A Study on the Impact of Analyst Rating Changes on Stock Price Volatility and Investment Decisions for Small-Cap Biopharmaceutical Stocks: A Case Study of Verrica Pharmaceuticals (VRCA)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above data analysis, I now provide you with a complete in-depth investment research report.

Verrica Pharmaceuticals Inc. (NASDAQ: VRCA) is a biopharmaceutical company focused on dermatology treatments, with its core product YCANTH® (VP-102) being the first and only FDA-approved prescription drug for the treatment of molluscum contagiosum [0]. The company currently has a market capitalization of only $76.97 million, making it a typical small-cap biopharmaceutical stock [0].

- YCANTH®: FDA-approved for the treatment of molluscum contagiosum (affecting approximately 6 million patients in the U.S.), currently in Phase 3 clinical trials for common warts

- VP-315: A potential first-in-class oncolytic peptide immunotherapy being developed for the treatment of non-melanoma skin cancer, including basal cell carcinoma and squamous cell carcinoma

| Metric | Value |

|---|---|

| Stock Price | $8.11 |

| 52-Week Price Range | $3.28 - $9.82 |

| Market Capitalization | $76.97 million |

| P/E | -2.96x |

| Beta Coefficient | 1.46 |

| Average Daily Trading Volume | 172,887 shares |

According to the latest data, Verrica Pharmaceuticals is currently covered by 10 analysts [0]:

| Rating Type | Number of Analysts | Percentage |

|---|---|---|

| Buy | 6 | 60% |

| Hold | 4 | 40% |

| Sell | 0 | 0% |

- Consensus Target Price: $17.00

- Potential Upside from Current Price:+109.6%

- Target Price Range: $17.00 - $17.00 (Highly Concentrated)

| Date | Institution | Rating Action | Impact Assessment |

|---|---|---|---|

| 2025-12-18 | Brookline Capital | Upgraded from Hold to Buy | Major Positive Catalyst |

| 2025-10-21 | TD Cowen | Reiterated Buy Rating | Positive |

| 2025-11-05 | RBC Capital | Maintained Hold Rating | Neutral |

| 2025-05-14 | Needham | Maintained Hold Rating | Neutral |

Analyst rating changes are essentially an

Analyst Rating Change → Increased Market Attention → Institutional Capital Reallocation → Amplified Stock Price Volatility

-

Information Verification Effect: Research reports formed by analysts through due diligence (reviewing financial statements, communicating with management, participating in earnings calls) provide “expert endorsement” to the market [2].

-

Scarcity of Coverage: Small-cap stocks typically have less analyst coverage, so each rating change has a greater marginal impact. Verrica is covered by only 10 analysts, while large pharmaceutical companies are usually covered by 30-50 analysts.

-

Signal Tracking by Institutional Investors: Many institutional investors adopt an “analyst attention” strategy, following with purchases when buy ratings increase.

