Investment Analysis Report of Yonyou Network (600588): Over RMB 4 Billion in Losses in Three Years, Growing Pains of Cloud Transformation Coexist with New AI Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above data analysis, I will provide you with an in-depth investment research report on Yonyou Network:

Yonyou Network Technology Co., Ltd. is a leading Chinese enterprise software and cloud service provider, founded in 1988 and listed on the Shanghai Stock Exchange in 2001. Its core products include enterprise management software and cloud service solutions such as Yonyou BIP (Business Innovation Platform), NC Cloud, and U8 Cloud.

| Indicator | Value |

|---|---|

| Market Capitalization | $46.33 billion |

| Stock Price | RMB 13.26 |

| P/E | -23.12x |

| P/B | 6.25x |

| Beta Coefficient | 0.40 |

According to the prospectus and public financial report data, Yonyou Network has experienced a sharp shift from profitability to huge losses in the past three years [1]:

| Fiscal Year | Operating Revenue (RMB 100 million) | Net Profit (RMB 100 million) | YoY Change |

|---|---|---|---|

| 2022 | 88.90 | +2.25 | Net Profit +3.4% |

| 2023 | 94.43 | -9.33 | Switched from profit to loss |

| 2024 | 88.17 | -20.70 | Loss expanded by 122% |

| 2025 First Three Quarters | 55.84 | -13.98 | Loss continues |

- 2023 was a turning point for Yonyou Network; after maintaining profitability for consecutive years, it fell into a quagmire of losses ever since

- In 2024, the loss reached RMB 2.07 billion, expanding by 122% compared to 2023, a staggering loss magnitude

- In the first half of 2025, the loss was RMB 981.3 million, which has exceeded the full-year loss of 2023, and the loss trend has not been effectively contained [1]

Yonyou Network attributes its losses to two core factors in its prospectus [1]:

- The complex business needs of top-tier customers have significantly increased the complexity of implementation and delivery

- Delivery cycles have been extended, and project payment collection cycles have been prolonged

- Increased customized demand from large enterprise customers has driven up labor and time costs

- During the promotion of new-generation cloud service products, R&D and promotion expenses remain high

- R&D costs in the first half of 2025 reached RMB 1.125 billion, accounting for 32.8% of total revenue [1]

- The gross profit margin of the cloud service business (accounting for 77% of total revenue) has continued to decline, dropping from 54.8% in 2022 to 45% in 2024

| Indicator | 2022 | 2023 | 2024 | H1 2025 |

|---|---|---|---|---|

| Overall Gross Profit Margin | 55.0% | 51.0% | 46.0% | YoY down 4pct |

| Cloud Service Gross Profit Margin | 54.8% | 49.5% | 45.0% | YoY down 2.9pct |

The continuous decline in gross profit margin reflects the “growing pains” during the cloud transformation: although the cloud service business accounts for 77% of revenue, its profitability is actually lower than that of the traditional software business, forming the awkward situation of “the more we transform, the more we lose” [1].

From the perspective of revenue structure, Yonyou Network’s cloud transformation has indeed made remarkable progress:

| Time Node | Proportion of Cloud Service Revenue |

|---|---|

| 2022 | 56% |

| 2023 | 67% |

| 2024 | 77% |

| 2025 First Three Quarters | 77% |

| H1 2025 | 80% |

This data indicates that Yonyou has transformed from a traditional software company to a technology company focused on cloud services [1]. As of June 30, 2025, the company has accumulated 6,065 large enterprise customers, 13,837 medium-sized enterprise customers, and 491,043 small and micro enterprise customers for cloud services, with a solid customer base.

However, cloud transformation is not a smooth road:

- In 2024, the revenue of the cloud service business was RMB 6.804 billion, a year-on-year decrease of 3.4% (2023: RMB 7.048 billion) [1]

- In the first half of 2025, the revenue of the cloud service business was RMB 2.747 billion, a year-on-year decrease of 3.6%

- In 2024, the gross profit margin of cloud services was 45%, 11.6 percentage points lower than that of the software product business

- The cloud service business should be a high-margin business, but its current profitability has instead become a drag

- Free cash flow in 2024 was -$2.033 billion (approximately -RMB 14.7 billion) [0]

- As of June 30, 2025, cash and cash equivalents decreased by approximately 51% compared to the end of 2024 [1]

Wang Wenjing, founder of Yonyou Network, resumed the position of chairman in March 2025, marking his third time at the helm of the company [1]:

| Time | Tenure Status | Background |

|---|---|---|

| Early Years | First tenure as chairman | Led Yonyou to become China’s ERP leader |

| 2023 | Resigned as chairman | Handed over to professional managers |

| 2024 | Chen Qiangbing → Huang Chenhong | Frequent leadership changes, unstable strategy |

| March 2025 | Wang Wenjing returns for the third time | Reverse the loss trend |

The multiple changes in management within less than one and a half years reflect the company’s strategic confusion and performance pressure during the critical period of cloud transformation.

