Analysis of Eurozone Inflation and the European Central Bank's 2025 Monetary Policy Shift

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient data and professional information, and below I present a systematic and comprehensive analysis report.

According to the preliminary estimate released by Eurostat on December 31, 2025,

In terms of inflation structure, the current Eurozone inflation has the following characteristics:

| Inflation Component | November Data | December Data | Trend |

|---|---|---|---|

| Headline Inflation | 2.1% | 2.0% | ↓ Decline |

| Core Inflation | 2.4% | 2.3% | ↓ Larger-than-expected decline |

| Services Inflation | - | 3.4% | ★ Remains elevated |

| Food, Alcohol & Tobacco | - | 2.6% | ↑ Increase |

According to the staff projections released at the ECB’s December meeting [3][4]:

| Indicator | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|

| Headline Inflation | 2.1% | 1.9% | 1.8% | 2.0% |

| Core Inflation | 2.4% | 2.2% | 1.9% | 2.0% |

| Economic Growth Rate | 1.4% | 1.2% | 1.4% | 1.4% |

Notably,

The European Central Bank

- Data-dependent, meeting-by-meeting decision-making: No predetermined interest rate path, with adjustments made flexibly based on economic data and inflation outlook

- Neutral policy stance: Most economists believe the current interest rate level is close to the neutral range

- All options on the table: The Governing Council unanimously agreed not to rule out the possibility of future interest rate hikes or cuts

- Inflation hits target: The December headline inflation rate has fallen to 2.0%, meeting the ECB’s target

- Insufficient growth momentum: The 2025 GDP growth forecast is 1.4%, lower than the historical average

- Downward trend in core inflation: Core inflation has continued to decline from its peak

- Market expectations: Some institutions predict that interest rate cuts may occur in the second half of 2025 or 2026

- Services inflation stickiness: Services inflation remains as high as 3.4%, with sustained wage growth pressure

- Upward revision of 2026 inflation forecast: The ECB is more cautious about the short-term inflation outlook

- Policy uncertainty: Rising risks in the international trade environment and geopolitics

- Impact of Federal Reserve policy: If the Federal Reserve delays interest rate cuts, the euro may appreciate passively

| Institution | Forecast | Core Logic |

|---|---|---|

| Vanguard | Interest rates to remain unchanged in 2026 | Inflation will be below target most of the time, with a dovish policy tilt |

| Morningstar | Interest rate cuts possible | Hitting the inflation target provides justification for rate cuts |

| Most Economists | Wait-and-see stance in 2025 | Caution is needed due to inflation stickiness and uncertainty |

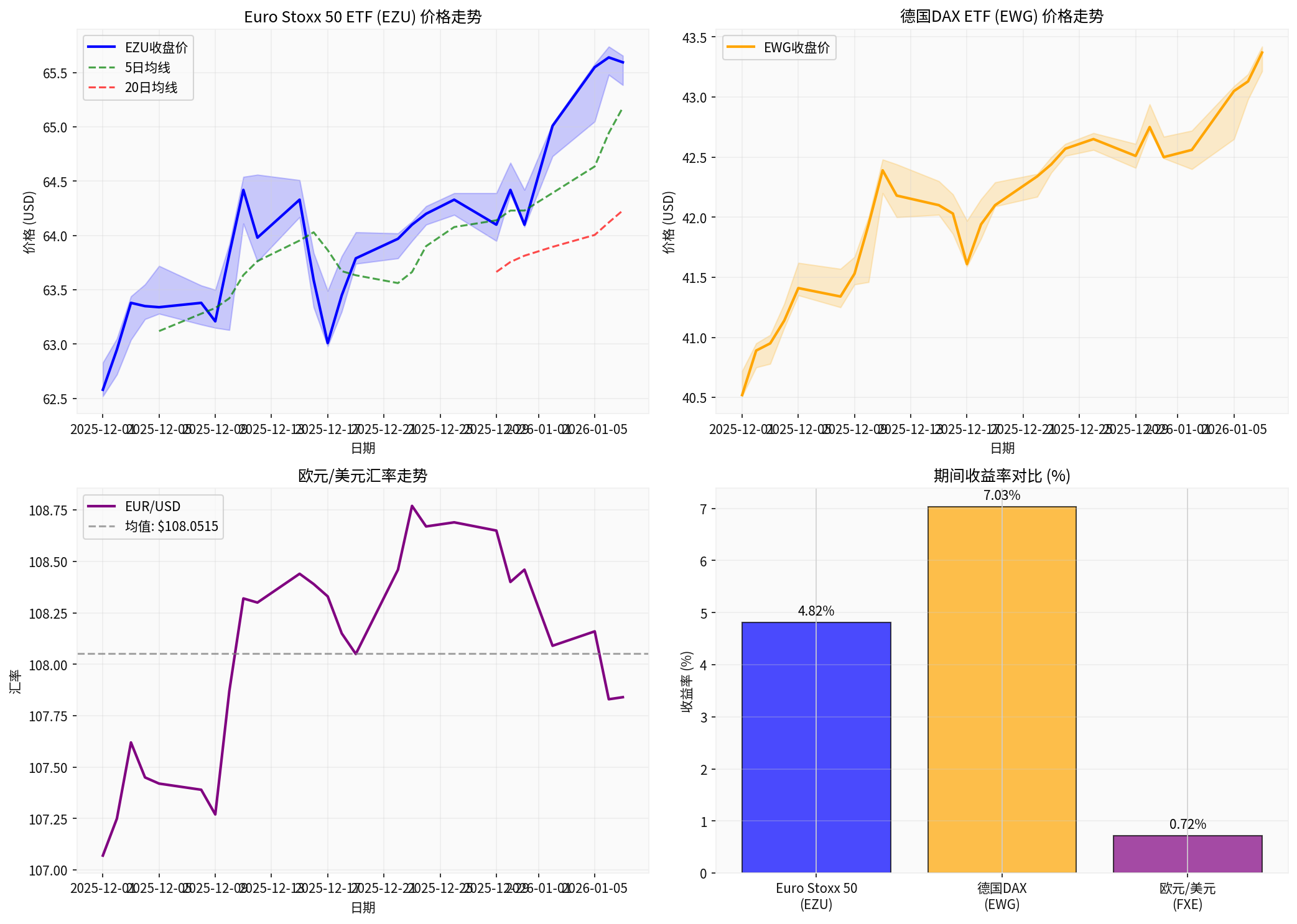

Based on the market data analysis I obtained [0], the performance of European stock markets from December 2025 to early January 2026 is as follows:

