Analysis of the Impact of Jensen Huang Receiving IEEE's Highest Honor Medal on NVIDIA (NVDA) Valuation and the AI Chip Competitive Landscape

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and market information above, I have prepared a systematic and comprehensive analysis report for you.

On January 7, 2026, IEEE (Institute of Electrical and Electronics Engineers), the world’s largest professional technical organization, officially announced that Jensen Huang, founder and CEO of NVIDIA, has been selected as the recipient of the “2026 IEEE Honor Medal” [1][2]. Established in 1917, this award is IEEE’s highest honor, with a $2 million prize, designed to recognize outstanding individuals who have made far-reaching impacts on the engineering and technology community [2].

IEEE President Mary Ellen Randall stated: “The IEEE Honor Medal represents the pinnacle of professional achievement. Jensen Huang’s contributions have advanced the frontiers of technology and spurred a series of innovations, whose influence remains to be further imagined and demonstrated in the future.” [1]

Jensen Huang thus joins a roster of distinguished laureates, including Vint Cerf and Robert Kahn, the architects of the Internet’s framework, Bradford Parkinson, the father of the Global Positioning System (GPS), and Morris Chang, a titan of the semiconductor industry [2].

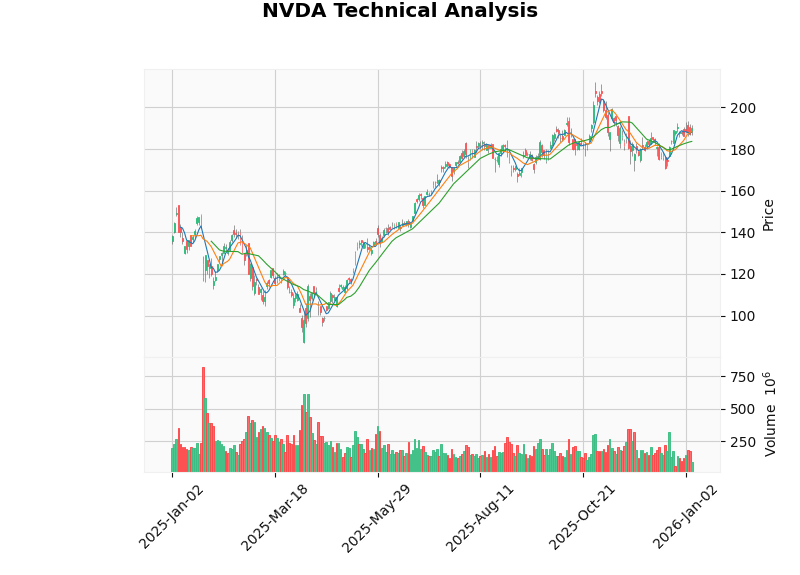

As of the close on January 7, 2026, NVIDIA (NVDA) shares closed at $189.90, rising 1.42% on the day, with a current market capitalization of $4.62 trillion [0]. From a technical analysis perspective, the stock price has been consolidating in a sideways range between $183.66 and $192.70 [0].

| Valuation Metric | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | 46.60x | Above semiconductor industry average |

| Price-to-Book (P/B) Ratio | 38.88x | Significantly above average |

| Price-to-Sales (P/S) Ratio | 24.72x | At a high level |

| Beta Coefficient | 2.31 | High-volatility stock |

Based on the latest institutional rating data, the market maintains a strong Buy consensus on NVIDIA [0]:

- Consensus Target Price: $257.50 (implied upside of +35.6%)

- Target Price Range: $140.00 - $352.00

- Rating Distribution: Strong Buy 2.5%, Buy 73.4%, Hold 20.3%, Sell 3.8%

Notably, NVIDIA became the world’s first company with a market capitalization exceeding $5 trillion in October 2025 [1][2], a milestone that further solidified its leading position in the global technology industry.

Jensen Huang receiving IEEE’s highest honor medal will have positive impacts on valuation from the following dimensions:

-

Management Endorsement Effect: As the highest honor in the technology field, this award is an authoritative recognition of Jensen Huang’s technological leadership, strengthening investors’ confidence in NVIDIA’s technological innovation capabilities.

-

Brand Value Enhancement: The global influence of the IEEE Honor Medal will enhance NVIDIA’s brand reputation, helping to attract more enterprise customers and partners.

-

Enhanced Talent Attraction: Top technical talents are more inclined to join enterprises recognized with the industry’s highest honors, which will strengthen NVIDIA’s talent advantage in the AI chip field.

-

Strengthened Long-Term Growth Narrative: IEEE explicitly cited Jensen Huang’s “forward-looking layout capabilities that lead the industry by decades” [3], which validates the long-term sustainability of NVIDIA’s strategy.

According to market data, NVIDIA still holds an absolute dominant position in the global AI GPU market, with a market share of approximately 92% in 2025 [4]. However, the competitive landscape is undergoing profound changes:

| Company | Market Share | Strategic Initiatives |

|---|---|---|

| AMD | ~4% | Actively advancing the Instinct GPU series with obvious cost-performance advantages |

| Intel | ~2% | Accelerating the advancement of the Gaudi series AI chips |

| Others | ~2% | Mainly startups and regional players |

According to a Bloomberg report, Google is collaborating with Meta to advance the “Torch TPU” project, aiming to build an ecosystem comparable to NVIDIA’s CUDA [4]. Hyperscale cloud providers such as Amazon (Trainium) and Microsoft (Maia) are also continuously investing in self-developed AI chips.