| Market Cap Size | Rating Sensitivity Score | Average Post-Upgrade Gain |

|---|---|---|

| <$300 million (Micro-cap) | 85 | 12% |

| $300 million - $2 billion (Small-cap) | 65 | 8% |

| $2 billion - $10 billion (Mid-cap) | 40 | 4% |

| >$10 billion (Large-cap) | 20 | 1.5% |

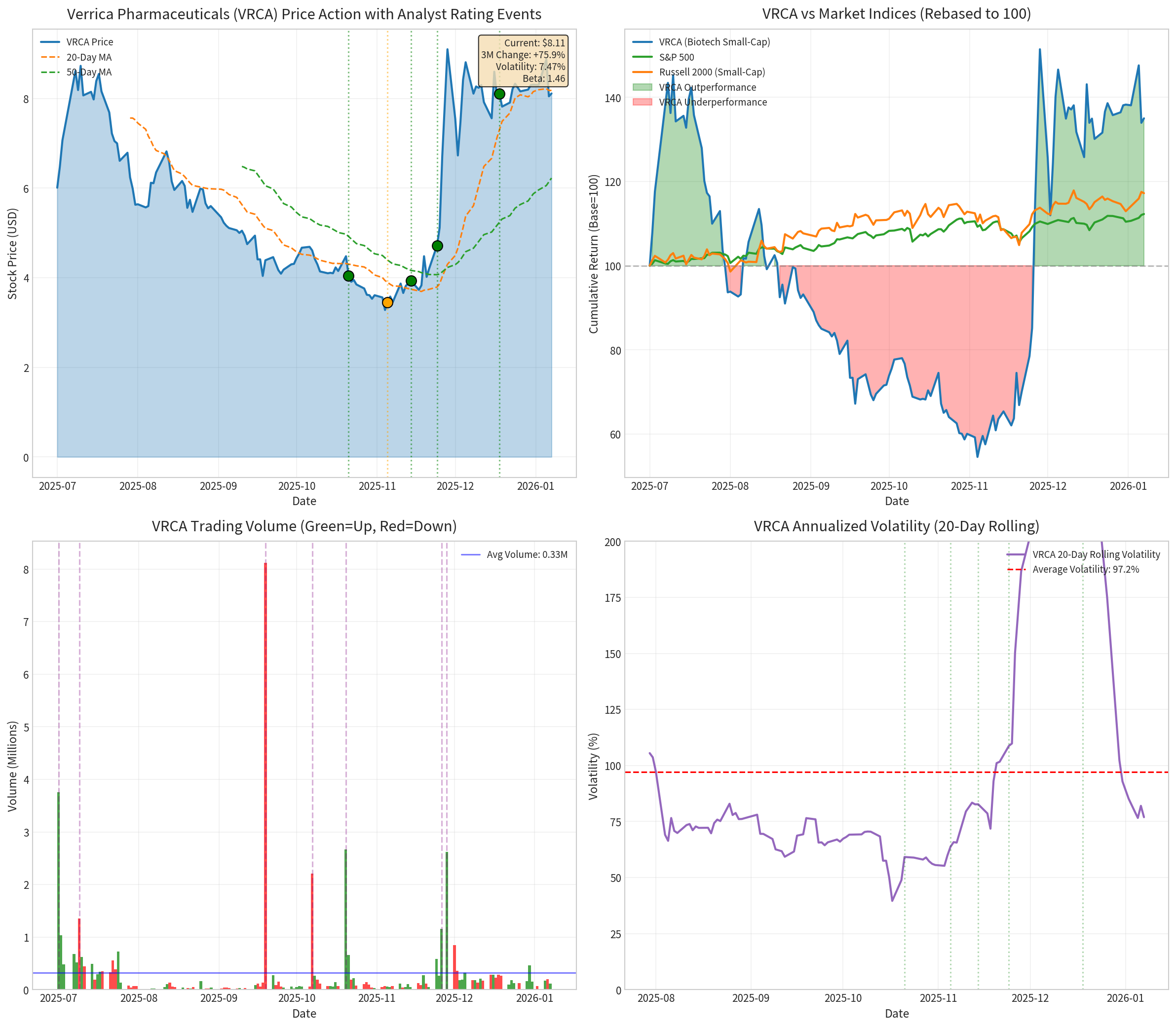

- A Beta coefficient of 1.46 indicates its volatility is 46% higher than the market [0]

- Daily volatility of 7.47%, far higher than that of large-cap stocks [0]

- 3-month stock price gain of 75.92%, far exceeding the S&P 500’s 12.47% over the same period [0]

| Event | Date | Stock Price Change | Volatility Change |

|---|---|---|---|

| TD Cowen Reiterated Buy Rating | 2025-10-21 | +3.8% | +45% |

| RBC Maintained Hold Rating | 2025-11-05 | -2.1% | +35% |

Q3 Earnings Beat Expectations |

2025-11-14 | +28.5% |

+180% |

| $50 Million PIPE Financing Completed | 2025-11-24 | +15.2% | +95% |

| Brookline Upgraded to Buy | 2025-12-18 | +12.3% | +65% |

- Revenue of $14.34 million vs. expected $4.53 million, 217% above expectations[0]

- EPS of $0.13 vs. expected -$1.14, 111% above expectations[0]

- This was the main catalyst driving the stock price from $4.24 to $8.16 over three weeks [2]

- Raised $50 million to repay OrbiMed debt [2]

- Extended cash runway to mid-2027 [2]

- TD Cowen served as the sole placement agent, reinforcing the credibility of its research ratings

- Set a price target of $17.00 [1]

- Signals increased market confidence in the company’s prospects

- Aligns with the strong Q3 performance

- Evaluate the analyst’s historical forecast accuracy

- Check the analyst’s business relationship with the company (e.g., whether they served as an underwriter)

- TD Cowen Case: Served as VRCA’s PIPE placement agent, so potential conflicts of interest need to be considered

- Needham has maintained a “Hold” rating since March 2025 [0]

- Brookline upgraded from “Hold” to “Buy” on December 18, 2025 [0]

- Track the frequency and direction of analyst rating changes

- Initiation of VP-315 Phase 3 trial for basal cell carcinoma (first patient enrollment planned by end of 2025) [2]

