In-Depth Study of SF Express' Exit from Douyin E-Commerce Return Business and Profitability Challenges in the Courier Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above in-depth research, I will provide you with a systematic and comprehensive analysis report.

On December 19, 2025, according to 36Kr reports, SF Express did not participate in the bidding for Douyin’s 2026 e-commerce return service, actively abandoning this business market [1]. This decision marks the termination of the years-long cooperation between SF Express and Douyin E-Commerce, and subsequent return fulfillment will be gradually taken over by logistics service providers such as JD Logistics, ZTO Express, and YTO Express [2].

SF Express later responded that the termination of this cooperation was a “natural expiration of the contract” and a normal commercial activity [2]. However, in-depth analysis shows that this decision is underpinned by profound strategic considerations.

The live-stream e-commerce industry represented by Douyin E-Commerce has a significantly higher return rate than traditional e-commerce. According to industry forecasts, the total number of e-commerce returns in 2025 is expected to reach approximately 12 billion pieces [1]. However, this huge market has obvious structural contradictions:

| Indicator | Industry Status |

|---|---|

| Douyin return single-ticket fee | Approximately RMB 2 per ticket |

| SF Express standard door-to-door return fee | RMB 5 per ticket |

| SF Express self-drop-off fee at outlets | RMB 18-25 per ticket |

This price gap reveals the fundamental conflict between e-commerce platforms’ extreme pursuit of reverse logistics cost control and courier companies’ profit demands [1][2].

China’s courier industry has experienced a long period of price decline. According to data from the State Post Bureau, the average domestic courier single-ticket price has continued to decline from RMB 28.55 in 2007 to RMB 7.49 by June 2025 [3]. Especially between 2015 and 2024, the price was almost halved, dropping from RMB 13.40 to RMB 8.02 [3].

The figure above clearly shows this downward trend:

- 2007: RMB 28.55 (Industry startup phase)

- 2015: RMB 13.40 (E-commerce boom phase)

- 2024: RMB 8.02 (Peak price war phase)

- 2025: Approximately RMB 7.48 (Anti-involution adjustment phase)

The formation of price wars stems from the superposition of multiple factors:

- E-commerce parcels account for more than 70% of courier business volume

- Platforms obtain strong price negotiation power through concentrated orders

- In the first half of 2025, in major e-commerce hubs such as Yiwu, extreme low prices of “RMB 0.8 for nationwide delivery” even emerged [3]

- “Tongda System” companies compete for market share through low-price strategies

- The vicious cycle of trading price for volume puts pressure on the overall industry profits

- J&T Express rose rapidly with low-price strategies

- The price war was particularly intense between 2019 and 2021

According to the first three quarters of 2025 financial report data, major courier enterprises show the characteristics of “general scale growth, profit differentiation” [4][5]:

| Enterprise | Operating Revenue (RMB 100 million) | Revenue Growth Rate | Net Profit Attributable to Shareholders (RMB 100 million) | Net Profit Growth Rate | Non-Recurring Profit and Deducted Net Profit Growth Rate |

|---|---|---|---|---|---|

| SF Express | 2,252.61 | 8.89% | 83.08 | 9.07% | 0.52% |

| STO Express | 385.70 | 15.17% | - | - | 18.71% |

| YTO Express | 541.56 | 9.69% | - | - | -1.70% |

| Yunda Express | 347.93 | - | - | - | - |

| ZTO Express | 346.88 | - | - | - | - |

As a leading enterprise in the courier industry, SF Express’ financial performance is particularly worthy of attention:

- Revenue grew by 8.89%, but non-recurring profit and deducted net profit only grew by 0.52%

- The growth rate gap reached 8.37 percentage points, indicating that profit growth lags far behind revenue expansion [4]

- Q1 2025: 13.3%

- Q2 2025: 13.1%

- Q3 2025: 12.5% [1]

Showing an obvious quarterly downward trend, the decline in single-quarter comprehensive gross profit margin reflects the profitability pressure brought by business structure changes.

