Analysis of the Market Impact of Shanghai Futures Exchange's Adjustment to Silver Futures Trading Parameters

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Now I will provide a systematic and comprehensive analysis for you.

According to the notice issued by the Shanghai Futures Exchange (SHFE) on January 7, 2026, starting from the settlement after the close of trading on Friday, January 9, 2026, adjustments will be made to the trading parameters of relevant silver futures contracts[1][2]:

| Trading Parameter | Before Adjustment | After Adjustment | Adjustment Range |

|---|---|---|---|

| Price Limit Range | Expanded from original level | 16% |

Significantly Expanded |

| Hedge Position Margin | Increased from original level | 17% |

Moderately Increased |

| General Position Margin | Increased from original level | 18% |

Significantly Increased |

The adjustment covers four near-month contracts:

The silver market experienced unprecedented volatile movements in 2025[4]:

- London Silver SpotandCOMEX Silver Futuresrose by more than155%during the year, far exceeding gold’s approximately 70% increase in the same period

- Silver prices once soared to a historical high, triggering extreme market euphoria

- The price of the SHFE silver front-month contract also surged sharply, with volatility hitting a record high

Recently, major global exchanges have intensively introduced risk control measures[5][6]:

- Chicago Mercantile Exchange (CME)raised silver futures performance marginsthree timesin December 2025

- The Shanghai Futures Exchange (SHFE)had already raised margin standards once on December 30, 2025

- Global regulators have taken synchronized actions to cool down the overheated market

Xia Yingying, Precious Metals Analyst at Nanhua Futures, pointed out[4]:

“The implied volatility of SHFE silver front-month at-the-money options has exceeded 80%, reaching a historical high, indicating a simultaneous sharp rise in price risks.”

| Impact Dimension | Specific Performance |

|---|---|

Higher Capital Threshold |

The general position margin has been increased from a lower level to 18%, significantly raising the required entry capital |

Reduced Leverage Multiple |

Calculated at a margin ratio of 18%, the maximum leverage multiple is approximately 5.6 times, which is significantly lower than before |

Increased Trading Costs |

Increased capital occupancy leads to higher capital costs, curbing frequent intraday trading |

-

Increased Volatility: After expanding the price limit range to 16%, the daily price fluctuation space has increased significantly, which may lead to more intense short-term price fluctuations[4].

-

Sentiment Release: Some investors may take profits before the new rules take effect, which may trigger concentrated selling pressure.

-

Lessons from History: Looking back at 2011 when silver prices soared to a historical high of $49.82 per ounce, the CME raised silver futures marginsthree timesin two consecutive weeks, directly triggering panic selling in the market. Silver prices plummeted from the high to around $32 per ounce, with adrop of over 35%[5].

According to expert analysis[4][6]:

| Investor Type | Expected Behavioral Changes |

|---|---|

Speculative Capital |

May choose to reduce positions or exit, lowering the market’s speculative fervor |

Hedge Capital |

The hedge position margin is 17%, relatively stable, with minimal impact on industrial clients |

Trend Investors |

The willingness to enter on dips still exists, as the long-term bullish logic remains unchanged |

-

Deleveraging Effect: The margin increase will force high-leverage capital to exit the market, achieving market “deleveraging”[5].

-

Liquidity Impact: The departure of some speculative capital may cause a short-term decline in liquidity.

-

Price Discovery Function: After expanding the price limit range, the price discovery function may be more fully realized, and daily prices can better reflect the market’s true supply and demand.

| Indicator | Situation at That Time | Current Reference |

|---|---|---|

| Silver Price Increase | Rose by over 150% during the year | 155% annual increase (2025) |

| Regulatory Measures | CME raised margins three times in two weeks | CME raised margins three times in one month, followed by SHFE |

| Result | Silver price plummeted by over 35% | Silver price pulled back by nearly 9% in the short term |

On April 16, 2024, the SHFE adjusted the price limit ranges of gold and silver futures from 6% and 7% to 8%, with margin ratios adjusted simultaneously[7]:

“As precious metal prices continue to rise rapidly, both trading volume and open interest of Shanghai Gold Futures and Shanghai Silver Futures have increased. The Shanghai Futures Exchange has promptly introduced multiple risk control measures to stabilize market sentiment and avoid overheated trading. Futures and options are leveraged products, and the relevant measures recently introduced by the SHFE have enhanced the risk control awareness of market participants, effectively alleviated excessive and speculative trading, and ensured the steady and orderly development of the market.”[7]

“The amplified volatility and squeeze scenario in the silver market indicate extremely high price risks.

