Deep Analysis of Xiaomi Group (1810.HK): Structural Conflicts of the Personal IP Binding Model and Investment Value Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above data and analysis, here is a detailed research report for you:

| Indicator | Data |

|---|---|

Current Price |

HK$38.16 (January 7, 2026) |

Monthly Decline |

7.47% (from HK$41.24 to HK$38.16) |

52-Week High |

HK$61.45 |

52-Week Low |

HK$32.20 |

Maximum Decline from High |

Approximately 34% |

Market Capitalization |

Approximately HK$989.4 billion |

P/E (TTM) |

19.63x |

According to the latest research report from Citibank, Lei Jun revealed in his first live stream of 2026 that Xiaomi Auto’s 2026 delivery target is 550,000 units, representing a year-on-year increase of over 34%, but

- 2025 Actual Deliveries: 410,000 units (exceeding the original target of 400,000 units)

- 2026 Market Expectation: 600,000-700,000 units

- 2026 Company Target: 550,000 units

- Citibank Forecast: 700,000 units

Citibank estimates that as of the end of 2025, the actual order backlog for Xiaomi Auto is

Lin Bin, co-founder of Xiaomi, has notified that starting from December 2026, he plans to sell Class B ordinary shares of the company with an annual value not exceeding US$500 million (approximately HK$3.9 billion), with a cumulative total sale value not exceeding US$2 billion (approximately HK$15.6 billion)[3]. The large-scale share reduction plan has exacerbated market uncertainty.

- SU7 Ultra Hood False Promotion Controversy: A refund dispute arose in the first half of 2025. Although Xiaomi provided a limited-time configuration modification service and a point compensation scheme, many car owners did not accept it[4]

- Extended Delivery Cycle for Xiaomi YU7: The delivery cycle is as long as 7 to 8 months, and the production capacity bottleneck has not yet been fully resolved

- Public Outcry Over Safety Accidents: Xiaomi Auto has been involved in multiple accidents causing serious personal injuries[4]

According to a report from 36Kr, since 2025, “black water army” (malicious paid trolls) attacks from competitors have put Lei Jun in a public opinion predicament. Lei Jun admitted in a live stream: “Sometimes I wonder if this is the goal of the black water army’s attacks on me, to make me stop talking”[4][5].

- Lei Jun’s fitness photos were maliciously interpreted and attacked

- Every word and action was taken out of context and misinterpreted

- The comment section on his Weibo account became a “large-scale complaining site”

Xiaomi’s collaboration with “The Almighty Bear” (a controversial KOL) sparked strong backlash from users, and even the collaborating blogger couldn’t help but warn “Don’t destroy your own foundation”[5]. This incident exposed loopholes in Xiaomi’s partner selection and brand risk management.

Once consumers form the cognitive inertia of “Lei Jun = Xiaomi”, any minor fluctuation will be infinitely amplified:

- SU7 accident → Doubts directly target “Lei Jun’s technical judgment ability”

- Collaboration with controversial KOL → Escalated to a trust crisis of “Xiaomi betraying its fans”

- Strategic decision-making errors → Interpreted as issues with the founder’s personal judgment

Xiaomi chose the strategic path of “binding founder IP with the brand” from its inception. This model has once brought huge dividends:

- Data shows that 37% of Xiaomi users follow the brand because of Lei Jun[5]

- A single statement at the SU7 launch drove 50,000 orders

- The first live stream of 2026 had over 2 million concurrent viewers on Bilibili, and topped 4 to 5 trending lists on Weibo[4]

- Low-cost customer acquisition

- High user stickiness

- High brand awareness

However, this model has fundamental structural conflicts:

| Dimension | Personal IP Dividend Period | Negative Backlash Period |

|---|---|---|

| Attention Allocation | Founder’s halo amplifies brand effect | All controversies target the individual |

| Risk Exposure | Personal image equals brand image | Personal negatives directly impact stock price |

| Narrative Ability | Personal stories drive brand narrative | Brand lacks independent narrative ability |

| Decision-Making Space | Founder’s decisions are highly trusted | Any mistake is over-interpreted |

| Crisis Response | Every word and action can influence the market | Speaking is risky, staying silent is also risky |

36Kr analysis points out that Xiaomi’s public opinion predicament is “the inevitable backlash after long-term imbalance in communication narrative”[5]:

- Spotlight Effect: All resources are focused on Lei Jun, leaving the brand itself and other business lines’ independent narratives in the shadows

- Cognitive Inertia: “Lei Jun = Xiaomi” causes any fluctuation to be infinitely amplified

- Blessing Turns to Curse: The greater the traffic dividend, the more severe the potential backlash

As 36Kr stated: “This is not a matter of right or wrong, but an inevitable cost of business choices — just like if you choose to accelerate with a rocket, you have to accept the weightlessness when the fuel runs out”[5].

| Conflict Dimension | Specific Manifestations |

|---|---|

Blurred Boundary Between Decision-Making and Responsibility |

The founder’s personal judgment highly overlaps with the company’s strategic decisions, leading to unclear responsibility boundaries |

Strong Correlation Between Personal Reputation and Valuation |

Lei Jun’s personal public opinion crisis directly translates into stock price fluctuations |

Lack of Brand Independence |

The Xiaomi brand lacks a value narrative system independent of the founder |

Systemic Vulnerability in Risk Resistance |

When the personal IP is attacked, the entire company falls into a passive position |

Despite the ongoing public opinion turmoil, the fundamentals of Xiaomi’s core businesses remain resilient:

- Global smartphone market share of approximately 12%

- Shipment volume of high-end models priced above US$800 increased by 56% year-on-year in the first 9 months of 2025

- Achieved significant breakthroughs in the ultra-high-end market priced above RMB 6,000[1][2]

