Baird's Rating Adjustments Reveal Profound Shifts in Investment Logic for the Athleisure Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I have comprehensive data and analysis. Let me prepare a detailed investment research report for you.

The differentiated rating adjustments by investment firm Baird for three athleisure companies—Deckers (DECK), Crocs (CROX), and Under Armour (UAA)—reflect a profound reshaping of institutional investors’ views on the industry’s competitive landscape and valuation logic. This rating adjustment reveals that the athleisure industry is undergoing a paradigm shift from “growth above all else” to “quality first”, and from “single hit product-driven” to “multi-brand synergy” [0].

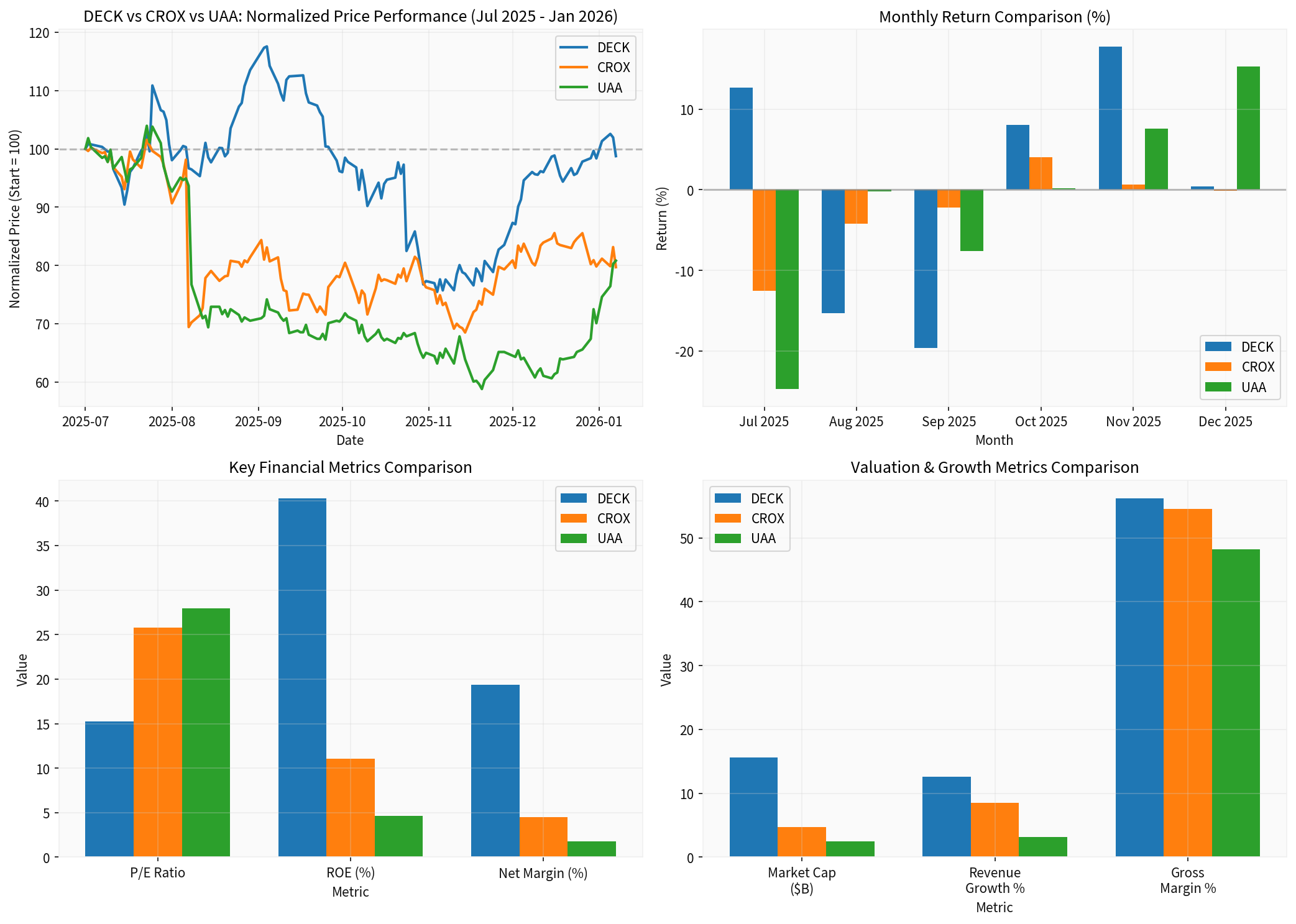

Based on trading data from July 2025 to January 2026, the three companies showed distinctly different trends [0]:

| Company | Normalized Price (July=100) | Period Return | Annualized Return |

|---|---|---|---|

DECK |

98.75 | -1.25% |

-49.26% |

CROX |

79.71 | -20.29% |

-23.15% |

UAA |

80.82 | -19.18% |

-31.76% |

Deckers showed the strongest resilience among the three, but still recorded a nearly 50% plunge over the year; Crocs and Under Armour exhibited greater volatility in both absolute and relative performance.

| Metric | DECK | CROX | UAA |

|---|---|---|---|

| Market Capitalization (USD 100 million) | 156.0 | 47.6 | 24.6 |

| Price-to-Earnings (P/E) | 15.21x | 25.79x | Loss |

| Return on Equity (ROE) | 40.31% |

11.08% | -4.61% |

| Net Profit Margin | 19.36% |

4.48% | -1.74% |

| Gross Profit Margin | 56.2% |

54.5% | 48.2% |

| Revenue Growth Rate | 12.62% |

~8.5% | ~3.2% |

Based on a compilation of multiple sources, Baird’s downgrade of Deckers is mainly based on the following considerations [1][2][3]:

The challenges facing Crocs are more structural and long-term [4][5]:

Baird has labeled Under Armour a “new trading opportunity”, reflecting a typical “turnaround” investment approach [6][7]:

