Analysis of the Impact of Intel's 18A Process Volume Production on Turning Its Foundry Business to Profit

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data, I now present a systematic and comprehensive analysis report for you.

According to Intel’s Q3 2025 earnings report (10-Q filing) [0] and industry analysis [1]:

| Time Period | Revenue | Operating Loss | Loss/Revenue Ratio |

|---|---|---|---|

| First 9 months of 2025 | $13B | $8B | 61.5% |

| Q3 2025 | $4.24B | $2.3B | 54.2% |

| Full Year 2024 | - | Billions of USD | Sustained Losses |

- Intel’s overall operating income in Q3 2025 was $683 million, but the foundry business alone remained in a state of severe losses [0]

- Intel’s capital expenditures reached $25-$28 billion in 2024, mainly used for advanced process fab construction [1]

- The company’s net profit in the first 9 months of 2025 was $359 million, which was mainly achieved through proceeds from asset disposals (such as the Altera divestiture) [0]

- Insufficient Capacity Utilization: Advanced process fabs are in the ramp-up phase, making it difficult to allocate fixed costs

- Weak Customer Base: External customer orders are limited, and internal product migration is lagging

- Competitive Pricing Pressure: Low-price strategies are needed to attract customers, further compressing profit margins

- Huge Depreciation and Amortization: Investment in advanced process equipment is substantial, which continuously erodes profits during the depreciation period

According to market reports [2][3]:

| Metric | Intel 18A | TSMC 2nm |

|---|---|---|

Volume Production Time |

January 2025 (Fab 52, Arizona) | 2026 (planned) |

Performance Improvement |

25% performance increase or 36% power reduction compared to Intel 3nm | 10-15% performance increase, 30% power reduction compared to 3nm |

Transistor Density |

Industry-leading | ~100-120 MTr/mm² |

Yield (Q3 2025) |

55% | Expected 60% |

Foundry Quotation |

~$20,000 per wafer | ~$25,000 per wafer (estimated) |

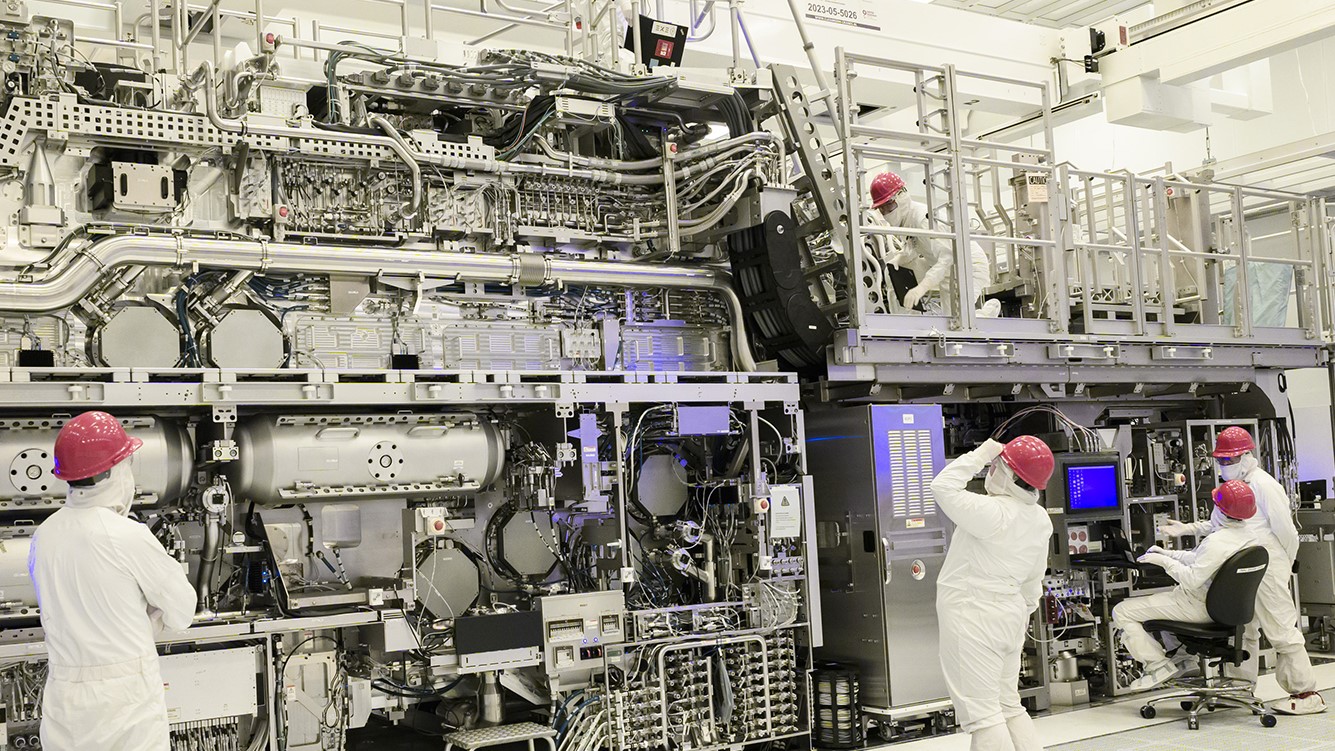

- RibbonFET (Gate-All-Around Transistor): Intel’s first introduction in a foundry node