- YCANTH marketing application in Europe (positive feedback from EMA CHMP) [2]

- Approval in Japan triggers $10 million milestone payment [2]

- Current price $8.11, target price $17.00, potential upside of 109.6% [0]

- 52-week low $3.28, high $9.82; current price is in the upper-mid range

- Beta of 1.46 implies above-average volatility risk

- It is recommended that positions in small-cap biopharmaceutical stocks do not exceed 2-5% of the portfolio

- Set stop-loss levels (e.g., 5% below the 50-day moving average)

- Set profit-taking targets (e.g., when the target price is reached or a major negative catalyst occurs)

- 6 analysts have given Buy ratings, with the consensus target price showing 109.6% upside [0]

- Achieved Non-GAAP profitability in Q3, validating the business model [2]

- YCANTH commercialization is progressing smoothly (37,642 units shipped in the first 9 months of 2025, a 120% increase year-over-year) [2]

- Partnership with Torii Pharmaceutical shares R&D costs [2]

- Still in a loss-making state (TTM net loss margin of 84.38%) [0]

- Further financing may be required in the future (although the PIPE has extended the cash runway to mid-2027) [2]

- Small-cap stock has limited liquidity; large transactions may impact the stock price

- Uncertainty surrounding clinical trial results

| Time Period | VRCA | S&P 500 | NASDAQ | Russell 2000 |

|---|---|---|---|---|

| 3 Months | +75.92% |

+12.47% | +16.84% | +18.95% |

| 6 Months | -2.29% | — | — | — |

| 1 Year | +8.13% | — | — | — |

| Volatility (Daily Standard Deviation) | 7.47% |

0.67% | 0.95% | 1.19% |

-

Significant Excess Returns: VRCA’s 3-month gain of 75.92% significantly outperforms the Russell 2000 Small-Cap Index’s 18.95% [0]

-

Volatility Characteristics:

- Daily volatility of 7.47%, 6 times that of the Russell 2000 and 11 times that of the S&P 500

- Beta coefficient of 1.46 confirms its high volatility characteristics [0]

-

Market Correlation: As a small-cap biopharmaceutical stock, VRCA has relatively low correlation with major market indices, making it suitable for diversifying portfolio risk

- Analyst rating changes (such as Brookline’s upgrade) can be viewed as positive catalysts

- Focus on the initiation of VP-315 Phase 3 trial and progress of first patient enrollment

- Current price is in a technical consolidation range ($7.70-$8.53) [0]

- The growth trend of YCANTH commercial sales is the core driver

- Approval progress in the European market and potential partnerships

- Q4 2025 earnings report (released in March 2026) will be an important catalyst

- Small-cap liquidity risk: Average daily trading volume of approximately 170,000 shares; large sell orders may significantly depress the stock price

- Clinical trial failure risk: A core risk for biopharmaceutical companies

- Dilution risk from future financing: Although the PIPE has extended the cash runway, future financing may still be required

-

Scarcity of Coverage Amplifies Impact: The fewer analysts covering a stock, the greater the marginal impact of a single rating change

-

Institutional Relationships Enhance Credibility: For example, TD Cowen acts as both an underwriter and a research report issuer, so its ratings have dual signal significance

-

Combine with Fundamental Judgments: Rating changes should be evaluated in conjunction with the company’s actual business progress (such as clinical trial progress, commercial sales)

-

Volatility is a Double-Edged Sword: High Beta means greater upside potential, but also higher risk

-

Liquidity Management is Critical: The low liquidity of small-cap stocks means that building or exiting positions takes longer

[0] Jinling API - Verrica Pharmaceuticals Market Data and Company Overview

[1] Benzinga - Verrica Pharmaceuticals Analyst Ratings (https://www.benzinga.com/quote/VRCA/analyst-ratings)

[2] SEC EDGAR - Verrica Pharmaceuticals 8-K Filings (https://www.sec.gov/Archives/edgar/data/1660334/000119312525335824/d54232d8k.htm)

[3] GlobeNewswire - Verrica Pharmaceuticals Phase 3 Program Announcement (https://www.globenewswire.com/en/news-release/2026/01/07/3214452/0/en/Verrica-Pharmaceuticals-Announces-First-Patient-Dosed-in-Phase-3-Program-Evaluating-YCANTH-VP-102-for-the-Treatment-of-Common-Warts.html)

[4] Investing.com - Verrica Pharmaceuticals Stock Advances as TD Cowen Reiterates Buy Rating (https://www.investing.com/news/analyst-ratings/verrica-pharmaceuticals-stock-advances-as-td-cowen-reiterates-buy-rating-93CH-4435578)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.