Genmab Pipeline Value Analysis and Valuation Outlook

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and analysis, I will provide you with an in-depth analytical report on Genmab’s R&D pipeline and its impact on valuation.

As a leading Danish biotechnology company, significant progress in Genmab’s R&D pipeline is the core driver behind UBS raising its target price to

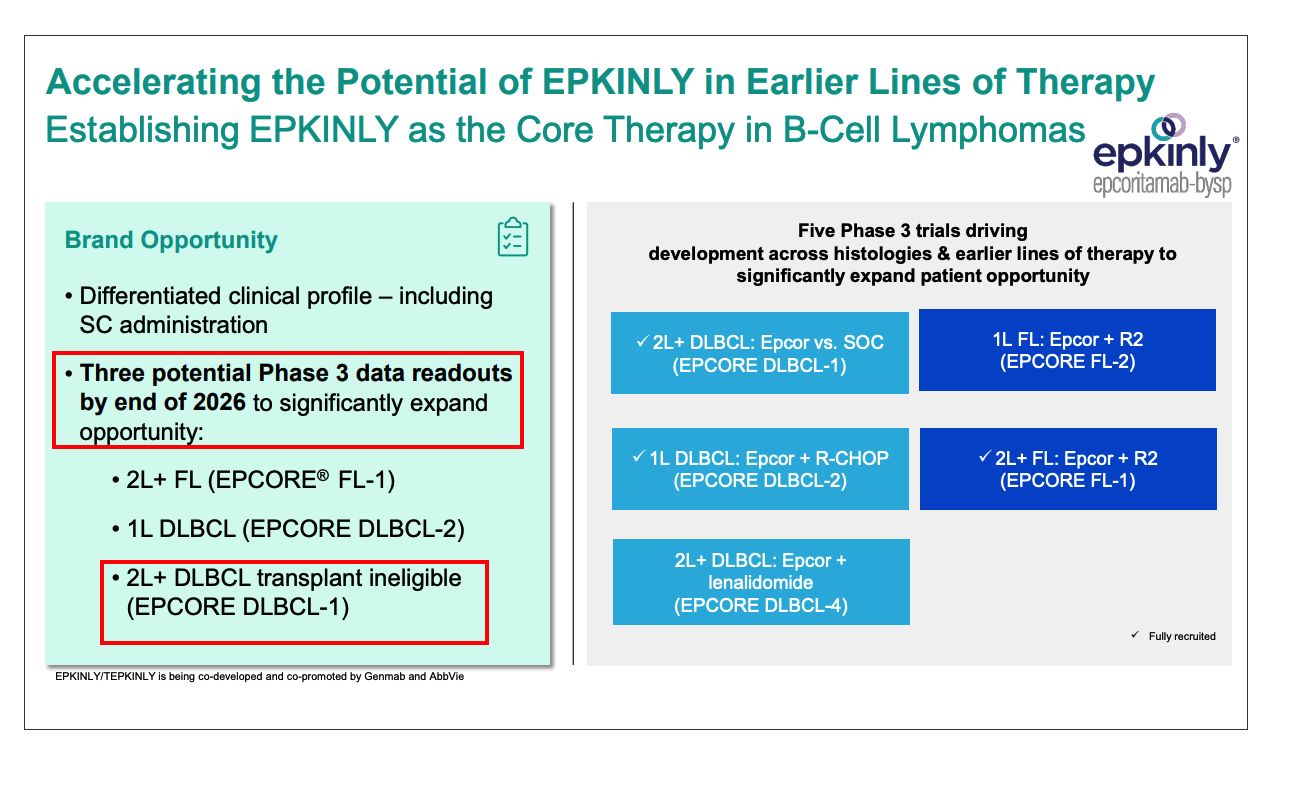

EPKINLY is a first-in-class bispecific antibody targeting CD20/CD3, co-developed by Genmab and AbbVie. This product has become one of the main drivers of the company’s revenue growth. In the first three quarters of 2025, net sales of EPKINLY continued to climb, driving the company’s overall revenue up 21% year-over-year to

| Time | Milestone Event | Valuation Impact |

|---|---|---|

| November 2025 | FDA approves EPKINLY+R2 combination therapy for relapsed/refractory follicular lymphoma (FL) [2] |

