In-Depth Analysis of Merck's $9.2 Billion Acquisition of Cidara

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above data and research, I now provide you with a comprehensive analysis report:

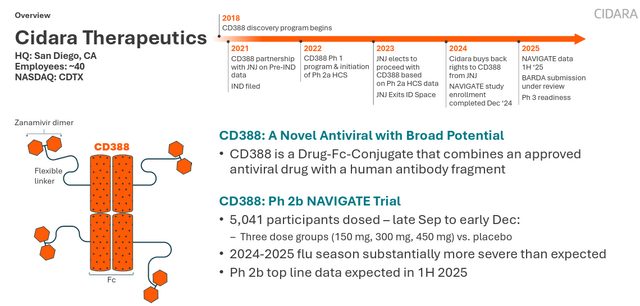

Merck & Co., Inc. (NYSE: MRK) announced the acquisition of Cidara Therapeutics (Nasdaq: CDTX) in November 2025, with a transaction consideration of $221.50 in cash per share, totaling approximately

Cidara’s core asset is

| Feature | Details |

|---|---|

Mechanism of Action |

Stably links multiple potent neuraminidase inhibitors to a human antibody Fc fragment |

Uniqueness |

Neither a vaccine nor a monoclonal antibody, but a low-molecular-weight biologic |

Half-Life |

Designed as a long-acting small-molecule inhibitor |

Indications |

Prevention of seasonal and pandemic influenza infections |

- June 2023: Received FDA Fast Track Designation[2]

- June 2025: Phase 2b NAVIGATE study met its primary endpoint, demonstrating statistically significant efficacy[3]

- September 2025: Initiated Phase 3 ANCHOR study

- October 2025: Received FDA Breakthrough Therapy Designation[2]

The strategic value of CD388 is reflected in the following:

- Filling Pipeline Gaps: Strengthens Merck’s product portfolio in the antiviral and respiratory fields

- Differentiated Competitive Advantage: Features “strain-agnostic” properties, covering all influenza virus strains

- Protection for High-Risk Populations: Designed specifically for populations at high risk of complications

- Platform Technology Potential: The Cloudbreak platform can be extended to other antiviral areas

The acquisition price of $221.50 per share represents the following premiums relative to Cidara’s historical stock prices[4]:

| Time Period | Average Price | Acquisition Premium |

|---|---|---|

| 1 Month Pre-Acquisition | ~$180 | ~23% |

| 6 Months Pre-Acquisition | ~$50 | ~343% |

| 1 Year Pre-Acquisition | ~$30 | ~638% |

From the perspective of biopharmaceutical M&A transactions[4]:

| Metric | Value |

|---|---|

| Acquisition Price/R&D Investment | 2-3x that of typical biotech acquisitions |

| Valuation per Phase 3 Asset | $2-4 billion |

| Cidara’s Concurrent CD377 Pipeline | Implied Value |

- Clinical Stage Advantage: CD388 is in Phase 3, with relatively controllable risks

- Regulatory Designation Support: Dual designations (Fast Track + Breakthrough) reduce approval risks

- Huge Market Potential: Global influenza drug market size is approximately$15 billion

- Synergies: Complements Merck’s existing vaccine and respiratory product lines

- Strategic Timing: Keytruda faces patent expiration pressure, requiring new product supplementation

- Still needs to complete Phase 3 clinical trials and obtain regulatory approval

- Intense competition in influenza vaccines, requiring demonstration of differentiated value

- Negative impact of approximately $0.30 per shareon EPS in the short term[1]

