In-Depth Analysis of Sunwoda's RMB 2.314 Billion Claim by Viridi E-Mobility

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected information, I now provide you with a systematic and comprehensive analysis report.

On December 26, 2025, Sunwoda Electronic Co., Ltd. (Stock Code: 300207.SZ) issued an announcement stating that its wholly-owned subsidiary Sunwoda Power Technology Co., Ltd. has been sued by Viridi E-Mobility Technology (Ningbo) Co., Ltd. over a sales contract dispute, with a claim amount of

| Party | Background Description |

|---|---|

Plaintiff: Viridi E-Mobility |

A new energy technology company jointly controlled by Zeekr (51% shareholding) and Geely Holding Group (49% shareholding), founded in 2013, mainly providing power battery systems for Geely Group brands[1][3] |

Defendant: Sunwoda Power |

A wholly-owned subsidiary of Sunwoda, focusing on R&D and manufacturing of power batteries. It won the designated supplier qualification for cell development of Viridi E-Mobility’s “PMA Platform Project” in 2021[1][2] |

Involved Time Period |

Cell products delivered between June 2021 and December 2023[1][2] |

In its complaint, Viridi E-Mobility alleges that the cells provided by Sunwoda have

- Direct economic loss: RMB 2.314 billion

- Interest calculated based on the LPR (Loan Prime Rate) starting from the date of the lawsuit

- Appraisal fees, attorney fees, and all litigation costs

It is worth noting that in February 2024, media reported that a Zeekr 001 in Shaoxing, Zhejiang, caught fire, with visible damage to the battery base and melted aluminum parts. This is highly consistent with the involved time window (June 2021 to December 2023)[2].

Sunwoda clearly stated in its announcement[1][2][3]:

- Denies quality defects: The cells delivered by the company have undergone strict testing and have no quality issues

- Disputes liability attribution: Emphasizes that cells are only the “core energy storage unit” of battery packs, which also include battery management systems (BMS), thermal management systems, structural components, etc., and the problem may lie in the system integration link

- Normal operations: Currently, the company and its subsidiaries within the consolidated statements are operating normally

- Proactive response: Will seek reasonable solutions, strengthen communication with relevant parties, and strive for a proper resolution

| Dispute Point | Sunwoda’s View | Industry Background |

|---|---|---|

| Cell Quality | Tested qualified, no defects | Cells are energy storage units, not the entire system |

| Root Cause of Problem | May lie in BMS or system integration | Power batteries are complex systems, and problems are the result of superimposed effects |

| Liability Division | Clear evidence chain required | There are differences in the industry on this |