The global athleisure market is experiencing structural growth. According to data from industry research institutions [8][9]:

- Market Size: The global athleisure market size is approximatelyUSD 154.69 billionin 2025, expected to reachUSD 163.35 billionin 2026, and expand toUSD 266.75 billionby 2035, with a compound annual growth rate (CAGR) of approximately 5.6%.

- Consumer Preferences: Approximately 68% of consumers choose an athleisure lifestyle, 63% prioritize comfort, and 58% actively participate in fitness activities.

- Segment Trends: Apparel (leggings, yoga wear) dominates demand; online channels account for more than 55% of sales; sustainability is a concern for approximately 52% of consumers.

Baird’s rating adjustments mark a fundamental shift in institutional investors’ investment logic for the athleisure industry:

| Dimension | Old Logic (2021-2023) | New Logic (2024-2026) |

|---|---|---|

| Core Metrics | Revenue growth, user growth | ROE, FCF, profit margins |

| Valuation Anchor | P/S (Price-to-Sales) multiple | P/E (Price-to-Earnings)/EV/EBITDA |

| Growth Expectations | The higher the better | Sustainability first |

| Risk Assessment | Track risk | Sustainability of competitive advantages |

| Brand Premium | Hit product-driven | Brand portfolio synergy |

The dilemma of Crocs’ acquisition of HEYDUDE reveals the risks of the “multi-brand platform” strategy:

- Underestimated Integration Difficulty: The complexity of cultural integration, channel synergy, and supply chain integration far exceeds expectations

- Overly Optimistic Growth Assumptions: HEYDUDE’s high growth before the acquisition is difficult to maintain during the integration period

- Goodwill Impairment Risk: The $2.5 billion acquisition price becomes a heavy burden when the brand’s performance falls short of expectations

In contrast, Deckers’ integration of HOKA was relatively successful, but HOKA’s own growth slowdown also reminds investors of the objective existence of a “hit product life cycle”.