- Since September 2022, the single-ticket revenue of SF Express’ logistics business has been in negative growth

- In August 2025, the decline rate reached as high as 15.32%

- For 9 consecutive months, the decline rate has exceeded that of A-share franchise-based peers [2]

- Labor costs continue to rise

- Transportation costs fluctuate due to oil prices

- Pressure from site rent and equipment depreciation is increasing

- STO Express achieved coordinated growth in revenue and profit (15.17% revenue growth, 18.71% non-recurring profit and deducted net profit growth) [4]

- YTO Express fell into the dilemma of “increasing revenue without increasing profits” (9.69% revenue growth, -1.70% non-recurring profit and deducted net profit growth) [4]

- Industry profit margins are continuously compressed

- Low-price competition leads to declining service quality

- Problems such as rough sorting, delivery delays, and lost parcels occur frequently

- Consumer complaint volume remains high

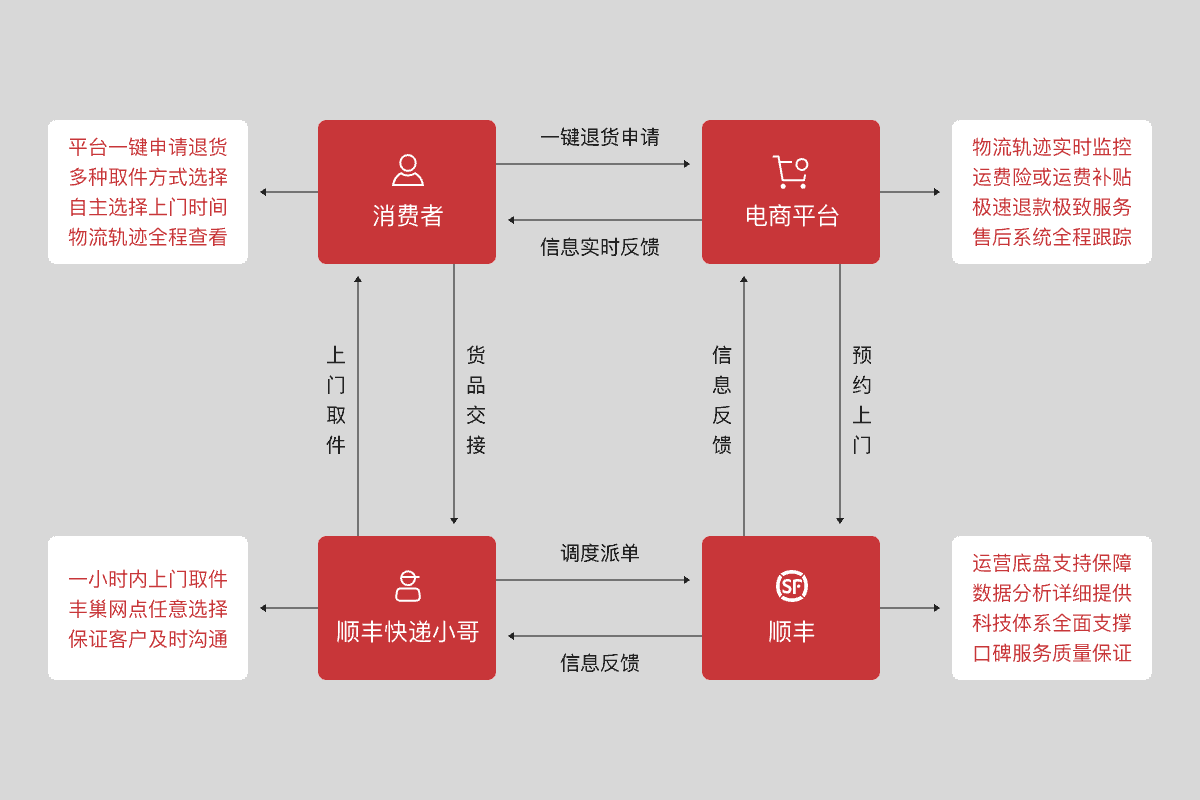

Zhao Xiaomin, an expert in the courier industry, pointed out that the cost of reverse logistics is higher than that of outgoing shipments, as it involves procedures such as scheduling couriers to visit and opening packages for inspection [2]. At the current stage, SF Express focuses on “lean growth”, increasing market share and competitiveness, improving profit performance, and enhancing customer stickiness, which is inconsistent with the platform’s cost-oriented logic of pursuing extreme cost reduction and efficiency [2].

