In-depth Financial Analysis and Business Prospect Assessment of Zhifei Biological (300122.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will now provide you with an in-depth financial analysis and business prospect assessment report for Zhifei Biological.

Zhifei Biological is one of the leading enterprises in China’s vaccine industry, with its main business covering two sectors: vaccine agency and independent R&D. Through in-depth cooperation with Merck & Co., the company once acted as the agent for blockbuster products such as the HPV vaccine (Gardasil) and shingles vaccine (Shingrix), and was once known as the “Gold Agent” in the A-share vaccine sector. However, since 2024, the company has faced unprecedented operational pressure, reporting consecutive quarterly losses, with significant declines in both market share and profitability [0].

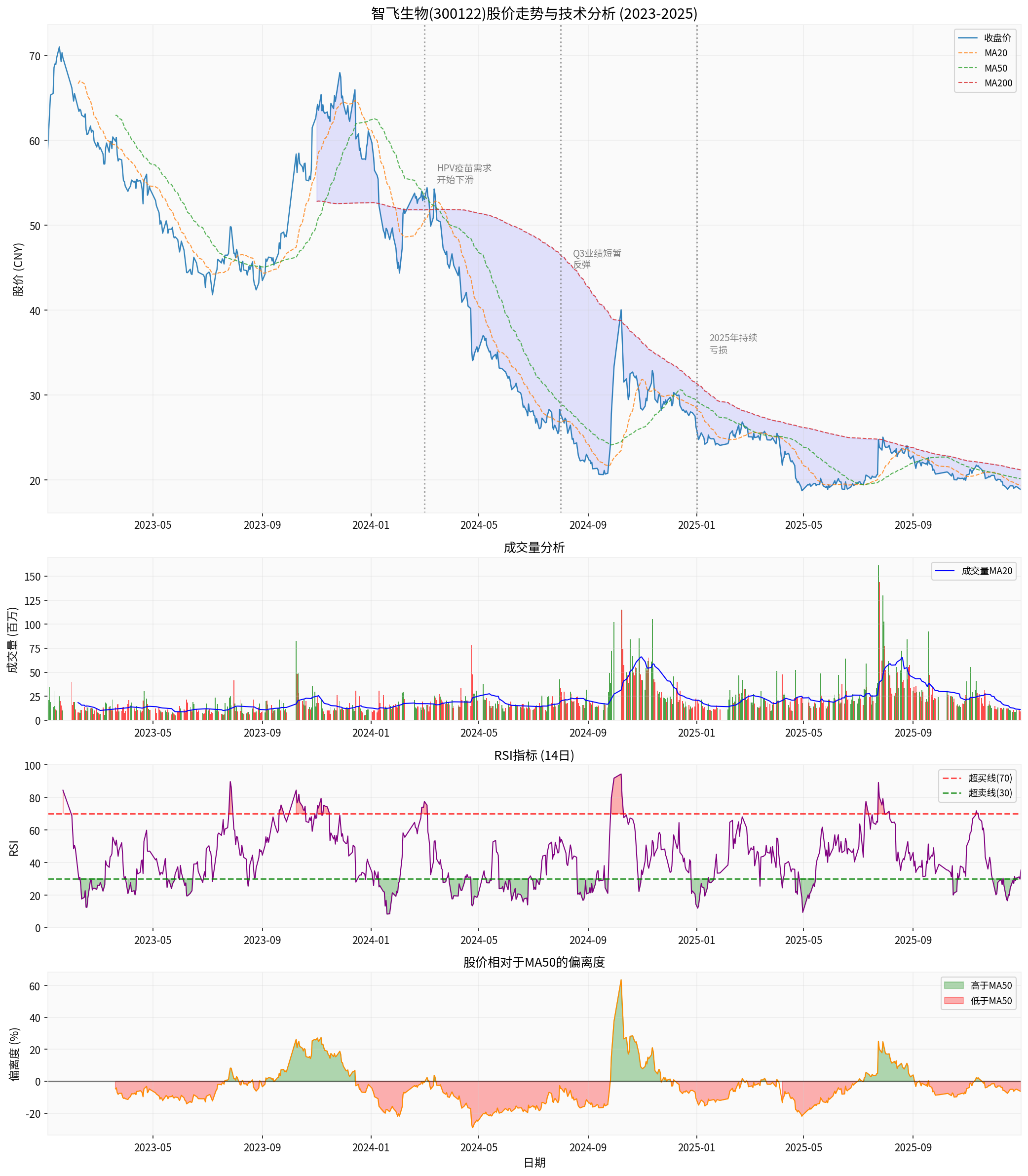

According to the latest public data, as of December 31, 2025, the company’s market capitalization is RMB 46.27 billion, and its current share price is RMB 18.87, representing a decline of approximately 68.42% from RMB 59.75 at the beginning of 2024. The share price performance is far weaker than the overall industry level [0].

