Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the in-depth analysis above, below are the systematic implications of Shell’s Q4 Trading and Chemical Business Loss Warning for energy stock investments:

Shell’s Q4 earnings update released on January 8, 2026 shows [1][2]:

| Business Segment | Q3 Performance | Q4 Outlook | Key Drivers of Change |

|---|---|---|---|

Trading & Optimization |

Normal Levels | Significantly Below Q3 |

Trading losses due to plummeting crude oil prices |

Chemicals & Products |

Near Break-Even | Substantial Losses |

Chemical margins fell from $160/ton to $140/ton |

Refining Business |

Margin of $12/barrel | Approx. $9-11/barrel | Utilization rate fell from 96% to 93-97% |

Integrated Natural Gas |

Stable | In Line with Expectations | Slight increase in LNG liquefaction volumes |

Bloomberg reported that Shell’s Q4 trading performance “deteriorated significantly”, primarily due to the sharp decline in crude oil prices in Q4 [3]. Meanwhile, ExxonMobil also issued a similar warning, projecting a Q4 loss of $800 million to $1.2 billion due to falling oil prices [4].

- Price Background: Brent crude oil fell by approximately 18% in 2025, marking the largest annual decline since 2020; WTI crude oil fell by nearly 20% year-over-year [4]

- Investment Impact:

- Pure upstream oil and gas companies (E&P) have profits highly correlated with oil prices, resulting in high volatility

- Valuation multiples remain under pressure, with P/E contracting by approximately 40% from cyclical highs

- Recommendation: Prioritize integrated companies with diversified upstream assets and a high natural gas proportion

Shell’s substantial loss warning in its chemicals business reveals industry-wide issues:

- Refining Profit Compression: Global refining overcapacity continues to pressure margins

- Weak Demand for Chemical Products: Sluggish manufacturing recovery leads to reduced petrochemical product orders

- Persistent Overcapacity: New capacities from large-scale investments in recent years have gradually come online

Traditionally, the trading divisions of integrated oil and gas giants like Shell and BP were regarded as ‘profit stabilizers’, contributing 20-30% of the companies’ profits. However, this warning shows:

- Narrowing Arbitrage Space: Increased integration of the global oil and gas market has narrowed price spreads

- Increased Volatility: Frequent geopolitical events lead to rapid price fluctuations

- Risk Management Challenges: Traditional hedging strategies struggle to cope with extreme market conditions

- Renewable energy projects are capital-intensive with long payback periods

- In a low oil price environment, cash flow from traditional energy is crucial to support transition investments

- Recommendation: Focus on ‘balanced’ energy companies rather than aggressive transition players

| Metric | Shell | Industry Average |

|---|---|---|

| Dividend Yield | 3.82% | 3.5% |

| Payout Ratio | ~45% | 50-60% |

| Cash Flow Coverage | 1.8x | 1.5x |

Shell maintains a dividend yield of approximately 3.8%, which remains attractive in the current low-interest-rate environment. However, caution is warranted: if oil prices remain depressed, future dividend growth may be constrained.