The bullish outlook on Under Armour reflects the capture of a “turnaround” opportunity, but the application of this strategy requires the following conditions to be met:

- Management has a clear transformation plan with verifiable execution progress

- Core brand assets (technology, channels, user perception) have not been fundamentally lost

- Financial position can support cash consumption during the transformation period

- Valuation has fully priced in pessimistic expectations

Under Armour’s restructuring plan progress, signs of improved profit margins, and growth in its licensing business support its “turnaround” narrative, but the recovery of demand in the North American market remains uncertain.

| Company | Rating | Core Logic | Risk Factors |

|---|---|---|---|

DECK |

Cautious | Growth slowdown but strong profitability remains | Intensified competition for HOKA, softening U.S. demand |

CROX |

Prudent | HEYDUDE integration dilemma suppresses valuation | Goodwill impairment, sustained integration costs |

UAA |

Opportunity to Watch | Turnaround potential + attractive valuation | Execution risk, market share loss |

- Macroeconomic Downturn: A decline in consumers’ disposable income may suppress athleisure consumption

- Intensified Competition: Sustained impact from emerging brands and technological disruptors

- Supply Chain Risks: Geopolitical and tariff uncertainties affect cost structures

- Execution Risks: The execution progress and results of corporate transformation strategies may fall short of expectations

Baird’s differentiated rating adjustments for Deckers, Crocs, and Under Armour are a microcosm of the paradigm shift in athleisure industry investment. As the industry transitions from a “period of incremental dividends” to a “period of stock competition”, investors are shifting from chasing high growth to prudently evaluating the sustainability of profit quality and competitive advantages. The slowdown of Deckers’ HOKA and the dilemma of Crocs’ HEYDUDE reveal the limitations of the “hit product-driven” and “acquisition-led growth” models, while Under Armour’s “turnaround” narrative provides a potential contrarian opportunity for investors willing to take on execution risk.

Against this backdrop, the core task for investors is to shift from “track investment” to “enterprise quality investment”, identifying high-quality targets with truly sustainable competitive advantages in an increasingly differentiated market.

[0] Jinling AI - Market Data and Financial Analysis API

[1] Porter’s Five Force - Deckers Competitive Landscape Analysis (https://portersfiveforce.com/blogs/competitors/deckers)

[2] Deckers Outdoor FY2025 Q4 Results (https://ir.deckers.com/news-events/press-releases/press-release/2025/Deckers-Brands-Reports-Fourth-Quarter-and-Full-Fiscal-Year-2025-Financial-Results/default.aspx)

[3] Yahoo Finance - Deckers Stock Slides After Wall St. Downgrades (https://finance.yahoo.com/news/deckers-stock-slides-wall-st-193458749.html)

[4] Crocs Inc. Q3 2025 Results (https://investors.crocs.com/news-and-events/press-releases/press-release-details/2025/Crocs-Inc--Reports-Third-Quarter-2025-Results/default.aspx)

[5] MatrixBCG - Crocs Growth Strategy and Future Prospects (https://matrixbcg.com/blogs/growth-strategy/crocs)

[6] Under Armour - Fiscal 2025 Restructuring Plan Expansion (https://about.underarmour.com/en/stories/press-releases/release.25246.html)

[7] Public.com - Under Armour Stock Forecast and Analyst Ratings (https://public.com/stocks/uaa/forecast-price-target)

[8] Global Growth Insights - Athleisure Market Trends (https://www.globalgrowthinsights.com/zh/market-reports/athleisure-market-121951)

[9] Business Research Insights - Athleisure Market Trends 2026-2035 (https://www.businessresearchinsights.com/zh/market-reports/athleisure-market-117411)

[10] Best Colorful Socks - Running Shoes Consumer Statistics 2025 (https://bestcolorfulsocks.com/blogs/news/running-shoes-consumer-statistics)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.