In-Depth Analysis of the Impact of Zhifei Bio (300122.SZ)'s HPV Vaccine Agency Business Decline on Its Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and in-depth analysis, I will provide you with a complete report on the impact of Zhifei Bio (300122.SZ)'s HPV vaccine agency business decline on its valuation.

Zhifei Bio (300122.SZ), a leading enterprise in China’s vaccine industry, once achieved rapid growth through its exclusive agency agreement with Merck for HPV vaccines. The company’s main business includes the R&D, production, sales, and distribution of vaccines and biological products, with its agency products primarily including Merck’s quadrivalent HPV vaccine (Gardasil 4), nine-valent HPV vaccine (Gardasil 9), and GlaxoSmithKline’s recombinant zoster vaccine (Shingrix) [0].

In 2022-2023, agency business accounted for over 90% of the company’s revenue, with HPV vaccines being the absolute core product. However, this business model, which is highly dependent on a single upstream supplier, has faced severe structural challenges since 2024.

According to the latest financial data, Zhifei Bio’s operating conditions have experienced the most severe deterioration since its listing [0][1][2]:

| Financial Indicator | H1 2023 | H1 2024 | Change Rate |

|---|---|---|---|

| Operating Revenue | RMB 18.273 billion | RMB 4.919 billion | -73.06% |

| Net Profit Attributable to Parent | RMB 2.234 billion | -RMB 0.597 billion |

-126.72% |

| ROE | 8.23% | -1.96% | Down 10.19 percentage points |

This marks Zhifei Bio’s first semi-annual loss since its listing in 2010, and the loss far exceeded market expectations.

Batch release data for core agency products more intuitively reflects the severity of business contraction [1][2][3]:

- Full-year 2023: Approximately 21 million doses

- 2024: 95.5% year-on-year decline to 470,000 doses

- H1 2025: 0 doses(Supply suspended)

- Full-year 2023: Approximately 36.5 million doses

- 2024: 14.8% year-on-year decline to 31.14 million doses

- H1 2025: 4.2388 million doses, 76.8% year-on-year decline

Notably, Merck announced in February 2025 that it would suspend HPV vaccine supplies to China due to the overall market environment, with the suspension lasting at least until mid-2025 [2].

The sharp contraction of the agency business has directly led to severe inventory backlog and cash flow pressure [1][2][3]:

| Indicator | Value | Impact |

|---|---|---|

| Inventory | RMB 21.014 billion |

Increased by 133% from RMB 9 billion at the end of 2023 |

| Accounts Receivable | RMB 13.517 billion | Accounts for over 50% of total assets |

| Combined Total | RMB 34.5 billion |

Accounts for approximately 75% of the company’s total assets |

| Inventory Turnover Days | Over 1000 days |

Based on quarterly revenue, it will take over 9 quarters to digest |

Most of this inventory consists of HPV vaccines, which have a shelf life of only 36 months, facing significant impairment risks. In the first three quarters of 2025, the company has already accrued RMB 38.3361 million in inventory impairment.

The core cause of Zhifei Bio’s agency business decline is the rapid rise of domestic HPV vaccines. In July 2025, Wantai Bio’s first domestic nine-valent HPV vaccine was approved for marketing, directly setting the price at

The price war has plunged the entire industry into “involutionary” competition:

- Wantai Bio’s bivalent HPV vaccine dropped from RMB 329 per dose in 2022 to a government procurement price of RMB 86 per dose

- Watson Bio even quoted a low price of RMB 27.5 per dose

- The centralized procurement price in Shandong even hit a historical low of RMB 27.5 per dose[3]

Multiple factors have led to a sharp contraction in HPV vaccine market demand [1][2]:

- Prior Demand Overdraft: During the “hard-to-get-a-dose” period in 2022-2023, a large number of eligible women have already completed vaccination

- Increased Price Sensitivity: During the economic downturn, willingness to consume high-priced vaccines has decreased significantly

- Supply-Side Overcapacity: Global HPV vaccine production capacity has increased significantly, shifting the market from “supply shortage” to “overcapacity”

- Policy Impact: Changes in government procurement models have compressed the space for the self-paid market

