In-Depth Analysis of the Impact of Filihua's Q Cloth Technological Breakthrough and Localization of Third-Generation Electronic Cloth on the PCB Industry Landscape

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me present this in-depth analysis report to you:

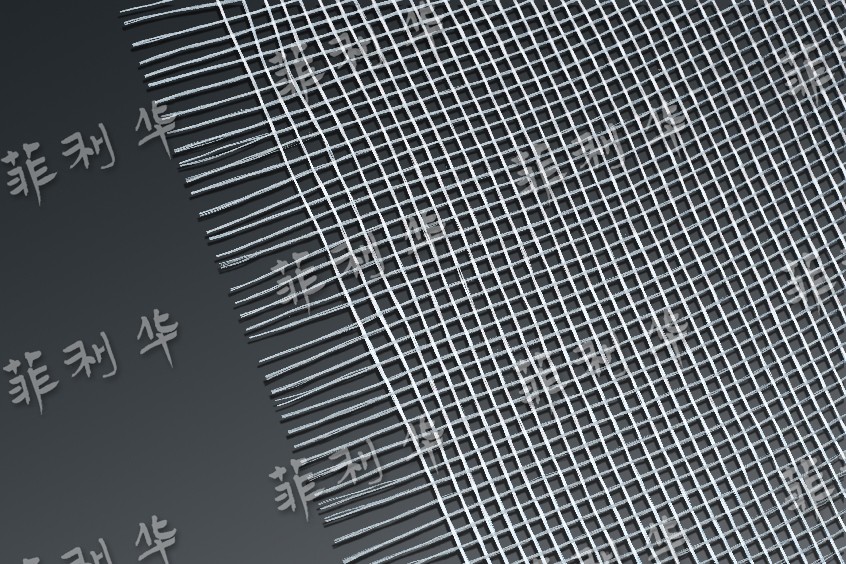

With the explosive growth of artificial intelligence computing power demand, high-end printed circuit boards (PCB) are undergoing a comprehensive upgrade from materials, processes to production capacity. NVIDIA’s Rubin architecture GPU will enter mass production in the second half of 2026, marking the official entry of AI server PCB into the era of ‘M9 Material + Quartz Fiber Cloth (Q Cloth)’[1][2]. This technological iteration provides a historic window for the localization of China’s high-end electronic cloth. Filihua (300395.SZ), as the only domestic enterprise with independent control over the entire industrial chain of ‘quartz sand purification - quartz fiber - quartz cloth’, is standing at the forefront of this industrial transformation.

| Indicator | 2025E | 2026E | 2027E |

|---|---|---|---|

| Q Cloth Price (RMB/meter) | 220 | 275 | 320 |

| Second-Generation Cloth Price (RMB/meter) | 130 | 175 | 210 |

| Q Cloth Supply-Demand Gap (10,000 meters) | 200 | 300 | 400 |

| Filihua Quartz Cloth Production Capacity (10,000 meters) | 300 | 800 | 1500 |

| Localization Rate of High-End Electronic Cloth | 15% | 28% | 42% |

Q Cloth is a third-generation high-end electronic reinforcement material specially designed for ultra-high frequency, ultra-high speed scenarios such as AI servers and 1.6T/800G optical modules, and its core performance indicators far exceed those of traditional electronic cloth[3][4]:

| Performance Indicator | Q Cloth (Quartz Fiber Cloth) | Second-Generation Low-Dk Cloth | Traditional E-Glass Cloth |

|---|---|---|---|

| Dielectric Constant (Dk) | 2.8-3.0 | 3.5-3.8 | 4.5-6.0 |

| Dissipation Factor (Df) | 0.0005 | 0.0010 | 0.0020 |

| Coefficient of Thermal Expansion (CTE) | 0.5 ppm/℃ | 8-10 ppm/℃ | 12-15 ppm/℃ |

- Ultra-Low Dielectric Constant: Meets the signal integrity requirements for 224Gbps high-speed transmission, increasing signal transmission speed by approximately 15%

- Ultra-Low Dissipation Factor: Reduces signal attenuation by more than 50%, ensuring data transmission stability for large-scale parallel computing of AI chips

- Ultra-Low Coefficient of Thermal Expansion: Matches the thermal expansion characteristics of silicon chips, preventing plate deformation and failure in high-temperature environments

Since 2017, Filihua has launched strategic cooperation with leading downstream CCL enterprises such as Shengyi Technology, laying out R&D for new electronic cloth, with 9 years of technical accumulation[5]. Through its holding subsidiary Zhongyi New Materials, the company has deeply engaged in the quartz electronic cloth field for nine years, developed the second-generation ultra-low loss quartz electronic cloth, adopted the rod drawing process, and directly targets international giants such as Shin-Etsu Chemical of Japan.

In June 2025, Filihua established a wholly-owned subsidiary Hubei Dingyi New Materials, further seizing the strategic fulcrum of high-end electronic cloth, and strengthening the closed-loop advantage of the entire industrial chain from quartz fiber raw materials to weaving and composite materials[6].