| Financial Indicator | Amount (in RMB 100 million) | Percentage |

|---|---|---|

| Viridi’s Claim Amount | 23.14 |

- |

| Sunwoda’s 2023 Net Profit | 10.76 | 215% |

| Sunwoda’s 2024 Net Profit | 14.68 | 158% |

| Total Net Profit for Two Years | 25.44 |

91% |

| Net Profit for First Three Quarters of 2025 | 14.1 | 164% |

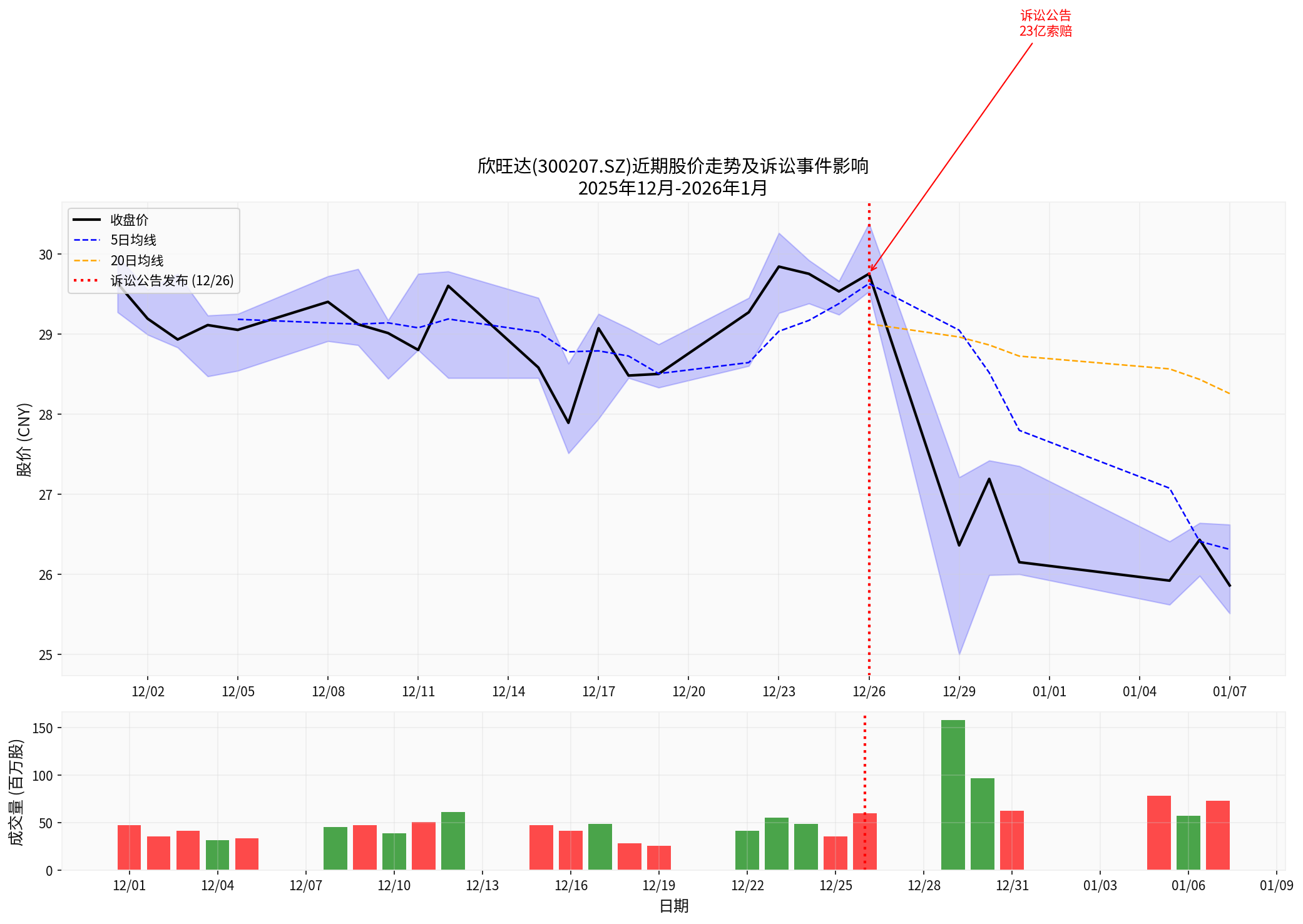

| Time Node | Closing Price | Change Description |

|---|---|---|

| Before the incident (December 25) | 29.53 CNY | Normal trading |

| First trading day after the incident (December 29) | Opened down 15.97% | Panic selling in the market |

| Lowest point (December 30) | 27.19 CNY | Maximum decline of -7.92% |

| Latest (January 7) | 25.86 CNY | 12.43% decline compared to before the incident |

| Risk Type | Potential Impact |

|---|---|

Liquidity Pressure |

The RMB 2.3 billion compensation will directly wipe out the accumulated profits of the past two years |

Credit Rating |

A loss in the case may lead to a rating downgrade, increasing financing costs by 2-3 percentage points |

Hong Kong Stock Listing |

The Hong Kong stock prospectus was just submitted in July 2025, and the lawsuit may affect the listing process |

Supplier Payment Terms |

Upstream suppliers may tighten credit policies |

According to data from the China Automotive Power Battery Industry Innovation Alliance, Sunwoda’s power battery market share reached

| Customer Type | Customer List | Impact Level |

|---|---|---|

Mainstream Domestic Automakers |

Li Auto, NIO, XPeng, Leapmotor, GAC Group | ⚠️ High |

Geely Group |

Zeekr, Volvo, Lotus | 🔴 Severe |

Traditional Automakers |

Dongfeng Motor, Dongfeng Liuzhou Motor, SAIC-GM-Wuling | ⚠️ Medium |

International Manufacturers |

Volkswagen, Renault, Nissan, eGT New Energy Automotive | ⚠️ Medium-High |

- Li Auto i6 adopts a dual-supplier strategy of CATL + Sunwoda

- Consumers explicitly request “no Sunwoda batteries” before paying the deposit

- Some car owners gave up pickup and refunded depositsafter finding their vehicles were equipped with Sunwoda batteries[3]

- Measured winter range is less than 70% of the claimed range

- Abnormal battery temperature rise when parked triggers safety concerns

- Some car owners sold used cars at a low priceto avoid risks[3]

- Models equipped with Sunwoda batteries have received intensive inquiries from users

- Dealers need to provide additional explanations, increasing service costs[3]

