Investment Value Analysis Report on Bendigo & Adelaide Bank (BEN)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data, I provide you with a systematic and comprehensive investment analysis report.

On January 7, 2026, Goldman Sachs upgraded the stock rating of

The current share price is

Following the rating upgrade, BEN’s share price rose

Bendigo & Adelaide Bank is one of Australia’s largest regional banks, operating primarily through two platforms [2]:

- Bendigo Bank Core Brand: Provides traditional deposit and loan services to retail, commercial, agricultural, and community banking customers

- Up Digital Bank: A fast-growing digital banking platform representing the bank’s fintech transformation direction

- Impressive customer growth: Total customers grew 11% to 2.9 millionin FY2025, outpacing all major and regional banks

- Strong customer loyalty: Net Promoter Score (NPS) reaches +28, far above the industry average

- Relationship-focused business model: Centers on customer relationships rather than competing solely on scale

Based on the latest financial data, Bendigo & Adelaide Bank’s financial position shows characteristics of

| Financial Dimension | Assessment Outcome | Core Metrics |

|---|---|---|

Financial Stance |

Aggressive | Low depreciation/capital expenditure ratio, limited earnings upside |

Revenue Capacity |

Stable | Operating margin of 11.52%, revenue growth of 6% |

Cash Flow |

Improving | Latest free cash flow (FCF) is AUD 1.679 billion |

Debt Risk |

High Risk | High leverage ratio, disadvantage in financing costs relative to large banks |

- Price-to-Book (P/B) Ratio: 0.93x, below 1.0x book value, indicating a certain valuation discount

- Price-to-Sales (P/S) Ratio: 1.18x

- Return on Equity (ROE): -1.41%(loss due to FY2025 one-off expenses)

- Dividend Yield: Approximately 6% (fully franked), attractive in a low-interest rate environment

The bank is advancing two key strategies [2]:

- Acquisition of RACQ Bank: A balance sheet acquisition expected to boost Return on Equity (ROE), currently pending regulatory approval

- Digital Upgrade: Launches an updated mobile banking app and new lending platform, aiming to align loan growth with market levels

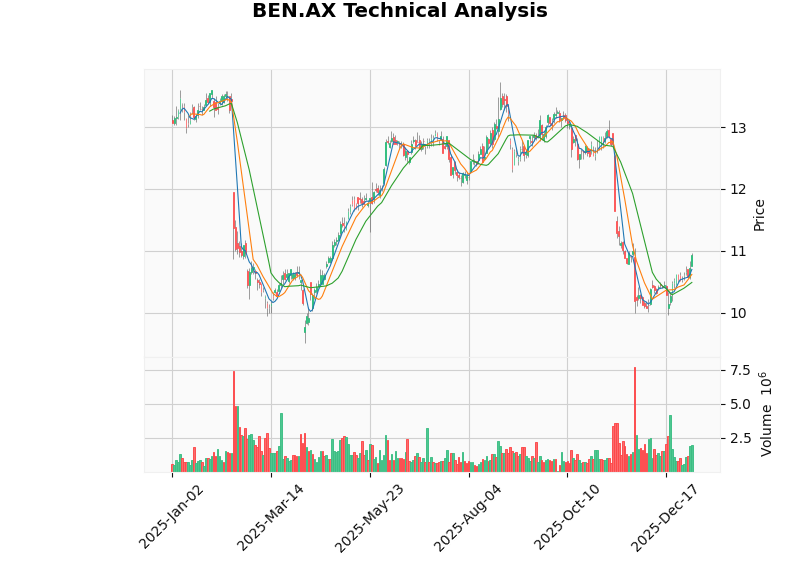

Based on technical analysis results, BEN.AX is currently in a

| Technical Indicator | Value | Signal Interpretation |

|---|---|---|

MACD |

No death cross | Bullish signal |

KDJ |

K:82.6, D:80.9, J:86.0 | Overbought Warning |

RSI (14) |

In overbought territory | Short-term pullback risk |

Beta |

0.79 | Lower volatility relative to the ASX200 |

- Resistance Level 1: $10.97 (approaching)

- Resistance Level 2: $11.16 (next target level)

- Support Level: $10.62

The trend score reaches

- Rising trading volume

- 10-day moving average > 20-day moving average

- MACD above the zero line

Over the past three months (October 2025 to January 2026), the share price fell by approximately

The Australian banking sector presents a clear

- Higher Capital Costs: Wholesale funding institutions demand higher bond coupons to compensate for risk

- Disadvantage in Deposit Competition: Lack of large banks’ corporate transaction account pools (which typically pay very low interest rates)

- Absence of Scale Effects: Unable to enjoy the economies of scale in technology and marketing that large banks benefit from

Australian regional banks generally trade at a

| Bank | Price-to-Book (P/B) Ratio | Relative Valuation |

|---|---|---|

| Bendigo & Adelaide Bank | 0.93x | Approximately 30% discount |

| Bank of Queensland (BOQ) | ~0.8x | Approximately 40% discount |

| Large Banks Average | ~1.3x | Benchmark |

Morningstar’s fair value estimate for BEN is approximately

According to the 2026 Australian Banking Sector Outlook released by Morningstar DBRS [5]:

- Strong Loan Growth: Supported by the low-interest rate environment and economic growth in Australia and New Zealand

- Stable Net Interest Margin (NIM): Expected to remain roughly at current levels

- Robust Asset Quality: Improved mortgage delinquency rates, with cost of risk (COR) still at historically low levels

- Rising Operating Costs: Continuing the upward trend of the past two years

- Corporate Loan Risks: Credit risk may still deteriorate

- External Economic Slowdown: Economic uncertainty caused by external factors

- Gradual Interest Rate Cut Path: Recent inflation rebound may delay the pace of interest rate cuts

