Investment Value Analysis Report on Shengyi Technology's RMB 4.5 Billion High-Performance Copper Clad Laminate Expansion Project

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I will generate a comprehensive analysis report for you.

According to the latest financial data, Shengyi Technology delivered outstanding operating results in the first three quarters of 2025 [1]:

| Financial Indicator | Value | YoY Change |

|---|---|---|

| Operating Revenue | RMB 20.614 billion | Significant Growth |

| Net Profit Attributable to Parent Shareholders | RMB 2.443 billion | +78.04% |

| Non-Recurring Net Profit | - | +81.25% |

- 2025 Q3: EPS $0.42 (1.57% above expectations), operating revenue $7.93B (1.80% above expectations)

- 2025 Q2: EPS $0.36, operating revenue $7.07B

- 2025 Q1: EPS $0.24, operating revenue $5.61B

- 2024 Q4: EPS $0.16, operating revenue $5.64B

| Indicator | Value | Evaluation |

|---|---|---|

| P/E (TTM) | 62.38x |

Relatively High |

| P/B (TTM) | 11.28x |

Relatively High |

| ROE | 18.36% |

Excellent |

| Net Profit Margin | 10.70% |

Healthy |

| Current Ratio | 1.55 |

Stable |

- Conservative Scenario: ¥22.75 (-68.6%)

- Base Scenario: ¥27.74 (-61.7%)

- Optimistic Scenario: ¥40.09 (-44.6%)

- Weighted Average Intrinsic Value: ¥30.19

According to industry research data [3][4][5], the global CCL market is undergoing structural upgrading:

| Indicator | Value |

|---|---|

| Global CCL Market CAGR (2024-2027) | 18% |

| High-End CCL Market CAGR | 40% |

| 2026 AI PCB Market Size | Approximately RMB 60 billion (YoY +229.8%) |

| M9-related Industry Chain Market Space | Exceeds RMB 140 billion |

| Platform | CCL Grade | Features |

|---|---|---|

| Current Mainstream AI Servers | M7/M8 | Widely Adopted |

2026 Rubin Platform |

M9 |

Soon to Enter Mass Production |

| 2027 Rubin Ultra | M9+/Q Cloth | Further Upgrade |

- NVIDIA plans to ship 1 million Rubin GPUs in 2026

- Each chip requires 0.5 square meters of M9 material PCB

- Directly generates approximately 500,000 square meters of M9 material PCB demand

- Corresponding to approximately 5,000 tons of M9 substrate demand[4]

According to industry dynamics [3]:

- Leading players such as Kingboard have adjusted CCL prices multiple times (August, December, and this month)

- Triple factors: rising copper prices+tight glass cloth supply+AI demand squeezing production capacity

- China Merchants Securities judges: “Price increases will be the main theme for the CCL industry in 2025-2026” [3]

According to data from Tripod Technology’s earnings conference [6], the 2024 global high-speed CCL market share:

| Ranking | Enterprise | Market Share | Remarks |

|---|---|---|---|

| 1 | Tripod Technology | 40% |

Dominant Position |

| 2 | Unimicron Technology | 19% | - |

| 3 | Taiwan Union Technology | 16% | - |

| 4 | Panasonic | 11% | - |

| 5 | Nan Ya Plastics | 5% | - |

6 |

Shengyi Technology |

5.7% |

Continuously Increasing |

| 7 | Kingboard | 4% | - |

| 8 | Doosan | 4% | - |

- Shengyi Technology’s market share increased from 4% in 2023 to 5.7%in 2024 [6]

- Its position in the high-end CCL market continues to improve

- The RMB 4.5 billion expansion project will further strengthen its competitiveness

According to estimates from China Merchants Securities [7]:

- Domestic effective production capacity supply for AI demand PCB: Approximately RMB 120 billion