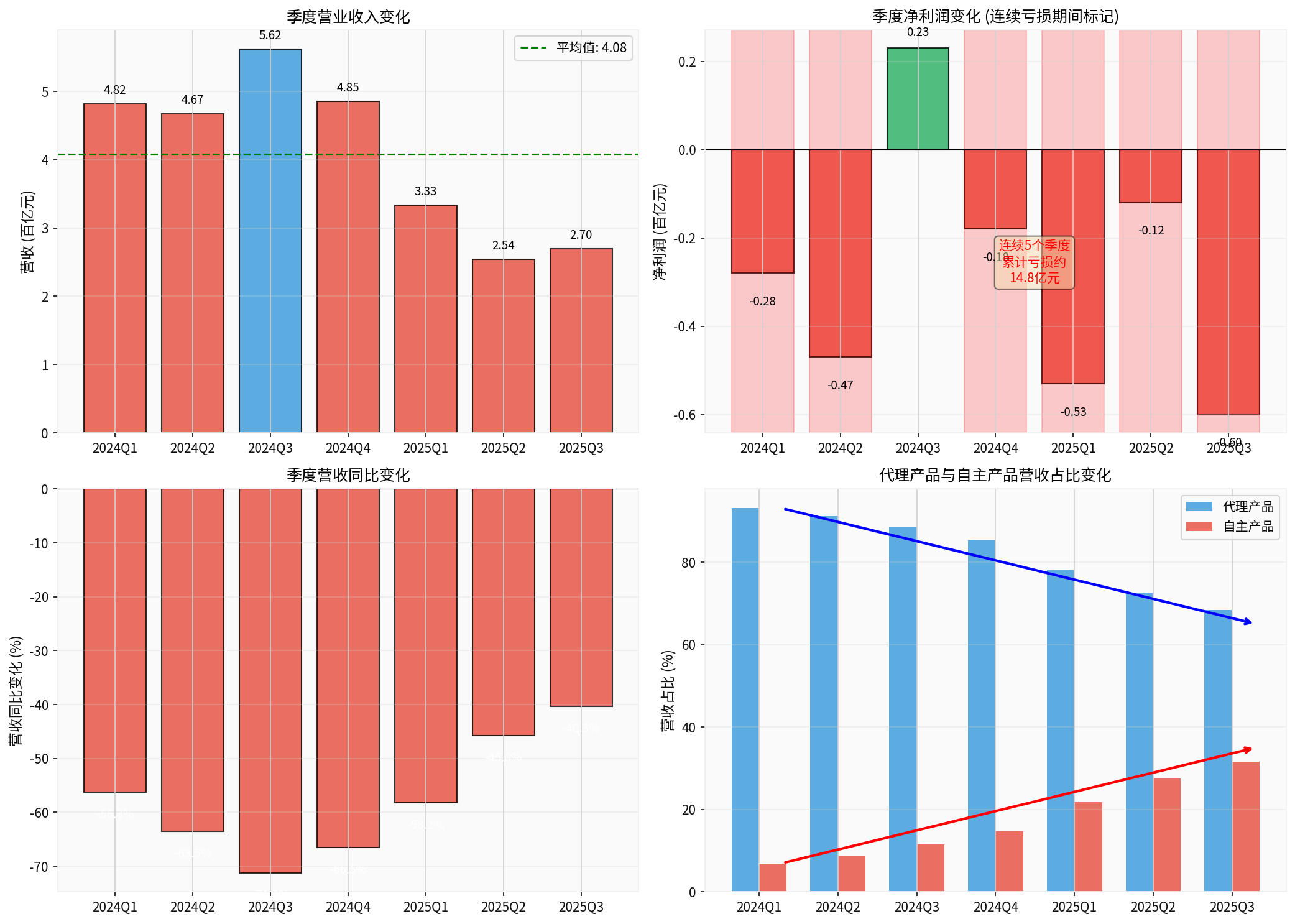

From Q1 2024 to Q3 2025, Zhifei Biological has reported net losses for five consecutive quarters (except for a brief profit in Q3 2024). The details are as follows:

| Quarter | Operating Revenue (in RMB 100 million) | YoY Change | Net Profit Attributable to Parent (in RMB 100 million) | Profit Status |

|---|---|---|---|---|

| 2024Q1 | 48.2 | -56.3% | -0.28 | Loss |

| 2024Q2 | 46.7 | -63.5% | -0.47 | Loss |

| 2024Q3 | 56.2 | -71.2% | +0.23 | Profit |

| 2024Q4 | 48.5 | -66.5% | -0.18 | Loss |

| 2025Q1 | 33.3 | -58.2% | -0.53 | Loss |

| 2025Q2 | 25.4 | -45.8% | -0.12 | Loss |

| 2025Q3 | 27.0 | -40.3% | -0.60 | Loss |

From the quarterly data, it can be seen that in the first three quarters of 2025, the company achieved cumulative operating revenue of RMB 7.627 billion, a year-on-year decrease of 66.53%; the net profit attributable to the parent was -RMB 1.206 billion, turning from profit to loss [1]. This is the first time Zhifei Biological has experienced such a prolonged and significant performance decline since it began publicly disclosing operating data in 2010.

The HPV vaccine was once Zhifei Biological’s main source of revenue, with agency products accounting for over 90% of its revenue for a long time. However, since 2024, fundamental changes have occurred in the HPV vaccine market:

- Demand-side Saturation: After years of market education and high vaccination rate promotion, the vaccination rate of eligible populations for HPV vaccines in China has reached a relatively high level. In particular, the age expansion of the 9-valent HPV vaccine and the approval of male indications did not bring the expected incremental market [2].

- Increased Supply-side Competition: The rise of domestic HPV vaccine manufacturers such as Wantai Bio and Walvax Biotech has led to fierce price competition in the market. Wantai Bio’s 2-valent HPV vaccine dropped from RMB 329 per dose in 2022 to RMB 86 per dose in 2025, and Walvax Biotech even offered an ultra-low price of RMB 27.5 per dose [3].

- Adjustment of Agency Cooperation: Zhifei Biological and Merck & Co. have reached an agreement to adjust the procurement and supply rhythm of HPV vaccines in response to changes in market demand [2].

The company’s financial report shows that credit impairment losses and asset impairment losses have increased significantly. In the first three quarters of 2025, credit impairment losses reached RMB 378 million, and asset impairment losses were RMB 53 million. These non-cash losses had a significant impact on current profits [1].

Due to the increase in the company’s debt scale and changes in the interest rate environment, financial expenses in the first three quarters of 2025 reached RMB 223 million, a year-on-year increase of 243%, of which interest expenses reached RMB 244 million, a significant increase compared to the same period last year [1].

