In-Depth Analysis of the Sustainability of Overseas Order Growth for Chinese Transformer Enterprises

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected comprehensive data and analytical information. Let me present a systematic and detailed analysis report to you.

According to the latest data, China’s transformer export value reached

In terms of regional market performance, China’s export growth to various regions showed significant differentiation in the first 8 months of 2025[2][3]:

| Region | Export Growth Rate | Market Characteristics |

|---|---|---|

Europe |

138% | Strongest growth pole, demand released from aging grid renovation |

Asia |

65.39% | Traditional advantageous market, sustained steady growth |

Middle East |

52% | Emerging hot market, accelerated infrastructure construction |

South America |

45% | High growth potential, increased energy investment |

Africa |

28.03% | Steady growth, large infrastructure gap |

Many leading transformer enterprises have reported strong overseas orders while maintaining an overall rational attitude[1][2]:

- Siyuan Electric (002028.SZ): Overseas business is growing in an orderly manner, with faster growth in the Middle East, Europe, Africa, and Central and South America; business in Central Asia and Southeast Asia has also expanded.

- Eaglerise (002922.SZ): Orders related to data center transformers grew rapidly in 2025; current orders are full, and product prices have not increased.

- TBEA (600089.SH): From January to September 2025, the company signedUSD 1.24 billionin international contracts for power transmission and transformation products, representing a year-on-year increase of over80%; it recently won a super large USD 2.4 billion contract in Saudi Arabia.

- XJ Electric: AI computing capacity construction has driven overseas transformer demand, with the market growing steadily.

Notably, despite strong market demand, there has been

- Delivery Cycle: The delivery cycle for domestic manufacturers is about 12 weeks, which, even including shipping time, is far superior to the 100-week delivery cycle of U.S. local suppliers[4].

- Price Trends: Enterprises such as Eaglerise have clearly stated that product prices have not increased, while some enterprises reported that product prices in overseas markets are slightly higher than those in China[2].

- Scheduling Status: Some manufacturers have orders scheduled beyond 2026, but this is orderly production scheduling rather than frantic stockpiling.

Grid facilities in Europe and the U.S. are facing large-scale replacement demand[2][3][5]:

- Europe: According to a September 2025 report by Goldman Sachs, most grid facilities in Europe have been in operation for 40-50 years, and the EU plans to investEUR 1.2 trillionin grid upgrades over the next decade.

- U.S.: Data from Bank of America shows that 31% of U.S. transmission equipment and 46% of distribution facilities are beyond their service life; the U.S. power industry plans to invest overUSD 1.1 trillionin the next five years for grid upgrading and expansion.

Global transformer supply faces multiple constraints[2][3][5]:

- Capacity Bottleneck: North America’s dependence on imports for power transformers is as high as 80%, but due to raw material and labor shortages, capacity expansion plans have generally been delayed until 2027-2028.

- Delivery Cycle: The delivery cycle for U.S. local transformers has stretched to over 100 weeks, becoming a core bottleneck determining the commissioning progress of data centers.

- China’s Advantages: Chinese transformer products have a delivery cycle of only 12 weeks, with prices being just one-fourth of those in the U.S. market; additionally, the training cycle for skilled workers is long (it takes 3 years just to master the winding process proficiently).

According to forecasts from the international energy industry analysis firm “Allied Market Research”[2][3]:

The global transformer market size will reach USD 103 billion by 2031, doubling from USD 58.6 billion in 2021, with a compound annual growth rate of approximately 7%.

Feng Junqi, Senior Researcher of Energy and Power Equipment Industry at Industrial Research, pointed out that driven by factors such as increased capital expenditure on global grid projects and the restructuring of the global transformer supply chain, overseas market performance of domestic transformer-related listed companies will continue to improve[1].

| Driving Factor | Short-Term (1-2 Years) | Mid-Term (3-5 Years) | Long-Term (Over 5 Years) |

|---|---|---|---|

| Aging grid replacement in Europe and the U.S. | ★★★★★ | ★★★★☆ | ★★★☆☆ |

| Data center computing capacity expansion | ★★★★★ | ★★★★★ | ★★★★☆ |

| New energy power generation construction | ★★★★☆ | ★★★★☆ | ★★★☆☆ |

| Supply chain restructuring dividends | ★★★★☆ | ★★★☆☆ | ★★☆☆☆ |

The rapid development of the AI industry is reshaping the demand pattern for power equipment[5][6][7]:

- Power Consumption Comparison: The power consumption of training the ChatGPT large model for three days is sufficient for 3,000 Tesla vehicles to travel a cumulative 320,000 kilometers.

- Data Center Demand: A new medium-sized data center built by Meta requires hundreds of step-down transformers.

- Scale Forecast: ABI Research predicts that over8,400 data centerswill be put into operation globally by 2030.

Traditional transformers can no longer meet the high-density, low PUE (Power Usage Effectiveness) requirements of AI data centers[5][6]:

| Feature | Traditional Silicon Steel Transformer | Solid-State Transformer (SST) |

|---|---|---|

| Power Supply Efficiency | 92% | Over 98% |

| Volume | Large | Reduced by 50% |

| Copper Material Usage | Standard | Reduced by 40% |

| Response Speed | Second-level | Millisecond-level |

| Power Regulation | Limited | Full-link controllable |

- Efficiency Improvement: Power supply efficiency is increased to over 96%, 4-6 percentage points higher than traditional solutions.