- Expected demand: Approximately RMB 150 billion

- High-end PCB production capacity will remain tight in 2026

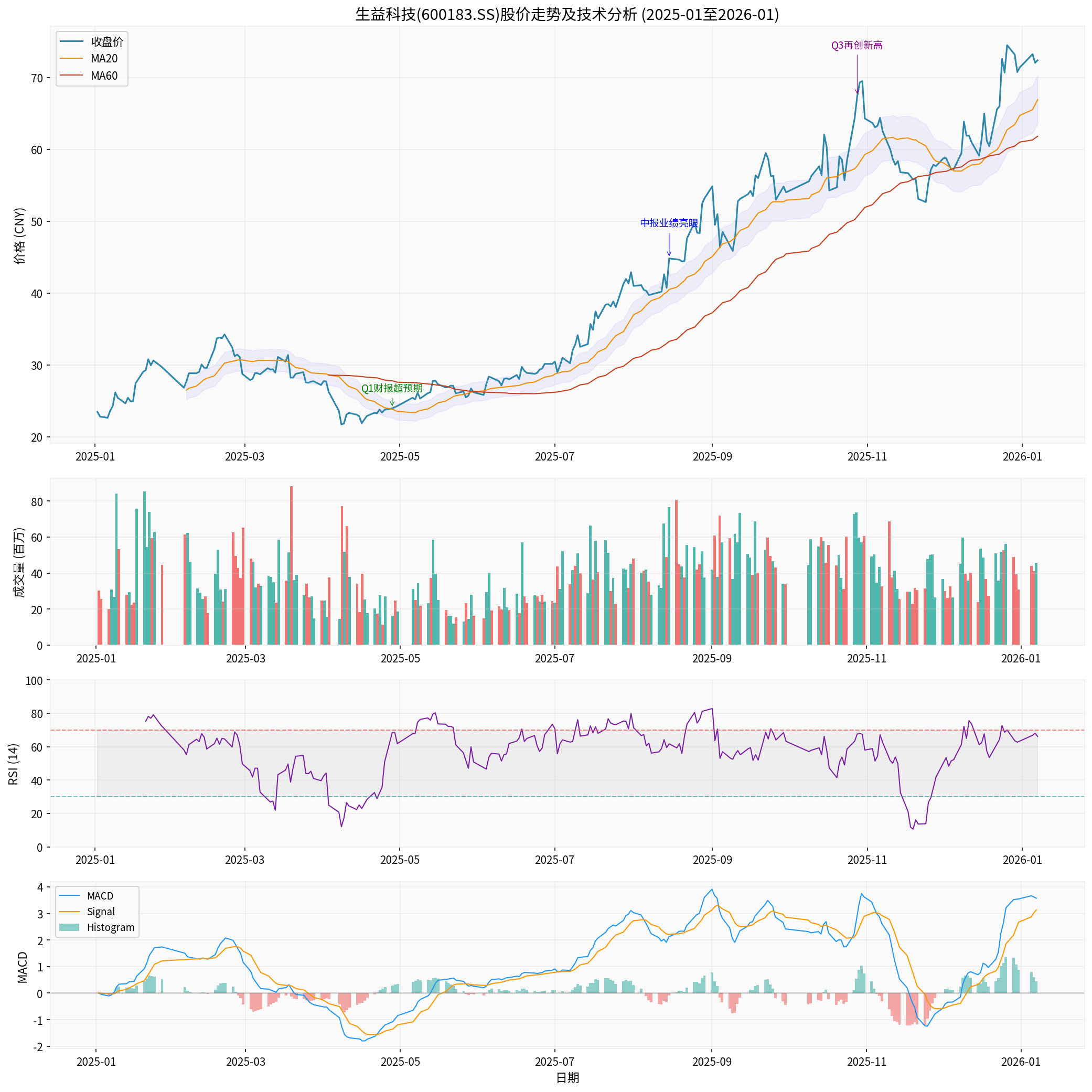

Shengyi Technology’s stock price performed strongly in 2025 [0]:

| Period | Increase |

|---|---|

| 1 Month | +26.44% |

| 3 Months | +30.31% |

| 6 Months | +139.34% |

| 1 Year | +206.26% |

| 52-Week Range | ¥20.80 - ¥75.40 |

According to technical analysis [0]:

| Indicator | Value | Signal |

|---|---|---|

| Latest Closing Price | ¥72.40 | - |

| 20-Day Moving Average | ¥66.92 | Support Level |

| 60-Day Moving Average | ¥61.82 | - |

| RSI (14) | 66.14 | Strong but Not Overbought |

| MACD | 3.5758 | Bullish Signal |

| KDJ | K:75.1, D:78.3 | Short-Term Overbought |

| Beta | 0.84 | Relatively Low Volatility |

| Support Level | ¥66.92 | - |

| Resistance Level | ¥74.31 | - |

- AI server iteration drives the upgrade of CCL materials from M7/M8 to M9

- The global CCL market has a CAGR of 18%, and the high-end market reaches 40%

- The industry has entered a price increase cycle, and leading enterprises will fully benefit

