Analysis of the Impact of Operators' Computing Power Network Investment on Equipment Vendors like ZTE

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and analysis, I now provide you with a systematic and comprehensive analysis report.

The continuous expansion of operators’ computing power network investment has brought

The investment logic of China’s operators is currently undergoing a

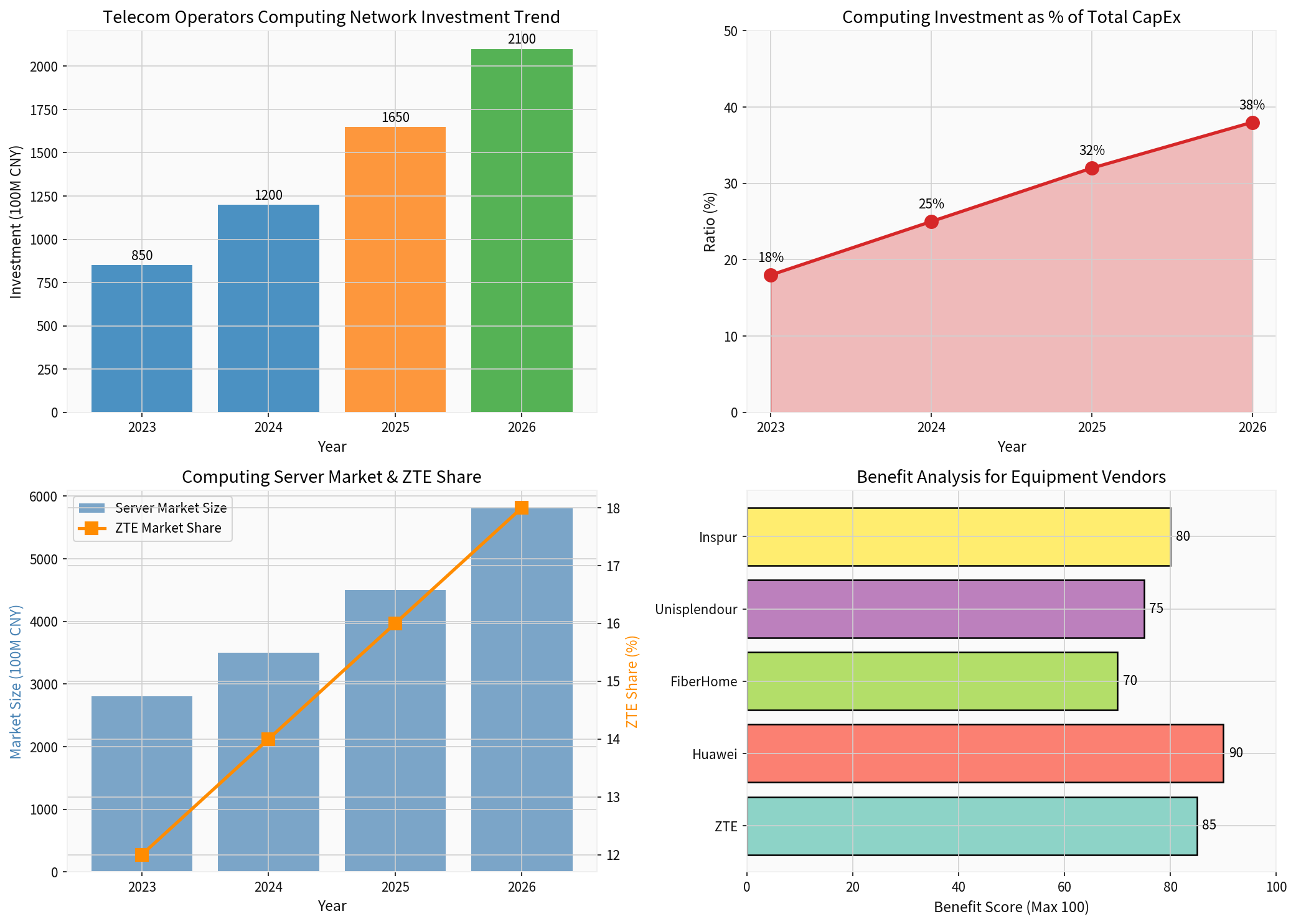

| Indicator | 2023 | 2024 | 2025 | 2026 (Forecast) |

|---|---|---|---|---|

| Computing Power Network Investment (RMB 100 million) | 850 | 1200 | 1650 | 2100 |

| Proportion of Total Capital Expenditure | 18% | 25% | 32% | 38% |

| YoY Growth Rate | - | +41% | +38% | +27% |

From the perspective of investment structure, operators’ computing power investment is mainly concentrated in the following areas:

- Data Center Cluster Construction: Focus on promoting the construction of large-scale data center clusters in computing power hub nodes such as the Beijing-Tianjin-Hebei, Yangtze River Delta, and Guangdong-Hong Kong-Macao Greater Bay Areas [1]

- Intelligent Computing Server Procurement: In the first half of 2025, China Mobile issued a bid for approximately 7,058 units of artificial intelligence general computing devices (inference type) [3]

- Liquid Cooling Technology Deployment: Promote the universal PUE of new large-scale data centers to be lower than 1.25, achieving coordinated development of computing power growth and energy consumption reduction [1]

- Cross-regional Computing Power Scheduling: Optimize the layout of computing power nodes in central and western regions to improve the scheduling efficiency of the national computing power network

As of the first quarter of 2025, the total computing power scale of China’s “East Data West Computing” eight hub nodes reached

According to industry data, the concentration of China’s server market is steadily increasing, with ZTE, Inspur, Huawei FusionServer, and H3C collectively accounting for

The figure above shows: (1) The continuous growth trend of computing power network investment by the three major operators; (2) The rapid increase in the proportion of computing power investment in total capital expenditure; (3) The simultaneous growth of the computing power server market size and ZTE’s market share; (4) A comparison of the benefit levels of major equipment vendors.