Facing profitability pressure, SF Express has launched the “Value Enhancement Plan”:

- Core Strategy: Rational pricing, optimizing customer structure, and adjusting parcel volume structure

- Goal: Increase the proportion of high-value customers

- Implementation: In view of the characteristics of consolidated e-commerce parcels and consolidated return parcels, actively introduce local and external resources for separate network operations [2]

SF Express’ exit from Douyin’s return business can be regarded as an important signal of its high-end strategy:

- Abandon low-margin reverse logistics business

- Focus resources on high-value-added fields such as time-sensitive parcels, cold chain, and pharmaceuticals

- Reshape competitive advantages through service differentiation

On July 29, 2025, the State Post Bureau held another symposium on rectifying “involutionary” competition, directly addressing the pain points and chronic problems of the industry [3]. This is the second intervention in a year, demonstrating the regulators’ emphasis on the healthy development of the industry.

Under policy guidance, the anti-involution price increase campaign expanded rapidly [3][6]:

| Time | Region | Price Adjustment Measures |

|---|---|---|

| July | Yiwu | The minimum single-ticket price was raised by RMB 0.1, with the base price increased to RMB 1.2 |

| July-August | Guangdong (Foshan, Zhongshan, Shenzhen) | Announced courier fee increases successively |

| November | National core regions | “Three Links and One Reach” (Tongda System) and J&T Express completed price adjustments, with single-ticket prices for e-commerce customers within 1kg increased by RMB 0.3-0.5 |

The anti-involution campaign has achieved initial results [3][4]:

- Industry single-ticket revenue rebounded continuously

- September single-ticket revenue reached RMB 7.55, hitting a new high for the year

- The dilemma of “increasing volume without increasing revenue” has loosened

- Courier enterprises’ profits recovered in the second half of the year

However, policy implementation faces certain challenges [3]:

- Lack of Rigidity in Policy Constraints: Price implementation is not in place in some regions

- Profit Differentiation Among Outlets: Outlets in high-volume regions reported increased shipping costs, but business volume assessment targets were not reduced

- Delayed Delivery Fee Adjustments: The delivery fee increase expected by frontline outlets has not been fully implemented yet

Current major courier enterprises show obvious strategic differentiation:

- Strategy: Full-line penetration, no longer solely relying on high-end parcels

- Result: Business volume growth rate has led the industry for 9 consecutive months

- Focus: High-value-added fields such as time-sensitive parcels, cold chain, and pharmaceuticals

- Focus on aviation (established ZTO Aviation, acquired Zhejiang Xinglian)

- Focus on cloud warehouse technology financing

- Goal: From “scale leadership” to “capability leadership”

- Secured RMB 10 billion in loans

- Strategic focus shifted to adjusting customer structure, focusing on mid-to-high-end customers

- Replicating the “Southeast Asian Miracle” overseas

- Acquired Dan Niao, launching the “franchise + direct operation” dual-drive model

- Core Strategy: “Experience First, Synergy and Efficiency, In-Depth Structural Cultivation”

- Goal: From scale expansion to quality upgrading

- “Oriental World Port” was officially put into operation

- “Digitalization, Intelligence, Internationalization” strategy

- Transforming into a global supply chain integrator

From automated warehousing to AI customer service, from dynamic routing planning to unmanned delivery, intelligent technology is becoming a new arena for industry competition [4]:

| Enterprise | Intelligent Layout |

|---|---|

| SF Express | Strategically invested in White Rhino (unmanned delivery vehicle company) and Quicktron Technology (logistics robot company) |

| JD Logistics | “Smart Wolf” elevator robots, “Ground Wolf” handling robots, and a million-level robot procurement plan |

| China Post | Purchased 7,000 unmanned vehicles to build the world’s largest low-speed unmanned logistics network |

| ZTO, YTO, STO Express | Large-scale deployment of automated sorting equipment and expansion of unmanned delivery coverage |

- Pure business volume competition will gradually give way to comprehensive competition in service quality, supply chain solutions, international networks, and technological capabilities

