In-Depth Analysis of Beneficiary Segments from Operator Computing Power Network Investment in 2026

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest industry research report, in 2026, the overall capital expenditure of the three major operators will show a trend of “steady with slight decline, structural optimization”, with the total annual investment scale expected to reach approximately 280 billion yuan[1]. Among them,

Operators are transforming from traditional “connection service providers” to “integrated digital infrastructure service providers”, and the proportion of investment in cloud computing + AI infrastructure will increase from 22% in 2024 to around 30%. This structural transformation mainly benefits from: accelerated implementation of AI large model applications, comprehensive deepening of the “Eastern Data Western Computing” project, and explosive growth in demand for intelligent computing centers.

- Investment Proportion: Approximately 25% (about 25 billion yuan)

- Benefit Level: ⭐⭐⭐⭐⭐ (Very High)

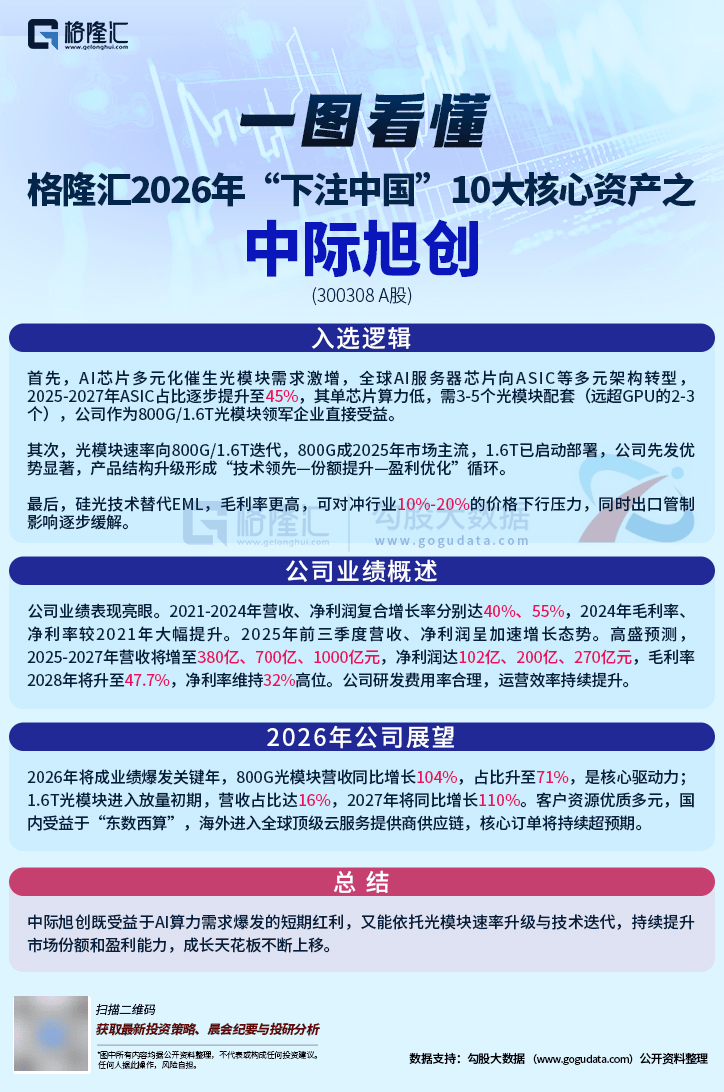

- Core Logic: Core transmission component of computing power networks, 800G products dominate the market, and 1.6T products will see explosive growth in 2026[4]. The focus of computing power demand is shifting from training to inference, driving sustained high growth in demand for optical modules.

- Beneficiary Targets: Zhongji Innolight (global leader in 800G/1.6T optical modules), Xinyisheng (core supplier of high-end optical modules), Accelink Technologies (full industrial chain layout)[5]

- Investment Proportion: Approximately 22% (about 22 billion yuan)

- Benefit Level: ⭐⭐⭐⭐⭐ (Very High)

- Core Logic: Core carrier of AI computing power, the scale of centralized procurement by operators has expanded significantly. In the first half of 2025, China Mobile issued a tender for approximately 7,058 general-purpose AI computing devices.