Goldman Sachs upgraded BEN from Neutral to Buy, possibly based on the following considerations:

- Valuation Fully Reflects Risks: The current P/B ratio of only 0.93x has already priced in the structural challenges facing regional banks

- Strong Momentum in Customer Growth: 11% customer growth rate leads the industry, laying the foundation for future growth

- Attractive Dividend Yield: The approximately 6% fully franked dividend yield is scarce in a low-interest rate environment

- Initial Results of Digital Transformation: The Up Bank platform is growing rapidly, and technology investment is beginning to translate into competitiveness

| Factor | Impact |

|---|---|

Interest Rate Cut Cycle |

Reduces financing costs, improves net interest margin, and stimulates loan demand |

Expectation of Economic Soft Landing |

Australia and New Zealand maintain economic growth, reducing asset quality pressure |

Sustained Customer Growth Trend |

Relationship-focused business model continues to attract deposit and loan customers |

Synergies from RACQ Acquisition |

Enhances scale effects and ROE levels |

| Factor | Impact |

|---|---|

Disadvantage in Capital Costs |

Wholesale funding costs may remain elevated |

Competition from Large Banks |

The Big Four still hold advantages in interest rate pricing and fees |

Regulatory Uncertainty |

Capital adequacy requirements may be further tightened |

Macroeconomic Risks |

Trade policy uncertainty may affect business confidence |

- The share price may fall further to the AUD 9.50-10.00range (near the 52-week low)

- In the event of an economic recession, regional banks face higher asset quality deterioration risks than large banks

- Technology investment fails to translate into earnings growth

- If interest rates fall rapidly, net interest margin improves more than expected

- The RACQ acquisition is approved and generates synergies

- Digital business grows at an accelerated pace to become a new growth engine

Taking into account Goldman Sachs’ rating upgrade, improving fundamental trends, and valuation levels, we assign

| Valuation Method | Price | Upside/Downside Potential |

|---|---|---|

Goldman Sachs Target Price |

AU$11.32 | +3.6% |

Morningstar Fair Value |

AU$11.00 | +0.6% |

Current Share Price |

AU$10.93 | - |

Bear Case Scenario |

AU$9.50-10.00 | -8% to -14% |

- Wait for the share price to pull back to the $10.50-10.70range before building a position to achieve a better risk-reward ratio

- Monitor the FY2026 Q2 earnings report to be released on February 15, 2026; better-than-expected results will provide an additional catalyst

- It is recommended to allocate no more than 15-20%of your Australian banking sector position to this stock

- Position it as a value allocation, rather than a growth allocation

- Set a stop-loss level of $10.00(approximately 8.5% below the current price)

- Focus on entry opportunities after the overbought signals from RSI and KDJ fade

- Monitor Australian macroeconomic data and interest rate policy changes

For investors with lower risk tolerance, consider allocating between BEN and large banks (such as CBA, ANZ):

| Comparison Dimension | BEN (Regional) | Large Banks |

|---|---|---|

| Valuation | P/B 0.93x (Discount) | P/B ~1.3x |

| Dividend Yield | ~6% | 4-5% |

| Growth Potential | Higher | Stable |

| Volatility | Higher | Lower |

| Risk | Higher | Lower |

- Goldman Sachs’ Rating Upgrade Is Justified: The current valuation has fully priced in the structural challenges facing regional banks, while BEN’s advantages in customer growth, digital transformation, and dividend yield provide a basis for valuation recovery.

- Sustainability of Valuation Recovery Depends on Multiple Factors: The interest rate cut cycle, economic soft landing, and effective strategy execution are the three pillars supporting valuation recovery; while capital cost disadvantages, economic recession risks, and regulatory changes are the main threats.

- Short-Term Technical Overbought: RSI and KDJ indicate short-term overbought conditions, so it is recommended to wait for a pullback before adding positions.

- Long-Term Allocation Value Emerges: With a 6% dividend yield and reasonable valuation, BEN is suitable as a value allocation target in the Australian banking sector.

The following indicators require focused attention in the future:

- FY2026 Q2 Earnings Report on February 15, 2026: Verification of earnings improvement and customer growth trends

- Progress of RACQ Acquisition: Regulatory approval and integration plans

- RBA Interest Rate Decisions: Pace of interest rate cuts and impact on net interest margin

- Macroeconomic Data: GDP growth, employment, and inflation trends

[0] Jinling API Financial Database - BEN.AX Real-Time Quotes, Technical Analysis and Financial Data (January 8, 2026)

[1] Marketscreener - “Goldman Sachs Upgrades Bendigo and Adelaide Bank to Buy from Neutral; Price Target is AU$11.32” (https://www.marketscreener.com/news/goldman-sachs-upgrades-bendigo-and-adelaide-bank-to-buy-from-neutral-price-target-is-au-11-32-ce7e59dcd88df721)

[2] Morningstar Australia - “Does this bank have what it takes to compete with the big 4?” (https://www.morningstar.com.au/stocks/does-this-bank-have-what-it-takes-compete-big-4)

[3] TIKR - “Analysts Are Taking a Fresh Look at Bendigo and Adelaide Bank after FY25” (https://www.tikr.com/blog/analysts-are-taking-a-fresh-look-at-bendigo-and-adelaide-bank-after-fy25)

[4] Firstlinks - “Bank reporting season scorecard November 2025” (https://www.firstlinks.com.au/bank-reporting-season-scorecard-november-2025)

[5] Morningstar DBRS - “2026 Major Australian Bank Outlook Neutral: Lending Momentum Supported by Improving Economic Dynamics” (https://dbrs.morningstar.com/research/469431/2026-major-australian-bank-outlook-neutral-lending-momentum-supported-by-improving-economic-dynamics)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.