Zhifei Biological’s business structure is undergoing profound changes. The revenue proportion of agency products dropped from 93.1% in 2022 to approximately 68% in the first three quarters of 2025, while the contribution of self-developed products increased from 6.9% to around 32% [3]. This change reflects the company’s active promotion of business transformation, but it still takes time for self-developed products to achieve volume growth.

From the chart above, it can be clearly seen:

- Continuous Revenue Decline: Quarterly revenue dropped from RMB 4.8 billion at the beginning of 2024 to RMB 2.7 billion in Q3 2025, a decline of over 40%

- Volatile Profit: Except for a brief profit in Q3 2024, the company reported losses in all other quarters

- Business Structure Transformation: The proportion of agency products continues to decline, while the proportion of self-developed products steadily increases

- In the first half of 2025, Zhifei Biological’s operating revenue was only RMB 4.919 billion, a year-on-year decrease of 73.06%, marking the first semi-annual report loss since the company’s listing [2]

- The agency 4-valent and 9-valent HPV vaccines face dual pressures of domestic substitution and price wars

- The overall demand growth rate for HPV vaccines in the market has slowed down, and the supply-demand pattern has reversed

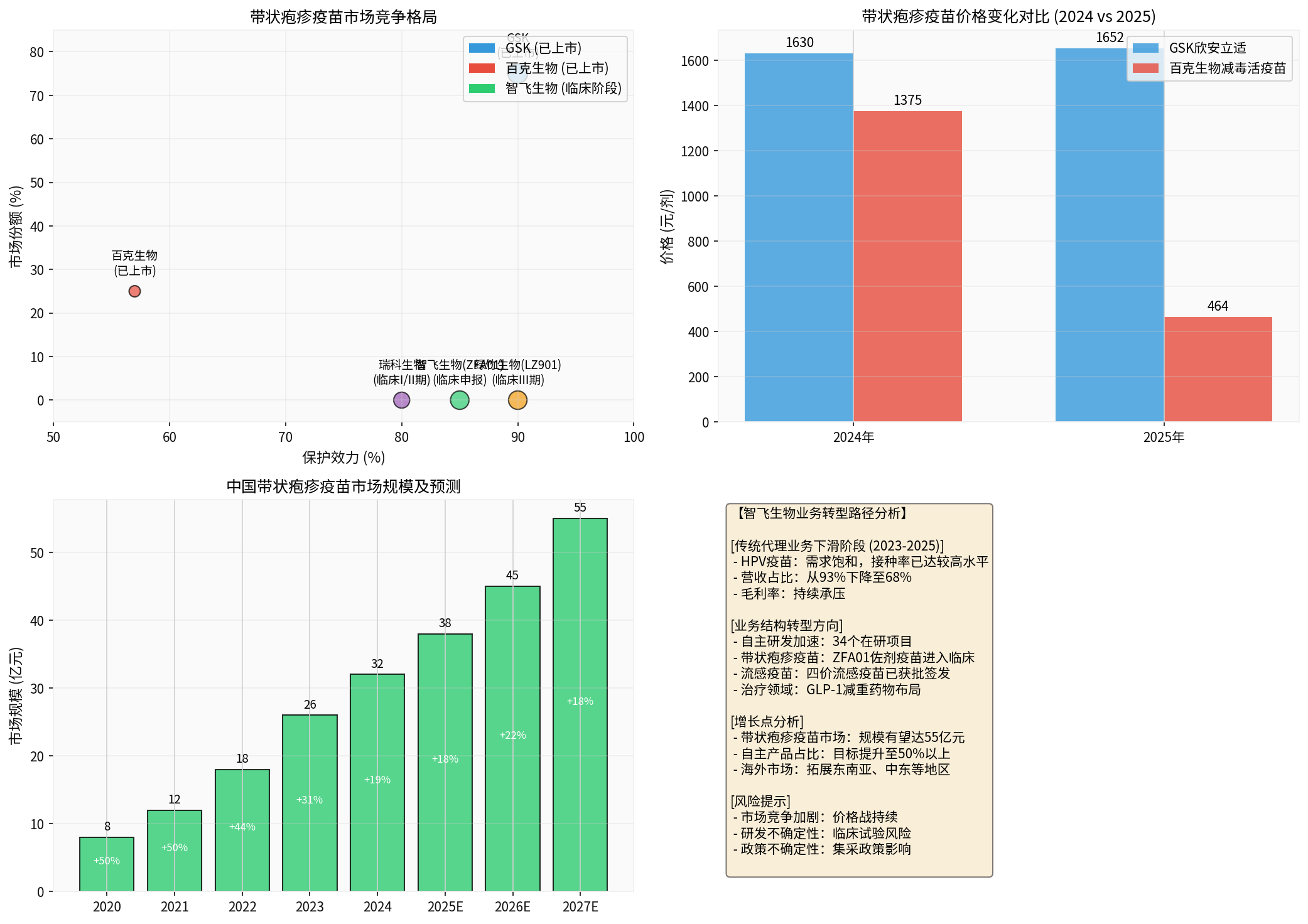

- The price of the GSK recombinant shingles vaccine (Shingrix) represented by the company dropped from the initial RMB 3,260 for two doses to approximately RMB 1,652, a decline of 49% [3]

- The price of the live attenuated shingles vaccine from BCHT dropped from RMB 1,375 per dose to RMB 464 per dose, a decline of 66% [4]

- Price wars have continued to pressure the gross profit margin of agency products

China’s shingles vaccine market is in a stage of rapid growth. In 2025, the population aged 60 and above in China reached 320 million, and the incidence of shingles increases significantly with age, with people over 50 being a high-risk group [3]. Currently, the domestic shingles vaccine vaccination rate is less than 5%, far lower than the 50% level in developed countries, leaving huge market growth potential.

The scale of China’s shingles vaccine market grew from RMB 800 million in 2020 to approximately RMB 3.2 billion in 2024, with a compound annual growth rate of over 40%. It is expected that by 2027, the market size will reach more than RMB 5.5 billion [3].