- Ecosystem barrier built with over 600 compatible products

- Leading position in the global consumer IoT market

- According to the Q3 2025 financial report, SU7-related businesses contributed operating profit of RMB 700 million

- Achieved an industry breakthrough of “profitability upon mass production”

- 200,000 pre-orders for YU7 were placed within 3 minutes of its launch, and the locked order volume exceeded 240,000 units within 18 hours

| Indicator | Assessment |

|---|---|

| Free Cash Flow (Latest Quarter) | RMB 26.274 billion |

| Debt Risk | Low Risk |

| Financial Stance | Aggressive (low depreciation/capital expenditure ratio) |

| P/E (TTM) | 19.63x |

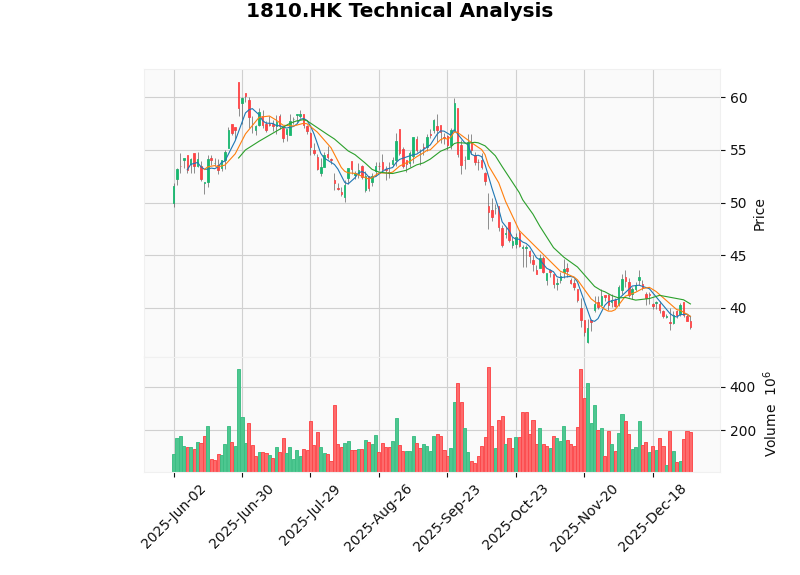

| Indicator | Status | Interpretation |

|---|---|---|

| Trend Judgment | Sideways Consolidation | No clear upward or downward trend |

| MACD | Bearish Crossover Signal | Medium-term momentum is bearish |

| KDJ | K:31.1, D:35.9, J:21.5 | Oversold Zone |

| Support Level | HK$37.54 | Dense Trading Zone |

| Resistance Level | HK$40.37 | 20-Day Moving Average Position |

- P/E: 19.63x (below historical average)

- P/B: 3.06x

- P/S: 1.93x

Referring to the valuation logic of peer companies in the technology hardware + smart auto + AI application track, Xiaomi’s current valuation is in the

| Risk Type | Specific Content |

|---|---|

| Public Opinion Risk | Negative events related to personal IP continue to ferment |

| Valuation Risk | Market repricing of expectations for the auto business |

| Share Reduction Risk | Large-scale share reduction plan by co-founder Lin Bin |

| Production Capacity Risk | Extended delivery cycle for YU7 may affect order conversion |

| Competition Risk | Intensified competition in the new energy vehicle market |

-

Nature of the Conflict: The deep binding of personal IP and corporate brand is a competitive advantage during the traffic dividend period, but it transforms into a systemic vulnerability during periods of negative public opinion. This is an inevitable cost of business model choice, rather than a management error.

-

Manifestations of the Conflict:

- Lei Jun’s personal public opinion crisis directly impacts the company’s valuation

- The brand lacks a value narrative system independent of the founder

- Any controversy at the business level is over-interpreted as the founder’s judgment error

-

Potential Solutions:

- Gradually establish independent brand narrative capabilities to reduce reliance on personal IP

- Learn from professional agency models to manage personal IP risks through institutional norms

- Use specific business data to demonstrate the rationality of multi-line operations and build value consensus

| Time Horizon | Assessment |

|---|---|

| Short-term (1-3 months) | Under Pressure : Affected by public opinion turmoil and share reduction expectations, the stock price may continue to fluctuate in the HK$37-HK$40 range |

| Medium-term (3-6 months) | Wait and See : Pay attention to the delivery of YU7 GT and updated SU7 models |

| Long-term | Watch Closely : If the auto business continues to scale up, combined with valuation repair opportunities, an allocation window may emerge |

[1] Citibank: Xiaomi Auto’s 2026 Shipment Target is 550,000 Units, Falling Short of Expectations (https://tw.stock.yahoo.com/news/花旗-小米汽車今年出貨目標55萬輛-低於預期-053600862.html)

[2] Citibank: Xiaomi’s Electric Vehicle Deliveries Met Expectations Last Month, Maintain Buy Rating (https://wealth.firstbank.com.tw/investment-tips/trend-insight/news/news-detail?id={97F8AA7E-F44B-4ACD-9954-7E02003C7B4E})

[3] Xiaomi Turns from Decline to Rise Intraday; Watch Xiaomi Call Warrants with Dual Deployment (https://warrants.ubs.com/sc/education/article-detail/id/1406)

[4] Lei Jun’s Day of Fear of Rumors (https://m.36kr.com/p/3624779410748163)

[5] Turbulent Times: Xiaomi Accelerates “Bottoming Out” (https://m.36kr.com/p/3628589524403457)

[6] Trust Reconstruction, Value Deepening: Top 10 Brand Events of 2025 Reveal New Logic in the Traffic Era (https://finance.sina.com.cn/roll/2025-12-26/doc-inhecipr0864865.shtml)

[0] Gilin AI Financial Database

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.