Analysis of Defensive Asset Allocation Strategies Amid Escalating Geopolitical Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest geopolitical dynamics and market data analysis, the following is an in-depth analysis of the impact of escalating geopolitical risks on defensive asset investment allocation strategies:

According to the latest intelligence, the Trump administration has submitted a

The EU has passed a

According to the Stimson Center’s Top Ten Global Risks Report 2026, the main risks include:

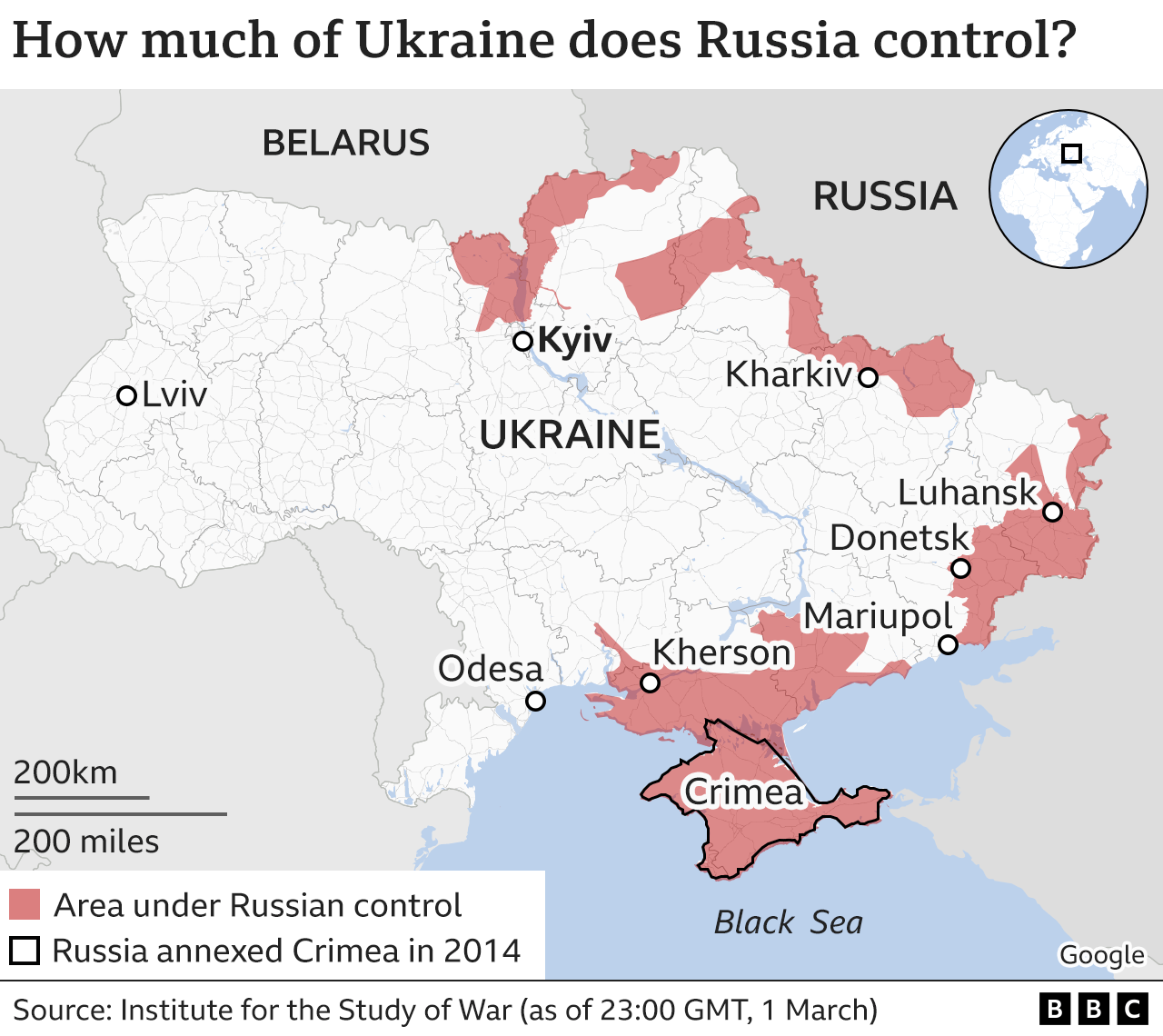

- Russia consolidates its advantages: Putin may become more aggressive and less interested in reaching an agreement

- Declining NATO cohesion: Differences between the US and Europe on the Ukraine issue may lead to NATO strategic division

- Energy security uncertainty: Continued Russian strikes on Ukrainian infrastructure [2]

| Indicator | Data |

|---|---|

| 2024-2026 Price Increase | +74.32% |

| Current Price | $4,436.50/ounce |

| 2025 High | $4,584.00/ounce |

| 200-Day Moving Average | $3,738.63 |

- J.P. Morgan: The average price is expected to reach$5,055 per ouncein Q4 2026, and$5,400 per ouncein Q4 2027 [3]

- Deutsche Bank: The average price is expected to exceed $4,400 per ounce in 2026 [4]

The main drivers of gold’s rise include:

- Persistent geopolitical tensions

- Strong central bank gold purchase demand(official reserve diversification)

- Expectations of Fed interest rate cutsreduce the opportunity cost of holding gold

- Declining demand for the US dollar[3][4]

| Indicator | Data |

|---|---|

| 2024-2026 Price Decline | -23.94% |

| Current Price | $57.12/barrel |

| Volatility (Daily Standard Deviation) | 1.94% |

| 200-Day Moving Average | $62.25 |

According to analysis from Wood Mackenzie and Reuters,

- Global liquid supply growth is expected to reach 2.5 million barrels per day, while demand growth will only be0.7 million barrels per day[5]

