Analysis of the Impact of Major Shareholder Share Sales on Innovative Eyewear (LUCY)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to public filings,

| Analysis Dimension | Data Performance | Interpretation |

|---|---|---|

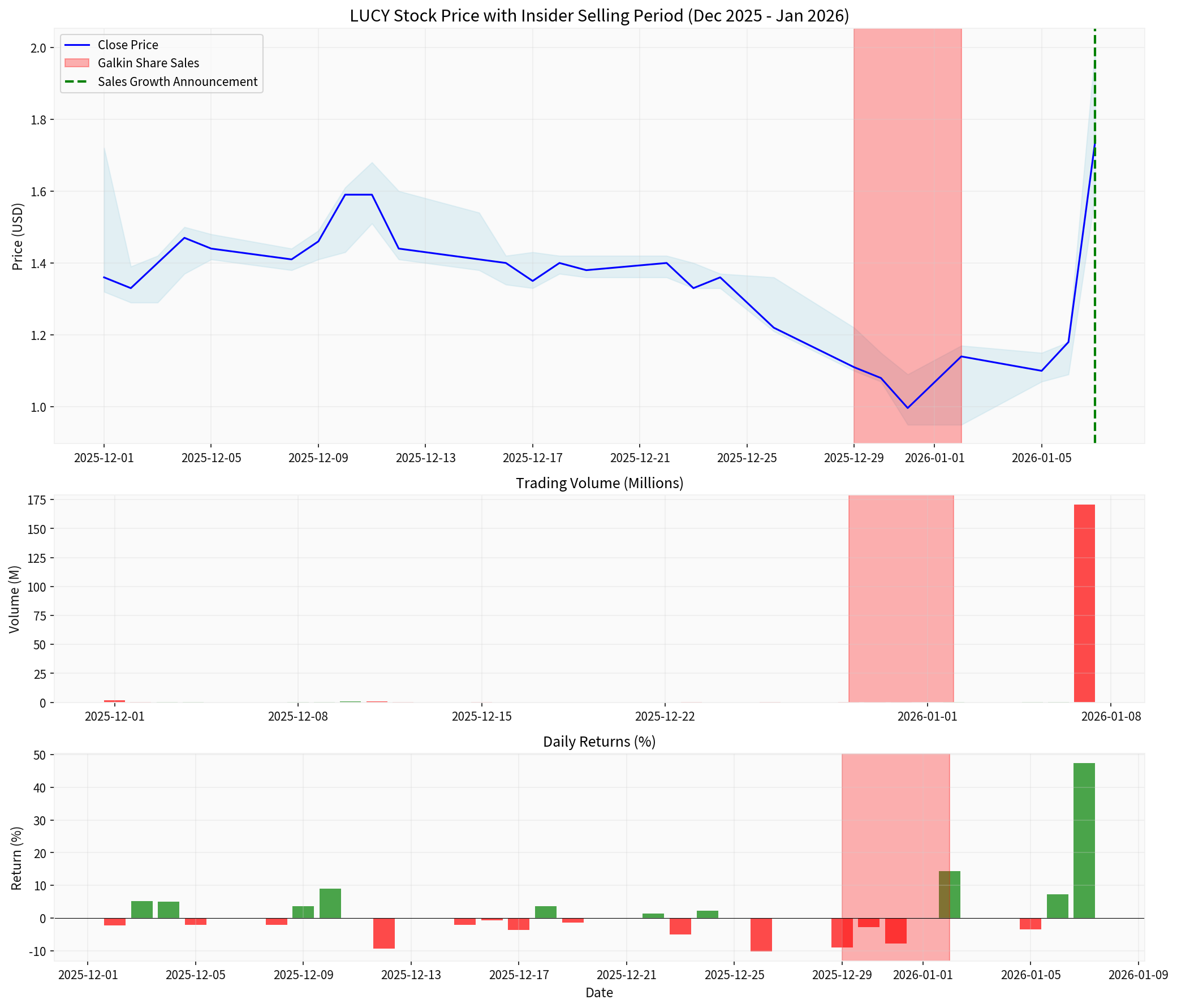

Price Movement During Sale Period |

$1.11 → $1.14 (+2.7%) | Price remained relatively stable, with no panic selling observed |

Price Movement Post-Sale |

$1.10 → $1.74 (+58.2%) | Significant increase, primarily driven by news of sales growth |

