Analysis of Sunlord Electronics' Raw Material Cost Challenges and Response Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient data and will provide you with a systematic analysis of Sunlord Electronics’ raw material cost challenges.

Since 2025, the magnetic components industry has been experiencing an unprecedented raw material price hike storm. Prices of non-ferrous metals represented by copper, aluminum, tin, manganese, etc., have continued to rise, forming a systemic impact on the entire industrial chain [1][2].

| Raw Material | 2025 Price Performance | Annual Growth Rate |

|---|---|---|

| Copper | Spot copper price breaks the 100,000 yuan/ton mark | Over 37% |

| Aluminum | Breaks 22,000 yuan/ton, hitting a new high since 2022 | Approximately 12% |

| Tin | Touches 344,000 yuan/ton | Nearly 50% |

| Manganese | Electrolytic manganese price rises 24% in a single month, hitting a three-year high | Significant increase |

Upstream powder material enterprises have clearly passed on cost pressures to the downstream. Taking Shandong Chunguang Magnetoelectric as an example, affected by the price increase of manganese tetroxide by about 5,000 yuan/ton and the continuous price hike of cobalt tetroxide, starting from December 26, 2025, all manganese-zinc ferrite power materials will be increased by 1,200 yuan/ton, and high-permeability materials will be increased by 900 yuan/ton [1][2].

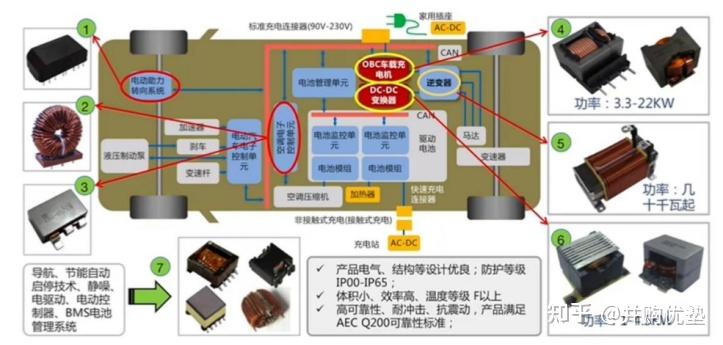

As a domestic leader in basic components, Sunlord Electronics’ products mainly include four categories: magnetic devices, microwave devices, sensor devices, and precision ceramics [0]. The raw material price hikes have had a significant impact on its cost structure:

- Increased costs of copper wire and magnetic materials: Copper is a core raw material for magnetic components such as inductors and transformers, accounting for a relatively high proportion of raw material costs

- Price increase of powder materials: The price hikes of manganese-zinc ferrite power materials and high-permeability materials directly push up the cost of magnetic cores

- Synchronous increase in supporting auxiliary materials: The price of welding materials such as tin has skyrocketed, further increasing manufacturing costs

From the financial data, Sunlord Electronics’ gross profit margin in the first half of 2025 was 36.68%, a year-on-year decrease of 0.28 percentage points [0]. Although it remains at a relatively high level, it has already shown the transmission effect of raw material price hikes:

| Indicator | 2025 Q1 | 2024 Q1 | Change |

|---|---|---|---|

| Gross Profit Margin | 36.56% | 36.95% | -0.39% |

| Net Profit Margin | 17.34% | Year-on-year increase | Improved |

The company’s financial analysis shows a debt risk level of “moderate_risk”, with a conservative financial attitude [0]. This means that the company may be relatively cautious in passing on costs.

The current magnetic components industry is facing “triple squeezes” [1][2]:

- Upstream cost pressure: Raw material prices are rising one after another, which is highly exogenous and uncontrollable

- Weak downstream demand: The recovery pace of terminal demand is slow, especially in some consumer electronics and traditional industrial sectors, with limited order flexibility

- Price reduction pressure from customers: In a fiercely competitive environment, power system manufacturers continue to demand price reductions and fast delivery from component suppliers

Facing cost pressure, Sunlord Electronics issued an announcement on December 29, 2025, stating that starting from January 1, 2026, it will increase the prices of some multilayer inductor beads and varistor products [1][2]. This is the company’s direct measure to respond to raw material price hikes.