Major positive catalyst |

| November 2025 | Phase 3 EPCORE FL-1 trial meets dual primary endpoints (ORR and PFS) [1] |

Validates clinical value |

| July 2025 | FDA accepts sBLA for priority review | Regulatory progress exceeds expectations |

- Market Potential: Analysts predict that EPKINLY has a peak sales potential of over$3 billionfor FL and diffuse large B-cell lymphoma (DLBCL) indications [3]

- Competitive Advantage: As the first approved bispecific antibody combination therapy, EPKINLY+R2 has established a differentiated position

- Indication Expansion: Clinical development for first-line therapy and other hematologic oncology indications is underway

Rina-S is one of the core assets in Genmab’s in-house pipeline, offering a new treatment option for patients with endometrial cancer.

| Metric | Details |

|---|---|

| Regulatory Status | FDA Breakthrough Therapy Designation (BTD) [1] |

| Development Stage | Phase 3 clinical trial ongoing |

| Target Indication | Advanced endometrial cancer |

| Expected Value | Peak sales potential of approximately $1.5 billion [3] |

In September 2025, Genmab announced the acquisition of Merus N.V. for

| Transaction Terms | Details |

|---|---|

| Acquisition Consideration | $97 per share, all-cash transaction |

| Transaction Premium | 41% premium over Merus’ closing price |

| Total Transaction Value | Approximately $8 billion |

| Expected Completion Time | Early Q1 2026 |

| Feature | Details |

|---|---|

| Drug Type | EGFRxLGR5 bispecific antibody |

| Development Stage | Phase 3 (two trials ongoing simultaneously) |

| Target Indication | Head and neck cancer (first-line and second-line therapy) |

| Regulatory Designation | Dual BTD designations (granted by FDA for first-line and second-line indications) [4] |

| Clinical Data | Phase 2 data presented at ASCO 2025 showed superiority over standard of care |

- 2026: Phase 3 trial data readout

- 2027: Expected first commercial launch

- 2029: Achieves≥$1 billionannual sales milestone [4]

- Long-term Potential: Multiple analysts predict peak sales could reach$3-4 billion[5]

- Accelerated Transformation: Drives Genmab’s transition from a collaborative development model to a fully in-house model

- Pipeline Complementarity: Synergizes with existing oncology pipeline to cover different tumor types

- Technology Integration: Leverages Genmab’s expertise in antibody development to accelerate petosemtamab’s development

Tivdak is an antibody-drug conjugate (ADC) co-developed with Pfizer for the treatment of relapsed/refractory cervical cancer.

| Time | Milestone |

|---|---|

| 2021 | FDA initial approval for cervical cancer indication |

| 2024 | Approved in Europe |

| 2025 | New drug application submitted in Japan |

Genmab’s

| Technology Platform | Core Function | Commercialization Cases |

|---|---|---|

| DuoBody® | Bispecific antibody development | Amivantamab (RYBREVANT®), EPKINLY |

| HexaBody® | Enhances antibody efficacy | Multiple preclinical assets |

| DuoHexaBody® | Dual targeting + enhanced efficacy | Clinical-stage assets |

| HexElect® | Precision cell killing | Preclinical research |

- Proven Commercialization Capability: The DuoBody technology has supported multiple approved products

- Sustained Collaborative Revenue: Partners including Eli Lilly and Johnson & Johnson continue to contribute royalties

- Internal Innovation Foundation: In-house pipeline assets are primarily developed based on proprietary technology platforms

| Metric | 2025 | 2024 | YoY Change |

|---|---|---|---|

| Total Revenue | $2.662 billion | $2.198 billion | +21% |

| DARZALEX Royalties | $2.219 billion | $1.802 billion | +23% |

| Operating Profit | $1.007 billion | $662 million | +52% |

- DARZALEX®: Johnson & Johnson reported 2025 net sales of$10.448 billion, up 22% year-over-year, and Genmab is receiving sustained growing royalties from this [1]

- EPKINLY®: Product sales have grown significantly, and the profit-sharing mechanism with AbbVie is driving revenue growth