- Initial Price: $62.58 → Ending Price: $65.59

- Period Return: +4.82%

- Technical Pattern: Short-term uptrend (Price > MA5 > MA20)

- Annualized Volatility: 9.74%

- Initial Price: $40.52 → Ending Price: $43.37

- Period Return: +7.03%

- Initial: $1.0707 → Ending: $1.0784

- Period Change: +0.72%

- Hitting the inflation target boosts market risk appetite

- The ECB’s unchanged interest rates provide liquidity support

- Upward revision of economic growth expectations (1.4% is higher than previous estimates)

- AI investment and digital transformation drive corporate profit growth

- Priority Allocation: German DAX (benefits from economic recovery and improved exports)

- Moderate Allocation: Euro Stoxx 50 (diversified investment covering major Eurozone enterprises)

- Sectors to Watch: Information Technology (driven by AI investment), Industrials (export recovery), Consumer Discretionary (domestic demand growth)

- If the ECB shifts to rate cuts, Eurozone government bond yields will decline and prices will rise

- Short-term bonds are less affected by interest rate changes and can be used as a defensive allocation

- German government bonds remain the top safe-haven choice

- European investment-grade credit bonds have allocation value

- Focus on the financial sector (relief from net interest margin pressure on banks)

- High-yield bonds require caution, with vigilance against economic downside risks

- Short-term (1-3 months): Range-bound, likely to fluctuate between 1.05-1.10

- Medium-term (6-12 months): If the ECB cuts rates, the euro may come under pressure to decline

- Comparison with USD: Need to monitor the Federal Reserve’s policy direction

- For USD-denominated European assets, it is recommended to appropriately hedge exchange rate risks

- For EUR assets, consider allocating a certain proportion of USD hedging positions

- Impact of US tariff policies on Eurozone exports

- Deterioration of the global trade environment

- Escalation of geopolitical tensions

- Resurgence of services inflation leading to monetary policy tightening

- Increase in defense and infrastructure spending

- Success of productivity reforms

- AI investment driving corporate profits to exceed expectations

| Asset Category | Recommended Allocation Ratio | Core Logic |

|---|---|---|

| European Equities | 30-40% | Reasonable valuation + improved profitability + expectations of monetary policy shift |

| Eurozone Bonds | 25-35% | Attractive yields + capital gains under rate cut expectations |

| Equities of Other Developed Countries | 15-20% | Diversified investment |

| Alternative Assets | 5-10% | Inflation hedging + risk diversification |

| Cash | 5-10% | Liquidity management + uncertainty mitigation |

- In the initial stage of hitting the inflation target, market sentiment improves; gradual position building is feasible

- Monitor signals from the ECB’s March 2025 meeting

- If economic data is solid and inflation is stable, increase equity allocation

- Seize capital gain opportunities from declining bond yields

- Adjust allocation direction based on ECB policy signals

- If rate cut signals emerge, appropriately extend duration

- Hitting the inflation target is of great significance: The Eurozone’s December inflation rate fell to 2.0%, marking a phased victory in the battle against inflation and creating conditions for a monetary policy shift [1][2].

- Policy shift requires caution: Although inflation has hit the target, services inflation stickiness and wage growth pressure mean the ECB will not rush to shift its stance [3][4]. It is expected to keep interest rates unchanged in 2025, with the window for rate cuts likely to open in the second half of 2025 to early 2026.

- European assets become more attractive: Hitting the inflation target + solid economic growth + expectations of monetary policy shift provide support for European stock and bond markets. The German DAX and Euro Stoxx 50 indices have a bullish technical pattern with moderate annualized volatility [0].

- Allocation Recommendations: It is recommended that investorsgradually increase their allocation to European assetsat the current time, focusing on sectors benefiting from domestic demand recovery and AI investment, while maintaining appropriate diversification.

Investors need to pay close attention to the following risk factors:

- Resurgence of services inflation leading to unmet monetary policy expectations

- Negative impact of US tariff policies on the Eurozone economy

- Rising geopolitical risks

- Deterioration of global financial market sentiment

[1] Morningstar - “Eurozone Inflation Falls to 2% in December, in Line with ECB Target” (https://global.morningstar.com/en-gb/economy/eurozone-inflation-falls-2-december-line-with-ecb-target)

[2] Trading Economics - “Euro Area Interest Rate” (https://tradingeconomics.com/euro-area/interest-rate)

[3] European Central Bank - “Press Conference - Monetary Policy Statement December 2025” (https://www.ecb.europa.eu/press/press_conference/monetary-policy-statement/2025/html/ecb.is251218~3a10402adb.en.html)

[4] European Central Bank - “Monetary Policy Decisions December 2025” (https://www.ecb.europa.eu/press/pr/date/2025/html/ecb.mp251218~58b0e415a6.en.html)

[0] Jinling AI - European Market Data Analysis (December 2025 - January 2026)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.