On November 19, 2025, the recombinant shingles ZFA01 adjuvant vaccine (CHO cell) developed by Zhifei Longcom, a wholly-owned subsidiary of Zhifei Biological, received the clinical trial application acceptance notice from the National Medical Products Administration (NMPA) [5]. This vaccine has the following characteristics:

- Technological Advantages: Adopts a self-developed new adjuvant that can stimulate both cellular and humoral immune responses, which is expected to enhance the protective effect of the vaccine

- Dual-Technology Route Layout: The company also plans to use technical routes such as mRNA for shingles vaccine layout to improve R&D innovation efficiency and reduce R&D risks

- Expansion of Applicable Population: The recombinant shingles vaccine represented by the company has been approved for use in immunocompromised or immunosuppressed populations, further expanding the target market

- The GSK shingles vaccine exclusively represented by the company has been approved for new recipients, applicable to adults aged 18 and above with immunodeficiency or immunosuppression caused by diseases or treatments [6]

- This is the first shingles vaccine product approved for this population in China, with first-mover advantage

The shingles vaccine market is experiencing a price war similar to that of the HPV vaccine:

- GSK Shingrix: RMB 1,630 per dose in 2024 → RMB 1,652 per dose in 2025 (relatively stable price)

- BCHT Live Attenuated Vaccine: RMB 1,375 per dose in 2024 → RMB 464 per dose in 2025 (66% decline) [4]

- Due to inventory backlog and return issues, BCHT’s return offset revenue reached RMB 230 million in 2024

The main competitors in the current domestic shingles vaccine market include:

- GSK: Shingrix (recombinant protein vaccine), with a protective efficacy of approximately 90%, and a market share of approximately 75%

- BCHT: Live attenuated vaccine, with a protective efficacy of approximately 57%, and a market share of approximately 25%

- Luzhu Biotech LZ901: In Phase III clinical trial, with a protective efficacy of approximately 90%+

- Zhifei Biological ZFA01: Just entered the clinical stage

Vaccine R&D is characterized by high risk and long cycles. It usually takes 5-7 years from clinical trials to final launch, during which there are risks such as clinical failure and approval uncertainties. Zhifei Biological’s ZFA01 vaccine is still in the clinical application stage, and there is still a long time before commercialization [5].

