Opening Range Breakout Strategy Analysis: Day 79 Implementation During Asia Session

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the Reddit post [1] published on November 12, 2025, documenting a trader’s 79th day implementing a 5-minute Opening Range Breakout (ORB) strategy. The strategy execution took place during the Asia session, combining technical indicators including EMA and VWAP for confluence, with specific entry criteria involving pullbacks to VWAP/50% retracement levels after initial breakouts [1].

The implementation occurred within a challenging market context, as Asian equities experienced over $10 billion in foreign outflows during November 2025, with the MSCI Asia ex-Japan IT sector declining 4.23% in the prior week [2]. On the specific trade date, Chinese markets showed negative performance with the Shanghai Index down 0.46%, Shenzhen down 1.39%, and ChiNext down 1.79% [0].

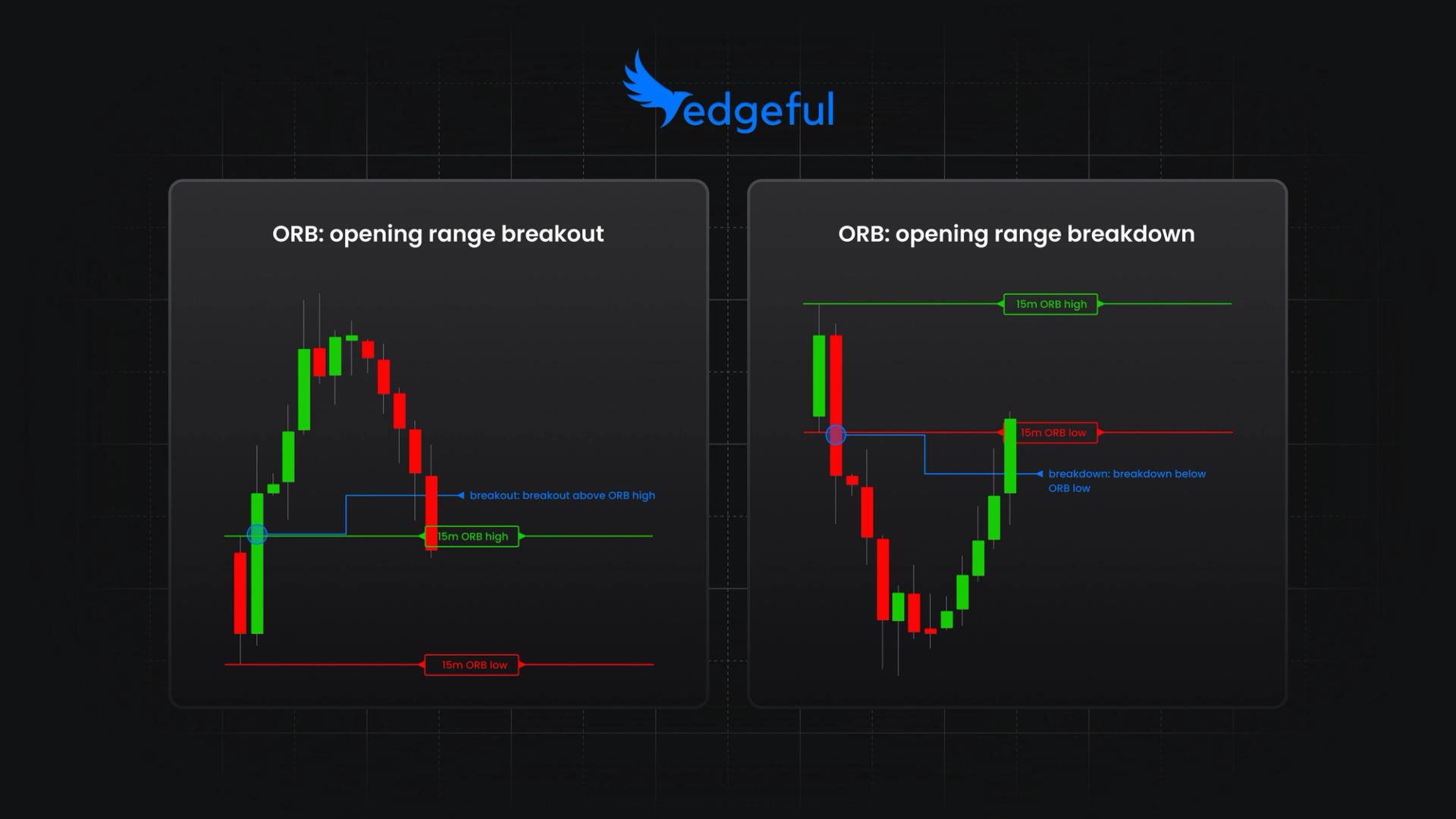

The ORB strategy mechanics focus on capturing early-session volatility by identifying the high and low price range during the initial minutes of trading. The trader’s 5-minute opening range is shorter than the traditional 15-minute standard, potentially offering more frequent but potentially less reliable signals [1]. The combination of EMA and VWAP provides multiple layers of confirmation, with VWAP serving as a crucial dynamic support level particularly effective during the Asia session when institutional order flow is more predictable [3].

- Market Environment Risk:The current Asian equity market weakness and foreign outflows could increase the probability of false breakouts and failed momentum trades [2]

- Strategy Saturation:ORB strategies have shown mixed results in 2025, with some traders reporting reduced edge due to algorithmic competition [1]

- Volatility Challenges:During periods of market stress, ORB strategies can either excel due to increased volatility or suffer from false breakouts [2]

- Technical Indicator Limitations:EMA crossovers should be used with volume analysis to confirm signals, as standalone indicators may produce false signals during choppy markets [4]

- Asia Session Efficiency:The relative isolation from US market noise provides cleaner breakout signals with higher success rates due to lower retail participation [3]

- Micro Contract Growth:Micro contracts have grown to represent approximately 30% of E-mini futures volume in 2025, providing improved liquidity and reduced capital requirements [4]

- Technical Confluence Strength:The combination of VWAP, EMA, and 50% retracement provides robust confirmation that may outperform single-indicator approaches during volatile periods [1, 3]

- Improved Market Microstructure:Asia session liquidity has improved significantly with 24-hour electronic trading, reducing slippage risk for breakout strategies [3]

The 5-minute ORB strategy implementation demonstrates a sophisticated approach to intraday futures trading during the Asia session. The strategy’s success rate typically ranges from 50-65% with proper risk management [1], though individual performance varies based on market conditions and execution precision. The use of VWAP as a dynamic support/resistance level remains one of the most reliable indicators for intraday futures trading [3], particularly when combined with Fibonacci retracement levels for optimal entry timing.

The trader’s risk management approach using micro contracts allows for precise position sizing and capital efficiency. Micro contracts require significantly lower margin than standard futures, enabling better diversification and risk control [4]. The 79-day implementation period suggests the trader has likely developed experience adapting the strategy to various market conditions, though specific performance metrics remain undisclosed.

Current market conditions present both challenges and opportunities. While the stalled AI rally and foreign outflows from Asian equities create a difficult environment [2], the Asia session’s unique characteristics and improved liquidity structure may provide advantages for well-executed breakout strategies. The technical confluence approach offers multiple confirmation layers that could help navigate the current market volatility.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.