The current power battery market presents a

| Ranking | Enterprise | Market Share (Jan-Nov 2025) |

|---|---|---|

| 1 | CATL | 42.7% |

| 2 | BYD | 22.9% |

| 3 | CALB | Approximately 7% |

| 6 | Sunwoda |

3.25% |

- Order Loss: Existing customers may switch to leading manufacturers such as CATL and BYD

- Hindered New Customer Expansion:

- Automakers will be more cautious in selecting suppliers

- Strict terms such as quality guarantees and shortened payment terms may be increased

- International manufacturers (such as Volkswagen and Renault) may re-evaluate cooperation

- Damaged Brand Reputation:

- Consumers have formed the perception that “Sunwoda batteries = quality issues”

- Li Auto once launched a policy of “additional extended warranty for models equipped with Sunwoda batteries”[3]

- Joint Venture Dissolution:

- In April 2025, Geely Automobile withdrewfrom the joint venture “Shandong Geely Sunwoda Power Battery Co., Ltd.”[3]

- In April 2025,

This lawsuit exposes the hidden concerns behind the rapid expansion of the new energy battery industry[3][4]:

| Aspect of the Problem | Specific Performance |

|---|---|

Consequences of Price Wars |

Second-tier manufacturers seize market share by “low prices and high volumes”, and relax quality control |

Complexity of System Integration |

Cells, BMS, packaging, and vehicle scenarios are superimposed issues, not single-point failures |

Narrow Fault Tolerance Space |

As a core component, cell quality issues are directly related to consumer safety |

Automakers’ Supplier Anxiety |

Zeekr once claimed “the only new energy vehicle brand with zero spontaneous combustion globally”, and fell into a trust crisis after being disproven |

| Trend | Forecast |

|---|---|

Strengthened Head Effect |

Automakers tend to choose stable suppliers such as CATL |

Differentiation of Second-Tier Manufacturers |

Focus on niche markets or “compete to the extreme” in terms of quality |

Quality System Upgrade |

Disclosure of problems and improvement roadmaps are key to rebuilding trust |

Supply Chain Transparency |

Battery supplier information will become an important consideration for consumers when purchasing cars |

| Dimension | Assessment |

|---|---|

Financial Impact |

A loss in the case will severely impact profits; the RMB 2.3 billion claim is equivalent to two years of profits being wiped out |

Stock Price Trend |

Has fallen by over 12%, facing obvious short-term pressure |

Customer Relationships |

Cooperation with Geely Group has essentially broken down, and other customers are taking a wait-and-see attitude |

Listing Process |

The Hong Kong stock listing plan may be passively delayed |

-

Case Trend:

- It is expected to enter the evidence appraisal stage, and may move towards a phased settlement

- Viridi’s claim of RMB 2.314 billion is to leave room for negotiations, and the actual compensation may be significantly reduced

-

Prospects for Customer Expansion:

- Domestic Customers: Li Auto, XPeng, etc. may maintain cooperation but will strengthen quality constraints

- International Customers: Volkswagen, Renault, etc. may suspend in-depth cooperation and wait for the lawsuit result

- Emerging Customers: New power automakers will be more cautious in selecting suppliers

-

Industry Restructuring:

- Second-tier battery manufacturers face increased survival pressure, and industry integration accelerates

- Quality will become the core competitive variable, and the “low-price strategy” will be unsustainable

[1] ESM China - “Sunwoda’s Subsidiary Involved in RMB 2.3 Billion Power Battery Quality Dispute” (https://www.esmchina.com/news/13792.html)

[2] Beijing News - “An Old Debt and a Gamble: Sunwoda’s ‘Year-End Crisis’” (https://www.bjnews.com.cn/detail/1767575117168698.html)

[3] NetEase/Sina Finance - “Sunwoda Hit with RMB 2.3 Billion Sky-High Claim, Exposing the ‘Quality Fester’ Behind the Fierce Competition in the Battery Industry” (https://www.163.com/dy/article/KIKU01T60556BMXG.html, https://cj.sina.cn/articles/view/3656659427/d9f431e3001018n54)

[4] Eastmoney - “Sunwoda’s Subsidiary Suddenly Hit with RMB 2.3 Billion Claim Over Cell Quality Issues” (https://wap.eastmoney.com/a/202512273603570473.html)

[5] Qianzhan Industry Research Institute - “Competition Pattern and Ranking of China’s Lithium Battery Industry” (https://finance.sina.com.cn/roll/2025-11-20/doc-infxzvma0848641.shtml)

[0] Gilin AI API Market Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.