Zhifei Bio’s business model, which is highly dependent on a single upstream supplier, has exposed severe vulnerabilities amid changes in the market environment [1][3]:

- Supply-Side Restrictions: Merck adjusts its supply to China based on global capacity allocation

- Loss of Bargaining Power: The rise of domestic substitutes has weakened the exclusive agent’s pricing power

- Demand-Side Squeeze: Downstream buyers have more alternative options

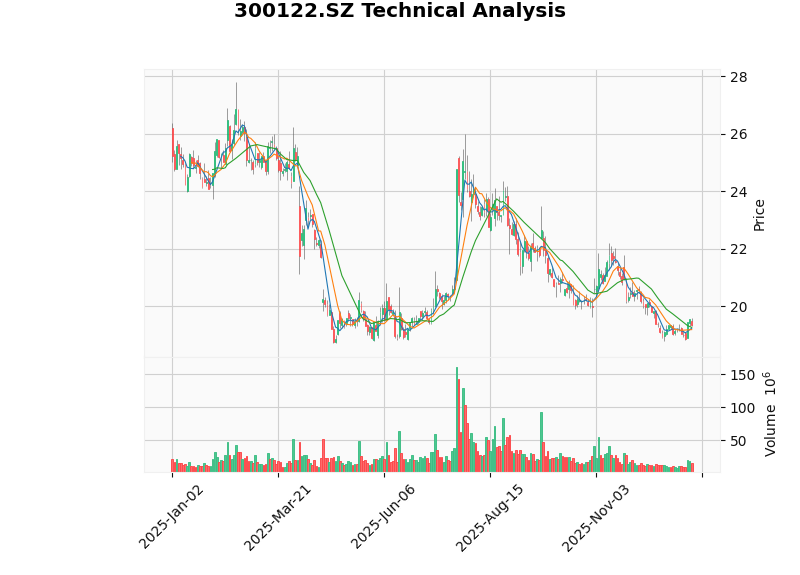

Zhifei Bio’s stock price has fallen sharply from its historical high [0]:

| Time Period | Decline |

|---|---|

| Past 1 Year | -23.72% |

| Past 3 Years | -70.50% |

| Past 5 Years | -80.62% |

As of January 7, 2026, the company’s market capitalization is USD 46.272 billion, and the current stock price is USD 19.33.

| Indicator | Value | Evaluation |

|---|---|---|

| P/E (TTM) | -34.57x |

In loss, no positive P/E ratio |

| P/B (TTM) | 1.58x | Relatively reasonable |

| P/S (TTM) | 4.24x | Relatively high |

| ROE (TTM) | -4.43% |

Negative return on shareholders’ equity |

| Net Profit Margin (TTM) | -12.27% |

Deep loss |

The company’s intrinsic value assessment based on the DCF model shows [0]:

| Valuation Scenario | Valuation Price | vs. Current Stock Price | Assumptions |

|---|---|---|---|

Conservative Scenario |

$27.45 | +42.0% | Zero growth, EBITDA margin 22.7%, WACC 12.1% |

Base Scenario |

$39.92 | +106.5% | 14.5% revenue growth, EBITDA margin 23.8%, WACC 10.9% |

Optimistic Scenario |

$68.76 | +255.7% | 57.6% revenue growth, EBITDA margin 25.0%, WACC 9.7% |

Probability-Weighted Valuation |

$45.38 | +134.7% | Combined probabilities of the three scenarios |

- WACC (Weighted Average Cost of Capital): 10.9%

- Beta Coefficient: 1.29 (relative to the S&P 500 Index)

- Risk-Free Rate: 4.5%

- Market Risk Premium: 7.0%

The current market is assigning a significant valuation discount to Zhifei Bio, mainly due to the following risk premiums:

- Business Transformation Risk: Uncertainty in transitioning from high-margin agency business to independent R&D

- Inventory Impairment Risk: RMB 21 billion in inventory faces price decline pressure

- Cash Flow Risk: Slowdown in accounts receivable turnover, pressure on working capital

- Deteriorated Competition Pattern: Intensified competition in the HPV vaccine market, ongoing price war

- Contract Performance Risk: RMB 98 billion procurement commitment with Merck faces adjustment pressure

