Baina Qiancheng (300291) Surges to Limit-Up: Acquisition-Driven Transformation Amid Coexisting Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Baina Qiancheng (300291) surged to a limit-up on January 7, 2026, closing at RMB 8.44 with a 19.63% gain and a turnover of RMB 1.099 billion [1]. The limit-up was driven by a combination of factors: the core catalyst is the company’s proposed acquisition of Zhonglian Century, an AI digital marketing firm; meanwhile, the appointment of a new management team has raised expectations of improved corporate governance; additionally, the overall strength of the AI application sector provided a tailwind [5]. However, the company faces significant fundamental pressures: it reported a net loss of RMB 393 million in 2024, and its revenue in the first three quarters of 2025 dropped 73.43% year-on-year [8]. The stock price has partially priced in transformation expectations, so caution is advised when chasing the rally.

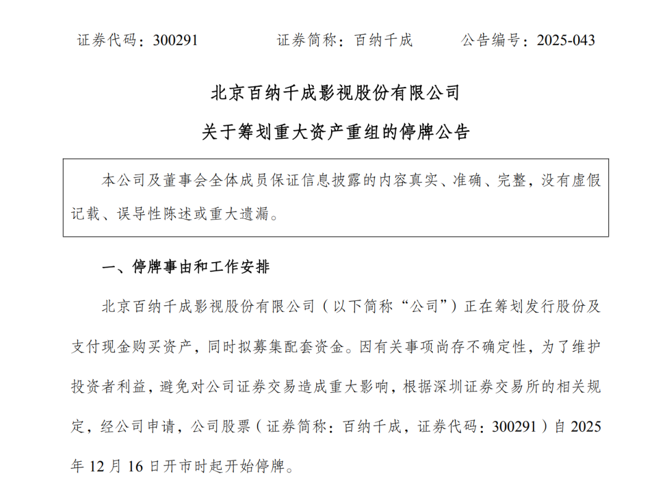

On December 25, 2025, Baina Qiancheng released a restructuring proposal, planning to acquire 100% equity of Xiamen Zhonglian Century Co., Ltd. by issuing shares and paying cash [2][3]. Zhonglian Century is a digital intelligence technology enterprise driven by “AI + big data”, which achieved revenue of RMB 6.417 billion in 2024 and has provided digital intelligence services to over 3,000 industry clients in sectors such as communications, finance, and e-commerce [4]. This acquisition will enable the listed company to directly obtain a mature AI technology platform and commercialization capabilities, transforming into a dual-driven model of “film and television + AI”.

Zhonglian Century has in-depth collaborations with leading digital ecosystems including Douyin, Tencent, Kuaishou, Huawei Cloud, and Alibaba Cloud, with its R&D team accounting for over 30% of its workforce [4], boasting strong technical strength and market competitiveness. Upon completion of the acquisition, the listed company will achieve a strategic transformation from a traditional “content provider” to an “integrated marketing solutions service provider”.

In early December 2025, the company completed a senior management reshuffle: former Chairman and CEO Fang Gang resigned for personal reasons, and Zhu Youyi was newly elected as Chairman of the 5th Board of Directors, with Li Qian appointed as General Manager [4]. Zhu Youyi has executive experience in well-known enterprises such as Midea and Alibaba, which is regarded by the market as a positive signal for improved corporate governance and upgraded development strategy. Meanwhile, the company revised 33 governance systems and established a special meeting mechanism for independent directors, further enhancing decision-making transparency.

On the afternoon of January 7, 2026, the AI application sector trended upward amid fluctuations. According to Cailian Press, DeepSeek’s next-generation flagship system R2 is expected to launch around the Spring Festival in February 2026 [5], which boosted the overall performance of the AI application sector. As an AI application concept stock, Baina Qiancheng was significantly driven by the sector’s enthusiasm.

On December 30, 2025, Baina Qiancheng was listed on the Shanghai and Shenzhen Stock Exchanges’ Dragon and Tiger List due to a daily increase of 15% and a cumulative deviation of 30% in gains over three consecutive trading days. The total purchase amount on that day reached RMB 292 million, with net buying from foreign capital [1][6]. On January 7, the turnover further expanded to RMB 1.099 billion, indicating extremely high market participation.

Baina Qiancheng showed a strong upward trend from late December 2025 to early January 2026: it resumed trading on December 26 after releasing the acquisition proposal; on December 30, it hit a one-year high of RMB 8.35, with a weekly gain of 17.03% [6]; it closed at RMB 7.49 on December 31; and surged to the limit-up price of RMB 8.44 on January 7, 2026. The stock price broke through the recent consolidation range, hitting a one-year high, and the 20cm limit-up indicates strong bullish sentiment in the market.

| Date | Price Change | Main Capital Flow |

|---|---|---|

| December 30 (Dragon and Tiger List) | +15%+ | Total purchase of RMB 292 million, net buying by foreign capital [1][6] |

| January 5 | -3.20% | Net outflow of RMB 41.9 million [7] |

| January 6 | - | Net outflow of RMB 65.27 million [8] |

From the perspective of capital flow, there is some divergence in short-term capital for this stock. Main capital showed net outflows for two consecutive days from January 5 to 6, indicating that some capital chose to take profits [7][8]. However, the strong limit-up on January 7 indicates that bullish momentum remains strong.