- Leading enterprises must, while consolidating scale advantages, seek breakthroughs through technological cost reduction and service quality improvement

- Demand for product structure upgrading: Pharmaceuticals, cold chain, and high-end electronic products have higher requirements for timeliness and temperature control

- A must-answer question for going overseas: Cross-border business has become a new growth pole

- Key competition points: Hub efficiency, overseas localization, and integration of three networks

- “Anti-involution” → unit price rebound → headquarters profit improvement → profit sharing with franchisees → outlet compliance

- A virtuous cycle of entire network stability → service upgrading is taking shape

| Strategic Direction | Specific Measures |

|---|---|

Differentiated Positioning |

Avoid homogeneous competition and build service barriers |

Refined Cost Management |

Improve operational efficiency through digitalization and intelligence |

Customer Structure Optimization |

Increase the proportion of high-value customers and improve parcel volume structure |

International Layout |

Seize cross-border logistics dividends and build overseas networks |

Service Upgrading |

Shift from price competition to value competition, and launch innovative services such as “compensation for delays” |

- Uncertainty in Policy Implementation: The sustainability of the anti-involution effects remains to be seen

- Risk of Recurring Price Wars: The industry competition pattern is not yet fully stable

- Cost Pressure: Rigid cost increase pressure from labor, transportation, etc., persists

- Demand Fluctuations: Slowdown in e-commerce growth may affect courier business volume growth

SF Express’ exit from Douyin E-Commerce’s return business is a typical case of strategic trade-offs made by courier enterprises amid a low-price competition environment. This decision reflects the following core insights:

-

Low-price competition is unsustainable: The charging model of less than RMB 2 per ticket for Douyin’s return business is fundamentally contradictory to SF Express’ door-to-door service cost of RMB 5 per ticket

-

Profitability pressure is widespread: SF Express’ gross profit margin declined quarter by quarter in the first three quarters (13.3% → 13.1% → 12.5%), and enterprises such as STO Express and YTO Express also face varying degrees of profitability challenges

-

The industry is undergoing transformation: The 2025 “anti-involution” campaign marks the industry’s attempt to transform from price wars to value wars, and although it faces implementation challenges, initial results have been achieved

-

Strategic differentiation is intensifying: Various courier enterprises choose differentiated paths based on their own positioning — SF Express focuses on high-end transformation, ZTO Express lays out aviation networks, J&T Express focuses on customer structure optimization, and STO Express explores the “franchise + direct operation” model

-

Intelligence is the future competitive high ground: From automated sorting to unmanned delivery, technological innovation is becoming a strategic fulcrum for building differentiated advantages

Looking ahead, competition in the courier industry will no longer be a single contest of scale or price, but a comprehensive competition of overall capabilities. Enterprises that can establish sustainable competitive advantages in service quality, operational efficiency, technological innovation, and international layout will stand out in the new round of industry reshuffling.

[1] Sina Finance - “Breaking Up with Douyin’s Return Service: What Are Wang Wei’s Plans for His RMB 130 Billion Empire?” (https://finance.sina.com.cn/stock/t/2025-12-22/doc-inhcsvvh1463760.shtml)

[2] Southern Metropolis Daily - “SF Express Terminates Cooperation with Douyin’s Return Service: Contract Expired, a Normal Commercial Activity” (https://www.nfnews.com/content/r6d5nWlmoE.html)

[3] 36Kr - “Anti-Involution, Grabbing Stock, Seeking Overseas… Top 10 Moments of China’s Courier Industry in 2025” (https://m.36kr.com/p/3617872575661058)

[4] Sina Finance - “Courier Industry 2025: Who is Celebrating Stock Price Surges, Who is Struggling with Profits?” (https://finance.sina.com.cn/jjxw/2026-01-06/doc-inhfiznq5956621.shtml)

[5] OFweek - “Courier Industry 2025: Who is Celebrating Stock Price Surges, Who is Struggling with Profits?” (https://mp.ofweek.com/iot/a556714330607)

[6] Tencent News - “How Can Tongda System, J&T Express, and JD Logistics Break Through? Who Will Be Eliminated? | 2026 New Courier Industry Battle” (https://news.qq.com/rain/a/20260104A0643P00)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.