Truist's Digital Onboarding Enhancement: Competitive Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I have comprehensive information to provide a detailed analysis. Let me compile the findings.

Truist Financial Corporation has launched

The functionality enables new clients to seamlessly transfer direct deposits from their existing accounts during the account opening process—a critical feature given that direct deposit relationships are among the strongest indicators of long-term customer retention and primary financial relationship status [1].

The direct deposit switching functionality addresses one of the most significant friction points in consumer banking: the transition period between opening a new account and establishing it as the primary financial hub. Early adoption metrics demonstrate the feature’s effectiveness—

This conversion rate is particularly meaningful because customers who successfully switch their direct deposits demonstrate substantially higher lifetime value and retention rates. Direct deposit relationships create habitual engagement patterns and reduce the likelihood of account abandonment.

The enhancement represents Truist’s strategic response to competitive pressures from neobanks and digital-only challengers. Industry data indicates that

By integrating atomic’s direct deposit switching technology, Truist now offers a feature that was previously the exclusive domain of technology-first competitors. This eliminates a meaningful differentiation advantage that neobanks have leveraged to attract younger, digitally-savvy demographics—particularly Millennials and Gen Z consumers who prioritize seamless digital experiences [1].

The onboarding enhancement is strategically positioned within Truist’s broader client experience investment framework, which includes:

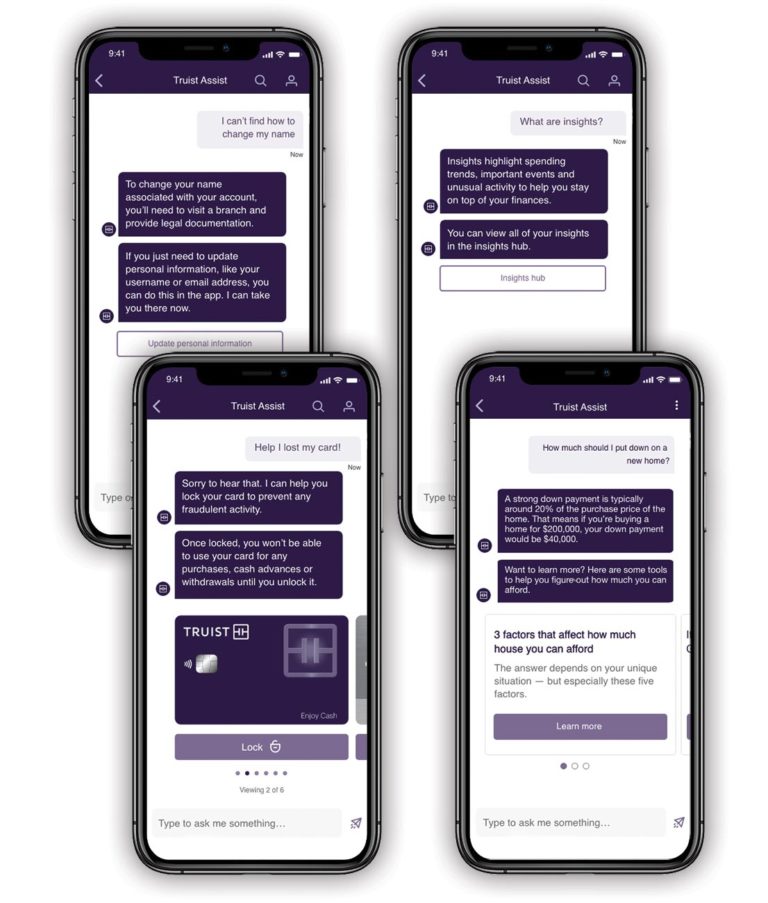

- Truist Assist: AI digital assistant averaging 440,000 monthly conversations [1]

- Truist Insights: AI tool delivering over 550 million personalized, real-time financial insights annually [1]

- Truist Client Pulse: Patent-pending AI pilot tool aggregating client feedback from millions of conversations [1]

- LightStream: Award-winning unsecured lending solution available digitally and in-branch [1]

The direct deposit switching capability creates opportunities for immediate cross-selling engagement when customers are in an active banking relationship transition mindset.