- PowerVia (Backside Power Delivery): Industry-first technology that optimizes power delivery

- Foveros Direct 3D & EMIB 3.5D: Advanced packaging technologies

| Customer | Chip Type | Deal Scale | Status |

|---|---|---|---|

Microsoft |

Custom Chips | $15 billion lifetime value | Design locked, volume production in 2025 |

Amazon AWS |

Custom Graviton | Billions of USD | Evaluation and design phase |

Apple |

Entry-level M-series | Potential partnership | Considering adoption in 2027 |

According to industry reports [4], Intel is facing significant resistance in acquiring foundry customers:

- Nvidia Suspends Testing: Has halted 18A process testing and production plan evaluation, which is a major blow to Intel

- Broadcom Did Not Place Orders After Evaluation: Neither of the two major AI chip design giants has confirmed orders

- Customer Structure Issues: Current customers are mostly small and medium-sized design companies, lacking high-margin orders such as AI accelerators

- Revenue Growth: With the ramp-up of 18A capacity, foundry revenue is expected to grow by more than 50% in 2026

- Improved Capacity Utilization: Capacity release from Fab 52 improves fixed cost allocation

- Customer Expansion: Potential customers such as Apple and Google join

- Break-even Timeline: Achieve positive operating profit margin for the foundry business in 2027

| Risk Type | Details | Impact Level |

|---|---|---|

Technology Risk |

Yield ramp-up falls short of expectations (current 55%) | High |

Market Risk |

Unable to compete with TSMC for AI chip orders | High |

Financial Risk |

Sustained losses consume cash reserves | Medium |

Policy Risk |

Uncertainty regarding CHIPS Act subsidies | Low |

- Customer Diversification: Secure orders from at least 3 top-tier chip design companies

- Yield Improvement: Reach over 70% by the end of 2026

- Capacity Utilization: Reach over 60%

- Order Backlog: Lifetime value exceeds $30 billion

According to the latest market data [0]:

| Time Period | Price Change |

|---|---|

| Past 6 Months | +93.89% |

| Past 1 Year | +113.17% |

| Current Price | $42.66 |

| Market Capitalization | $187.59B |

- Bullish View: Forbes analysis suggests that the success of the foundry business could push the valuation to $60-$65 per share [2]

- Bearish View: The consensus target price among analysts is only $39.00 per share (8.6% discount to the current price) [0]

- Rating Distribution: Buy 31.3%, Hold 54.2%, Sell 14.5% [0]

The volume production of Intel’s 18A process marks a major breakthrough in its foundry business, but

| Phase | Timeframe | Expected Progress |

|---|---|---|

Capacity Ramp-Up Phase |

2025 | Gradual improvement in capacity utilization |

Customer Expansion Phase |

2025-2026 | More external customers place orders |

Break-Even Phase |

2027 | Positive operating profit for the foundry business |

Scale Effect Phase |

After 2027 | Cost advantages emerge, profitability improves |

[0] Intel Corporation 10-Q Filing (Q3 FY2025), SEC.gov, https://www.sec.gov/Archives/edgar/data/50863/000005086325000179/intc-20250927.htm

[1] “The Physics of Money: Why TSMC Has Won the AI War”, StayingRational Substack, https://stayingrational.substack.com/p/the-physics-of-money-why-tsmc-has

[2] “The Silicon Renaissance: Intel Reclaims the Throne as 18A Enters High Volume Production”, FinancialContent Markets, https://markets.financialcontent.com/wral/article/tokenring-2026-1-5-the-silicon-renaissance-intel-reclaims-the-throne-as-18a-enters-high-volume-production

[3] “Intel’s Foundry Strategy Under Scrutiny Amid Nvidia’s 18A Testing Halt”, AInvest, https://www.ainvest.com/news/intel-foundry-strategy-scrutiny-nvidia-18a-testing-halt-2512/

[4] “How Intel Stock Can Jump 50%”, Forbes, https://www.forbes.com/sites/greatspeculations/2025/12/11/how-intel-stock-can-jump-50/

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.