Zhifei Bio is accelerating the layout of independently developed products to offset the decline in agency business [1][2]:

| Product | R&D Phase | Expected Contribution |

|---|---|---|

| Quadrivalent Influenza Vaccine | Approved for marketing | Contributes to revenue |

| Lyophilized Human Rabies Vaccine | Marketing application accepted | Near-term volume growth |

| 15-Valent Pneumococcal Conjugate Vaccine | Clinical trials completed | Mid-term growth driver |

| Split Influenza Virus Vaccine (Trivalent) | Marketing application accepted | Near-term contribution |

| Quadrivalent Influenza Vaccine (Pediatric) | Marketing application accepted | Niche market |

Zhifei Bio’s strategic cooperation with GlaxoSmithKline has been strengthened [1][2]:

- Extended the exclusive distribution and joint promotion rights for the recombinant zoster vaccine from the end of 2026 to the end of 2034

- Agreed to procure RMB 21.6 billion over the next 6 years, with an adjusted annual procurement amount compared to the previous RMB 20.6 billion agreement

- The extended cooperation period provides a buffer period for business stability

| Variable | Current Status | Valuation Recovery Trigger Conditions |

|---|---|---|

| Inventory Destocking | RMB 21 billion in inventory | Inventory drops below RMB 15 billion |

| Revenue Share of Independent Products | Less than 10% | Increased to over 30% |

| Gross Profit Margin | Under pressure | Recovered to over 40% |

| Net Profit Margin | Negative | Turns positive and maintains above 10% |

| Cash Flow | Under pressure | FCF turns positive |

The cliff-like decline of Zhifei Bio’s HPV vaccine agency business has had a

- Short-term (1-2 years): The company faces difficulties in inventory destocking, cash flow pressure, and sustained losses, making systematic valuation improvement unlikely. Key focuses are inventory digestion progress and volume growth of independent products.

- Mid-term (3-5 years): If the independent product pipeline is successfully commercialized and the company completes its strategic transformation from agency to independent R&D, valuation is expected to recover. The current DCF valuation shows134.7% upside potential, but achieving this goal requires meeting multiple preconditions.

- Long-term (5-10 years): The vaccine industry as a whole still has growth potential. The domestic adult vaccination rate increased from 12% in 2020 to 29% in 2025, and there are also opportunities for international expansion [3].

- Sustained Loss Risk: The contraction of agency business outpaces the growth of independent products

- Inventory Impairment Risk: RMB 21 billion in inventory may face larger-scale impairment provisions

- Contract Risk: Procurement commitments with Merck may result in default costs

- Valuation Downgrade Risk: The market may permanently lower the company’s valuation expectations

- Industry Policy Risk: Impact of policies such as volume-based procurement and price control

| Valuation Method | Valuation Range | Midpoint | Remarks |

|---|---|---|---|

| DCF Conservative Scenario | $24-$30 | $27.45 | Extremely pessimistic assumptions |

| DCF Base Scenario | $35-$45 | $39.92 | Neutral assumptions |

| DCF Optimistic Scenario | $60-$75 | $68.76 | Optimistic assumptions |

| Current Stock Price | $19.33 | - | Implies excessive pessimism |

Considering the company’s challenges and transformation potential,

[0] Jinling API Financial Database - Company Overview, Financial Analysis, Technical Analysis, and DCF Valuation Data of Zhifei Bio (300122.SZ)

[1] Tencent News - “Zhifei Bio’s Worst Semi-Annual Report in a Decade: Inventory Exceeds RMB 20 Billion, Inventory Turnover Days Surpass 1000” (October 15, 2025)

[2] The Beijing News - “Vaccine Agency Business Contribution Shrinks, Zhifei Bio Reports First Semi-Annual Loss Since Listing in Half-Year Report” (August 21, 2025)

[3] Eastmoney Wealth Account - “Expert Analysis: Severe ‘Involutionary’ Competition in China’s Vaccine Industry” (January 5, 2026)

[4] QQ News - “First Semi-Annual Loss in 15 Years of Listing! HPV Vaccine Drags Down Zhifei Bio” (August 20, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.