China's Rare-Earth Magnet Restrictions: Strategic Impact on U.S. Defense Supply Chains

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

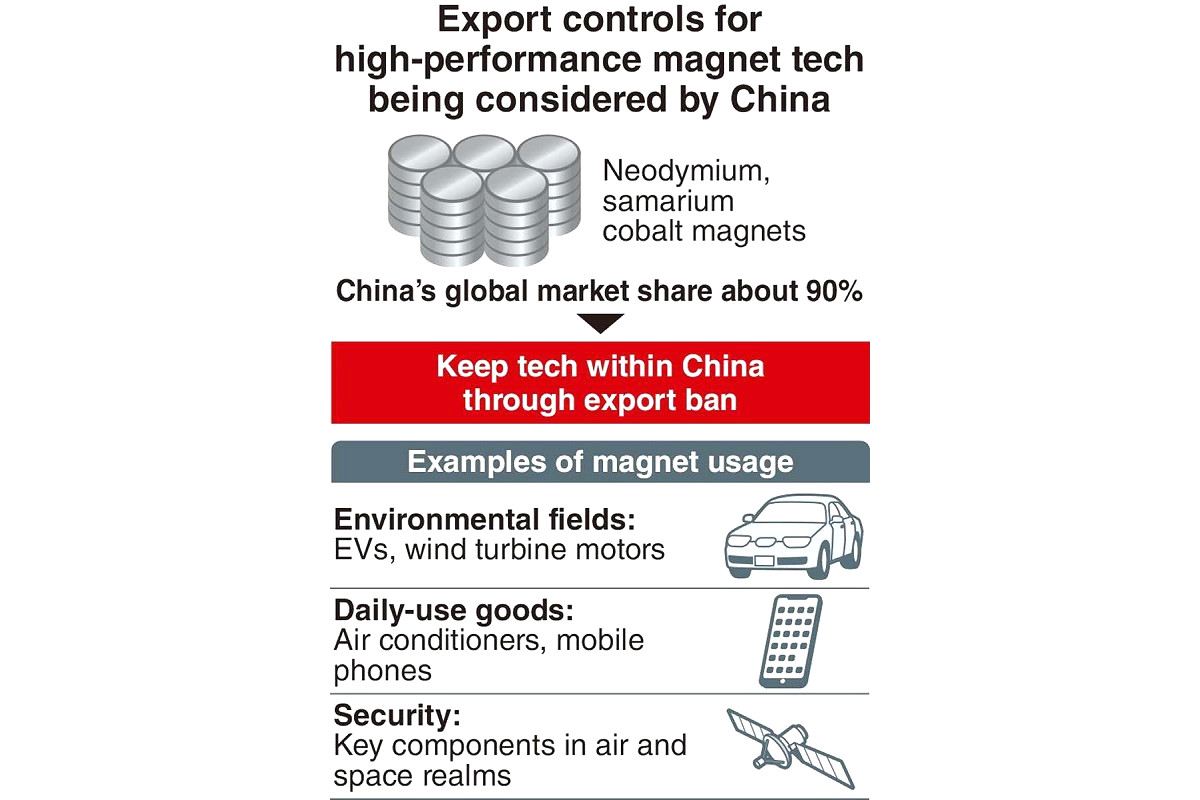

This analysis is based on multiple reports from November 11, 2025, detailing China’s development of a “validated end-user” (VEU) system to restrict rare-earth magnet exports specifically to U.S. military contractors [1][2][3]. The strategic move comes just weeks after a U.S.-China trade truce and represents a sophisticated approach that allows China to streamline civilian exports while targeting defense applications. With China controlling approximately 70% of global rare-earth mining and 90% of processing capabilities [3], these restrictions pose significant challenges to U.S. defense supply chains while creating opportunities for domestic production and international diversification efforts.

The proposed VEU system represents China’s most consequential measures to date targeting the U.S. defense sector [4]. This strategic maneuver follows the October 30, 2025, trade truce between Presidents Xi Jinping and Donald Trump, where China agreed to delay broader export restrictions by one year [1]. The VEU approach demonstrates sophisticated policy design that mirrors U.S. export-control procedures, allowing China to fulfill commitments to streamline exports while ensuring rare-earth materials do not reach Pentagon suppliers [2].