- The number of employees was reduced to 21,313 by the end of 2024, a decrease of 3,666 compared to the beginning of the year

- It further dropped to 19,135 by the end of June 2025, a decrease of 2,178 compared to the beginning of the year

- A total of 5,844 employees have been laid off in the past one and a half years, controlling costs by improving labor efficiency [1]

- Announced the intention of a secondary listing in Hong Kong in April 2025

- Submitted the prospectus for the first time in July 2025

- Updated the prospectus to supplement performance at the end of 2025, accelerating the listing process [1]

- Launched the enterprise application large language model YonGPT in 2023

- Launched the AI application suite Yonyou BIP Enterprise AI in 2025

- Released the BIP “Ontology Agent” in January 2026 [1]

After Wang Wenjing returned to the helm, the company has indeed shown some positive signs:

| Indicator | Change | Explanation |

|---|---|---|

| Revenue Growth Rate | Q1 YoY -21.22% → Q2 +7.1% → Q3 +3.65% | Revenue resumes growth |

| Gross Profit Margin Decline | Slowing magnitude | Improved product maturity |

| Backlog Orders | Increased from RMB 6.017 billion to RMB 6.322 billion | 5.1% increase |

However, these improvements are still insufficient to reverse the loss situation, with a loss of RMB 1.398 billion in the first three quarters of 2025 [1].

Yonyou Network is actively embracing the AI wave:

| Time | AI Progress |

|---|---|

| 2023 | Launched the enterprise application large language model YonGPT |

| 2025 | Launched the AI application suite Yonyou BIP Enterprise AI |

| January 2026 | Released the BIP “Ontology Agent” |

AI technology is mainly integrated into Yonyou BIP series products, embedded in enterprise business processes and management scenarios.

- AI is the next growth engine for the enterprise software industry

- The 700,000 enterprise customers accumulated by Yonyou provide natural scenarios for AI applications

- YonGPT has been implemented in scenarios such as finance, human resources, and supply chain

- Continuous increase in AI R&D investment further exacerbates capital pressure

- Intensified competition with tech giants such as Huawei, Alibaba, and Tencent

- Tight book funds; as of June 30, 2025, the book funds cannot cover short-term debts [1]

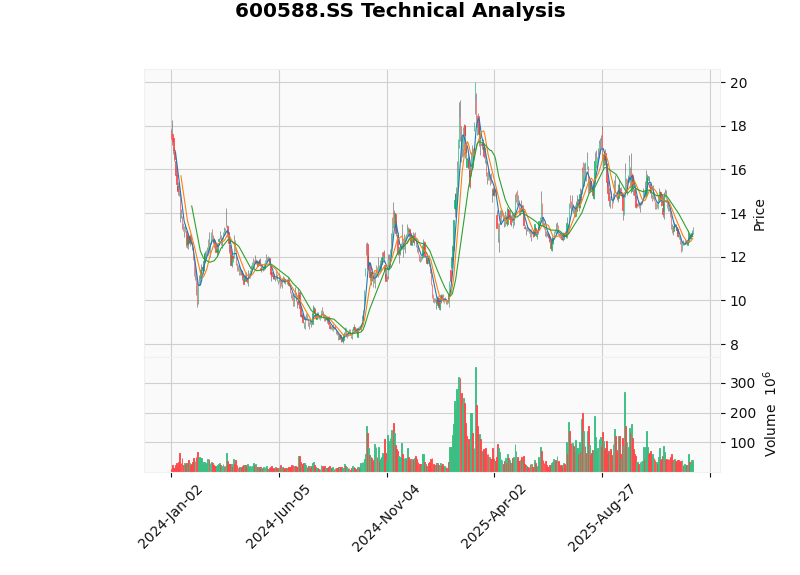

Yonyou Network’s stock price has experienced a deep correction:

| Period | Change Rate |

|---|---|

| Past 1 Year | +34.26% |

| Past 3 Years | -44.31% |

| Past 5 Years | -69.02% |

| Indicator | Value | Signal Interpretation |

|---|---|---|

| 20-Day Moving Average | RMB 12.93 | Short-term support level |

| 50-Day Moving Average | RMB 13.96 | Medium-term resistance level |

| 200-Day Moving Average | RMB 14.39 | Long-term resistance level |

| KDJ | K:75.3, D:62.9, J:100 | In overbought zone |

| MACD | No crossover | Bullish-leaning signal |

| Beta | 0.40 | Low correlation with the broader market |

- The stock price is in a sideways consolidation pattern with no clear trend direction