Truist operates as a

| Factor | Truist’s Position | Neobank Comparison |

|---|---|---|

| Branch Network | 100 new branches, 300+ renovated in high-growth markets [1] | No physical presence |

| Digital Experience | Enhanced onboarding with direct deposit switching [1] | Generally superior UX historically |

| Product Breadth | Full banking, payments, lending, wealth management [1] | Limited product depth |

| Customer Trust | Established brand with regulatory foundation [2] | Building credibility |

| ATM/Service Network | Extensive infrastructure [2] | Limited access points |

The digital onboarding enhancement directly addresses key neobank competitive advantages:

- Instant Onboarding: Truist’s streamlined digital process now competes effectively

- 24/7 Digital Access: Enhanced through AI tools like Truist Assist

- Mobile-First Interface: Integrated into the direct deposit switching workflow

- Lower Fees: Truist maintains traditional bank pricing while enhancing digital value [2][3]

However, Truist simultaneously maintains critical differentiators that digital-only competitors cannot easily replicate—particularly for customers who value in-person service for complex transactions and the security of established financial institutions [2][3].

The banking sector has experienced accelerated digital transformation, with traditional banks investing billions in technology modernization and AI capabilities. By 2025, approximately

This confluence indicates that competitive differentiation has evolved beyond “digital vs. physical” into a more nuanced battle over

Industry analysis suggests that hybrid banks—those combining digital capabilities with physical presence—are

The direct deposit switching capability strengthens Truist’s competitive position in several ways:

- Customer Acquisition: Reduces friction in the critical first interaction, improving conversion rates from prospect to active customer

- Customer Retention: Direct deposit relationships demonstrate stronger long-term engagement patterns

- Primary Financial Partner Status: Facilitates the transition from secondary to primary banking relationship

- Competitive Moat: Creates switching costs that make it more difficult for customers to migrate to competitors

Given the 19% adoption rate among engaged users, Truist has significant room for growth through:

- Enhanced user education and feature prominence

- A/B testing to optimize the switching workflow

- Integration with personalized financial planning tools

- Expansion into small business direct deposit switching

The feature also positions Truist favorably for potential regulatory changes around account switching portability, as the industry moves toward more open banking frameworks [1].

Truist’s digital onboarding enhancement through direct deposit switching functionality represents a strategically significant investment in competitive positioning. By partnering with Atomic to integrate this capability, Truist has effectively closed a meaningful experience gap with digital-first competitors while maintaining its hybrid model advantages.

The enhancement supports Truist’s broader strategy of becoming the “primary financial partner” for its clients—a positioning that creates substantial lifetime value through deeper relationships and reduced competitive vulnerability. With 19% of engaged new account applicants completing the direct deposit switch, early metrics demonstrate strong market reception.

In the context of intensified competition from both neobanks and traditional banking peers, this enhancement provides Truist with a differentiated capability that addresses a core customer need during the critical account opening phase. Combined with Truist’s continued investment in physical presence, AI tools, and product breadth, the digital onboarding enhancement reinforces a comprehensive competitive strategy that positions the bank favorably across multiple customer segments and use cases.

[1] Truist Financial Corporation. “Truist streamlines digital account opening with direct deposit switching.” Investor Relations Press Release, December 18, 2025. https://ir.truist.com/2025-12-18-Truist-streamlines-digital-account-opening-with-direct-deposit-switching

[2] Evans, David. “To Win New Customers, Banks Must Follow Neobanks.” The Financial Brand, December 10, 2025. https://thefinancialbrand.com/news/fintech-banking/to-win-new-customers-traditional-institutions-must-meet-head-on-the-appeal-of-the-neobanks-194300

[3] “Neo and Challenger Bank Analysis Report 2025.” FinTech Magazine, 2025. https://fintechmagazine.com/globenewswire/3176466

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.