At the same time, peer companies such as Fenghua Advanced Technology have also issued price adjustment notices one after another, moderately adjusting the prices of some resistors, inductors and other passive component products [1][2].

According to the financial data of the first half of 2025, Sunlord Electronics has achieved remarkable results in expense control [0]:

| Expense Item | Year-on-Year Growth Rate | Control Effect |

|---|---|---|

| Sales Expenses | +12.79% | Growth rate lower than revenue growth rate |

| General and Administrative Expenses | +8.00% | Effectively controlled |

| R&D Expenses | +23.82% | Strategic investment |

| Financial Expenses | -16.30% | Significant decrease |

The company actively promotes an expense control budget system, and the period expense ratio has dropped to 16.56%, a decrease of 0.90 percentage points compared with the same period last year [0], achieving a favorable situation where profit growth (32.03%) outpaces revenue growth (19.80%).

- Expansion in emerging fields: Automotive electronics business grew by 38.22% year-on-year, data center business achieved important growth, and emerging applications such as AI mobile phones drove the increase in single-unit value [0]

- High-end product layout: The company has global competitiveness in the 01005 and 008004 high-end inductor segments, and transfers cost pressure through product upgrades [0]

- Continuous R&D investment: R&D investment in the first half of 2025 reached 277 million yuan, a year-on-year increase of 23.82%, providing technical support for the company’s future development [0]

- Industry leading position: As a domestic leader in inductors, Sunlord Electronics has certain pricing power and can pass on prices relatively calmly [0]

- High gross profit margin level: A gross profit margin of over 36% provides a buffer space to absorb part of the cost pressure [0]

- Good cash flow status: Robust asset-liability structure and healthy cash flow status, with the ability to withstand short-term cost shocks [0]

- Optimized business structure: The proportion of high-margin emerging businesses such as automotive electronics and data centers has increased, enhancing overall profitability [0]

- Uncontrollable continuous rise in raw material prices: The prices of bulk commodities such as copper and tin are affected by the international market, and enterprises cannot fully hedge against this

- Acceptance by downstream customers: Price increases may affect customer relationships and order stability

- Competitive pressure from small and medium-sized enterprises: Most small and medium-sized enterprises “dare not raise prices, cannot raise prices”, which may suppress market prices

- Cost of technological upgrading: The R&D of new technologies such as magnetic integration and high-frequency low-loss requires substantial investment

- Raw material cost pressure will continue, and the company can partially mitigate the impact through product price increases and expense control

- Focus on whether the gross profit margin can stabilize and the market acceptance of price increases for new products

- Sustained growth in demand from high-end fields such as new energy and AI computing power provides the company with market space for volume and price growth

- Technological innovation and economies of scale are the keys for the company to maintain profitability

- It is expected that the net profit attributable to shareholders will be 1.067 billion yuan / 1.355 billion yuan / 1.676 billion yuan from 2025 to 2027 [0]

- Risk of further increases in raw material prices

- Downstream terminal demand falls short of expectations

- Industry competition intensifies, leading to the failure of price increase strategies

The price hikes of raw materials for magnetic components have posed severe challenges to Sunlord Electronics’ cost control, mainly reflected in the increase in direct material costs, pressure on gross profit margin, and the operational dilemma of “triple squeezes”. However, relying on its industry leading position, high gross profit margin level, effective expense control, and product structure optimization, the company has strong response capabilities. Through a four-pronged approach of product price increases, expense management, technological innovation, and business expansion, Sunlord Electronics is expected to maintain relative stability in profitability under cost pressure and gain greater growth space in the high-end market.

[1] Electronic Transformer & Inductor Network - “Raw Materials ‘Rising in Price’, How Will the Magnetic Components Industry Move Forward?” (https://www.big-bit.com/news/405227.html)

[2] Sina Finance - “Raw Materials ‘Rising in Price’, How Will the Magnetic Components Industry Move Forward?” (https://cj.sina.com.cn/articles/view/3471026640/cee3a9d00010177qu?froms=ggmp)

[0] Jinling AI - Sunlord Electronics (002138.SZ) Company Profile and Financial Analysis Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.