According to the Jinling Analysis Database [0], after breaking through the recent consolidation range, the stock price hit a new high, but short-term technical indicators such as RSI may have entered the overbought zone, so investors need to pay attention to the risk of a short-term pullback. Regarding key price levels: Support Level 1 is RMB 7.50 (the upper edge of the previous consolidation platform), Support Level 2 is RMB 6.80 (near the 20-day moving average); Resistance Level 1 is RMB 9.00 (psychological pressure at the integer level), Resistance Level 2 is RMB 10.00 (previous dense trading area).

Baina Qiancheng, formerly known as Hualu Baina, was founded in 2002 and listed on the ChiNext in 2012. It was once a benchmark enterprise in the film and television industry, with representative works including The Emperor Han Wu, The Beautiful Life of the Daughter-in-Law, and Hi, Mom [4]. However, affected by the overall downturn of the industry, the company’s operating conditions have continued to deteriorate in recent years.

| Financial Indicator | 2024 | First Three Quarters of 2025 |

|---|---|---|

| Operating Revenue | RMB 739 million | RMB 177 million (YoY -73.43%) [8] |

| Net Profit Attributable to Shareholders | -RMB 393 million | -RMB 67.5381 million (YoY -24.89%) [8] |

| Non-recurring Net Profit | - | -RMB 91.4133 million [8] |

| Gross Profit Margin | - | 18.23% [8] |

| Asset-Liability Ratio | - | 23.48% [8] |

The company has reported losses for three consecutive years from 2022 to 2024, with the loss expanding to -RMB 393 million in 2024 [4]. Its revenue in the first three quarters of 2025 dropped 73.43% year-on-year to RMB 177 million, with its traditional film and television business shrinking significantly. In the first half of 2025, the company’s film business revenue was only RMB 16.08 million, plummeting 70.68% year-on-year [4].

- Severe shrinkage of traditional film and television business: The deep loss situation of China’s film industry worsened in 2025, with the total annual loss of the entire industry possibly reaching up to RMB 10 billion [4]. As a participant in the industrial chain, the company has been significantly impacted.

- Asset impairment pressure: The company accrued asset impairment provisions of RMB 399 million in 2024 [4], which significantly eroded profits.

- High expense expenditure: The total three expenses in the first three quarters of 2025 reached RMB 87.2898 million, accounting for as high as 49% of revenue [4].

Zhonglian Century achieved revenue of RMB 6.417 billion in 2024 [4], with core businesses covering digital intelligence marketing, AI application scenario solutions, and digital channel construction. It has over 3,000 clients and in-depth collaborations with leading platforms including Tencent Ads, Kuaishou, Ocean Engine, and TikTok. If the acquisition is successful, it will significantly improve the business structure and profitability of the listed company.

- Continuous loss risk: The company has reported losses for three consecutive years from 2022 to 2024, with the loss expanding to -RMB 393 million in 2024. The effectiveness of its transformation remains to be verified, and its fundamental support is still weak.

- Acquisition and integration risk: The transaction is still subject to review by the Shenzhen Stock Exchange and registration with the China Securities Regulatory Commission [2], and there is a possibility of rejection or adjustment; there is uncertainty about whether synergies can be achieved after the acquisition is completed.

- Valuation risk: The current stock price has priced in much of the optimistic expectations for transformation. If performance fails to meet expectations, a sharp pullback may occur.

- Goodwill impairment risk: A large amount of goodwill will be formed after the acquisition is completed. If the target’s performance fails to meet expectations, the company will face impairment pressure.

- Industry risk: The deep loss situation of China’s film industry worsened, with the total annual loss of the entire industry possibly reaching up to RMB 10 billion [4], and the traditional business faces continuous pressure.

- Progress of acquisition approval (review by the Shenzhen Stock Exchange and registration with the CSRC)

- 2025 annual report performance

- Achievement of performance commitments by Zhonglian Century

- Implementation of the new management’s strategy

- Policy changes in the AI industry and sustainability of sector enthusiasm

| Scenario | Conditions | Expected Trend |

|---|---|---|

Optimistic |

Acquisition approved + Zhonglian Century’s performance exceeds expectations + AI industry remains prosperous | The stock price is expected to challenge the range of RMB 10-12 |

Neutral |

Acquisition completed smoothly + business integration transitions steadily | The stock price will consolidate in the range of RMB 7-9 |

Pessimistic |

Acquisition rejected + performance continues to decline + AI sector pulls back | The stock price may retrace to the range of RMB 5-6 |

The strong performance of Baina Qiancheng is driven by four factors:

From a trading perspective, this stock is a typical event-driven opportunity, suitable for investors with a higher risk appetite, but stop-loss arrangements are necessary. For conservative investors, it is recommended to consider entering the market after the acquisition is confirmed, paying attention to the support level around RMB 7.5.

| Dimension | Evaluation |

|---|---|

Catalyst Strength |

Strong (acquisition + management + AI hot topic) |

Fundamental Support |

Weak (continuous losses, performance pressure) |

Capital Attention |

High (net buying by capital on the Dragon and Tiger List) |

Technical Pattern |

Neutral to strong (breakout pattern, but RSI is overbought) |

Risk Level |

High (triple risks of performance, integration, and policy) |

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.