- Global high-speed CCL market share continues to increase (4%→5.7%)

- The RMB 4.5 billion expansion project strengthens the layout of high-end production capacity

- Performance continues to exceed expectations, with 2025 net profit increasing by 78% year-on-year

- Aligns with the national “15th Five-Year Plan” and the stable growth plan for the electronic information manufacturing industry

- CCL, as a key basic material for the new generation of information technology, receives key support

- The specific project plan still requires final approval by the board of directors or shareholders’ meeting

- Uncertainties exist in project construction land and pre-approval [1]

- The RMB 4.5 billion investment scale may put pressure on the company’s cash flow [1]

- Need to pay attention to financing arrangements and funding sources

- The current P/E reaches 62.38x, and DCF shows the stock price is significantly overvalued

- Valuation relies on the market’s optimistic expectations for AI demand

- Sino-US trade frictions may intensify

- Risk of AI application implementation falling short of expectations

- Risk of upstream raw material price fluctuations

- PCB material upgrades are rapid, and there is uncertainty in the technical route

- Demand Side:NVIDIA’s Rubin platform will enter mass production in 2026, with high certainty of M9 material demand

- Supply Side:High-end CCL production capacity remains tight, and leading enterprises have full order books

- Price Side:The price increase trend is clear, and profitability is expected to continue to improve

- Policy Side:Supported by national strategies, there is broad space for domestic substitution

- Need to track the actual shipment volume of NVIDIA’s Rubin platform

- Pay attention to the rhythm of downstream inventory adjustment

- Beware of pullback risks caused by overly high market expectations

| Dimension | Evaluation |

|---|---|

| Long-Term Value | The company is a core material supplier in the AI computing power industry chain, and the RMB 4.5 billion expansion project strengthens its leading position |

| Short-Term Risk | The current valuation is relatively high; wait for a more reasonable entry point |

| Investment Rating | Cautious Add (wait for valuation regression or performance verification) |

- 2025 annual report results (expected in February-March 2026)

- Progress of the RMB 4.5 billion expansion project

- Mass production progress of NVIDIA’s Rubin platform

- CCL price trends and industry order status

[1] Securities Times - “Shengyi Technology Signs RMB 4.5 Billion Investment Intent Agreement to Increase Layout of High-Performance CCL” (https://www.stcn.com/article/detail/3569239.html)

[2] Sina Finance - “Breaking! RMB 170 Billion PCB Leader Invests in High-Performance AI CCL Project” (https://finance.sina.com.cn/jjxw/2026-01-04/doc-inhfcxwm2801069.shtml)

[3] Sina Finance - “Price Increase Wave Reaches PCB Upstream: Leaders Raise CCL Prices by 10% AI Drives the Industry into an Upward Cycle” (https://finance.sina.com.cn/jjxw/2025-12-29/doc-inhemqaw5021714.shtml)

[4] PCBworld - “M9 Material Iteration, AI Demand Opens Up RMB 100 Billion Market Space for PCB” (https://www.eet-china.com/mp/a463463.html)

[5] Huxiu - “In 2026, AI Investment Depends on Exceeding Expectations” (https://pro.huxiu.com/article/4823514.html)

[6] CITIC Construction Investment - “2026 Investment Prospects of the PCB Industry Chain” (https://hao.cnyes.com/post/214796)

[7] Huxiu - “In 2026, AI Investment Depends on Exceeding Expectations” (https://pro.huxiu.com/article/4823514.html)

[0] Jinling AI Financial Database (Real-time market data, financial analysis, technical analysis, DCF valuation)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.