As of December 2025, Filihua’s quartz electronic cloth has completed the following key certification milestones[7]:

- Among the world’s top 20 CCL enterprises, 4have achieved stable batch procurement

- Another 7-8are in the small-batch testing stage

- Key customers including Taikoh, Doosan, Panasonic, and Shengyi Technology have all completed product certification and launched small-batch supply

- Early test price: approximately RMB200 per meter

- Q4 2025 selling price: RMB250-280 per meter

- 2026 forecast: Due to tight supply and demand, the price is expected to further rise to more than RMB300 per meter

NVIDIA’s Rubin architecture GPU will enter mass production in the second half of 2026, adopting an orthogonal backplane to replace the traditional copper cable design. Each Rubin server needs to be equipped with 3-4 26-layer high-end PCB boards, paired with a combination of M9 resin substrate and Q Cloth[8][9]. The demand for Q Cloth from the Rubin series alone is expected to reach

As the basic material for AI server PCB, second-generation Low-Dk Cloth is used in scenarios such as GB300 and Rubin Compute Tree. The demand for second-generation cloth in 2026 is expected to reach

Only a

Traditional electronic cloth giants such as Japan’s Nittobo and Asahi Kasei are constrained by cost pressures and have no large-scale expansion plans. The expansion progress of overseas factories is slow, further exacerbating the tight supply of high-end electronic cloth globally.

| Company | Capacity Expansion Project | Capacity/Benefit | Expected Release Time |

|---|---|---|---|

| Filihua (Zhongyi New Materials) | Quartz Electronic Cloth Capacity Expansion | 20 million meters by 2030 | Continuous release |

| Sinoma Technology (Taishan Fiberglass) | Special Glass Fiber Cloth Project | 35 million meters/year | Centralized release in 2026 |

| Honghe Technology | High-Performance Glass Fiber Yarn Project | 1,254 tons/year | 2026 |

| Linzhou Guangyuan | Low-Dk Production Line | 6 lines | 2025-2026 |

The price of Q Cloth in 2026 has been revised up to

NVIDIA’s GPU iteration drives continuous upgrades of PCB materials:

| GPU Platform | Material Grade | Electronic Cloth Type | Mass Production Time |

|---|---|---|---|

| A100 | M6 | First-Generation Low-Dk | 2020 |

| H100 | M7 | Second-Generation Low-Dk | 2022 |

| B100/B200 | M8 | Second-Generation Low-Dk | 2024 |

| Rubin | M9 | Q Cloth (Quartz Cloth) | 2026 |

| Rubin Ultra | M9.5 | Q Cloth | 2027 |

Each generation of material upgrade brings a significant increase in the unit value of PCB:

- Traditional server PCB: approximately RMB1,500 per unit

- AI server PCB: approximately RMB4,200 per unit in 2024 → expected to reach RMB8,500 per unit in 2027, a 467% increase[13]

The supply of high-end PCB production capacity will remain tight in 2026. According to China Merchants Securities’ estimate, the effective PCB production capacity of domestic listed companies that can meet AI demand is approximately RMB120 billion, while the demand side is expected to be around RMB150 billion, resulting in a supply-demand gap of approximately RMB30 billion[14].

- Volume Growth: The penetration rate of AI servers increases, and the compound annual growth rate of demand for PCB boards with 18 layers or more is 20.6%

- Price Growth: Material upgrades (M6→M7→M8→M9) drive the increase in price per square meter

According to data from the Hongshen Quartz Conference, the localization rate of China’s semiconductor quartz products is

| Year | Localization Rate | Driving Factor |

|---|---|---|

| 2024 | 8% | Completion of technical verification |

| 2025E | 15% | Small-batch supply |

| 2026E | 28% | Capacity release |

| 2027E | 42% | Large-scale mass production |

| 2030E | 75% | Comprehensive breakthrough |

Traditional Pattern: Japanese (Nittobo, Asahi Kasei) and Taiwanese (Taiwan Glass) players dominate the high-end electronic cloth market, with a combined market share of over 60%

New Pattern (2026E):

- Filihua: 25% (rapid increase)

- Nittobo: 30% (stable)

- Shin-Etsu Chemical: 22% (stable)

- Sinoma Technology: 12% (significant increase)

- Others: 11%

Filihua is the only enterprise in the world that has achieved

- Quartz sand purification

- Quartz rod manufacturing

- Quartz fiber drawing

- Weaving processing

This vertical integration layout brings significant cost advantages and technical moats, and the gross profit margin of the quartz electronic cloth business is expected to reach

Filihua’s holding subsidiary Zhongyi is responsible for the weaving link and has entered the small-batch production stage. The quartz electronic cloth revenue in the first half of 2025 was approximately RMB13 million, and reached

| Target | Core Logic | 2026E Net Profit | PE |

|---|---|---|---|

Filihua (300395.SZ) |

Absolute leader in Q Cloth, independent control over the entire industrial chain, benefits from Rubin mass production | RMB864 million | 36.7x |