- Trading range reference: support level at RMB 12.93, resistance level at RMB 13.43

- The short-term KDJ indicator is in the overbought zone, potentially facing adjustment pressure

Yonyou Network faces multi-dimensional competitive pressure:

| Competitor | Advantage Areas | Competitive Situation |

|---|---|---|

| Kingdee International | SME ERP | Traditional strong competitor, continues to erode market share |

| Huawei | Government and enterprise market | Strongly enters based on HarmonyOS ecosystem |

| Alibaba Cloud/DingTalk | Enterprise collaboration | Price war and ecosystem advantages |

| SAP/Oracle | High-end market | Advantages in multinational enterprise customers |

Based on 2024 revenue, Yonyou is the largest player in China’s enterprise software and service market with a 4.1% market share, but it faces continuous challenges from competitors such as Kingdee and Huawei [1].

| Risk Type | Specific Description | Risk Level |

|---|---|---|

| Performance Risk | Losses continue to expand, timeline for loss reversal is uncertain | High |

| Cash Flow Risk | Rapid cash consumption, liquidity pressure | High |

| Valuation Risk | Negative P/E, profit model not yet verified | High |

| Competition Risk | Continuous competition from Huawei, Kingdee, etc. | Medium |

| Technology Risk | High investment in AI transformation, uncertain returns | Medium |

| Indicator | Value | Evaluation |

|---|---|---|

| P/E | -23.12x | In loss status, cannot use P/E for valuation |

| P/S | 5.15x | Higher than historical average |

| P/B | 6.25x | Higher than the software industry average |

Yonyou Network is in the deep-water zone of cloud transformation and the initial stage of AI transformation, facing “three major challenges”:

- Performance Pressure: Accumulated losses of over RMB 4 billion in three years, losses continued to expand in 2024-2025

- Transformation Pains: Although the proportion of cloud service revenue has reached 77%, the gross profit margin has continued to decline, falling into the dilemma of “increasing revenue without increasing profits”

- Capital Pressure: Tight cash flow, secondary listing in Hong Kong is key to “capital infusion”

- After Wang Wenjing returned for the third time, management stability has improved

- Revenue resumed growth in the second and third quarters of 2025, indicating an initial inflection point

- Leading layout in AI transformation, which may become a new growth engine

- Solid customer base (700,000 enterprise customers)

| Dimension | Rating | Explanation |

|---|---|---|

| Short-term | Wait-and-See |

Losses continue, technical indicators are overbought |

| Medium-term | Cautious |

Pay attention to the progress of Hong Kong listing and performance improvement |

| Long-term | Under Observation |

The effectiveness of AI transformation and timeline for loss reversal are key |

- Whether the 2025 annual report can achieve a narrowing of losses

- Whether the secondary listing in Hong Kong can successfully complete fundraising

- Whether the AI business can contribute substantial revenue in 2026

The growing pains of Yonyou Network’s cloud transformation cannot be completely eliminated in the short term, but Wang Wenjing’s return and the advancement of the AI strategy have brought new hope for the company’s transformation. The success of the secondary listing in Hong Kong will be a key variable for the company to weather the current difficulties. If it can successfully raise funds and effectively control costs, the company is expected to reverse losses in 2026-2027; if fundraising is not smooth or losses continue to expand, the company will face more severe survival challenges.

[1] Eastmoney.com - Caifuhao. “Sprinting for Hong Kong Listing, Yonyou Urgently Needs ‘Capital Infusion’” (January 5, 2026). https://caifuhao.eastmoney.com/news/20260105214755427834490

[2] Jinling AI Financial Database. Yonyou Network (600588.SS) Company Overview and Technical Analysis Data (January 7, 2026).

[3] Jinling AI Financial Database. Yonyou Network (600588.SS) Financial Analysis Data (January 7, 2026).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.