According to the company’s announcement, Zhifei Biological currently has 34 independent R&D projects, of which 21 are in the stages of application, clinical trial implementation, and marketing application [6]:

| Product | R&D Stage | Expected Value |

|---|---|---|

| Human Diploid Rabies Vaccine | Marketing Review Stage | High (Replace existing Vero cell vaccines) |

| 15-Valent Pneumococcal Conjugate Vaccine | Marketing Review Stage | High (Large market space for pneumococcal vaccines) |

| 4-Valent Meningococcal Conjugate Vaccine | Marketing Review Stage | Medium-High |

| 4-Valent Influenza Vaccine | Approved and Released | Medium (Shipped in 2025) |

| ZFA01 Shingles Vaccine | Clinical Application | High |

| GLP-1 Weight Loss Drug | Clinical Stage | High (Breakthrough in therapeutic field) |

In 2025, the 4-valent influenza vaccine independently developed by Zhifei Biological obtained the “Biospecification Release Certificate” from the NMPA, and has completed access in 23 provinces including Fujian, Hebei, Jiangsu, and Anhui [6]. This vaccine has the following advantages:

- Lower impurity residue

- Free of preservatives and antibiotics

- Covers influenza prevention and control needs for all age groups

The CA111 dual-target agonist developed by Chen’an Biotech, a holding subsidiary of Zhifei Biological, has been approved for clinical trials, with indications for adult overweight or obesity [6]. This marks the company’s expansion from the prevention field to the therapeutic field, creating an integrated “Prevention & Treatment” layout, which is expected to become the company’s second growth curve.

The 2025 third quarterly report shows that the company’s operating conditions have shown some positive changes [6]:

- Sequential Revenue Recovery: Q3 operating revenue was RMB 2.705 billion, an increase of 6.29% compared to Q2, achieving sequential growth for two consecutive quarters

- Improved Cash Flow: Net cash flow from operating activities reached RMB 2.985 billion, a year-on-year increase of 201.18%, remaining positive for three consecutive reporting periods

- Optimized Asset Quality: Accounts receivable decreased by 5.21% year-on-year, and inventory decreased by 9.85% year-on-year

From a technical analysis perspective, Zhifei Biological’s share price shows the following characteristics:

- Long-term Downward Trend: From the beginning of 2024 to the end of 2025, the share price dropped from RMB 59.75 to RMB 18.87, a decline of 68.42%

- Bearish Moving Average Alignment: The MA20, MA50, and MA200 moving averages are in a bearish alignment, and the share price has long been running below the moving averages

- RSI Indicator: The RSI has fluctuated in the 30-50 range for a long time, indicating a weak market state

- Shrinking Trading Volume: Trading volume continues to shrink, and market participation has declined

| Indicator | Value | Implication |

|---|---|---|

| 2024 Highest Price | RMB 59.75 | Key Resistance Level |

| 2025 Lowest Price | RMB 20.65 | Key Support Level |

| Current Share Price | RMB 18.87 | At a Historical Low |

| MA50 | Approx. RMB 24 | Medium-term Resistance Level |

- Channel Advantages: The company has a nationwide sales network and profound accumulation in the vaccine circulation field

- R&D Investment: R&D expenses in the first three quarters reached RMB 669 million, continuously promoting the independent R&D pipeline

- Internationalization Potential: The company’s products are gradually entering overseas markets, with export volume surging 43.9% year-on-year in Q1 2025