ZTE’s core competitive advantages in the computing power field are reflected in the following technological breakthroughs:

ZTE proposed the new “

The equipment market driven by operators’ computing power investment presents the following competitive characteristics:

| Equipment Vendor | Competitive Advantage | Benefit Level Score |

|---|---|---|

| Huawei | Full-stack solution capabilities, ecological integration advantages | 90 |

| ZTE | Intelligent Computing Super Node technology, market share growth | 85 |

| Inspur Information | Server scale advantages, AI server layout | 80 |

| H3C Technologies | Network equipment foundation, computing-network integration capabilities | 75 |

| FiberHome Communications | Optical communication foundation, high growth of computing power business | 70 |

- AI Computing Power Servers: Operators have increased their demand for artificial intelligence computing power servers, and ZTE has built differentiated competitiveness based on self-developed chips [3]

- Liquid Cooling Supporting Equipment: Liquid cooling has entered the 0-1 demand release period at home and abroad, and higher-density computing power architectures have increased the application certainty of liquid cooling solutions [4]

- Optical Communication Equipment: Hollow-core optical fibers have been industrially applied in data center scenarios, benefiting enterprises such as FiberHome Communications significantly [4]

- Edge Computing Power Equipment: End-side AI competition has extended from “small toys” to “big tools” such as mobile phones, driving the growth of edge computing power demand [4]

According to the latest financial data, ZTE’s current market capitalization is approximately

| Financial Indicator | Value | Industry Position |

|---|---|---|

| ROE (Return on Equity) | 7.92% | Above average |

| Net Profit Margin | 4.43% | Stable |

| Current Ratio | 1.82 | Healthy |

| Quick Ratio | 1.23 | Good |

| Debt Risk | Low | Financially secure |

Institutions expect that as a core industry asset, ZTE will benefit from the dividends of the AI computing power chain and new-quality productive forces policies, with strong certainty in performance growth, and its

- Performance realization brought by the large-scale commercialization of 5G-A

- Continuous penetration of AI-native networks and low-altitude economy scenarios

- Steady increase in overseas market share

- Computing power businessbecoming a new growth engine

- Industry Cycle Risk: Network investment is still affected by the industry cycle, and 5G investment has passed the high-growth period [2]

- Commercialization Process Risk: The formation of a commercial closed-loop for intelligent computing business still takes time, and the profit model needs to be verified [2]

- Geopolitical Risk: Global geopolitical fluctuations may affect overseas market expansion

- Gross Margin Pressure: Intensified industry competition may lead to a decline in gross margin

- Technological Iteration Risk: The rapid iteration of AI technology increases the pressure of product updates

- Increase R&D investment to maintain technological leadership

- Expand diversified customers to reduce dependence on a single customer

- Optimize cost structure to improve operational efficiency

- Accelerate the commercialization of intelligent computing business

The continuous expansion of operators’ computing power network investment has brought

- Market Scale Expansion: China’s computing power market size is expected to reachRMB 835.1 billionin 2025, with a YoY growth rate of over 30% [3]

- Business Structure Optimization: The computing power business has become a new growth engine, promoting the upgrading of revenue structure

- Valuation Reassessment Opportunity: Transformation from a traditional communication equipment stock to a “core infrastructure of the digital economy”

As a leader in the communication equipment industry, ZTE has the following investment values:

| Dimension | Evaluation |

|---|---|

Growth |

Benefiting from computing power investment dividends, with strong certainty in performance growth |

Stability |

The network business serves as a “ballast” for profits, with stable cash flow |

Valuation |

A PE ratio of 31x is at the lower end of the historical range, with room for recovery |

Technological Barrier |

Core technologies such as Intelligent Computing Super Node form differentiated advantages |

[1] 2026 Operator Investment Outlook: How Big is the Market This Year? - CNfol Online Finance Channel

[2] Fang Rong, Chairman of ZTE: Forge Ahead, Achieve In-depth Breakthroughs, and Create a Digital-Intelligent Future of High-Quality Development - ZTE Official Website

[3] 2025 Computing Power Industry Review: Who is the Real Winner? - Huxiu.com

[4] 2026 Communication Investment Opportunities Review: Computing Power as Core, Satellite as Wing - Sina Finance

[5] Jinling API Company Profile Data - ZTE (000063.SZ) Market Data

[6] In-depth Analysis of Investment Opportunities in the Communication Field: FiberHome Communications, ZTE - East Money Wealth Account

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.