In the Chinese market, due to geopolitical factors, NVIDIA’s dominant “single-player” landscape has been broken [4]. According to a report released by Bernstein Research, the 2025 market share distribution of China’s AI accelerator market is as follows:

- Huawei: ~40% (sales revenue of $10.268 billion)

- NVIDIA: ~40% (sales revenue of $10.198 billion)

- Cambricon: ~4%

- Hygon: ~4%

- Alibaba T-Head, AMD, etc.: Single-digit market share

The formation of this “dual-core” landscape not only reflects the effectiveness of domestic substitution policies but also demonstrates Huawei’s competitive advantages in localization [5].

Another major trend in the 2026 AI chip market is that ASIC chips may surpass GPUs in shipment volume for the first time [4]. Nomura Securities predicts that as large AI models shift from the training phase to the inference phase, market demand for high-efficiency, low-cost ASIC chips will experience explosive growth [4].

This will have dual impacts on NVIDIA:

- Short-Term Challenge: Growth in the inference market may divert some market share from the training market

- Long-Term Opportunity: NVIDIA’s deep accumulation in architectural innovation and software ecosystem still provides moat advantages

The awarding of the IEEE Honor Medal has the following strategic significance for NVIDIA’s competitive position:

-

Technological Leadership Endorsement: As the world’s most authoritative professional organization in electrical and electronics engineering, IEEE’s recognition strengthens NVIDIA’s position as a technological benchmark in the accelerated computing field.

-

CUDA Ecosystem Defense: NVIDIA’s painstakingly built CUDA ecosystem is a key barrier against competitors. Jensen Huang’s award will further solidify the developer community’s confidence in the CUDA ecosystem.

-

Supply Chain Discourse Power: Jensen Huang revealed at CES 2026 that NVIDIA is the world’s first and almost the only major user of HBM4 in the short term, having established a highly close planning mechanism with major memory suppliers [3]. This supply chain advantage is expected to be further strengthened.

-

Continuation of Innovation Narrative: IEEE explicitly recognized Jensen Huang’s “persistent commitment to innovation” and “strategic layout decades ahead of the curve” [3], which provides authoritative endorsement for NVIDIA’s long-term innovation narrative.

NVIDIA’s financial fundamentals remain strong [0][6]:

| Profitability Metric | Value | Evaluation |

|---|---|---|

| Net Profit Margin | 53.01% | At an extremely high level |

| Operating Profit Margin | 58.84% | Indicates strong pricing power |

| Return on Equity (ROE) | 1.04% | Relatively low, but related to large-scale investments |

| Current Ratio | 4.47 | Sound financial position |

From the perspective of revenue structure, the data center business has become NVIDIA’s core pillar [6]:

- Data Center: 87.9% ($41.10B) - Significant year-over-year growth

- Gaming: 9.2% ($4.29B) - Traditional business remains stable

- Professional Visualization: 1.3%

- Automotive: 1.3%

- OEM and Other: 0.4%

This structure indicates that NVIDIA has successfully transformed from a gaming graphics card manufacturer to a leading AI infrastructure enterprise.

The latest quarterly results show that NVIDIA’s growth momentum remains strong [6]:

| Fiscal Quarter | EPS | Revenue (Billions of USD) | Beat Expectations |

|---|---|---|---|

| Q3 FY2026 | $1.30 | $57.01 | +3.17% EPS, +3.81% revenue |

| Q2 FY2026 | $1.05 | $46.74 | - |

| Q1 FY2026 | $0.81 | $44.06 | - |

The next earnings report will be released on February 25, 2026, with market expectations of EPS of $1.52 and revenue of $65.57 billion [6].

- Valuation Risk: The current P/E ratio of 46.60x implies high growth expectations

- Competition Risk: Competitors such as AMD, Huawei, and Google continue to catch up

- Geopolitical Risk: Sino-US technological frictions may impact business in the Chinese market

- Technological Route Risk: The rise of ASICs may alter the competitive landscape

- Supply Chain Risk: Supply of key components such as HBM may be constrained

Based on the event of Jensen Huang receiving IEEE’s highest honor medal, we believe:

The chart above shows the stock price candlestick chart and technical indicators of NVIDIA (NVDA). From a technical analysis perspective, the stock price is currently in a sideways consolidation phase; the MACD indicator shows a bullish trend, while the KDJ indicator indicates short-term pullback pressure [0].

[1] IEEE (Institute of Electrical and Electronics Engineers) - “NVIDIA Founder and CEO Jensen Huang Honored with the Highest Honor in Technology — 2026 IEEE Honor Medal” (https://www.eet-china.com/mp/a465475.html)

[2] Sina Finance - “NVIDIA CEO Jensen Huang Receives IEEE’s Highest Honor Medal, Awarded $2 Million Prize” (https://finance.sina.com.cn/tech/discovery/2026-01-07/doc-inhfmycz2345210.shtml)

[3] 36Kr - “Jensen Huang Responds to the Audience at CES: Memory is Bottlenecking GPUs” (https://m.36kr.com/p/3629151038145539)

[4] Sina Finance - “AI Chips in 2025: Giants Clash, Power Shifts” (https://finance.sina.com.cn/cj/2025-12-31/doc-inhesxnp3665369.shtml)

[5] EE Times China - “2025 Domestic GPU Market Landscape: Huawei & NVIDIA Tie for First Place” (https://www.eet-china.com/mp/a465594.html)

[6] Jinling AI - NVIDIA Company Overview and Financial Data API

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.