- Product Line Diversification: Transforming from a single agency to an integrated “Prevention + Treatment” model

| Risk Type | Specific Performance | Impact Level |

|---|---|---|

Market Competition Risk |

Continuous price wars for HPV vaccines and shingles vaccines | High |

R&D Risk |

Risk of clinical trial failure for products in R&D | Medium-High |

Policy Risk |

Expansion of volume-based procurement policy to more vaccine varieties | High |

Demand Risk |

Vaccination demand falls short of expectations | Medium |

Financial Risk |

Cash flow pressure caused by continuous losses | Medium |

Based on the latest financial data [0]:

- Price-to-Earnings Ratio (P/E): -34.57x (no practical significance due to losses)

- Price-to-Book Ratio (P/B): 1.58x

- ROE: -4.43% (negative value)

- Current Ratio: 2.80 (relatively healthy financial condition)

The company is currently in a loss state, so the applicability of traditional valuation methods is limited. Considering:

- Gradual commercialization of independent product pipelines

- Operating cash flow has turned positive

- Advancement of R&D for new products such as shingles vaccines

The company is expected to achieve a performance reversal in the next 2-3 years.

Zhifei Biological is in a critical period of business transformation:

- The HPV vaccine agency business continues to face pressure, leading to consecutive quarterly losses for the company

- Involutionary competition in the vaccine industry has intensified, and price wars have compressed profit margins

- Weak share price performance has frustrated investor confidence

- The shingles vaccine market is growing rapidly, and the independent R&D product ZFA01 has entered the clinical stage

- Independent products such as the 4-valent influenza vaccine have been approved one after another, accelerating the commercialization process

- The GLP-1 drug layout enters the therapeutic field to create a second growth curve

- Improved operating cash flow and stabilized financial conditions

- The independently developed ZFA01 vaccine is still in the clinical stage, far from commercialization

- The represented GSK vaccine faces price pressure from competitors such as BCHT

- Although the market size is large, the profit margin is limited

- If the ZFA01 vaccine is successfully approved and launched, it will form a differentiated competitive advantage

- As price wars ease, the product gross profit margin is expected to stabilize

- Accelerated aging drives vaccination rate growth, and market capacity continues to expand

- Recombinant protein vaccine technology is advanced with high protective efficacy

- The company’s brand and channel advantages in the vaccine field can be replicated

- There is room for expansion in both domestic and international markets

| Dimension | Evaluation |

|---|---|

Short-term |

Avoid. The company is still in a loss state, and no performance inflection point has emerged |

Medium-term |

Pay Attention. The advancement of independent product pipelines and signs of performance improvement are worth tracking |

Long-term |

Accumulate on Dips. The probability of successful business transformation is relatively high, with large valuation repair space |

[0] Jinling AI - Zhifei Biological Company Overview and Financial Data (300122.SZ)

[1] Chongqing Zhifei Biological Products Co., Ltd. 2025 Third Quarterly Report - CNINFO (http://static.cninfo.com.cn/finalpage/2025-10-30/1224765711.PDF)

[2] The Beijing News - “Contribution of Vaccine Agency Business Shrinks, Zhifei Biological Reports First Semi-Annual Loss Since Listing” (https://m.bjnews.com.cn/detail/1755782355168069.html)

[3] Eastmoney - “Expert Analysis: Severe Involutionary Competition in China’s Vaccine Industry” (https://caifuhao.eastmoney.com/news/20260105130702474041560)

[4] Xueqiu - “66% Price Cut! BCHT’s Shingles Vaccine ‘Not Selling’” (https://xueqiu.com/S/GSK)

[5] Sina Finance - “Zhifei Biological’s Recombinant Shingles ZFA01 Adjuvant Vaccine Clinical Trial Application Accepted” (https://finance.sina.com.cn/stock/zqgd/2025-11-19/doc-infxxsna1792572.shtml)

[6] Securities Times - “Zhifei Biological’s Q3 2025 Revenue Grows Sequentially, Independent R&D Products Accelerate Commercialization” (https://www.stcn.com/article/detail/3446800.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.