Caution is advised when chasing highs in the short term; it is recommended to reduce positions or liquidate before the holiday to control risks and protect profits.”[4]

“The significant margin increase will significantly raise the speculative trading costs in the market, and some investors have chosen to lock in existing profits before the adjustment.”[4]

- The silver market is small in scale and highly volatile, serving both as a financial hedging tool and an industrial raw material

- Demand in the technology, electric vehicle, and renewable energy sectors shows structural growth

- Production on the supply side is difficult to increase, and the supply-demand contradiction remains prominent

- “The long-term bullish logic still holds, and we tend to go long after a pullback”

“At least in the first half of 2026, silver and other precious metal prices may fall, as high prices are weakening silver demand in many industries.”

| Factor | Details |

|---|---|

Demand Side |

Demand continues to grow in sectors such as photovoltaic industry, AI hardware, and new energy vehicles |

Supply Side |

Global silver production has failed to keep up with demand for years, with mineral supply constrained |

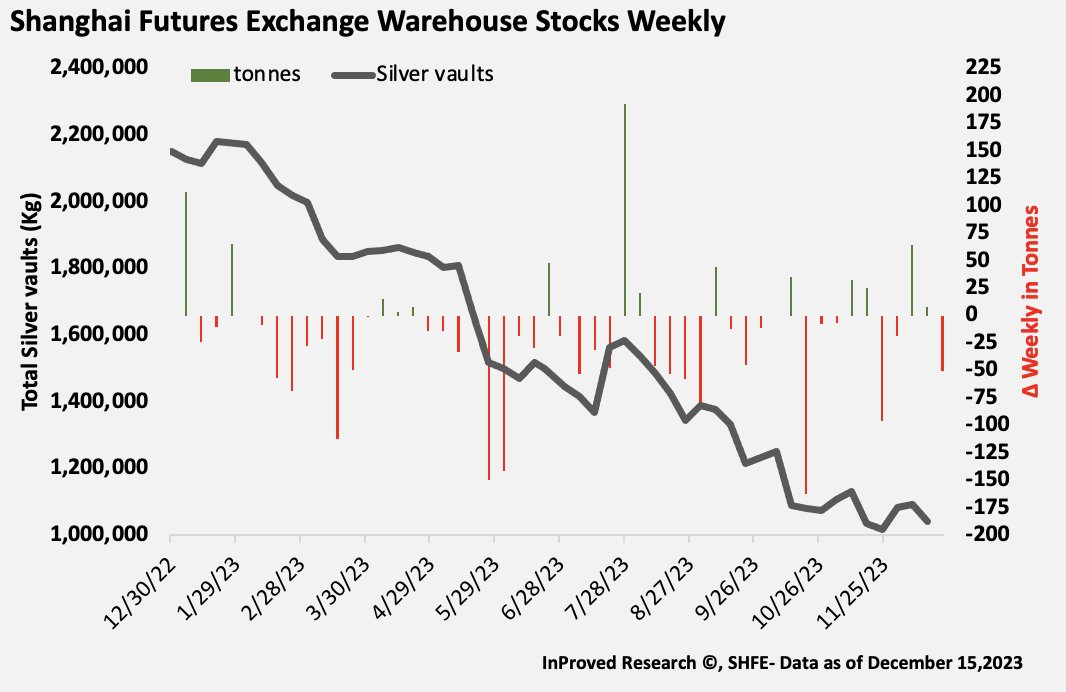

Inventories |

Global visible silver inventories have entered a de-stocking cycle , and SGE inventories are at a ten-year low |

Central Bank Demand |

Many central banks are increasing gold holdings for “de-dollarization”, which may also spill over to silver |

- Policy Risk: Margin adjustments by domestic and foreign exchanges may continue

- Liquidity Risk: Liquidity may dry up when market volatility intensifies

- Pullback Risk: The excessive short-term increase creates a demand for a technical pullback

- Holiday Risk: Market liquidity declines during the New Year’s holiday, and volatility may remain high[4].

| Strategy Type | Specific Recommendations |

|---|---|

Risk Control |

Strictly set stop-loss levels and keep positions within a reasonable range |

Capital Management |

Reserve sufficient margin to avoid forced margin calls |

Timing |

Exercise caution when chasing highs in the short term, and deploy positions on dips after pullbacks |

Product Allocation |

Pay attention to changes in the gold-silver ratio and grasp inter-product arbitrage opportunities |

The Shanghai Futures Exchange’s adjustment to silver futures trading parameters this time is a

- Short Term: Helps curb excessive speculation, stabilize market sentiment, and prevent irrational price increases

- Medium Term: The deleveraging effect may lead to a periodic pullback in prices

- Long Term: The structural supply-demand contradiction of silver remains unchanged, and the long-term bullish logic still holds

Investors should closely follow subsequent policy changes and the interactive reactions of the international market, and grasp investment opportunities on the premise of risk control.

[1] Sina Finance - SHFE: Adjust the margin ratio and price limit range of silver futures related contracts (https://cj.sina.cn/articles/view/5182171545/134e1a99902002bczy?vt=4)

[2] Yicai Global - SHFE: Adjust the margin ratio and price limit range of silver futures related contracts (https://www.yicai.com/brief/102991960.html)

[3] Economic Observer Online - SHFE adjusts the margin ratio and price limit range of silver futures related contracts (http://www.eeo.com.cn/2026/0107/777742.shtml)

[4] Southern Metropolis Daily - “Silver Plunge Refreshes 46-Year Historical Record” Tops Search Rankings (https://news.southcn.com/node_812903b83a/9b4415969c.shtml)

[5] 100W Fund Network - Precious Metals Market Turmoil Again: CME Raises Margins for the Second Time (https://www.100wjjw.com/knowledgeinfo/2467.html)

[6] Eastmoney - In-Depth Study on the Impact of Exchange Regulatory Dynamics on Silver Prices (https://caifuhao.eastmoney.com/news/20251231114505074416830)

[7] Securities Times - Gold Surges, Exchange Intervenes! (https://www.stcn.com/article/detail/1178251.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.