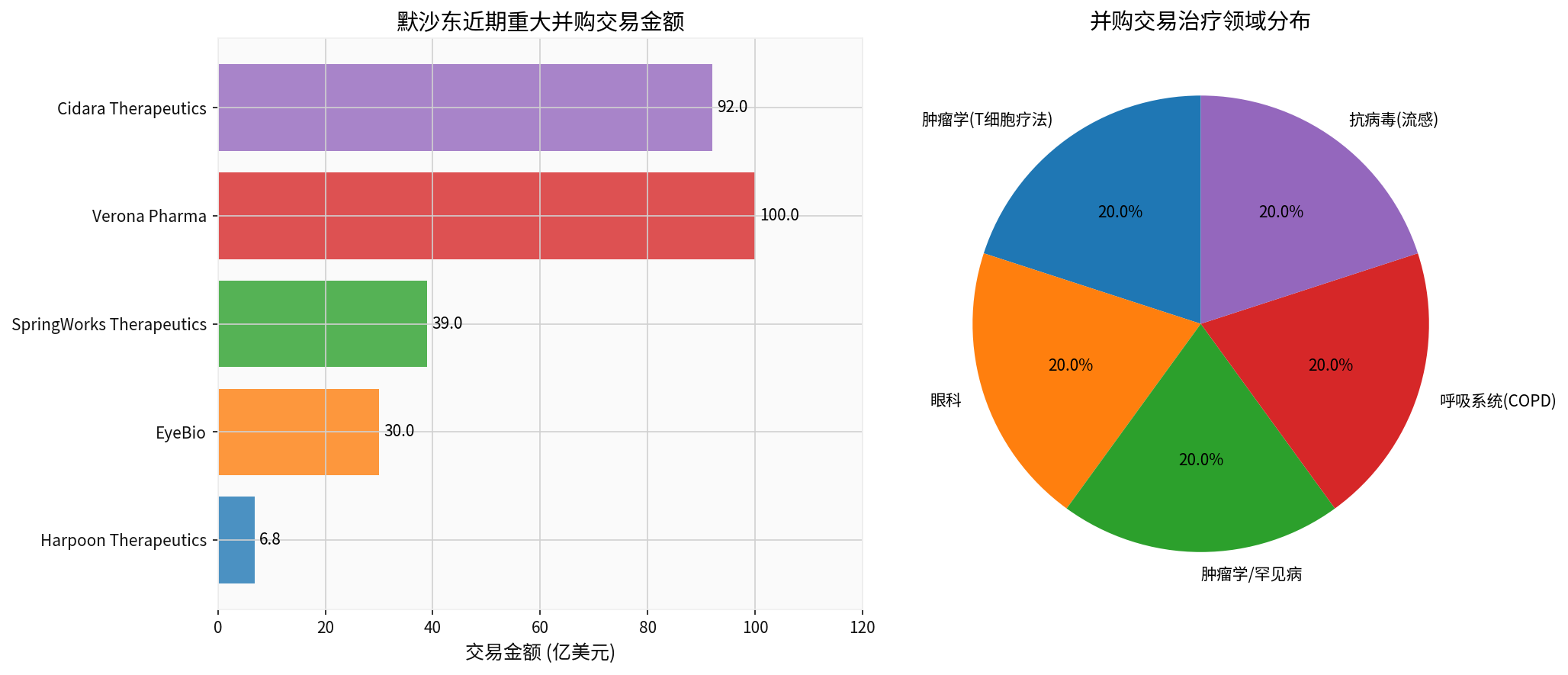

Over the past two years, Merck has completed

| Date | Target | Amount | Field | Stage |

|---|---|---|---|---|

| January 2024 | Harpoon Therapeutics | $680 million | Oncology (T-cell Therapy) | Clinical |

| July 2024 | EyeBio | $3 billion | Ophthalmology | Clinical |

| April 2025 | SpringWorks Therapeutics | $3.9 billion | Oncology/Rare Diseases | Commercial + Clinical |

| July 2025 | Verona Pharma | $10 billion | Respiratory (COPD) | Commercialized |

| November 2025 | Cidara Therapeutics | $9.2 billion | Antiviral (Influenza) | Phase 3 |

Merck is transitioning from

- Oncology: Maintains core position, but expands to T-cell therapy, KRAS inhibitors, and other areas

- Respiratory: Builds a complete product matrix through Verona and Cidara

- Ophthalmology: Enters the innovative ophthalmology track through EyeBio

- Rare Diseases: Strengthens oncology rare disease pipeline through SpringWorks

| Strategy Type | Case | Objective |

|---|---|---|

| Late-Phase Assets for Quick Revenue Contribution | Verona Pharma | OHTUVAYRE is already commercialized |

| Differentiated First-in-Class Assets | Cidara (CD388) | Fills antiviral pipeline gaps |

| Platform Technology Expansion | Harpoon | T-cell engager platform |

| Long-Term Layout of Early-Phase Pipeline | EyeBio | Innovative ophthalmology therapies |

According to Merck’s Q3 2025 Financial Report[6]:

-

Robust Financial Position:

- Net Profit Margin: 29.63%

- ROE: 38.95%

- Current Ratio: 1.66

- Abundant cash to support M&A financing

-

Affordable Short-Term Costs:

- 2026 EPS is expected to decrease by approximately $0.30[1]

- Maintains investment rating

- Debt-financed, no impact on credit rating

-

Limited Revenue Contribution:

- Cidara needs to complete Phase 3, making short-term revenue contribution difficult

- Verona’s COPD drug OHTUVAYRE will contribute incremental revenue

-

Increased R&D Expenses:

- Accounting treatment for asset acquisition will lead to an increase of approximately $900 million in R&D expenses[1]

- Impact of approximately $3.65 per share (GAAP and non-GAAP)

-

Increased Pipeline Density:

- Adds over 10 clinical-stage assets

- Covers 5 new therapeutic areas

-

Revenue Diversification:

- Reduces Keytruda dependence (currently accounts for ~45% of revenue)

- New product lines are gradually commercialized

-

Strengthened Competitive Position:

- Respiratory field: Competes with GSK and AstraZeneca

- Antiviral field: Competes with Roche and GSK

-

Response to Patent Expiration:

- Keytruda’s core patent expires in 2028

- New pipeline provides growth momentum

-

Platform Technology Accumulation:

- Cloudbreak DFC platform

- T-cell engager technology

- Innovative ophthalmology platform

| Dimension | Assessment |

|---|---|

Financial Strength |

Market capitalization of $276.2 billion, abundant cash flow to support continuous M&A |

R&D Capability |

Possesses strong clinical development and commercialization capabilities |

Pipeline Depth |

Diversified therapeutic area layout reduces concentration risk |

Execution Capability |

Completed 5 major M&A transactions in the past 2 years, with verified integration capabilities |

| Challenge | Details |

|---|---|

Patent Cliff |

Keytruda faces patent expiration in 2028 |

Policy Risk |

US CDC vaccine policy adjustments may affect vaccine business[7] |

Integration Pressure |

Multiple M&A transactions require effective integration |

Intensified Competition |

Competition in the oncology field is becoming increasingly fierce |

Based on the latest data[4][6]:

- Median Target Price: $120.00 (Current price $109.91, 9.2% upside potential)

- Rating Distribution: 72.2% Buy, 25.0% Hold, 2.8% Sell

- Recent Rating Actions:

- BMO Capital (December 18, 2025): Upgraded to “Outperform”

- Morgan Stanley (December 12, 2025): Maintained “Equal Weight”

| Assessment Dimension | Score (1-5) | Explanation |

|---|---|---|

| Strategic Fit | 5 | Perfectly matches respiratory system strategy |

| Asset Quality | 4 | First-in-class asset, Phase 3 stage |

| Valuation Rationality | 3 | Premium is reasonable, and is industry norm |

| Financial Impact | 3 | Short-term EPS pressure, long-term potential is significant |

Composite Score |

3.8/5 |

Rational but execution needs attention |

- The $9.2 billion acquisition of Cidara is strategically rational, aligning with Merck’s long-term strategy of building a respiratory product matrix

- CD388 has differentiated competitive advantages, with FDA dual designations increasing the probability of success

- Merck’s M&A strategy is overall proactive and orderly, using diversified layout to address Keytruda’s patent expiration

- Short-term financial pressure is manageable, with Merck’s financial strength sufficient to support continuous investment

- Long-term competitiveness depends on execution capabilities, including clinical development, regulatory approval, and market promotion

- Risk of clinical trial failure

- Regulatory approval uncertainty

- Market acceptance risk

- Integration execution risk

- Macroeconomic and policy change risk

[1] Seeking Alpha - “Merck completes cash tender offer for Cidara Therapeutics” (https://seekingalpha.com/news/4537257-merck-completes-cash-tender-offer-cidara-therapeutics)

[2] Merck Official News Release - “Merck to Acquire Cidara Therapeutics, Inc., Diversifying Its Portfolio” (https://www.merck.com/news/merck-to-acquire-cidara-therapeutics-inc-diversifying-its-portfolio-to-include-late-phase-antiviral-agent/)

[3] Cidara Therapeutics - “Positive Topline Results from Phase 2b NAVIGATE Trial” (https://www.cidara.com/news/cidara-therapeutics-announces-positive-topline-results-from-its-phase-2b-navigate-trial-evaluating-cd388-a-non-vaccine-preventative-of-seasonal-influenza/)

[4] Jilin AI Market Data - Cidara Therapeutics (CDTX) Company Profile

[5] Matrix BCG / Porters Five Force - “Merck Growth Strategy and Future Prospects” (https://matrixbcg.com/blogs/growth-strategy/merck)

[6] Jilin AI Market Data - Merck & Co. (MRK) Company Profile and Financial Analysis

[7] Benzinga - “US Cuts Childhood Vaccine Schedule To 11 Core Shots” (https://www.benzinga.com/news/health-care/26/01/49720130/us-cuts-childhood-vaccine-schedule-to-11-core-shots-what-it-means-for-vaccine-makers-like-merck-)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.