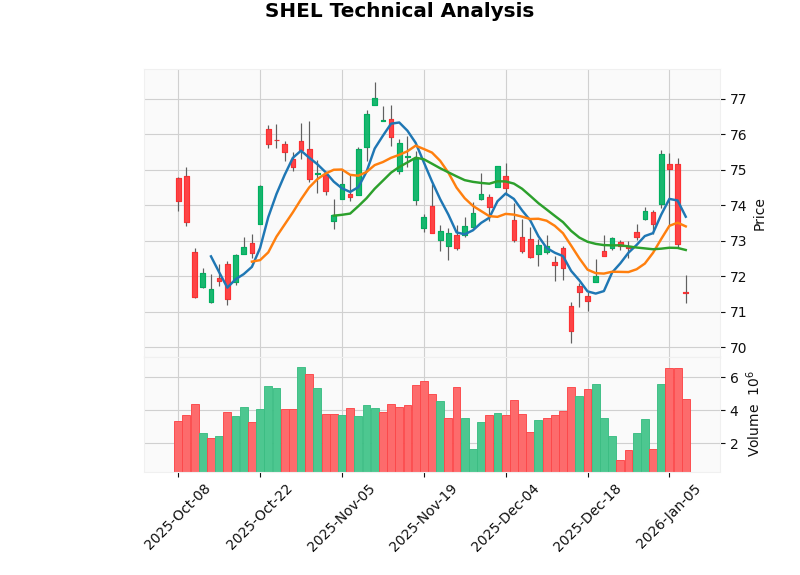

| Technical Indicator | Value | Signal Interpretation |

|---|---|---|

| Current Price | $71.54 | 7.6% below 52-week high |

| Trading Range | $70.94 - $72.74 | Narrow consolidation, no clear breakout direction |

| 50-Day Moving Average | $72.10 | Price is below the moving average |

| Beta | -0.1 | Very low correlation with the market |

| MACD | No Crossover | Neutral signal |

Fitch has a ‘Neutral’ outlook for the global oil and gas industry in 2026, based on the following considerations:

- Supply Side: Non-OPEC+ production increases by approximately 1.2 million barrels per day, while OPEC+ maintains production cuts

- Demand Side: Accelerated electrification of transportation, weak chemical demand

- Price Forecast: Narrow range of $60-70 per barrel

| Segment | Rating | Rationale |

|---|---|---|

Upstream Oil & Gas |

Neutral-Cautious | High oil price volatility, pressure on capital returns |

LNG Trading |

Positive |

Growing global natural gas demand, expanding Asian market |

Refining Integration |

Neutral | Profit compression, but stable cash flow |

Oilfield Services |

Positive |

Improved margins under capital expenditure discipline |

New Energy |

Cautious | Overvalued, long payback periods |

- Companies with upstream assets as the core and natural gas proportion >40%

- Strong balance sheets (Net Debt/EBITDA <1.5x)

- Companies with free cash flow yield >8% and consistent share repurchases

- Integrated companies with downstream business proportion >50%

- Companies with high volatility in trading business

- Companies with excessive capital expenditure and negative free cash flow

Shell’s Q4 earnings warning is a microcosm of the systemic challenges facing the global energy industry. Against the backdrop of intensified oil and gas price volatility, compressed downstream profits, and fluctuating trading business, energy stock investments need to place greater emphasis on:

- Cash flow stabilityrather than mere production growth

- Dividend sustainabilityrather than high growth expectations

- Asset qualityrather than scale expansion

For investors seeking energy stock allocations, it is recommended to adopt a

[1] GuruFocus - “Shell (SHEL) Projects Higher Q4 Oil and Gas Output Amid Trading Challenges” (https://www.gurufocus.com/news/4101234/shell-shel-projects-higher-q4-oil-and-gas-output-amid-trading-challenges)

[2] Benzinga - “Shell fourth quarter 2025 update note” (https://www.benzinga.com/pressreleases/26/01/g49774711/shell-fourth-quarter-2025-update-note)

[3] Bloomberg - “Shell Signals Weak Oil Trading Result to Cap Rocky Year” (https://www.bloomberg.com/news/articles/2026-01-08/shell-signals-weak-oil-trading-result-to-cap-rocky-year)

[4] Bloomberg - “Exxon Says Oil Slump Cut $1 Billion From Fourth-Quarter Results” (https://www.bloomberg.com/news/articles/2026-01-07/exxon-says-oil-slump-cut-1-billion-from-fourth-quarter-results)

[5] Seeking Alpha - “Shell stock: What the Ratings say” (https://seekingalpha.com/news/4536925-shell-stock-what-the-ratings-say)

[6] Fitch Ratings - “Global Oil & Gas Outlook for 2026 Is Neutral” (https://www.fitchratings.com/research/corporate-finance/global-oil-gas-outlook-for-2026-is-neutral-12-12-2025)

[0] Gilin AI Financial Analysis Platform Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.