- Space Optimization: Volume is reduced by 50%, suitable for high-density deployment in data centers.

- Intelligent Regulation: Achieves millisecond-level power regulation, natively compatible with high-voltage DC ecosystems.

According to forecasts from industry research institutions[5][6]:

- 2026: SST will enter a key year for prototype verification.

- 2027: Commercial implementation is expected to begin.

- 2030: Shipment volume of solid-state transformers is expected to reach several gigawatts.

| Year | Global Data Center Transformer Demand Increment | Year-on-Year Growth |

|---|---|---|

| 2025 | Base Year | - |

| 2026 | +25% | 25% |

| 2027 | +35% | 28% |

| 2028 | +45% | 30% |

According to industry data, China’s new energy installation capacity performed strongly in 2025[5]:

| Energy Type | Year-on-Year Growth of New Installation Capacity | Remarks |

|---|---|---|

Wind Power |

+51% | Accelerated construction of large-scale wind power bases |

Centralized Photovoltaics |

+5% | “Desert, Gobi, and Barren Land” large bases contribute major increments |

Energy Storage |

+253% | Explosive growth |

Data from the International Energy Agency (IEA) shows[5][6]:

It is estimated that by 2025, wind and solar photovoltaic power will meet over 90% of the global incremental power demand; the total power generation from wind and solar photovoltaic will exceed 5,000 TWh in 2025 and surpass 6,000 TWh in 2026.

The global layout of China’s new energy industry chain has also created opportunities for power equipment to go global[5]:

- The scale of grid equipment going global is estimated to be about RMB 665 billionin 2025, representing a year-on-year increase of 20%.- Transformers are one of the high-prosperity segments in the overseas market.- Switchgear export value reached USD 4.8 billion from January to October 2025, with a year-on-year increase of 29%.

| Company | Ticker | Market Capitalization (USD 100 million) | P/E | 2025 Growth | Overseas Business Characteristics |

|---|---|---|---|---|---|

| Siyuan Electric | 002028.SZ | 120.15 | 43.85x | 120.94% | Fast growth in Europe, Middle East, South America |

| TBEA | 600089.SH | 121.43 | 22.82x | 97.31% | International contracts up 80% YoY, USD 2.4 billion contract in Saudi Arabia |

| Eaglerise | 002922.SZ | 14.08 | 55.92x | 95.71% | Fast growth in data center orders |

| Jinpan International | 688676.SH | 39.64 | 60.40x | 106.29% | No. 1 market share in North American SST market |

| TGOOD | 300001.SZ | 28.23 | 23.90x | 29.62% | Developing SST technology |

| Chint Electric | 601877.SH | 62.96 | 13.75x | 35.02% | Low valuation, steady growth |

| Company | ROE | Net Profit Margin | Current Ratio | Financial Attitude |

|---|---|---|---|---|

| Siyuan Electric | 20.71% | 14.56% | 1.80 | Aggressive |

| TBEA | 7.67% | 5.41% | 1.16 | Conservative |

| Eaglerise | 7.69% | 5.01% | 1.18 | Steady |

| Jinpan International | 14.41% | 8.99% | 1.75 | Growth-Oriented |

| Chint Electric | 10.60% | 7.06% | 1.53 | Steady |

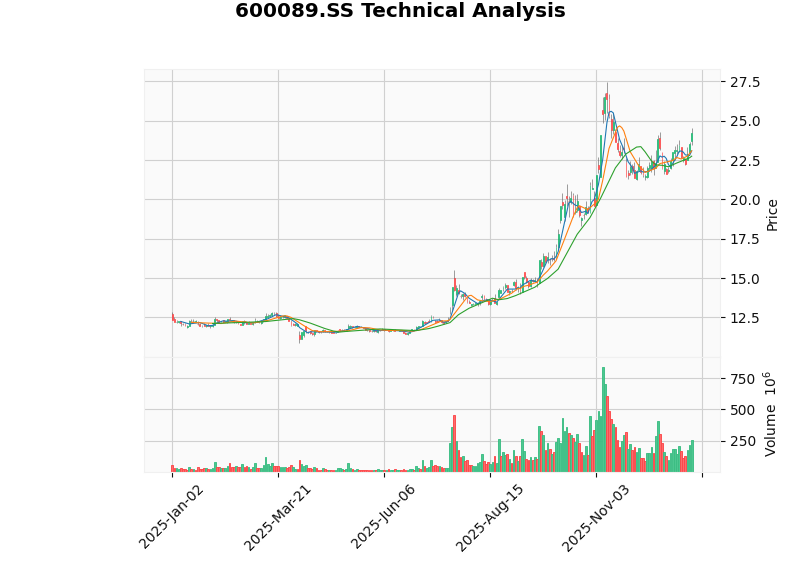

Taking TBEA (600089.SH) as an example for technical analysis[0]:

- Current Price: $24.19

- Trend Judgment: In an upward trend (breakout to be confirmed), buy signal appeared on January 6

- Key Price Levels:

- Support Level: $23.08

- Resistance Level: $24.55

- Next Target: $25.42

- Technical Indicators: KDJ shows a golden cross (bullish), RSI is in the overbought zone, so attention should be paid to pullback risks

- Overseas business proportion continues to increase, order growth rate outperforms the overall market

- High ROE indicates excellent profitability and operational efficiency

- High valuation reflects market’s optimistic expectations for its growth

- Relatively reasonable valuation (P/E 22.82x), high margin of safety

- Explosive growth in international business (80% YoY increase), USD 2.4 billion Saudi contract lays foundation for long-term growth

- Conservative financial attitude, guaranteed asset quality

- Leading SST technology, obvious layout advantages in the North American market

- Strong stock price performance, high market recognition

- High valuation, need to pay attention to valuation pullback risks

| Risk Type | Specific Description | Risk Level |

|---|---|---|

Grid Investment Falling Short of Expectations |

Grid renovation plans in Europe and the U.S. may be delayed due to policy changes or funding issues | Medium |

New Energy Installation Falling Short of Expectations |

Construction progress of wind, solar, and energy storage may be affected by policies or economic environment | Medium |

New Technology R&D Falling Short of Expectations |

Commercialization progress of new technologies such as SST may be slower than expected | Medium |

Raw Material Price Increase |

Price hikes of raw materials such as copper and steel may compress profit margins | Low |

Trade Policy Changes |

Tariff adjustments may affect export competitiveness | Medium |

Geopolitical Risks |

Regional conflicts may affect overseas market expansion | Low |

- Focus on export leaders with channel advantages and fast delivery capabilities

- Benefit from high-premium orders brought by the 30% supply gap in North America

- 2026 will be a key year for prototype verification, with commercialization expected in 2027

- Focus on the first-mover advantage of technology-leading enterprises

- Expectation of higher grid investment in the 15th Five-Year Plan period

- Focus on UHV incremental policies and the implementation of new standard electricity meters in Q1 2026

| Target | Ticker | Recommendation Logic | Risk Warning |

|---|---|---|---|

TBEA |

600089.SH | Low valuation + high growth in international business + large Saudi contract | Large short-term growth |

Siyuan Electric |

002028.SZ | Increasing overseas business proportion + high ROE | High valuation |

Jinpan International |

688676.SH | Leading SST technology + North American market advantages | Commercialization needs verification |

Eaglerise |

002922.SZ | Full data center orders + reasonable valuation | Relatively small scale |

-

Overseas order growth has sustainability: Driven by three factors: aging grids in Europe and the U.S., expansion of data center computing capacity, and new energy construction, the high prosperity of overseas transformer markets is expected to last 3-5 years

-

Data centers are the core increment: The explosive power demand brought by AI computing capacity expansion is reshaping data center power supply architectures, and new technologies such as solid-state transformers will become new growth poles

-

New energy construction provides definite support: Installation capacity of wind power, photovoltaics, and energy storage continues to grow, forming a stable pull on transformer demand

-

China’s manufacturing advantages are solid: With short delivery cycles, obvious cost advantages, and sufficient reserves of skilled workers, the competitiveness of Chinese transformers in the global market is difficult to replace

-

The industry has not reached the exaggerated stage of ‘supply shortage’: It is currently in a stage of orderly growth, with stable prices and controllable delivery cycles

- Transformer Exports: Expected to maintain high growth of 30-40%

- SST Technology: Expected to enter the first year of prototype verification

- Regional Markets: Europe, the Middle East, and South America will continue to maintain high growth

- Price Trends: Generally stable, some high-end products may see moderate increases

[1] Cailianshe - “Transformers Selling Like Hot Cakes Overseas? Related Listed Companies: Strong Demand but No ‘Supply Shortage’” (https://m.sohu.com/a/973613018_222256)

[2] China Business Strategy/Huxiu - “Global Scramble for Chinese Transformers” (https://m.huxiu.com/article/4823650.html)

[3] Sina Finance - “Global Scramble for Chinese Transformers” (https://cj.sina.cn/articles/view/6192937794/17120bb4202002myvy)

[4] Xinhua News Agency - “Four Investigations into ‘Seven Tigers’ Competing in Nantong” (https://www.news.cn/politics/20260105/4e2bb25833f64b7188ac472ec21c0db5/c.html)

[5] China Energy Network - “AI-Powered Transformation, Resonance of Internal and External Demand” Investment Research Report (https://www.cnenergynews.cn/article/4PpVpGpO6vh)

[6] Securities Times - “Transformers in Short Supply, Chinese Factories ‘Patch’ the Global Grid” (https://www.stcn.com/article/detail/3548480.html)

[7] Caifuhao/Eastmoney - “NVIDIA’s ‘AI Energy Security Conference’ and the Explosion of AIDC Energy Storage” (https://caifuhao.eastmoney.com/news/20251213205701608382300)

[0] Jinling AI Financial Database - Listed company financial data, technical analysis indicators, market quotation data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.