Expected Revenue |

|---|---|---|---|---|---|

| Q2 FY2025 | $0.18 | $0.17 | +5.88% | $1.02B | $1.02B |

| Q1 FY2025 | $0.12 | - | - | $961.83M | - |

| Q4 FY2024 | $0.15 | - | - | $1.06B | - |

The company’s diversified revenue streams are generating synergies:

- Value-Added Services: Account for 38.3% of revenue, including membership and live streaming income

- Advertising Business: Account for 24.6% of revenue, with the fastest growth and highest profit margin

- Mobile Games: Account for 18.7% of revenue, with the classic game Three Kingdoms: Art of War operating stably

- E-Commerce and Other: Account for 18.5% of revenue, with standout performance during the Double 11 period

Based on financial analysis data[0][3]:

- Debt Risk: Low-risk rating, with a solid financial position

- Current Ratio: 1.64, indicating strong short-term solvency

- ROE: 5.35%, with improved shareholder return capacity

- Net Profit Margin: 2.59%, with continuous improvement in profitability

| Rating | Number | Percentage |

|---|---|---|

| Buy | 18 | 75.0% |

| Hold | 6 | 25.0% |

| Sell | 0 | 0% |

- Consensus Target Price: $33.00

- Target Price Range: $28.00 - $36.03

- Potential Upside: +22.7%

| Valuation Metric | Value | Industry Comparison |

|---|---|---|

| P/E (TTM) | 101.76x | High |

| P/B | 5.26x | Medium |

| EV/OCF | 23.13x | Reasonable |

While the current P/E valuation is relatively high, the market is re-rating the stock considering it is in a turnaround phase of improving profitability and has strong revenue growth prospects. TIKR’s analysis model shows that based on the current profit improvement trend, the stock price is expected to reach $33 by 2027, implying a total return of 33%[4].

- 1-year gain of 60.25%, significantly outperforming the broader market

- Recent trading volume has been active, indicating increased market attention

- Other Chinese concept stocks such as XPeng and NIO have shown similar trends, reflecting increased capital preference for high-quality Chinese concept stocks

While Three Kingdoms: Art of War operates stably and the new game Nine Provinces: Wild Lands has achieved success[2], the following risks remain:

- The market potential of Three Kingdoms: Hundred Generals Card Game remains uncertain

- There are execution risks associated with the launch plan for new game versions

- Changes in regulatory policies for the gaming industry may impact the business

The current P/E ratio stands at 101.76x, and the valuation has partially priced in expectations of fundamental improvements. If performance growth falls short of expectations, the stock may face valuation correction pressure.

Chinese concept stocks are highly affected by geopolitical factors, and fluctuations in overall market sentiment may impact individual stock performance.

Bilibili’s nearly 3% pre-market rally against the backdrop of declines for most Chinese concept stocks is the result of

- Advertising business grew 30% year-over-year, with AI ads emerging as a new growth driver

- User growth and usage duration have maintained a strong momentum

- Achieved positive EBIT, with operating margin improved to approximately 8%

- Beat performance expectations for multiple consecutive quarters

- 75% of analysts have issued Buy ratings

- The consensus target price represents a 22.7% upside from the current price

- Significant capital inflow, with a 1-year gain of 60.25%

- AI infrastructure investment plan strengthens long-term growth expectations

Overall, Bilibili is transitioning from a high-growth but consistently loss-making company to an online entertainment platform that has begun to achieve stable profitability. If the growth rate of its advertising business can be sustained and uncertainties in the gaming business are gradually resolved, the company is expected to gain higher valuation recognition from the market.

[1] Sina Finance - “US Stock Movement | Bilibili Rallies 3% in Pre-Market Trading; Morgan Stanley Cites Robust Ad Growth” (https://finance.sina.com.cn/stock/bxjj/2026-01-08/doc-inhfqtyr6693668.shtml)

[2] Futu News - “Bilibili (BILI.US) Demonstrates Robust Advertising Growth; Rated ‘In Line with Market’” (https://news.futunn.com/post/67040956/morgan-stanley-bilibili-bilius-demonstrates-robust-advertising-growth-rated-in)

[3] Investing.com - “Bilibili (BILI) Latest Stock Price and Quotes” (https://cn.investing.com/equities/bilibili-inc)

[4] TIKR - “Up 33% in 2025, Here’s Why Bilibili Stock Could Pass $30 in 2026” (https://www.tikr.com/blog/can-bilibili-reach-33-by-2027)

[0] Jinling AI Financial Database (Real-time market data, corporate financial data, technical analysis)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.