- Kesimpta®: Novartis’ multiple sclerosis treatment continues to contribute royalty revenue

| Financial Metric | Value | Industry Comparison |

|---|---|---|

| Net Profit Margin | 32.22% | Excellent |

| Operating Profit Margin | 26.08% | Excellent |

| ROE | 27.32% | Outstanding |

| Current Ratio | 6.03 | Very Robust |

Genmab’s financial data indicates that the company has transitioned from the R&D investment phase to a stable profit-making phase, providing a financial buffer for sustained pipeline investment.

| Metric | Value |

|---|---|

| Current Stock Price | $33.90 |

| UBS Target Price | $41.50 (DKK 2,750) |

| Upside Potential | +22.4% |

| Analyst Consensus Target Price | $41.50 |

Based on UBS’ analytical framework, the core supporting factors for the DKK 2,750 target price include:

| Driver | Contribution Weight | Core Logic |

|---|---|---|

EPKINLY Commercial Expansion |

~25% | Approval of FL+R2 combination therapy unlocks growth space |

Petosemtamab Potential |

~25% | Merus acquisition brings next blockbuster asset |

Rina-S Value Realization |

~15% | Phase 3 advancement + BTD designation reduces risks |

DARZALEX Royalty Growth |

~10% | Sustained and stable cash flow source |

Technology Platform Value |

~5% | Sustained innovation capability and collaborative revenue |

- Petosemtamab Phase 3 Data Readout: Interim data from two head and neck cancer trials is expected to significantly impact valuation

- Rina-S Clinical Trial Progress: Milestone events in endometrial cancer trial

- 2025 Full-Year Financial Report: Q4 results to be released on February 11 may include updates on 2026 business outlook

- Potential Petosemtamab Launch: First fully in-house blockbuster product

- EPKINLY First-Line Therapy Approval: Expands patient coverage

- More Pipeline Assets Enter Late-Stage Development: Sustains innovation engine momentum

- Uncertainty in Petosemtamab Phase 3 Results: Trial failure could lead to approximately $800 million in investment losses

- Rina-S Clinical Trial Progress: May be affected by factors such as patient enrollment and achievement of clinical endpoints

- EPKINLY Market Competition: Other bispecific antibodies and CAR-T therapies may erode market share

- Pricing Pressure: The pricing environment for oncology drugs is becoming increasingly challenging

- Debt Burden from Merus Acquisition: Approximately $5.5 billion in debt financing will increase financial leverage

- Exchange Rate Risk: Exchange rate fluctuations between the Danish kroner and US dollar affect financial statement performance

Genmab’s R&D pipeline provides solid support for UBS’

| Value Dimension | Evaluation Conclusion |

|---|---|

Pipeline Depth |

4 key assets are in critical development stages, covering hematologic oncology and solid tumors |

Clinical Progress |

Multiple Phase 3 trials are ongoing, 2026 will be a data-rich readout year |

Commercialization Capability |

Successful commercialization of EPKINLY validates the team’s execution capability |

Strategic Transformation |

Merus acquisition accelerates transition to fully in-house model |

Cash Flow Support |

Strong royalty revenue provides financial buffer for pipeline investment |

[0] Jinling API - Genmab Company Profile and Market Data

[1] Genmab Announces Financial Results for the Nine Months of 2025 (https://ir.genmab.com/news-releases/news-release-details/genmab-announces-financial-results-nine-months-2025)

[2] Genmab Announces EPKINLY® in Combination with Rituximab and Lenalidomide Approved by FDA (https://ir.genmab.com/news-releases/news-release-details/genmab-announces-epkinlyr-epcoritamab-bysp-combination-rituximab)

[3] Seeking Alpha - Genmab Pipeline and Revenue Analysis (https://static.seekingalpha.com)

[4] Genmab to Acquire Merus, Expanding Late-Stage Pipeline (https://ir.genmab.com/news-releases/news-release-details/genmab-acquire-merus-expanding-late-stage-pipeline-and)

[5] FierceBiotech - Genmab pays $8B to buy Merus (https://www.fiercebiotech.com/biotech/genmab-pays-8b-buy-merus-and-phase-3-stage-bispecific-wowed-analysts)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.