Single-Day Maximum Gain |

+47.46% (January 7) | Record single-day gain |

Abnormal Trading Volume |

Peak of 170 million shares (25x average) | Highly active trading behavior |

- Insider Signal: Major shareholder share reduction is typically interpreted as a cautious stance on short-term stock price or fundamentals

- Change in Shareholding Concentration: Although Galkin remains a major shareholder, the decline in his shareholding ratio may raise market questions about his level of confidence

- Historical Performance Warning: The company’s 1-year return is-72.20%, and 3-year return is-91.91%, showing a long-term downward trend[4]

- Management Share Repurchase Plan: Core management including the CEO, CFO, and COO announced aplan to purchase shares on the open market, forming a hedging signal against the shareholder’s share sale[3]

- Sales Growth Validation: 2025 sales reached $2.7 million (65% year-over-year growth), with Q4 sales of approximately $1 million (45% year-over-year growth)[3]

- Market Share Advantage: The company holds approximately 44% of the Amazon smart safety glasses market, making it an industry leader[3]

| Valuation Metric | Value | Industry Comparison |

|---|---|---|

Market Capitalization |

$7.96M | Micro-cap stock |

P/S Ratio |

0.01x | Extremely low valuation |

P/E Ratio |

N/A | In loss-making status |

Current Price Position |

83% above 52-week low | Near the bottom of the range |

- MACD: Golden cross pattern (bullish)

- KDJ Indicator: K=46.6, D=29.7 (bullish range)

- RSI: Overbought risk zone

- Trend Judgment: Sideways consolidation ($1.33-$1.82 range)

- Beta Value: 3.25 (highly volatile stock)

-

Rational Interpretation Perspective:

- The scale of the shareholder’s share sale is relatively limited (accounting for approximately 18.6% of his holdings), not a full liquidation

- The timing of the sale may be related to personal capital needs or tax planning, rather than a negative view of the company’s prospects

- Management simultaneously announced a share repurchase plan, sending a signal of confidence

-

Sentiment-Driven Perspective:

- Micro-cap stocks are inherently highly volatile

- The abnormal trading volume of 25x the average amplified market sentiment fluctuations

- Investors need to be wary of profit-taking pressure following the “news-driven market”

This major shareholder share sale

- Limited Sale Scale: Approximately 150,000 shares account for a small proportion relative to the average daily trading volume (approximately 7 million shares)

- Fundamental Support: The 65% sales growth and management’s share repurchase plan offset selling pressure

- Technical Alignment: Multiple indicators show bullish short-term momentum

| Risk Type | Details |

|---|---|

Fundamental Risk |

The company remains in a loss-making state (EPS -$2.03, ROE -140.85%)[4] |

Valuation Risk |

Market capitalization is only $7.96M, with limited liquidity and susceptibility to manipulation |

Volatility Risk |

A Beta value of 3.25 means market fluctuations will be significantly amplified |

Execution Risk |

The management’s share repurchase plan is only an “intent statement”; the specific execution timeline and scale are pending |

- Short-Term Traders: Focus on the $1.82 resistance level; follow the trend if it breaks above, and implement a stop loss if it falls below $1.33

- Long-Term Investors: Wait for clearer signals of fundamental improvement; the current loss-making status does not support a long-term holding decision

- Risk-Averse Investors: It is recommended to avoid such high-volatility micro-cap stocks

The major shareholder share sale event for LUCY reflects the

[1] TipRanks - “Major Insider Move at Innovative Eyewear Sends a Powerful Signal to Investors” (https://www.tipranks.com/news/insider-trading/major-insider-move-at-innovative-eyewear-sends-a-powerful-signal-to-investors-insider-trading)

[2] StockTitan - “Innovative Eyewear director reports multiple common stock trades” (https://www.stocktitan.net/sec-filings/LUCY/form-4-innovative-eyewear-inc-insider-trading-activity-5061ba9c4ee7.html)

[3] SEC Form 8-K (2026-01-07) - “Innovative Eyewear Announces Record-Breaking 65% Annual Sales Growth in 2025 & Insider Buying Intent” (https://www.sec.gov/Archives/edgar/data/1808377/000182912626000089/innovativeeye_8k.htm)

[4] Jinling API Market Data - LUCY Company Profile and Financial Metrics

[5] Jinling API Technical Analysis - LUCY Technical Indicators and Trend Judgment

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.