Sinoma Technology (002080.SZ) |

Dual layout of second-generation cloth and Q Cloth, rapid capacity release | RMB2.016 billion | 20.3x |

Honghe Technology (603256.SH) |

Global leader in ultra-thin electronic cloth, first in second-generation cloth production capacity | RMB180 million | 108.8x |

Shengyi Technology (600183.SH) |

Leader in copper-clad laminates, deeply bound to Q Cloth supply | RMB3.5 billion+ | 25x |

According to calculations by Bank of China Securities[18]:

- The quartz electronic cloth business alone can bring Filihua a net profit increment of over RMB1 billionin 2026

- Combined with the original main business profit of RMB500 million, the total profit in 2026 is expected to reach RMB1.5 billion

- Calculated at a valuation of 40x, the market value can reach RMB60 billion

- Benefiting from the explosive demand for “M9” in 2027, the profit of the electronic cloth business is expected to reach nearly RMB3 billion, driving the overall market value to the range ofRMB80-100 billion

| Risk Type | Specific Content | Impact Level |

|---|---|---|

| Technical Risk | The pace of electronic cloth technological progress is slower than expected | ★★★ |

| Demand Risk | Downturn in the prosperity of the photovoltaic and optical communication industries | ★★ |

| Certification Risk | 18-24 month certification cycle for automotive-grade and AI server products | ★★ |

| Capacity Risk | Raw material supply risk | ★★ |

| Competition Risk | Price war initiated by overseas manufacturers | ★ |

| Valuation Risk | Current PE is approximately 124x, requiring high growth to digest | ★★★ |

- Technological Breakthrough: Filihua’s Q Cloth technology has achieved parity with international giants, its products have passed certification from key customers, and it has mass production capacity

- Supply-Demand Pattern: In 2026, there will be a supply-demand gap of approximately 3 million meters for both Q Cloth and second-generation cloth, and prices will continue to rise

- Industrial Transformation: The mass production of NVIDIA’s Rubin platform will drive AI server PCB into the era of “M9+Q Cloth”, leading to volume and price growth across the industrial chain

- Pattern Restructuring: The localization rate of high-end electronic cloth will increase from 8% in 2024 to 75% in 2030, and Filihua is expected to become a global leader

- Investment Value: Filihua’s quartz electronic cloth business will begin to contribute significant profit increments from 2026, with explosive growth in 2027

- Short-Term (2025-2026): Capacity release and customer certification are the key, and Q Cloth prices will rise steadily

- Mid-Term (2027-2028): The Rubin Ultra platform will be launched, M9.5+Q Cloth will become a new rigid demand, and the market scale will grow 3-4 times

- Long-Term (2029-2030): Localization will be basically completed, and Filihua is expected to occupy more than 30% of the global Q Cloth market share

[1] 2026 Electronic Industry Strategy: AI-Driven New Industry Cycle - Chengtong Securities, December 2025

[2] “Material War” Driven by AI Computing Power Revolution - Supply-Demand Pattern and Investment Opportunities of Q Cloth and Second-Generation Cloth - Eastmoney, December 2025

[3] 140 Billion! Who Will Benefit from NVIDIA’s M9 Material Industrial Chain? - EET China, October 2025

[4] Domestic Low-Dielectric Fiber Cloth Achieves Technological Breakthrough - Sina Finance, December 2025

[5] Scheme Upgrade Trend is Clear, Optimistic About High Elasticity of PCB Industrial Chain - Sina Finance, December 2025

[6] [Buy Filihua] - Bank of China Securities, July 18, 2025

[7] Investor Relations Activity Record of Hubei Filihua Quartz Glass Co., Ltd. - Investor Relations, December 2025

[8] In 2026, AI Investment Depends on Exceeding Expectations - PEdaily, January 2026

[9] Top 10 Forecasts for the Electronic Industry in 2026 - Orient Securities, December 2025

[10] 2026 Electronic Materials Industry Strategy - Eastmoney, January 2026

[11] Special Glass Fiber Cloth is in Short Supply, Domestic Manufacturers Accelerate Penetration - Kaiyuan Securities, July 2025

[12] “Material War” Driven by AI Computing Power Revolution - Eastmoney Securities Research, December 2025

[13] 2026 Electronic Industry Strategy: AI-Driven New Industry Cycle - Chengtong Securities, December 2025

[14] In 2026, AI Investment Depends on Exceeding Expectations - PEdaily, January 2026

[15] Buy Filihua - Bank of China Securities, July 2025

[16] 2025 Semi-Annual Report of Hubei Filihua Quartz Glass Co., Ltd. - Company Financial Report, 2025

[17] Scheme Upgrade Trend is Clear, Optimistic About High Elasticity of PCB Industrial Chain - Sina Finance, December 2025

[18] Buy Filihua - Bank of China Securities Research, July 2025

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.