- The average price of Brent crude is expected to be $59 per barrelin 2026, $10 lower than in 2025 [5]

- OPEC+ is suppressing non-OPEC supply growth by pushing down prices

- Tensions between the US and Venezuela may trigger supply disruptions

- Discussions of the US acquiring Greenland have intensified geopolitical uncertainty

- Continued strikes on energy infrastructure amid the Russia-Ukraine conflict [6]

| Indicator | Data |

|---|---|

| Current Price | $496.87 |

| 2024-2026 Price Decline | -10.65% |

| Beta Coefficient | 0.24 (low correlation with S&P 500) |

| 20-Day Moving Average | $484.67 |

| Technical Trend | Sideways consolidation (range of $484.67-$503.38) |

| Asset Class | Allocation Recommendation | Adjustment Range | Key Rationale |

|---|---|---|---|

Gold |

Increase Holdings |

+15% | Safe-haven demand, central bank purchases, expectations of weaker US dollar |

Treasury Bonds |

Increase Holdings |

+10% | Safe-haven attributes, attractive yields |

Military Industry |

Selectively Increase Holdings |

+5% | Geopolitical risk premium, defense budget uncertainty |

Energy |

Neutral/Reduce Holdings |

-5% | Oversupply concerns, but need to guard against supply disruptions |

Cash |

Maintain Liquidity |

0% | Hedge against market volatility, provide operational flexibility |

- Core Allocation: It is recommended to allocate10-15%of the portfolio to gold assets

- Investment Forms: Physical gold, gold ETFs, and gold mining stocks are all viable options

- Entry Timing: Consider adding positions when the gold price pulls back to around the 200-day moving average (approximately $3,738)

- Target Price: According to J.P. Morgan’s forecast, the medium-term target is $5,000 per ounce [3]

- Cautious Stance: Given the oversupply fundamentals,reduce holdingsof crude oil-related exposures

- Risk Hedging: Retain a small number of long oil positions to hedge against geopolitical supply disruption risks

- Key Focus Areas: OPEC+ production decisions, changes in US policies towards Venezuela/Iran

- Selective Allocation: Focus on targets with the following characteristics:

- Companies benefiting from defense budget growth

- Companies with technological advantages in drone, missile defense, and cybersecurityfields

- Companies benefiting from

- Risk Warning: Need to pay attention to short-term volatility that may be caused by the progress of peace negotiations

- US Treasury Bonds: Perform steadily during market turmoil and can serve as a portfolio stabilizer

- Investment-Grade Bonds: Provide relatively safe yields

- Maturity Allocation: It is recommended to allocate to medium- and short-term treasury bonds to balance returns and liquidity

- Diversification: Avoid excessive concentration in a single asset class

- Dynamic Adjustment: Timely adjust exposures based on the progress of peace negotiations

- Stop-Loss Mechanism: Set clear stop-loss levels to control downside risks

- Liquidity Management: Maintain sufficient cash reserves to cope with severe market volatility

- Gold: May fall by 5-10% (decline in safe-haven demand)

- Energy: Short-term rebound (eased supply chain concerns), but oversupply fundamentals limit gains

- Military Industry: Under pressure (decline in defense budget expectations)

- Gold: Continue to rise (safe-haven demand + central bank gold purchases)

- Energy: Increased volatility, rising risk premium for supply disruptions

- Military Industry: Benefit from expected increases in defense spending

- Gold: Moderate rise (persistent uncertainty)

- Energy: Price stabilizes, ranges trading

- Military Industry: Stable orders, steady stock prices

Amid the backdrop of escalating geopolitical risks, gold’s position as a traditional safe-haven asset has been strengthened, and institutional forecasts indicate that it still has upside potential. The energy sector needs to be vigilant against oversupply risks, but geopolitical events may lead to severe short-term volatility. The military industry sector can serve as a tool to hedge against geopolitical risks, but close attention should be paid to the progress of peace negotiations.

[1] Russia Analytical Report, Dec. 22, 2025–Jan. 5, 2026 (https://www.russiamatters.org/news/russia-analytical-report/russia-analytical-report-dec-22-2025-jan-5-2026)

[2] Top Ten Global Risks for 2026 - Stimson Center (https://www.stimson.org/2026/top-ten-global-risks-for-2026/)

[3] Gold price predictions from J.P. Morgan Global Research (https://www.jpmorgan.com/insights/global-research/commodities/gold-prices)

[4] Gold’s Momentum Extends Into 2026 - US Gold Bureau (https://www.usgoldbureau.com/news/post/golds-momentum-extends-into-2026-why-physical-gold-remains-a-compelling-investment)

[5] Five energy market trends to track in 2026 - Reuters (https://www.reuters.com/markets/commodities/five-energy-market-trends-track-2026-year-glut-2025-12-29/)

[6] Crude Oil Outlook: Supply Risks vs Geopolitics - Forex.com (https://www.forex.com/en-us/news-and-analysis/crude-oil-outlook-supply-risks-vs-geopolitics/)

[7] Five themes shaping the energy world 2026 - Wood Mackenzie (https://www.woodmac.com/blogs/the-edge/five-themes-shaping-the-energy-world-2026/)

[8] Trump administration’s 28-point Ukraine-Russia peace plan - ABC News (https://abcnews.go.com/International/trump-administrations-28-point-ukraine-russia-peace-plan/story?id=127735249)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.