- Beneficiary Targets: Inspur Information (leader in AI server shipments), ZTE Corporation (core supplier for operator centralized procurement), GRG Banking (KunlunXin partner)

- Investment Proportion: Approximately 10% (about 10 billion yuan)

- Benefit Level: ⭐⭐⭐⭐⭐ (Very High)

- Core Logic: Domestic substitution is accelerating, and domestic GPU manufacturers such as Cambricon, KunlunXin, and Muxi are intensively entering the capital market. The Ascend series chips will launch the 950PR/950DT models in 2026[5].

- Beneficiary Targets: Cambricon (domestic AI chip leader), Hygon Information Technology (domestic GPU/CPU chips), KunlunXin (Baidu AI chip ecosystem)[6]

- Investment Proportion: Approximately 18% (about 18 billion yuan)

- Benefit Level: ⭐⭐⭐⭐ (High)

- Core Logic: Foundation for computing power hosting, construction of hub nodes for the “Eastern Data Western Computing” project is accelerating. As of the end of June 2025, the scale of standard racks in in-use data centers in China reached 10.85 million units[5].

- Beneficiary Targets: Aofei Data (Baidu Smart Cloud cabinet hosting), Cloudnet Technology (data center and cloud computing service provider)

- Investment Proportion: Approximately 12% (about 12 billion yuan)

- Benefit Level: ⭐⭐⭐⭐ (High)

- Core Logic: Essential technology for high-density computing power, the PUE of newly built large-scale data centers is generally below 1.25. Huagong Zhengyuan released the world’s first 3.2T liquid-cooled CPO solution[5].

- Beneficiary Targets: Sugon Digital Creation (integrated solution provider for liquid-cooled data centers), Envicool (leader in precision temperature control equipment)

- Investment Proportion: Approximately 8% (about 8 billion yuan)

- Benefit Level: ⭐⭐⭐ (Medium)

- Core Logic: An important component of the integrated cloud-edge-end collaborative computing power network, the proportion of distributed inference computing power will increase to over 70%[4].

- Beneficiary Targets: Talkweb Information (KunlunXin partner for AI computing power all-in-one machines), Digital China (channel distributor for KunlunXin AI servers)

| Portfolio Type | Core Targets | Investment Logic |

|---|---|---|

Core Beneficiary Portfolio |

Zhongji Innolight + Inspur Information + Cambricon | High certainty, directly driven by computing power construction |

Growth-Oriented Portfolio |

Sugon Digital Creation + Envicool + Aofei Data | High flexibility, benefits from increasing technology penetration |

Domestic Substitution Portfolio |

Hygon Information Technology + Talkweb Information + Digital China | Policy-driven, accelerated procurement of domestic computing power |

- Technology Iteration Risk: There are still uncertainties in the 6G technical route, scale of AI computing power demand, etc.[1]

- Market Competition Risk: Competition among internet cloud vendors and third-party IDC service providers is intensifying[1]

- Investment Return Risk: Macroeconomic fluctuations may affect the willingness of government and enterprise customers to invest in digitalization[1]

- Supply Chain Risk: Supply of advanced AI chips is still affected by external factors

[1] Sina Finance - “2026 Operator Investment Outlook: How Large is the Market This Year?” (https://finance.sina.com.cn/stock/relnews/cn/2026-01-04/doc-inhfcxwp8783946.shtml)

[2] Northeast Communications - “2026 Communications Industry Annual Strategy Report: Seize the AI Main Line” (https://finance.sina.com.cn/roll/2025-12-12/doc-inhaprxi5681791.shtml)

[3] Tencent News - Illustrated Operator Investment Plan 2024-2026 (https://inews.gtimg.com/om_bt/Oh3l6f99Y8B3Ap2PxcED_BhBLQ1kDIrz8MkH21cvJlPGkAA/641)

[4] ICCSZ Optical Communication Network - “Review 2025: The Surging Computing Power Demand Will Continue in 2026” (http://www.iccsz.com/4g/news.Asp?ID=0b35ad4f3045480987e53fc655237a37)

[5] Huxiu - “2025 Computing Power Industry Review: Who is the Real Winner?” (https://www.huxiu.com/article/4823921.html)

[6] Caifuhao - “Review of Beneficiary Concept Stocks for KunlunXin’s Independent Listing” (https://caifuhao.eastmoney.com/news/20260105105339230587110)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.