The timing and specificity of these restrictions highlight the growing strategic importance of critical materials in U.S.-China competition. Rare-earth magnets, particularly neodymium-iron-boron (NdFeB) magnets, are essential components in military applications including fighter jets, missile guidance systems, drones, and advanced radar systems [4][5]. The bifurcated export regime creates a new paradigm in strategic materials control, potentially setting precedents for other critical minerals.

The global rare-earth magnet market reached $21.99 billion in 2024 and is projected to grow at a 9.1% CAGR to reach $52.54 billion by 2034 [7]. China’s dominance is overwhelming across the entire value chain:

- Mining Control: Approximately 70% of global rare-earth mining [3]

- Processing Capabilities: About 90% of global processing capabilities [3]

- Magnet Production: Estimated 132,000 tons of high-performance NdFeB magnets annually by 2025 [8]

- U.S. Import Dependence: Around 10,000 tonnes of rare-earth magnets annually from China [6]

The VEU system will create significant market segmentation, fast-tracking licenses for vetted civilian firms while excluding customers with defense ties [2]. This approach could impact dual-use manufacturers serving both civilian and defense markets, potentially forcing companies to choose between market segments or develop separate supply chains.

The United States has been actively working to reduce dependence on Chinese rare-earth supplies through multiple strategic initiatives:

- $400 million equity investment making the U.S. government the largest shareholder

- 10-year price floor commitment of $110 per kilogram for NdPr products

- Goal to scale magnet manufacturing from 1,000 metric tons in 2025 to 10,000 metric tons over the next decade [5][6]

However, even at full capacity, MP Materials would produce only about 7% of China’s current output [8], highlighting the significant scale challenge.

- Australia: $8.5 billion critical minerals framework agreement signed in October 2025 [6][9]

- Lynas Rare Earths: Strategic partnership with Noveon Magnetics for U.S. supply chain development [9]

- Other Allies: Agreements with Japan, Malaysia, Thailand, Vietnam, and Cambodia [6]

The analysis reveals a critical vulnerability in U.S. defense supply chains that extends beyond immediate material shortages. The VEU system represents a new form of strategic targeting that allows China to maintain economic relationships while specifically undermining military capabilities. This precision approach may be more difficult to counter through broad trade measures and requires sophisticated policy responses.

The industry is advancing technologies to reduce heavy rare-earth content, offering potential mitigation pathways:

- Grain Boundary Diffusion: Can reduce heavy rare-earth content by over 70% while maintaining performance [10]

- Cost Reduction: Up to 28% reduction in magnet material costs through advanced engineering [10]

- Recycling Initiatives: Growing focus on rare-earth magnet recycling to improve supply security

These technological solutions could provide medium-term relief while domestic capacity scales up, but require significant investment and development time.

The U.S. response demonstrates recognition that supply chain independence cannot be achieved unilaterally. The strategic partnerships with Australia, Japan, and other allies represent a comprehensive approach to diversification that combines mining, processing, and manufacturing capabilities. However, these partnerships face challenges including technology transfer restrictions, investment requirements, and timeline pressures.

China’s proposed VEU system represents a significant escalation in strategic materials competition, specifically targeting U.S. defense supply chains while maintaining civilian trade relationships. The U.S. response through MP Materials partnership and international alliances demonstrates comprehensive recognition of supply chain vulnerabilities, but the scale disparity remains substantial - even at full capacity, U.S. production would represent only 7% of China’s current output [8].

The rare-earth industry stands at a critical juncture where geopolitical considerations are increasingly driving market dynamics. Success in this evolving landscape will require strategic adaptation across multiple dimensions: supply chain diversification, technological innovation, international cooperation, and sophisticated policy responses.

For defense contractors, immediate priorities include securing alternative sources, developing strategic stockpiles, and investing in alternative technologies. Civilian manufacturers face compliance complexity but may benefit from streamlined access to Chinese materials. International partners encounter enhanced investment opportunities but must navigate technology transfer restrictions and capacity development challenges.

The analysis suggests that while short-term disruptions are likely, the long-term impact will depend on the effectiveness of U.S. and allied efforts to develop alternative supply chains and technological solutions that reduce dependence on Chinese rare-earth materials.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.